TIDMABDP

RNS Number : 4452J

AB Dynamics PLC

27 April 2022

AB Dynamics plc

Unaudited interim results for the six months ended 28 February

2022

"Strong financial performance and strategic progress"

AB Dynamics plc (AIM: ABDP, "ABD", "the Group"), the designer,

manufacturer and supplier of advanced testing, simulation and

measurement products to the global transport market, is pleased to

announce its interim results for the six-month period to 28

February 2022 (the "period").

H1 2022 H1 2021 %

GBPm GBPm

Revenue 37.8 27.3 +39%

Gross margin 57.7% 57.7% -

Adjusted operating profit(1) 5.7 3.5 +63%

Adjusted operating margin(1) 15.1% 12.8% +230bps

Statutory operating profit 2.5 0.7 (2) +264%

Adjusted cash flow from operations(1) 8.5 8.0 +6%

Net cash 27.7 33.1 -16%

--------------------------------------- -------- -------- --------

Pence Pence

Adjusted diluted earnings

per share(1) 19.9 13.1 +52%

Statutory diluted earnings

per share 8.5 3.2 (2) +166%

Interim dividend per share 1.76 1.60 +10%

--------------------------------------- -------- -------- --------

(1) Before amortisation of acquired intangibles, acquisition

related charges, and exceptional items. A reconciliation to

statutory measures is given in the Half Year Review.

(2) The prior year comparative has been restated to reflect the

write off of previously capitalised ERP development costs on

adoption of the IFRIC update on cloud computing arrangements. The

impact was a GBP0.7m decrease in statutory operating profit.

Financial highlights

-- Order intake momentum continued with strong growth,

particularly in Asia Pacific. The Group's positive book to bill

ratio provides confidence in delivery of H2 revenue expectations, a

significant proportion of which is covered by the current order

book.

-- Revenue increased by 39% against H1 2021 and by 21% on an

organic constant currency basis, albeit against a weak comparative

period that was impacted by COVID-19.

-- Constant currency revenue was slightly up against H2 2021

reflecting increased track testing activity. Track testing revenue

was 45% higher than H1 2021, up 23% on an organic constant currency

basis, and up 6% against H2 2021.

-- Laboratory testing and simulation delivered revenue growth of

17% against H1 2021 driven by increased demand for simulation

software.

-- Operating margins of 15.1% improved by 230 bps as a result of

the increased levels of activity.

-- Strong adjusted cash flow from operations of GBP8.5m (H1

2021: GBP8.0m). Significant net cash balance of GBP27.7m at the

period end (28 February 2021: GBP33.1m, 31 August 2021: GBP22.3m)

providing scope for continued support to the Group's strategic

growth objectives.

-- Interim dividend of 1.76p per share (H1 2021: 1.6p), growth of 10%.

Operational and strategic highlights

-- Market and customer activity levels have remained positive

throughout H1, with strong activity in track testing driving

significant improvements in both orders and revenues.

-- Whilst the current macroeconomic operating environment still

presents challenges in relation to supply chain disruption,

operational output has not been adversely affected to date and the

Group has been successful in mitigating inflationary cost pressures

through price increases for new orders.

-- Further progress made on the implementation of strategic

initiatives targeting diversification alongside the established

pillars and opening up new markets beyond automotive through the

launch of ABD Solutions.

-- ABD Solutions was awarded its first development contract by

an industrial equipment supplier in Japan for a driverless retrofit

solution for mining vehicles.

-- Continued progress in growing the proportion of recurring and

service-based sales, to 41% up from 31%, enhanced by the

strengthening of our APAC regional footprint.

-- New product development continues in line with our technology

roadmap for existing track testing and simulation markets and

development of the core technology for ABD Solutions.

-- Vadotech Group has been successfully integrated into the

Group and delivered a solid performance since it was acquired in H2

2021.

Current trading and outlook

-- Performance in the first half of the year was as anticipated

with good conversion of orders to sales.

-- The positive order intake trend provides confidence for continued momentum into H2.

-- Whilst mindful of ongoing geopolitical uncertainty, the Board

now expects the financial results for the current year to be

slightly ahead of market expectations.

-- Future growth prospects remain supported by long-term

structural and regulatory growth drivers in active safety,

autonomous systems and the automation of vehicle applications.

There will be a presentation for analysts this morning at 9.30am

at the London Stock Exchange. Please contact

abdynamics@tulchangroup.com if you would like to attend.

Commenting on the results, Dr James Routh, Chief Executive

Officer said:

"The Group has delivered a strong financial and operational

performance in the first half of the year, with continued momentum

in our key markets and progress against our strategic

objectives.

Against the backdrop of external challenges in relation to

supply chain disruption and inflationary pressures, the Group has,

to date, successfully mitigated these effects and continued to

invest in all areas of the business, supporting our ambitious

growth plans.

Whilst mindful of ongoing geopolitical uncertainty and the risk

of further logistics disruption and inflation, given the

improvement in order intake, the Board now expects the financial

results for the year to be slightly ahead of market

expectations.

Our market drivers remain strong. Against that background and

based on the recent track record of improving demand and continued

strategic investment, the Board is confident of delivering progress

during the second half of 2022 and beyond ."

Enquiries:

AB Dynamics plc 01225 860 200

Dr James Routh, Chief Executive Officer

Sarah Matthews-DeMers, Chief Financial

Officer

Peel Hunt LLP 0207 894 7000

Mike Bell

Ed Allsopp

Tulchan Communications 0207 353 4200

James Macey White

Matt Low

Laura Marshall

Certain information contained in this announcement would have

constituted inside information (as defined by Article 7 of

Regulation (EU) No 596/2014) ("MAR") prior to its release as part

of this announcement and is disclosed in accordance with the

Company's obligations under Article 17 of those Regulations.

The person responsible for arranging the release of this

information is David Forbes, Company Secretary.

Half Year Review

Group overview

Against a backdrop of macroeconomic conditions that remain

challenging, the Group has delivered a strong performance, whilst

also continuing to invest to ensure AB Dynamics can capitalise on

the significant long-term structural and regulatory growth drivers

within its markets.

The Group has seen continued improvement in order intake through

the first half of the year, including our first collaborative

development contract for ABD Solutions with an industrial equipment

supplier in Japan. The Group has managed supply chain disruptions

through accelerating procurement and flexible production

scheduling, with inflationary cost pressures managed through

implementation of price increases for new orders.

Financial performance

Revenue increased by 39% against H1 2021, or 21% on an organic

constant currency basis, albeit against a weak prior period

comparative that was impacted by the COVID-19 pandemic. Constant

currency revenue was slightly ahead of H2 2021 .

Gross margins remained comparable to H1 2021 and up 90 bps on

the full year at 57.7% (H1 2021: 57.7%, FY 2021: 56.8%), supported

by effective pricing management and increased recurring

revenue.

Group adjusted operating profit of GBP5.7m increased 63% against

H1 2021 or 68% on a constant currency basis. The adjusted operating

margin increased against H1 2021 to 15.1% (H1 2021: 12.8%), as a

result of the increase in sales volumes.

Net finance costs were GBP0.2m (H1 2021: GBPnil, FY 2021:

GBP0.4m).

Adjusted profit before tax was GBP5.5m (H1 2021: GBP3.5m). The

Group adjusted tax charge totalled GBP1.0m (H1 2021: GBP0.5m), an

adjusted effective tax rate of 18.0% (H1 2021: 14.7%).

Adjusted diluted earnings per share was 19.9p (H1 2021: 13.1p),

an increase of 52%, reflecting the increase in operating

profit.

Statutory operating profit increased by 264% to GBP2.5m and

after net finance costs of GBP0.2m (H1 2021: GBPnil), statutory

profit before tax was up 238% from GBP0.7m to GBP2.3m, giving

statutory basic earnings per share of 8.6p (H1 2021: 3.2p). The

statutory tax charge was GBP0.4m (H1 2021: GBPnil). A

reconciliation of statutory to underlying non-GAAP financial

measures is provided below. The adjustments of GBP3.2m comprise

GBP2.7m of amortisation of acquired intangibles and GBP0.5m of ERP

cloud computing costs (H1 2021: GBP2.8m comprising GBP1.7m of

amortisation of acquired intangibles, GBP0.7m of ERP cloud

computing costs and GBP0.4m of acquisition costs). The tax impact

of these adjustments was GBP0.6m.

The Group delivered strong adjusted operating cash flow of

GBP8.5m with the net cash position at the period end of GBP27.7m

underpinning a robust balance sheet and providing the resources to

continue the Group's investment programme.

Russia/Ukraine

At this stage the consequences for the global economy of the

tragic events in Ukraine are uncertain. Whilst the Group has no

operations in this part of the world and no direct exposure to

customers and suppliers in the region, we continue to monitor the

situation carefully and in particular any effects on wider supply

chains. The Group has also reviewed the current sanctions regime

relating to Russia and Ukraine and can confirm the Group has no

exposure to any sanctioned entities or individuals.

Sector review

Track testing

Track testing revenue of GBP30.4m was up 45% against H1 2021

(GBP20.9m) and up 6% against H2 2021 (GBP28.7m). On an organic

constant currency basis track testing revenue was up 23%.

Driving robot sales increased 7% against H1 2021 to GBP9.7m (H1

2021: GBP9.1m), following the recovery of order intake during H2

2021. The Group expects continued moderate growth in driving robots

once new regulatory requirements for new ADAS technologies are

released.

ADAS platform sales increased 39% to GBP13.3m in H1 2021 (H1

2021: GBP9.6m). Demand for these products, particularly the

LaunchPad continues to build. The new higher speed versions of the

GST and Launchpad, which can operate at speeds of up to 120kph and

80kph respectively, enable customers to perform a greater range of

tests, particularly the assessment of automated lane keeping

technology and vehicle interactions with Vulnerable Road Users such

as motorcyclists. The trend towards multi-object test scenarios

will further drive demand for a range of platforms that meet these

test requirements, including platforms to carry a range of objects

(e.g. pedestrian dummies, cyclists, scooters, motorcycles, etc.)

that can operate at a range of speeds and can interact with a

variety of test vehicles from passenger cars to commercial

vehicles.

The acquisition of Vadotech in March 2021 saw revenue related to

the provision of testing services increase to GBP7.4m (H1 2021:

GBP2.2m).

Order intake for track testing products has continued to

improve, providing confidence for the second half of the year.

ABD Solutions, the Group's new market-facing business unit that

develops solutions to automate vehicle applications, was awarded

its first collaborative development contract with an industrial

equipment supplier in Japan for a driverless retrofit solution for

mining vehicles. The contract, while not financially significant at

GBP1.1m for delivery over eighteen months, will provide the

opportunity to validate the technology for this specific

application. This represents an encouraging first step in the

Group's diversification strategy to reduce dependence on the

traditional passenger vehicle automotive market.

The Group continues to invest in new product development in this

sector in order to meet forthcoming regulatory requirements and to

ensure we retain our market leadership in track testing products

and technology.

Laboratory testing and simulation

The laboratory testing and simulation business delivered strong

revenue growth to GBP7.4m, an increase of 17% on H1 2021

(GBP6.4m).

Simulation sales grew significantly reflecting high customer

demand for our simulation software and aVDS simulators, with

revenue of GBP5.4m, up 26% compared with H1 2021 (GBP4.3m). During

the first half of the year, development continued on the new

variant of our full motion simulator for a major automotive

OEM.

SPMM revenue of GBP2.0m was in line with H1 2021 (GBP2.1m) and

the division carries forward a solid order book, which provides

good coverage for the remainder of the financial year alongside

further opportunities in the pipeline.

Progress on our strategy

The Group continues to make good progress against its core

strategic priorities, as well as further integrating ESG as a core

tenet of our strategy and operating model.

As part of the objective to diversify into adjacent markets, the

newly established ABD Solutions aims to accelerate the automation

of vehicle applications in four new primary market sectors with an

initial focus on mining and defence.

The recruitment and build out of the ABD Solutions team is on

track, with good progress made against the technology development

plan for object detection and the technology stack. In addition to

the development contract for the retrofit solution for mining

vehicles, demonstrations have been given to a number of potential

customers and partners in the defence industry.

New product development continues across our core business to

enhance our offering in these attractive markets.

Acquisitions

During the second half of 2021, the Group acquired Vadotech

Group for a maximum consideration of up to EUR26m including two

performance payments of EUR3m and EUR6m. The first performance

targets were met and EUR3m was paid in H2 2021. The second

performance payment is expected to be made in H2 2022. The

acquisition provided a strategically important footprint in the

Asia Pacific region, allowing the introduction of our new

divisional operating hub in Singapore. Vadotech Group has performed

well since acquisition and in line with the Board's

expectations.

Acquisitions have and will continue to be a significant part of

our overall strategy and we have a promising pipeline of potential

acquisition opportunities.

Alternative performance measures

In the analysis of the Group's financial performance and

position, operating results and cash flows, alternative performance

measures are presented to provide readers with additional

information. The principal measures presented are adjusted measures

of earnings including adjusted operating profit, EBITDA, adjusted

operating margin, adjusted profit before tax and adjusted earnings

per share.

The interim report includes both statutory and adjusted non-GAAP

financial measures, the latter of which the Directors believe

better reflect the underlying performance of the business and

provide a more meaningful comparison of how the business is managed

and measured on a day-to-day basis. The Group's alternative

performance measures and KPIs are aligned to the Group's strategy

and together are used to measure the performance of the business

and form the basis of the performance measures for remuneration.

Adjusted results exclude certain items because if included, these

items could distort the understanding of the performance for the

year and the comparability between the periods.

We provide comparatives alongside all current period figures.

The term 'adjusted' is not defined under IFRS and may not be

comparable with similarly titled measures used by other companies.

All profit and earnings per share figures in this interim report

relate to underlying business performance (as defined above) unless

otherwise stated.

A reconciliation of adjusted measures to statutory measures is

provided below:

H1 2022 H1 2021

Adjusted Adjustments Statutory Adjusted Adjustments* Statutory*

EBITDA (GBPm) 7.3 (0.5) 6.8 4.6 (1.1) 3.5

Operating profit (GBPm) 5.7 (3.2) 2.5 3.5 (2.8) 0.7

Operating margin (%) 15.1 (8.5) 6.6 12.8 (10.3) 2.5

Profit before tax (GBPm) 5.5 (3.2) 2.3 3.5 (2.8) 0.7

Tax expense (GBPm) (1.0) 0.6 (0.4) (0.5) 0.5 -

Profit after tax (GBPm) 4.5 (2.6) 1.9 3.0 (2.3) 0.7

Diluted earnings per share (pence) 19.9 (11.4) 8.5 13.1 (9.9) 3.2

The adjustments to operating profit comprise:

H1 2022 H1 2021*

GBPm GBPm

Amortisation of acquired intangibles 2.7 1.7

ERP cloud computing costs 0.5 0.7

Acquisition related costs - 0.4

Adjustments 3.2 2.8

-------------------------------------- -------- ---------

* The prior year comparative has been restated to reflect the

write off of previously capitalised ERP development costs on

adoption of the IFRIC update on cloud computing arrangements.

Research and development

While research and development forms a significant part of the

Group's activities, a significant proportion relates to specific

customer programmes which are included in the cost of the product.

Development costs of GBP0.1m (H1 2021: GBP0.6m) have been

capitalised in relation to projects for which there are a number of

near-term sales opportunities. Other research and development

costs, all of which have been expensed to the profit and loss

account as incurred, total GBP0.1m (H1 2021: GBP0.2m).

Foreign currency exposure

The Group faces currency exposure on its foreign currency

transactions and with significant overseas operations, also has

exposure to foreign currency translation risk.

The Group maintains a natural hedge whenever possible to

transactional exposure by matching the cash inflows and outflows in

the respective currencies.

There was no material difference between the reported profit for

the year and that calculated on a constant currency basis as the

impact of the strengthening US dollar was offset by the weakening

Euro.

Dividends

The Board has declared an interim dividend of 1.76p per ordinary

share (H1 2021: 1.6p) which will be paid on 20 May 2022 to

shareholders on the register on 6 May 2022. A final dividend of

3.24p per share was paid in respect of the year ended 31 August

2021. It is the Board's intention to pursue a sustainable and

growing dividend policy in the future having regard to the

development of the Group.

Summary and Outlook

The Group has delivered a strong financial and operational

performance in the first half of the year, with continued momentum

in our key markets and progress against our strategic

objectives.

Against the backdrop of challenges in relation to supply chain

disruption and inflationary pressures, the Group has, to date,

successfully mitigated these effects and continued to invest in all

areas of the business, supporting our ambitious growth plans.

Whilst mindful of ongoing geopolitical uncertainty and the risk

of further logistics disruption and inflation, given the

improvement in order intake, the Board now expects the financial

results for the year to be slightly ahead of market

expectations.

Our market drivers remain strong. Against that background and

based on the recent track record of improved demand and continued

strategic investment, the Board is confident of delivering progress

during the second half of 2022 and beyond.

Directors' Responsibility Statement

The Directors confirm that this condensed consolidated half year

financial information has been prepared in accordance with

International Accounting Standard 34, 'Interim Financial Reporting'

as adopted by the United Kingdom, and that the half year management

report herein includes a fair review of the information required by

DTR 4.2.7 and DTR 4.2.8, namely:

-- an indication of important events that have occurred during

the first six months and their impact on the condensed consolidated

half year financial information, and a description of the principal

risks and uncertainties for the remaining six months of the

financial year; and

-- material related party transactions in the first six months

and any material changes in the related party transactions

described in the last annual report.

By order of the Board

Dr James Routh

Chief Executive Officer

27 April 2022

AB Dynamics plc

Unaudited consolidated statement of comprehensive income

for the six months ended 28 February 2022

Unaudited 6 months ended 28 Unaudited 6 months ended Audited Year ended

February 2022 28 February 31 August

2021 2021

Adjusted Adjustments Statutory Adjusted Adjustments Statutory Adjusted Adjustments Statutory

(Restated)* (Restated)*

Note GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue 2 37,826 - 37,826 27,280 - 27,280 65,380 - 65,380

Cost of sales (16,011) - (16,011) (11,552) - (11,552) (28,269) - (28,269)

Gross profit 21,815 - 21,815 15,728 - 15,728 37,111 - 37,111

General and

administrative

expenses (16,102) (3,214) (19,316) (12,231) (2,810) (15,041) (26,288) (6,630) (32,918)

--------- ------------ ---------- --------- ------------ ------------ ------------- ------------ ----------

Operating profit 5,713 (3,214) 2,499 3,497 (2,810) 687 10,823 (6,630) 4,193

----------------- ----- --------- ------------ ---------- --------- ------------ ------------ ------------- ------------ ----------

Operating profit

is

analysed as:

Before

depreciation

and

amortisation 7,313 (480) 6,833 4,598 (1,132) 3,466 13,500 (2,198) 11,302

Depreciation and

amortisation (1,600) (2,734) (4,334) (1,101) (1,678) (2,779) (2,677) (4,432) (7,109)

--------- ------------ ---------- --------- ------------ ------------ ------------- ------------ ----------

Operating profit 5,713 (3,214) 2,499 3,497 (2,810) 687 10,823 (6,630) 4,193

----------------- ----- --------- ------------ ---------- --------- ------------ ------------ ------------- ------------ ----------

Finance income 131 - 131 21 - 21 15 - 15

Finance expense (86) - (86) (18) - (18) (91) - (91)

Other finance

expense (215) - (215) - - - (332) - (332)

Profit before

tax 5,543 (3,214) 2,329 3,500 (2,810) 690 10,415 (6,630) 3,785

Tax expense (999) 606 (393) (515) 555 40 (1,895) 1,095 (800)

--------- ------------ ---------- --------- ------------ ------------ ------------- ------------ ----------

Profit for the

period 4,544 (2,608) 1,936 2,985 (2,255) 730 8,520 (5,535) 2,985

--------- ------------ ---------- --------- ------------ ------------ ------------- ------------ ----------

Other

comprehensive

income/(loss)

Items that may be

reclassified

to consolidated income

statement:

Cash flow hedges 30 - 30 - - - (31) - (31)

Exchange gain/(loss) on

foreign

currency net

investments 132 - 132 (948) - (948) (614) - (614)

Total comprehensive

income/(loss)

for the year 4,706 (2,608) 2,098 2,037 (2,255) (218) 7,875 (5,535) 2,340

--------- ------------ ---------- --------- ------------ ------------ ------------- ------------ ----------

Earnings per share -

basic (pence)

5 20.1 (11.5) 8.6 13.2 (10.0) 3.2 37.7 (24.5) 13.2

Earnings per share -

diluted

(pence) 5 19.9 (11.4) 8.5 13.1 (9.9) 3.2 37.4 (24.3) 13.1

* The prior year comparative has been restated to reflect the write off of previously capitalised ERP

development costs on adoption of the IFRIC update on cloud computing arrangements (see note 3).

AB Dynamics plc

Unaudited consolidated statement of financial position

as at 28 February 2022

Unaudited Unaudited Audited

28 February 28 February 31 August

2022 2021 2021

(Restated)*

GBP'000 GBP'000 GBP'000

ASSETS Note

Non-current assets

Goodwill 22,269 15,821 22,221

Acquired intangible assets 25,304 15,719 28,282

Other intangible assets 1,618 1,078 1,577

Property, plant and equipment 25,210 26,845 25,815

Right-of-use assets 1,020 466 913

75,421 59,929 78,808

------------- ------------- -----------

Current assets

Inventories 9,535 9,090 6,771

Trade and other receivables 17,641 14,466 15,500

Contract assets 3,728 1,613 4,269

Taxation 815 1,119 1,443

Cash and cash equivalents 7 28,772 34,084 23,282

------------- ------------- -----------

60,491 60,372 51,265

------------- ------------- -----------

Assets held for sale 1,893 - 1,893

------------- ------------- -----------

LIABILITIES

Current liabilities

Borrowings - 485 -

Trade and other payables 10,607 10,972 10,933

Contract liabilities 8,184 3,885 3,568

Derivative financial instruments 1 - 31

Short-term lease liabilities 7 556 246 456

Deferred consideration 5,016 - 4,929

------------- ------------- -----------

24,364 15,588 19,917

------------- ------------- -----------

Non-current liabilities

Deferred tax liabilities 6,464 2,927 6,552

Long-term lease liabilities 7 511 237 511

6,975 3,164 7,063

------------- ------------- -----------

Net assets 106,466 101,549 104,986

------------- ------------- -----------

Shareholders' equity

Share capital 226 230 226

Share premium 62,210 61,785 62,210

Other reserves 8 (2,177) (2,642) (2,339)

Retained earnings 46,207 42,176 44,889

------------- ------------- -----------

Total equity 106,466 101,549 104,986

------------- ------------- -----------

* The prior year comparative has been restated to reflect the

write off of previously capitalised ERP development costs on

adoption of the IFRIC update on cloud computing arrangements (see

note 3).

AB Dynamics plc

Unaudited consolidated statement of changes in equity

for the six months ended 28 February 2022

Share Share premium Other reserves Retained Total equity

capital earnings

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 September

2021 226 62,210 (2,339) 44,889 104,986

Share based payments - - - 570 570

Total comprehensive

income - - 162 1,936 2,098

Deferred tax on

share based payments - - - (455) (455)

Dividend paid - - - (733) (733)

At 28 February

2022 226 62,210 (2,177) 46,207 106,466

--------- -------------- --------------- ---------- -------------

At 1 September

2020 226 61,736 (1,694) 41,956* 102,224*

Share based payments - - - 570 570

Total comprehensive

income - - (948) 730* (218)*

Deferred tax on

share based payments - - - (86) (86)

Dividend paid - - - (994) (994)

Issue of shares 4 49 - - 53

--------- -------------- --------------- ---------- -------------

At 28 February

2021 230 61,785 (2,642) 42,176* 101,549*

--------- -------------- --------------- ---------- -------------

At 1 September

2020 226 61,736 (1,694) 41,956 102,224

Share based payments - - - 1,139 1,139

Total comprehensive

income - - (645) 2,985 2,340

Deferred tax on

share based payments - - - 165 165

Dividend paid - - - (1,356) (1,356)

Issue of shares - 474 - - 474

--------- -------------- --------------- ---------- -------------

At 31 August 2021 226 62,210 (2,339) 44,889 104,986

--------- -------------- --------------- ---------- -------------

* The prior year comparative has been restated to reflect the

write off of previously capitalised ERP development costs on

adoption of the IFRIC update on cloud computing arrangements.

AB Dynamics plc

Unaudited consolidated cash flow statement

for the six months ended 28 February 2022

Unaudited Unaudited Audited

6 months 6 months Year

ended ended ended

28 February 28 February 31 August

2022 2021 2021

(Restated)*

GBP'000 GBP'000 GBP'000

Profit before tax 2,329 690 3,785

Depreciation and amortisation 4,334 2,779 7,109

Net finance expense/(income) 170 (3) 408

Acquisition costs - - 304

Share based payments 570 570 1,240

----------------- ------------- -----------

Operating cash flows before changes

in working capital 7,403 4,036 12,846

(Increase)/decrease in inventories (2,764) 90 2,409

Increase in trade and other receivables (1,600) (298) (3,913)

Increase in trade and other payables 4,954 3,285 2,956

----------------- ------------- -----------

Cash flows from operations 7,993 7,113 14,298

----------------------------------------- ----------------- ------------- -----------

Cash impact of adjusting items 480 868 1,663

Adjusted cash flow from operations 8,473 7,981 15,961

----------------------------------------- ----------------- ------------- -----------

Interest received 131 21 15

Finance costs paid (46) (113) (154)

Income tax (paid)/received (707) 1,570 1,062

----------------- ------------- -----------

Net cash flows from operating

activities 7,371 8,591 15,221

Cash flows used in investing activities

Acquisition of businesses - (560) (14,329)

Purchase of property, plant and

equipment (554) (3,363) (5,536)

Capitalised development costs

and purchased software (138) (589) (1,104)

----------------- ------------- -----------

Net cash used in investing activities (692) (4,512) (20,969)

Cash flows (used in)/generated

from financing activities

Movements in loans - (20) (493)

Maturity of fixed term deposits - 5,000 5,000

Dividends paid (733) (994) (1,356)

Proceeds from issue of share capital - 53 474

Repayment of lease liabilities (423) (249) (656)

----------------- ------------- -----------

Net cash flow (used in)/generated

from financing activities (1,156) 3,790 2,969

----------------- ------------- -----------

Net increase/(decrease) in cash

and cash equivalents 5,523 7,869 (2,779)

Cash and cash equivalents at beginning

of the period 23,282 26,183 26,183

Effect of exchange rates on cash

and cash equivalents (33) 32 (122)

----------------- ------------- -----------

Cash and cash equivalents at end

of period 28,772 34,084 23,282

----------------- ------------- -----------

* The prior year comparative has been restated to reflect the

write off of previously capitalised ERP development costs on

adoption of the IFRIC update on cloud computing arrangements.

AB Dynamics plc

Notes to the unaudited interim report

for the six months ended 28 February 2022

1. Basis of preparation

The Company is a public limited company limited by shares and

incorporated under the UK Companies Act. The Company is domiciled

in the United Kingdom and the registered office and principal place

of business is Middleton Drive, Bradford on Avon, Wiltshire, BA15

1GB.

The principal activity is the specialised area of design,

manufacture and supply of advanced testing, simulation and

measurement products to the global transport market.

The annual financial statements of the Group are prepared in

accordance with International Financial Reporting Standards as

adopted for use by the UK in conformity with the requirements of

the Companies Act 2006. A copy of the statutory accounts for the

year ended 31 August 2021 has been delivered to the Registrar of

Companies. The auditor's report on those accounts was unqualified

and did not contain any statements under section 498(2) or (3) of

the Companies Act 2006.

The same accounting policies, presentation and methods of

computation have been followed in this unaudited interim financial

information as those which were applied in the preparation of the

Group's annual financial statements for the year ended 31 August

2021.

Certain new standards, amendments to standards and

interpretations are not yet effective for the year ended 31 August

2022 and have therefore not been applied in preparing this interim

financial information.

The interim accounts are unaudited and do not constitute

statutory accounts as defined in Section 434 of the Companies Act

2006.

Going concern basis of accounting

The Directors have assessed the principal risks discussed in

note 9, including by modelling a number of severe but plausible

downside economic scenarios, whereby the Group experiences:

-- A reduction in demand of 25%

-- A 10% increase in operating costs from supply chain disruption

-- An increase in cash collection cycle

With GBP27.7m of net cash at 28 February 2022 and availability

of a revolving credit facility of GBP15m, in this severe downside

scenario, the Group has sufficient headroom to be able to continue

to operate for the foreseeable future. The Directors believe that

the Group is well placed to manage its financing and other business

risks satisfactorily and have a reasonable expectation that the

Group will have adequate resources to continue in operation for at

least 12 months from the signing date of this interim financial

information. They therefore consider it appropriate to adopt the

going concern basis of accounting in preparing the interim

financial information.

The interim financial information for the six months ended 28

February 2022 was approved by the Board on 27 April 2022.

2. Segment information

Revenues attributable to individual foreign countries are as

follows:

Unaudited Unaudited Audited

6 months 6 months Year

ended ended ended

28 February 28 February 31 August

2022 2021 2021

GBP'000 GBP'000 GBP'000

United Kingdom 2,780 3,191 4,449

Rest of Europe 6,772 4,763 11,352

North America 10,105 8,963 15,884

Asia Pacific 17,501 9,668 32,717

Rest of the World 668 695 978

-------------- -------------- --------------

37,826 27,280 65,380

-------------- -------------- --------------

Revenues are disaggregated as

follows:

Track testing 30,420 20,937 49,680

Laboratory testing and simulation 7,406 6,343 15,700

-------------- -------------- --------------

37,826 27,280 65,380

-------------- -------------- --------------

3. Alternative Performance measures

In the analysis of the Group's financial performance and

position, operating results and cash flows, alternative performance

measures are presented to provide readers with additional

information. The principal measures presented are adjusted measures

of earnings including adjusted operating profit, EBITDA, adjusted

operating margin, adjusted profit before tax and adjusted earnings

per share.

The interim financial information includes both statutory and

adjusted non-GAAP financial measures, the latter of which the

Directors believe better reflect the underlying performance of the

business and provide a more meaningful comparison of how the

business is managed and measured on a day-to-day basis. The Group's

alternative performance measures and KPIs are aligned to the

Group's strategy and together are used to measure the performance

of the business and form the basis of the performance measures for

remuneration. Adjusted results exclude certain items because if

included, these items could distort the understanding of the

performance for the year and the comparability between the

periods.

We provide comparatives alongside all current year figures. The

term 'adjusted' is not defined under IFRS and may not be comparable

with similarly titled measures used by other companies. All profit

and earnings per share figures in this interim report relate to

underlying business performance (as defined above) unless otherwise

stated.

A summary of the items which reconcile statutory to adjusted

measures is included below:

Unaudited Unaudited Audited

6 months 6 months Year

ended ended ended

28 February 28 February 31 August

2022 2021 2021

(Restated)*

GBP'000 GBP'000 GBP'000

Amortisation of acquired intangibles 2,734 1,678 4,432

ERP development costs 480 668 1,358

Acquisition related costs - 464 840

3,214 2,810 6,630

-------------- -------------- --------------

* The prior year comparative has been restated to reflect the

write off of previously capitalised ERP development costs on

adoption of the IFRIC update on cloud computing arrangements.

Amortisation of acquired intangibles

The amortisation relates to the acquisition of Vadotech Group on

3 March 2021 and the businesses acquired in 2019, DRI and

rFpro.

ERP Development costs

During April 2021 the IFRS Interpretations Committee finalised

its agenda decision regarding configuration and customisation costs

in Cloud Computing Arrangements (Software as a Service (SaaS))

under IAS 38. The agenda decision specifies that where ERP systems

are hosted on the cloud, no intangible asset arises and

configuration and customisation costs should be expensed. The ERP

system currently being implemented is hosted on the cloud;

therefore, the capitalised expenditure for development costs has

now been expensed.

Acquisition related costs

The prior year costs relate to the acquisition of the Vadotech

Group as well as staff retention payments to the employees of

rFpro.

4. Tax

The statutory effective tax rate for the period is a charge of

16.9% (H1 2021: tax credit of 6%), the difference from the prior

period reflecting the availability of additional R&D credits

and an increased patent box deduction.

The adjusted effective tax rate, adjusting both the tax charge

and the profit before taxation is 18.0% (H1 2021: 14.7%).

5. Earnings per share

The calculation of earnings per share is based on the following

earnings and number of shares:

Unaudited Unaudited Audited

6 months 6 months Year

ended ended ended

28 February 28 February 31 August

2022 2021 2021

(Restated)*

Profit after tax attributable

to owners of the Company (GBP'000) 1,936 730 2,985

Adjusted profit after tax attributable

to owners of the Company (GBP'000) 4,544 2,985 8,520

Weighted average number of shares

( '000 )

Basic 22,624 22,583 22,602

Diluted 22,834 22,781 22,782

Earnings per share (pence)

Basic 8.6 3.2 13.2

Diluted 8.5 3.2 13.1

Adjusted basic 20.1 13.2 37.7

Adjusted diluted 19.9 13.1 37.4

* The prior year comparative has been restated to reflect the

write off of previously capitalised ERP development costs on

adoption of the IFRIC update on cloud computing arrangements.

6. Dividends

An interim dividend of 1.6p per ordinary share in respect of the

year ended 31 August 2021 was paid on 14 May 2021 to shareholders

on the register on 30 April 2021.

At the Annual General Meeting the shareholders approved a final

dividend in respect of the year ended 31 August 2021 of 3.24p per

ordinary share totalling GBP733,000. This was paid on 28 January

2022 to shareholders on the register on 31 December 2021.

An interim dividend of 1.76p per ordinary share has been

declared in respect of the year ending 31 August 2022 which will be

paid on 20 May 2022 to shareholders on the register on 6 May

2022.

7. Net cash

Net cash comprises cash and cash equivalents, bank overdrafts

and lease liabilities.

Unaudited Unaudited Audited

28 February 28 February 31 August

2022 2021 2021

GBP'000 GBP'000 GBP'000

Cash and cash equivalents 28,772 34,084 23,282

Borrowings - (485) -

Lease liabilities (1,067) (483) (967)

------------- ------------- -----------

27,705 33,116 22,315

------------- ------------- -----------

The Group has a GBP15m revolving credit facility with National

Westminster Bank plc. The facility remained undrawn at 28 February

2022.

8. Other reserves

Merger relief Reconstruction Translation Hedging Total

reserve reserve reserve reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 September 2020 11,390 (11,284) (1,800) - (1,694)

Total comprehensive

income - - (948) - (948)

-------------- --------------- ------------ --------- ----------

At 28 February 2021 11,390 (11,284) (2,748) - (2,642)

Total comprehensive

income - - 334 (31) 303

-------------- --------------- ------------ --------- ----------

At 31 August 2021 11,390 (11,284) (2,414) (31) (2,339)

Total comprehensive

income - - 132 30 162

-------------- --------------- ------------ --------- ----------

At 28 February 2022 11,390 (11,284) (2,282) (1) (2,177)

-------------- --------------- ------------ --------- ----------

9. Principal risks

The principal risks and uncertainties impacting the Group are

described on pages 56-58 of our Annual Report 2021 and remain

unchanged at 28 February 2022.

They include: COVID-19 disruption, downturn or instability in

major geographic markets or market sectors, loss of major customers

and changes in customer procurement processes, failure to deliver

new products, dependence on external routes to market, acquisitions

integration and performance, supply chain, cybersecurity and

business interruption, competitor actions, loss of key personnel,

threat of disruptive technology, product liability, failure to

manage growth, foreign currency, credit risk and intellectual

property/patents.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR UNSWRUWUSUAR

(END) Dow Jones Newswires

April 27, 2022 02:01 ET (06:01 GMT)

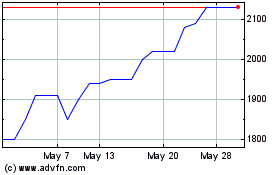

AB Dynamics (AQSE:ABDP.GB)

Historical Stock Chart

From Feb 2025 to Mar 2025

AB Dynamics (AQSE:ABDP.GB)

Historical Stock Chart

From Mar 2024 to Mar 2025