TIDMAEP

RNS Number : 3651K

Anglo-Eastern Plantations PLC

24 August 2023

Anglo-Eastern Plantations Plc

("AEP", "Group" or "Company")

Announcement of interim results for the six months ended 30 June

2023

The group, comprising Anglo-Eastern Plantations Plc and its

subsidiaries (the "Group"), is a major producer of palm oil and

rubber with plantations across Indonesia and Malaysia, has today

released its results for the six months ended 30 June 2023.

Financial Highlights

2023 2022 2022

6 months 6 months 12 months

to 30 June to 30 to 31 December

June

$m $m $m

Continuing operations (unaudited) (unaudited) (audited)

Revenue 173.4 249.2 447.6

Profit before tax

- before biological assets

("BA") movement 32.2 94.8 138.7

- after BA movement 32.5 89.5 132.9

Basic Earnings per ordinary

share ("EPS")

- before BA movement 50.27cts 153.51cts 221.86cts

- after BA movement 50.73cts 144.73cts 212.34cts

Enquiries:

Anglo-Eastern Plantations Plc

Dato' John Lim Ewe Chuan +44 (0)20 7216 4621

Panmure Gordon (UK) Limited

Dominic Morley / Amrit Mahbubani +44 (0)20 7886 2500

Chairman's Interim Statement

The interim results for the Group for the six months to 30 June

2023 are as follows:

Revenue from continuing operations for the six months to 30 June

2023 was $173.4 million, 30% lower than $249.2 million reported for

the same period of 2022. The Group's gross profit from continuing

operations was $33.2 million compared to $90.3 million for the

first six months of 2022. Overall profit before tax, after

biological assets ("BA") movement, from continuing operations for

the first half of 2023 was 64% lower at $32.5 million against $89.5

million for the corresponding period in 2022. There was no reversal

of impairment losses for the first half of 2023 compared to a net

reversal of impairment losses of $0.2 million for the first half of

2022. The BA movement adjustment from continuing operations for the

first half of 2023 was a credit of $0.3 million as compared to a

debit of $5.3 million for the same period last year. The lower

profit was mainly attributed to lower Crude Palm Oil ("CPO")

prices, as well as lower crop productions in Bengkulu and North

Sumatra and lower third party crops.

Fresh Fruit Bunches ("FFB") production from continuing

operations for the first half of 2023 was 5% lower at 522,700mt

compared to 550,800mt for the same period in the previous year due

to lower production in Bengkulu and North Sumatera regions. The

harvest in Bengkulu was lower by 16% due primarily to the reduction

of almost 1,300ha of matured area of which 985ha was replanted in

2022 while another 682ha was cleared for replanting in the first

half of 2023. Production in Kalimantan continued to recover by

registering a 10% increase in harvest with 500ha coming to maturity

in the first half of 2023. Bought-in crops for the first half of

2023 decreased by 10% to 501,400mt from 557,600mt for the same

period last year. The 20% increase in third party crops in

Kalimantan could not off-set a 14% decrease in bought in crops in

Bengkulu and North Sumatera. Lower crop trend faced by our estates

in North Sumatera and Bengkulu was also experienced by local

smallholders and farmers.

Operational and financial performance

For the six months ended 30 June 2023, gross profit margin from

continuing operations decreased to 19.2% from 36.2% as the Group

experienced lower CPO and palm kernel prices.

CPO price ex-Rotterdam averaged $991/mt for the first six months

to 30 June 2023, 40% lower than $1,640/mt over the same period in

2022. The rally in the first three months of 2022 was built upon;

speculation of unfavourable weather conditions in prime

soybean-producing countries which have adversely affected the

supply of soybean oil (of which CPO is the closest substitute), the

gradual re-opening of the world economy after the ravage of

Covid-19 and the disruption to supplies because of the

Russia-Ukraine conflict. As a result, the Group's average ex-mill

price was lower by 27% at $751/mt for the same period (H2 2022:

$1,035/mt). The ex-mill prices are normally at a discount to

ex-Rotterdam prices as buyers factor in logistic charges and

Indonesian CPO tax and levy, which they have to bear. Palm kernel

prices were also lower by 55% at the average price of $361/mt

against $808/mt in the same period last year.

Profit after tax from continuing operations for the six months

ended 30 June 2023 was 65% lower at $24.1 million, compared to a

profit after tax from continuing operations of $68.8 million for

the first six months of 2022.

The resulting basic earnings per share from continuing

operations for the period was 50.73cts (H1 2022: 144.73cts).

The Group's balance sheet remains strong with no outstanding

bank loans. Net assets as at 30 June 2023 were $605.5 million

compared to $585.3 million as at 30 June 2022 and $573.0 million as

at 31 December 2022. The increase in net assets from the last

interim report was attributed to profit during the period. The

Indonesian Rupiah has appreciated by 4% against the US dollar in

the first half of 2023.

As at 30 June 2023, the Group had cash and cash equivalents

including short-term investments known as fixed deposits with banks

of $261.3 million (H1 2022: $246.8 million, 31 December 2022:

$277.0 million). The Group remitted in advance about $10 million to

the Company's Registrar for payment of a dividend resulting in

lower cash position at 30 June 2023 compared to 31 December

2022.

Operating costs

Operating costs for the Indonesian operations were lower in the

first half of 2023 compared to the same period in 2022 mainly due

to lower volume and prices paid for third party crops. This helped

to offset higher maintenance costs in plantations and mills and

also higher harvesting costs arising from the increase in newly

matured area. Fertiliser costs rose sharply by 7.5% in the first

half of 2023 to $17.0 million from $15.8 million for the

corresponding period in 2022. We have recently concluded a tender

to purchase fertilisers for the second half of 2023 and we are

pleased to report that prices of fertiliser have corrected sharply

by as much as 40% since peaking in the first half of 2023.

Transport costs have also increased significantly by 54% to $4.3

million from $2.8 million for the corresponding period in 2022 due

to increases in diesel prices.

Production and Sales

2023 2022 2022

6 months 6 months Year

to 30 June to 30 June to 31 December

mt mt mt

Oil palm production

FFB

- all estates from continuing

operations 522,700 550,800 1,124,400

- estates from discontinued

operations 15,700 21,500 46,300

- bought-in from third parties 501,400 557,600 1,080,300

Saleable CPO 210,900 227,800 455,600

Saleable palm kernels 48,600 54,400 106,200

Oil palm sales

CPO 201,800 200,000 449,800

Palm kernels 47,400 48,900 105,700

FFB sold outside 24,200 17,800 42,800

Rubber production 250 168 440

The Group's six mills processed a total of 1,015,600mt in FFB

for the first half of 2023, a 9% decrease compared to 1,112,100mt

for the same period last year.

Overall CPO produced for the first half of 2023 was 7% lower at

210,900mt from 227,800mt for the corresponding period in 2022. The

oil extraction rate for the first half of 2023 was 20.8%, slight

improvement compared to 20.5% for the same period last year.

Commodity prices

The CPO price ex-Rotterdam for the first half of 2023 averaged

$991/mt, 40% lower than last year (H1 2022: $1,640/mt). CPO price

started the year at $1,060/mt and generally traded within a 12%

range peaking at $1,100/mt in early January and March 2023 before

dropping to a low of $860/mt in late May 2023. CPO price recovered

slightly to close at $955/mt at 30 June 2023. The trend of CPO

price in the first half of 2023 reflected the increase in inventory

of soft oils amidst reports of a slowdown in global demand.

Rubber price averaged $1,307/mt, 22% lower than H1 2022 at

$1,670/mt.

Development

The Group's planted areas at 30 June 2023 comprised:

Total Mature Immature

Continuing operations Ha ha Ha

North Sumatera 19,093 18,699 394

Bengkulu 16,742 13,568 3,174

Riau 4,816 4,816 -

Kalimantan 18,068 15,389 2,679

Bangka 2,647 1,716 931

Plasma 3,761 2,629 1,132

------- ------- ---------

Indonesia 65,127 56,817 8,310

Malaysia 3,453 3,453 -

------- ------- ---------

68,580 60,270 8,310

------- ------- ---------

Discontinued operations

South Sumatera 6,681 6,288 393

Plasma 1,068 1,043 25

------- ------- ---------

7,749 7,331 418

------- ------- ---------

Total: 30 June 2023 76,329 67,601 8,728

------- ------- ---------

Total: 31 December 2022 76,095 66,694 9,401

------- ------- ---------

Total: 30 June 2022 75,239 67,358 7,881

------- ------- ---------

The Group's new planting and replanting for the first six months

of 2023 totalled 987ha compared to 439ha for the same period last

year . In addition, Plasma planting for the period was 89ha (H1

2022: 152ha).

The Group remains optimistic that it will meet substantially its

planting target of 2,500ha (including replanting) in 2023. The

Group's total landholding from its continuing operations comprises

some 90,670ha, of which the planted area stands at around 68,580ha

(H1 2022: 67,512ha) with a balance of estimated plantable land at

9,500ha (H1 2022: 10,850ha).

The seventh mill in North Sumatera which was earmarked for

completion in the first half of 2023 has been delayed because of

the tragic explosion, as previously announced on 9 May 2023,

resulting in a loss of lives of 4 employees of the contractor

whilst conducting final trials and tests before handing over. The

police recently completed their investigation and the contractor is

now allowed access to the area to assess the damages and to

determine the extent of repairs required. We do not expect the mill

be in commercial operation until early next year.

The environment impact assessment study ("EIA") for the eighth

mill in Kalimantan has been completed. The earthworks however

cannot commence until the relevant government ministry has approved

the EIA report. The backlog of companies seeking approval of their

EIA reports is expected to set back the commencement of earthworks

by a few months.

Dividend

The final dividend of 25.0 cents per share in respect of the

year ended 31 December 2022 was paid on 7 July 2023.

As you are aware AEP has not been paying Interim dividend for a

number years, however, the Board is pleased to declare an interim

dividend of 15.0 cents per share in respect of the year ending 31

December 2023. The interim dividend will be paid on 6 October 2023

to those shareholders on the register on 8 September 2023.

Outlook

Despite a traditionally more robust FFB production in the second

half of the year, which would increase supply, CPO price is

expected to perform better due to a projected drop in soybean

production in the United States as farmers planted more corns at

the expense of soybeans. The Indonesian government strong

commitment for the B35 biodiesel mandate is expected to strengthen

local demand and should augur well for the CPO price. Russia's

recent pull out from the Black Sea Grain deal which allowed for the

secure passage of agricultural products from Ukraine's ports in the

Black Sea would also have some impact on sunflower oil and CPO

prices. We do not expect the drought induced by El Nino weather

phenomenon to have a significant effect on yield for the second

half of 2023. The effect, if any would be more prominent in

2024.

Principal risks and uncertainties

The principal risks and uncertainties, including the risks due

to the Covid-19 and other contagious diseases, have broadly

remained the same since the publication of the annual report for

the year ended 31 December 2022.

A more detailed explanation of the risks relevant to the Group

is on pages 31 to 36 and from pages 139 to 144 of the 2022 annual

report which is available at https:// www.angloeastern.co.uk /

.

Subsequent events

The disposal of the three non-performing plantations in South

Sumatera, namely PT Riau Agrindo Agung, PT Karya Kencana Sentosa

Tiga and PT Empat Lawang Agro Perkasa, to Mrs Lina (also known as

Liena Efendy) and Miss Lenny Nurimba on 5 July 2023 for a total

cash consideration of $8.5 million had been completed. Since the

Group is no longer in control of the subsidiaries, all the assets

and liabilities of the subsidiaries will be derecognised from July

2023 onwards.

In July 2023, the Group also completed the acquisition of 25% of

the issued share capital of PT United Kingdom Indonesia Plantations

and the 10% of the issued share capital of PT Mitra Puding Mas,

from PT. Canadianty Corporindo, the minority shareholder in

Indonesia, for a total cash consideration of $25.2million,

increasing the Group ownership interest to 100%.

Mr Jonathan Law Ngee Song

Chairman

24 August 2023

Responsibility Statements

We confirm that to the best of our knowledge:

a) The unaudited interim financial statements have been prepared

in accordance with International Accounting Standards ("IAS") 34:

Interim Financial Reporting as adopted by the European Union;

b) The Chairman's interim statement includes a fair review of

the information required by Disclosure and Transparency Rule

("DTR") 4.2.7R (an indication of important events during the first

six months and a description of the principal risks and

uncertainties for the remaining six months of the year); and

c) The interim financial statements include a fair review of the

information required by DTR 4.2.8R ( material related party

transactions in the six months ended 30 June 2023 and any material

changes in the related party transactions described in the last

Annual Report) of the DTR of the United Kingdom Financial Conduct

Authority.

By order of the Board

Dato' John Lim Ewe Chuan

Executive Director

24 August 2023

Condensed Consolidated Income Statement

2023 2022 2022

6 months to 30 June 6 months to 30 June Year to 31 December

(unaudited) (unaudited) (audited)

---------------------------------- ---------------------------------- --------------------------------

Notes Result

Result before Result

before BA BA BA BA before BA BA

movement* movement Total movement* movement Total movement* movement Total

$000 $000 $000 $000 $000 $000 $000 $000 $000

----------------- ------- ---------- --------- ---------- --------- ----------- ---------- --------- -------------

Continuing

operations

Revenue 3 173,449 - 173,449 249,229 - 249,229 447,619 - 447,619

Cost of sales (140,496) 291 (140,205) (153,633) (5,314) (158,947) (304,424) (5,792) (310,216)

------------------ ------ ---------- --------- ----------- ---------- --------- ----------- ---------- --------- -------------

Gross profit 32,953 291 33,244 95,596 (5,314) 90,282 143,195 (5,792) 137,403

Administration

expenses (4,224) - (4,224) (3,021) - (3,021) (9,683) - (9,683)

Reversal of

impairment - - - 622 - 622 - - -

Impairment losses - - - (366) - (366) (617) - (617)

Operating profit 28,729 291 29,020 92,831 (5,314) 87,517 132,895 (5,792) 127,103

Exchange (losses)

/ gains (493) - (493) 311 - 311 991 - 991

Finance income 4 3,990 - 3,990 1,714 - 1,714 4,859 - 4,859

Finance expense 4 (15) - (15) (8) - (8) (12) - (12)

------------------ ------ ---------- --------- ----------- ---------- --------- ----------- ---------- --------- -------------

Profit before tax 5 32,211 291 32,502 94,848 (5,314) 89,534 138,733 (5,792) 132,941

Tax expense 6 (8,349) (65) (8,414) (21,865) 1,169 (20,696) (32,737) 1,276 (31,461)

------------------ ------ ---------- --------- ----------- ---------- --------- ----------- ---------- --------- -------------

Profit for the

period

from continuing

operations 23,862 226 24,088 72,983 (4,145) 68,838 105,996 (4,516) 101,480

( Loss) / Gain on

discontinued

operations,

net of tax (2,542) 67 (2,475) (297) (75) (372) (5,684) (139) (5,823)

------------------ ------ ---------- --------- ----------- ---------- --------- ----------- ---------- --------- -------------

21,320 293 21,613 72,686 (4,220) 68,466 100,312 (4,655) 95,657

------------------ ------ ---------- --------- ----------- ---------- --------- ----------- ---------- --------- -------------

Profit for the

period

attributable to:

- Owners of the

parent 17,795 248 18,043 60,582 (3,551) 57,031 83,548 (3,904) 79,644

- Non-controlling

interests 3,525 45 3,570 12,104 (669) 11,435 16,764 (751) 16,013

------------------ ------ ---------- --------- ----------- ---------- --------- ----------- ---------- --------- -------------

21,320 293 21,613 72,686 (4,220) 68,466 100,312 (4,655) 95,657

------------------ ------ ---------- --------- ----------- ---------- --------- ----------- ---------- --------- -------------

Profit for the

period

from continuing

operations

attributable to:

- Owners of the

parent 19,924 184 20,108 60,845 (3,480) 57,365 87,937 (3,772) 84,165

- Non-controlling

interests 3,938 42 3,980 12,138 (665) 11,473 18,059 (744) 17,315

------------------ ------ ---------- --------- ----------- ---------- --------- ----------- ---------- --------- -------------

23,862 226 24,088 72,983 (4,145) 68,838 105,996 (4,516) 101,480

------------------ ------ ---------- --------- ----------- ---------- --------- ----------- ---------- --------- -------------

Earnings per

share

attributable to

the

owners of the

parent

during the

period

Profit

- basic and 8 45.52cts 143.89cts 200.94cts

diluted

Profit from

continuing

operations

- basic and 8 50.73cts 144.73cts 212.34cts

diluted

* The total column represents the IFRS figures and the result

before BA movement is an Alternative Performance Measure ("APM")

which reflects the Group's results before the movement in fair

value of biological assets has been applied. We have opted to

additionally disclose this APM as the management do not use the

fair value of BA movement in assessing business performance.

Condensed Consolidated Statement of Comprehensive Income

2023 2022 2022

6 months 6 months Year

to 30 June to 30 June to 31 December

(unaudited) (unaudited) (audited)

$000 $000 $000

------------------------------------------------------------ ------------ ------------ ---------------

Profit for the period 21,613 68,466 95,657

------------------------------------------------------------ ------------ ------------ ---------------

Other comprehensive income / (expenses):

Items may be reclassified to profit or loss:

Profit / (Loss) on exchange translation of foreign

operations 25,971 (22,933) (54,975)

------------------------------------------------------------ ------------ ------------ ---------------

Net other comprehensive income / (expenses)

may be reclassified to profit or loss 25,971 (22,933) (54,975)

------------------------------------------------------------ ------------ ------------ ---------------

Items not to be reclassified to profit or loss:

Remeasurement of retirement benefits plan, net

of tax - - 177

------------------------------------------------------------ ------------ ------------ ---------------

Net other comprehensive income not being reclassified

to profit or loss - - 177

------------------------------------------------------------ ------------ ------------ ---------------

Total other comprehensive income / (expenses)

for the period, net of tax 25,971 (22,933) (54,798)

Total comprehensive income for the period 47,584 45,533 40,859

Attributable to:

- Owners of the parent 39,100 38,570 34,343

- Non-controlling interests 8,484 6,963 6,516

------------------------------------------------------------ ------------ ------------ ---------------

47,584 45,533 40,859

------------------------------------------------------------ ------------ ------------ ---------------

Condensed Consolidated Statement of Financial Position

2023 2022 2022

as at 30 June as at 30 June as at 31 December

(unaudited) (unaudited) (audited)

$000 $000 $000

------------------------------------------ -------------- -------------- ------------------

Non-current assets

Property, plant and equipment 273,024 259,545 252,414

Investment 27 49 42

Receivables 20,142 22,591 18,963

Deferred tax assets 2,310 1,674 1,832

------------------------------------------- -------------- -------------- ------------------

295,503 283,859 273,251

------------------------------------------ -------------- -------------- ------------------

Current assets

Inventories 23,468 41,012 19,590

Income tax receivables 8,198 4,766 4,122

Other tax receivables 40,327 52,054 37,576

Biological assets 6,735 7,133 6,161

Trade and other receivables 17,591 4,457 3,468

Short-term investments 39,040 59,495 55,566

Cash and cash equivalents 222,286 187,339 221,476

------------------------------------------- -------------- -------------- ------------------

357,645 356,256 347,959

Assets in disposal groups classified

as held for sale 8,500 13,000 9,000

------------------------------------------- -------------- -------------- ------------------

366,145 369,256 356,959

------------------------------------------ -------------- -------------- ------------------

Current liabilities

Trade and other payables (29,909) (40,175) (33,966)

Income tax liabilities (1,501) (11,474) (10,230)

Other tax liabilities (1,976) (566) (1,221)

Dividend payables (9,941) (2,007) (32)

Lease liabilities (124) (152) (73)

------------------------------------------- -------------- -------------- ------------------

(43,451) (54,374) (45,522)

------------------------------------------ -------------- -------------- ------------------

Net current assets 322,694 314,882 311,437

------------------------------------------- -------------- -------------- ------------------

Non-current liabilities

Deferred tax liabilities (783) (1,259) (805)

Retirement benefits - net liabilities (11,563) (12,089) (10,874)

Lease liabilities (311) (68) (31)

------------------------------------------- -------------- -------------- ------------------

(12,657) (13,416) (11,710)

------------------------------------------ -------------- -------------- ------------------

Net assets 605,540 585,325 572,978

------------------------------------------- -------------- -------------- ------------------

Issued capital and reserves attributable

to owners of the parent

Share capital 15,504 15,504 15,504

Treasury shares (1,171) (1,171) (1,171)

Share premium 23,935 23,935 23,935

Capital redemption reserve 1,087 1,087 1,087

Exchange reserves (267,990) (260,368) (288,891)

Retained earnings 718,721 697,631 712,919

------------------------------------------- -------------- -------------- ------------------

490,086 476,618 463,383

Non-controlling interests 115,454 108,707 109,595

------------------------------------------- -------------- -------------- ------------------

Total equity 605,540 585,325 572,978

------------------------------------------- -------------- -------------- ------------------

Condensed Consolidated Statement of Changes in Equity

Attributable to owners of the parent

Capital Non-controlling

Share Treasury Share redemption Exchange Retained interests Total

capital shares premium reserve Reserves earnings Total equity

Note $000 $000 $000 $000 $000 $000 $000 $000 $000

---------------------------------------------------------- ----- --------- ---------- --------- ----------- ---------- ---------- --------- ---------------- ---------

Balance at 31 December 2021 15,504 (1,171) 23,935 1,087 (241,907) 642,582 440,030 102,078 542,108

Items of other comprehensive

income:

* Remeasurement of retirement benefits plan, net of

tax - - - - - 144 144 33 177

* Loss on exchange translation of foreign operations - - - - (45,445) - (45,445) (9,530) (54,975)

---------------------------------------------------------- ----- --------- ---------- --------- ----------- ---------- ---------- --------- ---------------- -----------

Total other comprehensive

(expenses) / income - - - - (45,445) 144 (45,301) (9,497) (54,798)

Profit for the year - - - - - 79,644 79,644 16,013 95,657

---------------------------------------------------------- ----- --------- ---------- --------- ----------- ---------- ---------- --------- ---------------- -----------

Total comprehensive (expenses)

/ income for the year - - - - (45,445) 79,788 34,343 6,516 40,859

Acquisition of non-controlling

interests - - - - (1,539) (7,469) (9,008) 3,175 (5,833)

Dividends paid - - - - - (1,982) (1,982) (2,174) (4,156)

----------------------------------------------------------

Balance at 31 December

2022 15,504 (1,171) 23,935 1,087 (288,891) 712,919 463,383 109,595 572,978

----- --------- ---------- --------- ----------- ---------- ---------- --------- ---------------- -----------

Items of other comprehensive

income:

-Remeasurement of retirement

benefits plan, net of tax - - - - - - - - -

-Profit on exchange translation

of foreign operations - - - - 21,057 - 21,057 4,914 25,971

---------------------------------------------------------- ----- --------- ---------- --------- ----------- ---------- ---------- --------- ---------------- -----------

Total other comprehensive

income - - - - 21,057 - 21,057 4,914 25,971

Profit for the period - - - - - 18,043 18,043 3,570 21,613

---------------------------------------------------------- ----- --------- ---------- --------- ----------- ---------- ---------- --------- ---------------- -----------

Total comprehensive income

for the period - - - 21,057 18,043 39,100 8,484 47,584

Acquisition of non-controlling

interests 10 - - - - (156) (2,332) (2,488) (120) (2,608)

Dividends payable - - - - - (9,909) (9,909) (2,505) (12,414)

Balance at 30 June 2023 15,504 (1,171) 23,935 1,087 (267,990) 718,721 490,086 115,454 605,540

---------------------------------------------------------- ----- --------- ---------- --------- ----------- ---------- ---------- --------- ---------------- -----------

Attributable to owners of the parent

Capital Non-controlling

Share Treasury Share redemption Exchange Retained interests Total

capital shares premium reserve reserves earnings Total Equity

$000 $000 $000 $000 $000 $000 $000 $000 $000

---------------------------------------------------------- --------- ---------- --------- ----------- ---------- ---------- --------- ---------------- ---------

Balance at 31 December

2021 15,504 (1,171) 23,935 1,087 (241,907) 642,582 440,030 102,078 542,108

Items of other comprehensive

income:

* Loss on exchange translation of foreign operations - - - - (18,461) - (18,461) (4,472) (22,933)

---------------------------------------------------------- --------- ----------- -------- ----------- ---------- ---------- --------- ---------------- ---------

Total other comprehensive

expenses - - - - (18,461) - (18,461) (4,472) (22,933)

Profit for the period - - - - - 57,031 57,031 11,435 68,466

---------------------------------------------------------- --------- ----------- -------- ----------- ---------- ---------- --------- ---------------- ---------

Total comprehensive (expenses)

/ income for the period - - - - (18,461) 57,031 38,570 6,963 45,533

Dividends payable - - - - - (1,982) (1,982) (334) (2,316)

Balance at 30 June 2022 15,504 (1,171) 23,935 1,087 (260,368) 697,631 476,618 108,707 585,325

---------------------------------------------------------- --------- ----------- -------- ----------- ---------- ---------- --------- ---------------- ---------

Condensed Consolidated Statement of Cash Flows

2023 2022 2022

6 months 6 months Year

to 30 June to 30 June to 31 December

(unaudited) (unaudited) (audited)

$000 $000 $000

----------------------------------- ------------ ------------ ---------------

Cash flows from operating

activities

Profit before tax from continuing

operations 32,502 89,534 132,941

Adjustments for:

Biological assets movement (291) 5,314 5,792

Gain on disposal of property,

plant and equipment (26) (49) (91)

Depreciation 8,116 8,370 16,724

Retirement benefit provisions 386 1,100 1,157

Net finance income (3,975) (1,706) (4,847)

Unrealised loss / (gain)

in foreign exchange 493 (311) (991)

Property, plant and equipment

written off 28 80 134

(Reversal of impairment)

/ impairment of losses - (256) 617

Provision for expected credit

loss 20 6 1,665

Operating cash flows before

changes in working capital 37,253 102,082 153,101

Increase in inventories (2,871) (27,157) (6,291)

(Increase) / Decrease in

non-current, trade and other

receivables (15,582) 584 (896)

(Decrease) / Increase in

trade and other payables (5,804) 8,849 4,035

----------------------------------- ------------ ------------ ---------------

Cash inflows from operations 12,996 84,358 149,949

Retirement benefits paid (301) (137) (612)

Overseas tax paid (22,172) (28,935) (27,495)

----------------------------------- ------------ ------------ ---------------

Operating cash flows (used

in) / from continuing operations (9,477) 55,286 121,842

Operating cash flows used

in discontinued operations (850) (850) (1,331)

----------------------------------- ------------ ------------ ---------------

Net cash flows (used in)

/ from operating activities (10,327) 54,436 120,511

Investing activities

Property, plant and equipment

* purchases (17,110) (17,763) (34,026)

* sales 155 51 111

Interest received 3,990 1,714 4,859

Increase in receivables from

cooperatives under plasma

scheme (1,473) (1,395) (2,570)

Placement of fixed deposits

with original maturity of

more than three months (39,040) (59,495) (55,566)

Withdrawal of fixed deposits

with original maturity of

more than three months 55,566 1,439 1,439

----------------------------------- ------------ ------------ ---------------

Cash from / (used in) investing

activities from continuing

operations 2,088 (75,449) (85,753)

Cash used in investing activities

from discontinued operations (935) (887) (1,865)

----------------------------------- ------------ ------------ ---------------

Net cash from / (used in)

investing activities 1,153 (76,336) (87,618)

----------------------------------- ------------ ------------ ---------------

Financing activities

Dividends paid to the holders

of the parent - - (1,975)

Dividends paid to non-controlling

interests (2,505) (334) (2,174)

Repayment of lease liabilities

- principal (102) (112) (220)

Repayment of lease liabilities

- interest (15) (8) (12)

Acquisition of non-controlling

interests - - (5,142)

----------------------------------- ------------ ------------ ---------------

Cash used in financing activities

from continuing operations (2,622) (454) (9,523)

Cash used in financing activities

from discontinued operations - - -

----------------------------------- ------------ ------------ ---------------

Net cash used in financing

activities (2,622) (454) (9,523)

----------------------------------- ------------ ------------ ---------------

Net (decrease) / increase

in cash and cash equivalents (11,796) (22,354) 23,370

Cash and cash equivalents

At beginning of period 221,476 218,249 218,249

Exchange gain / (loss) 12,606 (8,556) (20,143)

----------------------------------- ------------ ------------ ---------------

At end of period 222,286 187,339 221,476

----------------------------------- ------------ ------------ ---------------

Comprising:

Cash at end of period 222,286 187,339 221,476

----------------------------------- ------------ ------------ ---------------

Notes to the interim statements

1. Basis of preparation of interim financial statements

These interim consolidated financial statements have been

prepared in accordance with IAS 34, "Interim Financial Reporting".

They do not include all disclosures that would otherwise be

required in a complete set of financial statements and should be

read in conjunction with the 2022 Annual Report. The financial

information for the half years ended 30 June 2023 and 30 June 2022

does not constitute statutory accounts within the meaning of

Section 434(3) of the Companies Act 2006 and has been neither

audited nor reviewed pursuant to guidance issued by the Auditing

Practices Board.

Basis of preparation

The annual financial statements of Anglo-Eastern Plantations Plc

are prepared in accordance with UK adopted International Accounting

Standards. The comparative financial information for the year ended

31 December 2022 included within this report does not constitute

the full statutory accounts for that period. The statutory Annual

Report and Financial Statements for 2022 have been filed with the

Registrar of Companies. The Independent Auditors' Report on the

Annual Report and Financial Statements for 2022 was unqualified,

did not draw attention to any matters by way of emphasis, and did

not contain a statement under Sections 498(2) or 498(3) of the

Companies Act 2006.

The Directors have a reasonable expectation, having made the

appropriate enquiries, that the Group has control of the monthly

cashflows and that the Group has sufficient cash resources to cover

the fixed cashflows for a period of at least 12 months from the

date of approval of this interim report. For these reasons, the

Directors adopted a going concern basis in the preparation of the

interim report. The Directors have made this assessment after

consideration of the Group's budgeted cash flows and related

assumptions including appropriate stress testing of identified

uncertainties, specifically on the potential shut down of the

entire operations if all the plantations are infected with

Coronavirus as well as the impact on the demand for palm oil due to

the Coronavirus pandemic. Stress testing of other identified

uncertainties was undertaken on primarily commodity prices and

currency exchange rates.

Changes in accounting standards

The same accounting policies, presentation and methods of

computation are followed in these condensed consolidated financial

statements as were applied in the Group's latest annual audited

financial statements.

2. Foreign exchange

2023 2022 2022

6 months 6 months Year

to 30 June to 30 June to 31 December

(unaudited) (unaudited) (audited)

Closing exchange rates

Rp : $ 15,026 14,848 15,731

$ : GBP 1.27 1.21 1.20

RM : $ 4.67 4.41 4.41

Average exchange rates

Rp : $ 15,071 14,445 14,810

$ : GBP 1.23 1.30 1.24

RM : $ 4.46 4.27 4.40

3. Revenue

Disaggregation of Revenue

The Group has disaggregated revenue into various categories in

the following table which is intended to:

-- Depict how the nature, amount and uncertainty of revenue and

cash flows are affected by timing of revenue recognition; and

-- Enable users to understand the relationship with revenue

segment information provided in note 5.

There is no right of return and warranty provided to the

customers on the sale of products and services rendered.

CPO, palm

6 months to 30 June kernel Rubber Shell Biomass Biogas Others

2023 and FFB nut products products Total

$000 $000 $000 $000 $000 $000 $000

Contract counterparties

Government - - - - 550 - 550

Non-government

- Wholesalers 169,920 327 2,337 - - 315 172,899

---------- --------- -------- ---------- ---------- --------- ----------

169,920 327 2,337 - 550 315 173,449

---------- --------- -------- ---------- ---------- --------- ----------

Timing of transfer

of goods

Delivery to customer

premises 3,339 327 - - - - 3,666

Delivery to port of

departure - - - - - - -

Customer collect from

our mills / estates 166,581 - 2,337 - - - 168,918

Upon generation /

others - - - - 550 315 865

---------- --------- -------- ---------- ---------- --------- ----------

169,920 327 2,337 - 550 315 173,449

---------- --------- -------- ---------- ---------- --------- ----------

CPO, palm

6 months to 30 June kernel Rubber Shell Biomass Biogas Others

2022 and FFB nut products products Total

$000 $000 $000 $000 $000 $000 $000

Contract counterparties

Government - - - - 540 - 540

Non-government

- Wholesalers 245,456 280 2,605 24 - 324 248,689

245,456 280 2,605 24 540 324 249,229

---------- --------- -------- ---------- ---------- --------- ----------

Timing of transfer

of goods

Delivery to customer

premises 3,569 280 - - - - 3,849

Delivery to port of

departure - - - 24 - - 24

Customer collect from

our mills / estates 241,887 - 2,605 - - - 244,492

Upon generation / others - - - - 540 324 864

245,456 280 2,605 24 540 324 249,229

---------- --------- -------- ---------- ---------- --------- ----------

CPO, palm

Year to 31 December kernel Rubber Shell Biomass Biogas Others

2022 and FFB nut products products Total

$000 $000 $000 $000 $000 $000 $000

Contract counterparties

Government - - - - 1,160 - 1,160

Non-government

- Wholesalers 437,247 630 5,438 24 - 3,120 446,459

---------- --------- -------- ---------- ---------- --------- ----------

437,247 630 5,438 24 1,160 3,120 447,619

---------- --------- -------- ---------- ---------- --------- ----------

Timing of transfer

of goods

Delivery to customer

premises 5,359 630 - - - - 5,989

Delivery to port of

departure - - - 24 - - 24

Customer collect from

our mills / estates 431,888 - 5,438 - - - 437,326

Upon generation / others - - - - 1,160 3,120 4,280

---------- --------- -------- ---------- ---------- --------- ----------

437,247 630 5,438 24 1,160 3,120 447,619

---------- --------- -------- ---------- ---------- --------- ----------

4. Finance income and expense

2023 2022 2022

6 months 6 months Year

to 30

June to 30 June to 31 December

(unaudited) (unaudited) (audited)

$000 $000 $000

Finance income

Interest receivable on:

Credit bank balances and time

deposits 3,990 1,714 4,859

Finance expense

Interest payable on:

Interest expense on lease liabilities (15) (8) (12)

------------ ------------ ---------------

(15) (8) (12)

------------ ------------ ---------------

Net finance income recognised

in income statement 3,975 1,706 4,847

------------ ------------ ---------------

5. Segment information

North Total South*

Sumatera Bengkulu Riau Bangka Kalimantan Indonesia Malaysia UK Total Sumatera

$000 $000 $000 $000 $000 $000 $000 $000 $000 $000

6 months to 30 June 2023

(unaudited)

Total sales revenue

(all

external)

* CPO, palm kernel

and FFB 57,802 46,763 22,485 1,679 40,169 168,898 1,022 - 169,920 2,789

* Rubber 327 - - - - 327 - - 327 -

* Shell nut 1,171 337 785 - 44 2,337 - - 2,337 -

* Biomass products - - - - - - - - - -

* Biogas products 168 187 - - 195 550 - - 550 -

* Others 213 58 - 20 14 305 8 2 315 69

Total revenue 59,681 47,345 23,270 1,699 40,422 172,417 1,030 2 173,449 2,858

--------- --------- -------- ------- ----------- ---------- --------- -------- -------- ---------

Profit / (loss)

before

tax 11,795 6,734 5,747 (67) 8,973 33,182 (513) (458) 32,211 (696)

BA movement 366 (1) (77) 30 (76) 242 49 - 291 86

--------- --------- -------- ------- ----------- ---------- --------- -------- -------- ---------

Profit / (loss) for

the

period before tax

per consolidated

income statement 12,161 6,733 5,670 (37) 8,897 33,424 (464) (458) 32,502 (610)

--------- --------- -------- ------- ----------- ---------- --------- -------- -------- ---------

Interest income 2,164 1,267 501 - 21 3,953 36 1 3,990 2

Interest expense (13) - - - - (13) (2) - (15) -

Depreciation (2,571) (1,749) (419) (239) (3,054) (8,032) (84) - (8,116) -

Provision of

expected

credit loss (4) (8) - - (7) (19) - (1) (20) (9)

Inter-segment

transactions 2,046 (945) (270) (146) (996) (311) 301 10 - -

Inter-segmental

revenue 16,269 3,540 - - 5,230 25,039 - - 25,039 2,023

Tax expense (3,093) (1,299) (1,200) 44 (1,554) (7,102) (96) (1,216) (8,414) 471

Total assets 261,948 141,814 51,847 19,054 155,488 630,151 10,342 11,677 652,170 9,478

Non-current assets 86,369 46,374 8,145 16,399 108,633 265,920 7,104 - 273,024 -

Non-current assets

- additions 6,104 5,102 377 1,036 5,162 17,781 12 - 17,793 137

* South Sumatera represents the operations which have been

discontinued and have therefore been separated from the continuing

operations.

North Total South*

Sumatera Bengkulu Riau Bangka Kalimantan Indonesia Malaysia UK Total Sumatera

$000 $000 $000 $000 $000 $000 $000 $000 $000 $000

6 months to 30 June 2022

(unaudited)

Total sales revenue

(all

external)

* CPO, palm kernel

and FFB 82,911 70,778 42,666 1,662 45,875 243,892 1,564 - 245,456 5,290

* Rubber 280 - - - - 280 - - 280 -

* Shell nut 1,017 614 909 - 65 2,605 - - 2,605 -

* Biomass products 24 - - - - 24 - - 24 -

* Biogas products 149 241 - - 150 540 - - 540 -

* Others 110 49 36 20 106 321 3 - 324 63

Total revenue 84,491 71,682 43,611 1,682 46,196 247,662 1,567 - 249,229 5,353

--------- --------- -------- ------- ----------- ---------- --------- ------ --------- -----------

Profit / (loss)

before

tax 35,009 23,688 14,233 484 22,156 95,570 (87) (635) 94,848 401

BA movement (1,523) (1,176) (872) (114) (1,645) (5,330) 16 - (5,314) (96)

--------- --------- -------- ------- ----------- ---------- --------- ------ --------- -----------

Profit / (loss) for

the

period before tax

per consolidated

income statement 33,486 22,512 13,361 370 20,511 90,240 (71) (635) 89,534 305

--------- --------- -------- ------- ----------- ---------- --------- ------ --------- -----------

Interest income 1,180 429 85 - 17 1,711 3 - 1,714 2

Interest expense (4) - - - - (4) (4) - (8) -

Depreciation (2,669) (1,969) (411) (196) (2,963) (8,208) (162) - (8,370) -

Reversal of

impairment - - - - 622 622 - - 622 -

Impairment losses - - - - - - (366) - (366) -

(Provision) /

Reversal

of expected credit

loss (10) (1) - 1 2 (8) - 2 (6) (9)

Inter-segment

transactions 2,503 (988) (283) (149) (1,004) 79 299 10 388 (388)

Inter-segmental

revenue 25,434 580 - - 5,527 31,541 - - 31,541 4,608

Tax expense (8,617) (4,864) (2,873) (52) (3,998) (20,404) (119) (173) (20,696) 339

Total assets 273,345 135,559 42,725 17,045 151,209 619,883 12,735 6,613 639,231 13,884

Non-current assets 81,387 41,272 8,206 14,938 105,917 251,720 7,825 - 259,545 4,726

Non-current assets

- additions 10,146 2,897 201 773 3,707 17,724 39 - 17,763 367

* South Sumatera represents the operations which have been

discontinued and have therefore been separated from the continuing

operations.

North Total South*

Sumatera Bengkulu Riau Bangka Kalimantan Indonesia Malaysia UK Total Sumatera

$000 $000 $000 $000 $000 $000 $000 $000 $000 $000

Year to 31 December 2022 (audited)

Total sales revenue

(all

external)

* CPO, palm kernel

and FFB 146,044 124,480 77,688 2,554 84,198 434,964 2,283 - 437,247 9,192

* Rubber 630 - - - - 630 - - 630 -

* Shell nut 2,056 1,197 2,067 - 118 5,438 - - 5,438 -

* Biomass products 24 - - - - 24 - - 24 -

* Biogas products 354 475 - - 331 1,160 - - 1,160 -

* Others 141 - 2,662 33 264 3,100 20 - 3,120 114

--------- --------- --------- ------- ----------- ---------- --------- ---------- --------- ------------

Total revenue 149,249 126,152 82,417 2,587 84,911 445,316 2,303 - 447,619 9,306

--------- --------- --------- ------- ----------- ---------- --------- ---------- --------- ------------

Profit / (loss)

before

tax 51,210 35,809 26,166 433 29,079 142,697 (721) (3,243) 138,733 (1,105)

BA movement (1,845) (1,571) (846) (106) (1,354) (5,722) (70) - (5,792) (178)

--------- --------- --------- ------- ----------- ---------- --------- ---------- --------- ------------

Profit / (loss) for

the

year before tax

per consolidated

income statement 49,365 34,238 25,320 327 27,725 136,975 (791) (3,243) 132,941 (1,283)

--------- --------- --------- ------- ----------- ---------- --------- ---------- --------- ------------

Interest income 3,149 1,321 320 - 31 4,821 38 - 4,859 4

Interest expense (5) - - - - (5) (7) - (12) -

Depreciation (5,295) (3,942) (813) (374) (5,922) (16,346) (378) - (16,724) -

Impairment losses - - - - (185) (185) (432) - (617) -

(Provision) /

Reversal

for expected

credit loss (169) (57) - - 12 (214) - (1,451) (1,665) 91

Inter-segment

transactions 4,654 (1,927) (551) (291) (1,960) (75) 589 53 567 (567)

Inter-segmental

revenue 44,080 2,711 - - 9,628 56,419 - - 56,419 7,305

Tax expense (12,022) (7,262) (5,499) (26) (5,414) (30,223) (98) (1,140) (31,461) 494

Total assets 258,237 138,272 52,321 17,469 139,914 606,213 11,540 2,602 620,355 9,855

Non-current assets 79,119 41,193 7,820 14,901 101,780 244,813 7,601 - 252,414 5,704

Non-current assets

-

additions 15,007 7,283 709 1,788 9,376 34,163 107 - 34,270 793

* South Sumatera represents the operations which have been

discontinued and have therefore been separated from the continuing

operations.

In the 6 months to 30 June 2023, revenue from 4 customers of the

Indonesian segment represent approximately $85.8m (H1 2022:

$156.8m) of the Group's total revenue. In the year 2022, revenue

from 4 customers of the Indonesian segment represent approximately

$263.0m of the Group's total revenue for continuing operations. An

analysis of this revenue is provided below. Although Customers 1 to

3 each contribute over 10% of the Group's total revenue, there was

no over reliance on these Customers as tenders were performed on a

weekly basis. Three of the top four customers were the same as in

the year to 31 December 2022.

2023 2022 2022

6 months 6 months Year

to 30 June to 30 June to 31 December

(unaudited) (unaudited) (audited)

$m % $m % $m %

Major Customers

Customer 1 27.9 16.1 89.7 36.0 146.4 32.6

Customer 2 23.1 13.3 31.0 12.4 55.9 12.5

Customer 3 17.7 10.2 18.5 7.4 33.1 7.4

Customer 4 17.1 9.9 17.6 7.0 27.6 6.2

------------------ --------- --------- ---------- -------- -------- --------

Total 85.8 49.5 156.8 62.8 263.0 58.7

------------------ --------- --------- ---------- -------- -------- --------

6. Tax expense

2023 2022 2022

6 months 6 months Year

to 30

June to 30 June to 31 December

(unaudited) (unaudited) (audited)

$000 $000 $000

Foreign corporation tax

- current year 8,843 18,224 29,727

Foreign corporation tax

- prior year - (57) 7

Deferred tax adjustment

- origination and reversal

of temporary differences (429) 2,529 832

Deferred tax - prior year - - 895

8,414 20,696 31,461

------------ ------------ ---------------

Corporation tax rate in Indonesia is at 22% (H1 2022: 22%, 2022:

22%) whereas Malaysia is at 24% (H1 2022: 24%, 2022: 24%). The

standard rate of corporation tax in the UK for the current year is

19% (H1 2022: 19%, 2022: 19%).

7. Dividend

The final and only dividend in respect of 2022, amounting to

25.0 cents per share, or $9,909,093 was paid on 7 July 2023 (2021:

5.0 cents per share, or $1,981,819 paid on 15 July 2022).

The interim dividend of 15.0 cents per share, or $5,945,456 in

respect of the year ending 31 December 2023 will be paid on 6

October 2023 to those shareholders on the register on 8 September

2023.

8. Earnings per ordinary share ("EPS")

2023 2022 2022

6 months 6 months Year

to 30

June to 30 June to 31 December

(unaudited) (unaudited) (audited)

$000 $000 $000

Total operations

Profit for the period attributable

to owners of the Company before

BA movement 17,795 60,582 83,548

BA movement 248 (3,551) (3,904)

------------ ------------ ---------------

Earnings used in basic and

diluted EPS 18,043 57,031 79,644

------------ ------------ ---------------

Continuing operations

Profit for the period attributable

to owners of the Company before

BA movement 19,924 60,845 87,937

BA movement 184 (3,480) (3,772)

------------ ------------ ---------------

Earnings used in basic and

diluted EPS 20,108 57,365 84,165

------------ ------------ ---------------

Discontinued operations

Loss for the period attributable

to owners of the Company before

BA movement (2,129) (263) (4,389)

BA movement 64 (71) (132)

------------ ------------ ---------------

Earnings used in basic and

diluted EPS (2,065) (334) (4,521)

------------ ------------ ---------------

Number Number Number

'000 '000 '000

Weighted average number of

shares in issue in the period

- used in basic EPS 39,636 39,636 39,636

- dilutive effect of outstanding

share options - - -

------------ ------------ ---------------

- used in diluted EPS 39,636 39,636 39,636

------------ ------------ ---------------

Total operations

- Basic and diluted EPS before

BA movement 44.90cts 152.85cts 210.79cts

- Basic and diluted EPS after

BA movement 45.52cts 143.89cts 200.94cts

Continuing operations

- Basic and diluted EPS before

BA movement 50.27cts 153.51cts 221.86cts

- Basic and diluted EPS after

BA movement 50.73cts 144.73cts 212.34cts

Discontinued operations

- Basic and diluted EPS before

BA movement (5.37)cts (0.66)cts (11.07)cts

- Basic and diluted EPS after

BA movement (5.21)cts (0.84)cts (11.41)cts

9. Fair value measurement of financial instruments

The carrying amounts and fair values of the financial

instruments which are not recognised at fair value in the Statement

of Financial Position are exhibited below:

2023 2022 2022

6 months 6 months Year

to 30 June to 30 June to 31 December

(unaudited) (unaudited) (audited)

Carrying Fair Carrying Fair Carrying Fair

amount value amount value amount value

$000 $000 $000 $000 $000 $000

Non-current

receivables

Due from non-controlling

interests 434 434 5,345 3,016 1,549 797

Due from cooperatives

under Plasma

scheme 19,708 13,390 17,246 12,373 17,414 11,729

--------- ------- --------- ------- --------- -------

20,142 13,824 22,591 15,389 18,963 12,526

--------- ------- --------- ------- --------- -------

Financial instruments not measured at fair value include cash

and cash equivalents, trade and other receivables, trade and other

payables, and borrowings due within one year.

Due to their short-term nature, the carrying value of cash and

cash equivalents, trade and other receivables, trade and other

payables and borrowings due within one year approximates their fair

value.

All non-current assets, non-current receivables and long-term

loan are classified as Level 3 in the fair value hierarchy.

The valuation techniques and significant unobservable inputs

used in determining the fair value measurement of non-current

receivables and borrowings due after one year, as well as the

inter-relationship between key unobservable inputs and fair value,

are set out in the table below:

Item Valuation approach Inputs Inter-relationship

used between key unobservable

inputs and fair

value

----------------- -------------------------- --------- ---------------------------

Non-current receivables

Due from Based on cash flows Discount The higher the

non-controlling discounted using rate discount rate,

interests current lending rate the lower the

of 6% (H1 2022 and fair value.

2022: 6%).

Due from Based on cash flows Discount The higher the

cooperatives discounted using rate discount rate,

under Plasma an estimated current the lower the

scheme lending rate of 10.25% fair value.

(H1 2022: 7.00%,

2022: 8.50%).

10. Acquisition of non-controlling interests

In June 2023, the Group also acquired some additional 0.4% and

4.5% interest in the voting shares of PT Sawit Graha Manunggal

("SGM") and PT Kahayan Agro Plantation ("KAP"), respectively,

increasing the Group ownership interest to almost 100% with a

consideration of $2.6 million. The following is the schedule of

additional interest acquired in SGM and KAP:

$000

Consideration paid to non-controlling shareholders 2,608

Carrying value of the additional interest (120)

------

Difference recognised in retained earnings 2,488

------

11. Subsequent events

The disposal of the three non-performing plantations in South

Sumatera, namely PT Riau Agrindo Agung, PT Karya Kencana Sentosa

Tiga and PT Empat Lawang Agro Perkasa, to Mrs Lina (also known as

Liena Efendy) and Miss Lenny Nurimba on 5 July 2023 for a total

cash consideration of $8.5 million had been completed. Since the

Group is no longer in control of the subsidiaries, all the assets

and liabilities of the subsidiaries will be derecognised from July

2023 onwards.

In July 2023, the Group also completed the acquisition of 25% of

the issued share capital of PT United Kingdom Indonesia Plantations

and the 10% of the issued share capital of PT Mitra Puding Mas,

from PT Canadianty Corporindo, the minority shareholder in

Indonesia, for a total cash consideration of $25.2million,

increasing the Group ownership interest to 100%.

12. Report and financial information

Copies of the interim report for the Group for the period ended

30 June 2023 are available on the AEP website at

https://www.angloeastern.co.uk/.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR PPUBURUPWGUC

(END) Dow Jones Newswires

August 24, 2023 06:15 ET (10:15 GMT)

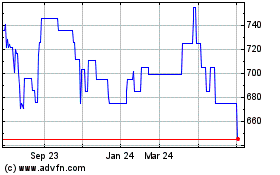

Anglo Eastern Plantations (AQSE:AEP.GB)

Historical Stock Chart

From Apr 2024 to May 2024

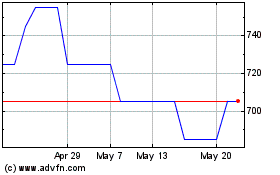

Anglo Eastern Plantations (AQSE:AEP.GB)

Historical Stock Chart

From May 2023 to May 2024