TIDMAIEA

RNS Number : 3225H

Airea PLC

27 July 2023

27 July 2023

AIREA plc

("AIREA", the "Group" or the "Company")

Interim results for the six months ended 30 June 2023

AIREA plc (AIM: AIEA), the UK design-led specialist flooring

company, supplying both the UK and international markets, is

pleased to announce its interim results for the six months ended 30

June 2023.

Financial highlights

30 June 2023 30 June 2022 Change

(GBP) (GBP) (%)

Group revenue 9,825k 8,551k 14.9

------------------ ------------------ ------------

Operating profit before

valuation 836k 756k 10.5

------------------ ------------------ ------------

Profit before tax 620k 656k (5.4)

------------------ ------------------ ------------

EBITDA (Earnings before

interest tax depreciation

and amortisation) 1,010k 1,016k (0.1)

------------------ ------------------ ------------

Cash and cash equivalents 4,919k 5,450k (9.7)

------------------ ------------------ ------------

Net cash 2,694k 2,493k 8.1

------------------ ------------------ ------------

Operational highlights

-- Continued focus on sales growth in existing and new

territories, with key wins in export markets.

-- Successful launch of carbon-neutral products in line with

market trends and demand for low-carbon products.

-- Installation and commissioning of solar panels, reducing exposure to energy price volatility.

-- Appointment of Tanya Ashton, Non-Executive Director, in May 2023.

Martin Toogood, Non-Executive Chairman of AIREA plc,

commented:

"The first half of 2023 has seen continued growth in our sales

fuelled by a focus on refreshing our product offering and taking

advantage of new markets. The current economic environment

continues to put a strain on the cost of labour, energy, and raw

materials. We do however continue to take actions to manage these

risks with investments for the future such as the installation of

our renewable energy solutions, all with a view to capitalising on

the opportunities in our markets as and when wider macro conditions

improve."

- Ends -

For further information please contact:

AIREA plc Tel: +44 (0) 192 426 6561

Médéric Payne, Chief Executive

Officer

Ryan Thomas, Chief Financial Officer

Singer Capital Markets Tel: +44 (0) 20 7496 3000

(Nominated Adviser and Sole Broker)

Peter Steel / Sam Butcher

Yellow Jersey PR Tel: +44 (0) 20 3004 9512

(Financial media and PR)

Sarah Hollins / Shivantha Thambirajah

/ Jazmine Clemens

This announcement contains inside information for the purposes

of article 7 of the Market Abuse Regulation (EU) 596/2014 as

amended by regulation 11 of the Market Abuse (Amendment) (EU Exit)

Regulations 2019/310. With the publication of this announcement,

this information is now considered to be in the public domain.

Notes to Editors

AIREA plc is a UK design-led specialist flooring company,

supplying both UK and international markets. Since 2007, the Group

has been focused solely on floor coverings and enjoys a strong and

growing brand position within the commercial flooring market.

The Group's core brand Burmatex(R) is one of the UK's leading

designers and manufacturers of commercial carpet tiles and planks.

Burmatex(R) focuses on the design and creation of sustainable

innovative flooring solutions to meet the needs of architects,

specifiers and contractors with a continuously developing range to

suit the education, leisure, commercial, hospitality and public

sectors. The brand was acquired by AIREA in 1984.

The Group was admitted to trading on AIM of the London Stock

Exchange on 12 December 2007.

For further information, please visit:

https://aireaplc.com/.

Chief Executive Officer's Statement

Introduction

I am pleased to report the Group's interim results for the six

months ended 30 June 2023. During this period, AIREA has made good

progress and maintained momentum in both its home and export

markets. We have made a positive start to the year and the Group's

performance during the period is in line with management

expectations.

In May 2023, the Company seized the opportunity to exhibit at

the renowned Clerkenwell Design Week, which gave us the platform to

showcase our new ranges and promote the Burmatex(R) brand to the

market and engage with our target customer audience in this setting

for the first time in over ten years.

Results

Revenue for the period increased by 15% to GBP9.8m (2022:

GBP8.6m). In the UK, our sales were 9.8% ahead of the prior

six-month comparative period, largely driven by a combination of

cost increases being passed onto customers combined with an

improved sales mix. Export sales were up 36% compared to the

comparative period as demand recovered in most of our target export

markets, with good progress being made in new markets. The UK

market remains challenging given the economic backdrop, however,

performance is encouraging as our sales mix moves towards more

design-led products.

The Group's operating profit was GBP0.8m (2022: GBP0.8m). Our

underlying product margins faced downward pressures due to

increased energy, raw materials, and labour costs. We were

restricted in passing on these cost increases in a price-sensitive

market. Net finance costs increased by GBP0.1m largely because of

the increased pension interest charge. After charging net finance

costs of GBP0.2m (2022: GBP0.1m) and incorporating the appropriate

tax charge, the net profit for the period was GBP0.5m (2022:

GBP0.6m). Basic earnings per share were 1.18p (2022: 1.58p).

Operating cash flows before movements in working capital were

GBP1.2m (2022: GBP0.8m). Working capital increased in the period to

GBP0.5m due to an increase in inventory for new lines and higher

receivables from customers (2022: GBP0.0m). Contributions to the

defined benefit pension scheme were GBP0.0m (2022: GBP0.0m) in line

with the agreement reached with the scheme trustees following the

last triennial valuation as of 1 July 2023. Capital expenditure of

GBP0.9m (2022: GBP0.2m) was spent renewing and enhancing the

manufacturing plant and equipment, with an important investment in

our new solar panels.

Net cash (cash less loans and borrowings) decreased by GBP0.5m

in the six-month period to GBP2.7m as of 30 June 2023, from GBP3.2m

as of 31 December 2022. We continue to have further liquidity

available of GBP1.0m via our unutilised overdraft facility (2022:

GBP1.0m unutilised). Our cash reserves and strong balance sheet

enable us to invest in the future of the business and manage the

impact of the continued economic uncertainty and related risks.

Update on Board composition

The Board appointed Tanya Ashton as Non-Executive Director to

the Board on 10 May 2023. Tanya's appointment signals the

importance that we attach to good standards of corporate governance

at AIREA.

We have commenced the selection process for our new Chief

Financial Officer following the resignation of Ryan Thomas on 4

July 2023. We have made good progress and expect to be in a

position to make an announcement in the coming months.

We acknowledge the importance of reviewing Board composition on

an ongoing basis to ensure that the Group has the required level of

skills and experience to enable the business to operate efficiently

and react quickly to any issues that may arise.

Outlook

The development of our sustainable products indicates the

transformational change the Group is focused on to enable AIREA to

be more competitive, innovative, and agile. Our marketing and sales

strategy is not only UK-focused but also on growing our

international sales in both existing and new territories.

As the cost pressures persist, we continue to adapt our

processes and procedures to mitigate and manage the impact on the

business. In some areas, this has and will continue with the need

to invest in our facilities such that we reduce waste, improve

productivity, and utilise energy efficiently.

Given the plans to continue to invest in the future of the

business coupled with the continued levels of uncertainty in the

market and the wider economy, the Group will continue to prioritise

the preservation of cash. We will therefore not be proposing an

interim dividend at this time (2022: GBPnil). We were pleased to

have been able to declare and pay a final dividend following the

2022 results and we cautiously expect to be in the position to do

similar once our 2023 results are finalised.

Finally, we would like to thank everyone associated with the

AIREA Group for their support during the period.

Médéric Payne

Chief Executive Officer

26 July 2023

Consolidated Income Statement

6 months ended 30 June 2023

Unaudited 6 Unaudited Audited

months ended 6 months 12 months

30 June ended ended 31

2023 30 June December

2022 2022

GBP000 GBP000 GBP000

---------------------------------------- --------------------------- --------------- --------------------

Revenue 9,825 8,551 18,483

Operating costs (9,301) (7,935) (17,111)

Other operating income 312 140 280

---------------------------------------- --------------------------- --------------- --------------------

Operating profit before valuation

gain 836 756 1,652

Unrealised valuation gain - - --

---------------------------------------- --------------------------- --------------- --------------------

Operating profit 836 756 1,652

Finance income 39 8 32

Finance costs (255) (108) (251)

---------------------------------------- --------------------------- --------------- --------------------

Profit before taxation 620 656 1,433

Taxation (130) (45) (138)

---------------------------------------- --------------------------- --------------- --------------------

Profit attributable to shareholders

of the Group 490 611 1,295

---------------------------------------- --------------------------- --------------- --------------------

Earnings per share (basic and diluted)

for the Group 1.18p 1.58p 3.36p

Consolidated Statement of Comprehensive Income

6 months ended 30 June 2023

Unaudited Unaudited Audited

---------------------------------------------

6 months 6 months 12 months

---------------------------------------------

ended ended ended

30 June 30 June 31 December

2023 2022 2022

GBP000 GBP000 GBP000

--------------------------------------------- --------- --------- -----------

Profit attributable to shareholders

of the Group 490 611 1,295

Items that will not be reclassified

to profit or loss

Actuarial gain/(loss) recognised in

the pension scheme 513 35 (1,247)

Related deferred taxation (128) (7) 318

--------------------------------------------- --------- --------- -----------

385 28 (929)

--------------------------------------------- --------- --------- -----------

Items that will be reclassified subsequently

to profit or loss when specific conditions

are met

Revaluation of property - - (25)

Related deferred taxation - - 5

--------------------------------------------- --------- --------- -----------

- - (20)

--------------------------------------------- --------- --------- -----------

Total other comprehensive income/(loss) 385 28 (949)

--------------------------------------------- --------- --------- -----------

Total comprehensive income attributable

to shareholders of the Group 875 639 346

--------------------------------------------- --------- --------- -----------

Consolidated Balance Sheet

as at 30 June 2023

Unaudited 30 Unaudited Audited

June 30 June 31 December

2023 2022 2022

GBP000 GBP000 GBP000

------------------------------ -------------------------------- --------------- ---------------------

Non-current assets

Property, plant and equipment 5,976 5,307 5,272

Intangible assets 59 51 71

Investment property 4,000 4,000 4,000

Right-of-use asset 754 943 917

Deferred tax asset 763 682 879

------------------------------ -------------------------------- --------------- ---------------------

11,552 10,983 11,139

Current assets

Inventories 6,560 6,132 5,895

Trade and other receivables 2,871 2,370 2,351

Cash and cash equivalents 4,919 5,450 5,762

------------------------------ -------------------------------- --------------- ---------------------

14,350 13,952 14,008

------------------------------ -------------------------------- --------------- ---------------------

Total assets 25,902 24,935 25,147

------------------------------ -------------------------------- --------------- ---------------------

Current liabilities

Trade and other payables (3,986) (3,683) (3,316)

Provisions (74) (175) (77)

Lease liabilities (127) (124) (131)

Loans and borrowings (736) (731) (734)

------------------------------ -------------------------------- --------------- ---------------------

(4,923) (4,713) (4,258)

Non-current liabilities

Deferred tax (1,144) (1,047) (1,040)

Pension deficit (1,000) - (1,345)

Lease liabilities (140) (212) (202)

Loans and borrowings (1,489) (2,226) (1,858)

------------------------------ -------------------------------- --------------- ---------------------

(3,773) (3,485) (4,445)

------------------------------ -------------------------------- --------------- ---------------------

Total liabilities (8,696) (8,198) (8,703)

------------------------------ -------------------------------- --------------- ---------------------

Net assets 17,206 16,737 16,444

------------------------------ -------------------------------- --------------- ---------------------

Equity

Called up share capital 10,339 10,339 10,339

Share premium account 504 504 504

Own Shares (1,805) (2,000) (2,000)

Share-based payment reserve --80 - ---

Capital redemption reserve 3,617 3,617 3,617

Revaluation reserve 3,096 3,150 3,096

Retained earnings 1,375 1,127 888

------------------------------ -------------------------------- --------------- ---------------------

Total equity 17,206 16,737 16,444

------------------------------ -------------------------------- --------------- ---------------------

Consolidated Cash Flow Statement

6 months ended 30 June 2023

Unaudited Unaudited Audited

6 months 6 months 12 months

ended 30 ended ended 31

June 30 June December

2023 2022 2022

GBP000 GBP000 GBP000

--------------------------------------------- --------------------- --------------- --------------------

Cash flow from operating activities

Profit for the period 490 611 1,295

Depreciation 165 165 309

Depreciation of right-of-use assets 124 126 260

Amortisation 15 14 29

Movement in Provision (3) (70) (168)

Share-based payment expense/(credit) 80 (157) (157)

Net Finance costs 216 100 219

Profit on disposal of property, plant

and equipment - (77) (77)

Tax charge 130 45 138

Operating cash flows before movements

in working capital 1,217 757 1,848

(Increase)/decrease in inventory (665) 18 255

Increase in trade and other receivables (520) (483) (464)

Increase in trade and other payables 670 425 66

--------------------------------------------- --------------------- --------------- --------------------

Cash generated from operations 702 717 1,705

Contributions to defined benefit pension - - ---

scheme

--------------------------------------------- --------------------- --------------- --------------------

Net cash generated from operating activities 702 717 1,705

--------------------------------------------- --------------------- --------------- --------------------

Cash flows from investing activities

Payments to acquire intangible fixed

assets (4) (10) (45)

Payments to acquire tangible fixed

assets (868) (167) (312)

Receipts from sales of tangible fixed

assets - 77 77

--------------------------------------------- --------------------- --------------- --------------------

Net cash used in investing activities (872) (100) (280)

--------------------------------------------- --------------------- --------------- --------------------

Cash flows from financing activities

Interest paid on lease liabilities (5) (4) (11)

Interest paid on borrowings (82) (69) (142)

Interest received 39 8 32

Principal paid on lease liabilities (66) (67) (141)

Repayment of loans and borrowings (366) (569) (935)

Equity dividends paid (193) (154) (154)

--------------------------------------------- --------------------- --------------- --------------------

Net cash used in financing activities (673) (855) (1,351)

--------------------------------------------- --------------------- --------------- --------------------

Net (decrease)/increase in cash and

cash equivalents (843) (238) 74

Cash and cash equivalents at start

of the period 5,762 5,688 5,688

--------------------------------------------- --------------------- --------------- --------------------

Cash and cash equivalents at end of

the period 4,919 5,450 5,762

--------------------------------------------- --------------------- --------------- --------------------

Consolidated Statement of Changes in Equity

6 months ended 30 June 2023

Share Share-based Capital Profit

Share premium Own payment redemption Revaluation and

capital account Shares reserve reserve reserve loss Total

account equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

--------------------------------------------- ------------ ------------- --------------- --------------- ------------ ------------ ------

At 1 January 2022

10,339 504 (555) 157 3,617 3,150 (803) 16,409

Comprehensive income

for the year

Profit for the year

- - - - - - 1,295 1,295

Actuarial loss recognised

on the pension scheme

- - - - - - (929) (929)

Revaluation of property

- - - - - (25) 5 (20)

--------------------------------------------- ------------ ------------- --------------- --------------- ------------ ------------ ------

Total comprehensive

income for the year

- - - - - (25) 371 346

Contributions by and

distributions to owners

Dividend paid - - - - - - (154) (154)

Share-based payment - - - (157) - - - (157)

Own share

transfer

Revaluation - - (1,445) - - - 1,445 -

Reverse

Transfer - - - - - (29) 29 -

-------------------- ---------------------------------- --------------------------------------------------- -------

Total contributions

by and

distributions

to owners - - (1,445) (157) - (29) 1,320 (311)

-------------------- ---- ----------- --------------- ----------- ----------- ------------ ----------- -------

At 31 December

2022

and 1 January 2023

10,339 504 (2,000) - 3,617 3,096 888 16,444

-------------------------- ----------- --------------- ----------- ----------- ------------ ----------- -------

Comprehensive income

for the period

Profit for the period

-

Actuarial gain

recognised - - - - - 490 490

on the pension scheme

- - - - - - 385 385

Revaluation of property - - - - - - -

-

-------------------------- ----------- --------------- ----------- ----------- ------------ ----------- -------

Total comprehensive

income for the period

- - - - - - 875 875

Contributions

by and

distributions

to owners

Dividend paid - - - - - - (193) (193)

Share-based payment

- - - 80 - - - 80

Own Shares Transfer

- - 195 - - - (195) -

-------------------------- ----------- --------------- ----------- ----------- ------------ ----------- -------

Total contributions

by and distributions

to

owners - - 195 80 - - (388) (113)

-------------------------- ----------- --------------- ----------- ----------- ------------ ----------- -------

At 30 June 2023 10,339 504 (1,805) 80 3,617 3,096 1,375 17,206

-------------------------- ----------- --------------- ----------- ----------- ------------ ----------- -------

Notes to the Financial Statements

1. BASIS OF PREPARATION AND ACCOUNTING POLICIES

The financial information for the six months ended 30 June 2023

and the six months ended 30 June 2022 have not been audited and do

not constitute full financial statements within the meaning of

Section 434 of the Companies Act 2006.

The financial information relating to the year ended 31 December

2022 does not constitute full financial statements within the

meaning of Section 434 of the Companies Act 2006. This information

is based on the Group's statutory accounts for that period. The

statutory accounts were prepared in accordance with UK adopted

International Accounting Standards and received an unqualified

audit report and did not contain statements under Section 498(2) or

(3) of the Companies Act 2006. These financial statements have been

filed with the Registrar of Companies.

These interim financial statements have been prepared using the

recognition and measurement principles of UK adopted International

Accounting Standards. The accounting policies used are the same as

those used in preparing the financial statements for the period

ended 31 December 2022. These policies are set out in the annual

report and accounts for the period ended 31 December 2022 which is

available on the Company's website at www.aireaplc.co.uk.

Further copies of this report are available from the Company

Secretary at the registered office at Victoria Mills, The Green,

Ossett, Wakefield, West Yorkshire WF5 0AN and are also available,

along with this announcement, on the company's website at

www.aireaplc.co.uk.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BRGDRDGDDGXL

(END) Dow Jones Newswires

July 27, 2023 02:00 ET (06:00 GMT)

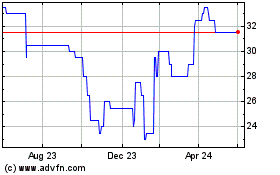

Airea (AQSE:AIEA.GB)

Historical Stock Chart

From Oct 2024 to Nov 2024

Airea (AQSE:AIEA.GB)

Historical Stock Chart

From Nov 2023 to Nov 2024