AssetCo PLC Acquisition (9244R)

March 06 2023 - 1:00AM

UK Regulatory

TIDMASTO

RNS Number : 9244R

AssetCo PLC

06 March 2023

6 March 2023

LEI: 213800LFMHKVNTZ7GV45

For Immediate Release

AssetCo plc

("AssetCo" or the "Company")

Conditional acquisition of Ocean Dial Asset Management Limited

by AssetCo

AssetCo (AIM: ASTO), the agile asset and wealth management

company, is pleased to announce that it has reached agreement to

acquire the entire issued share capital of Ocean Dial Asset

Management Limited (the "Acquisition") from Avendus Capital Asset

Management (UK) Limited for a total consideration of GBP4.125

million (the "Consideration").

The Consideration will be satisfied by the delivery of 2,928,258

ordinary shares of GBP0,01 each in the capital of the Company

("Ordinary Shares") and GBP2.125 million in cash of which 732,065

Ordinary Shares and GBP500,000 shall be deferred until after the

calendar year end in accordance with the provisions of the Sale and

Purchase Agreement. The Ordinary Shares that form part of the

consideration will be transferred out of treasury post

completion.

The Acquisition is conditional on, inter alia, approval by the

FCA to a change in controller which is expected to occur by the end

of Q2 2023 and the Reserve Bank of India and Securities Exchange

Board of India which is expected to run into Q3 2023. The Company

will provide further updates, as appropriate.

About Ocean Dial Asset Management

Ocean Dial was established in 2005 and is wholly owned by

Avendus Capital Asset Management (UK) Limited. Ocean Dial's current

business is the management of the assets of the India Capital

Growth Fund Limited, which, as at 28 February 2023, had a net asset

value in excess of GBP127m and an annualised run rate revenue of

GBP1.4m. The Acquisition is expected to be earnings enhancing for

the Group and it is anticipated that further synergies will be

achievable following completion. Ocean Dial will have net assets as

at completion of not less than GBP250,000 or such other sum as may

be required in order to meet its regulatory capital requirements.

The fund has been successfully advised for several years by Guarav

Narain and team, based in India.

Martin Gilbert, Chairman of AssetCo, commented:

" We are delighted to welcome India Capital Growth Fund as a

client of our Group and look forward to working with the Fund's

current management to provide the Fund's Board with a first class

service. AssetCo's mission is to acquire, improve and grow asset

management businesses with potential. We are excited about the

long-term potential that India offers and see opportunities to add

value by bringing Ocean Dial together with the other active equity

asset management businesses we are combining under the River and

Mercantile brand."

Gaurav Deepak, Co-Founder and CEO of Avendus Capital (India) added:

"Avendus is delighted to have concluded an arrangement with

AssetCo, a UK AIM-listed company, for the sale of our ODAM

business. This sale will benefit all the stakeholders of ODAM and

allow us to participate in AssetCo's on-going success as a

shareholder. We look forward to working with Martin and his team to

complete the transaction and to a long and fruitful future

relationship."

For further information, please contact:

AssetCo plc Numis Securities Limited

Campbell Fleming, CEO Nominated adviser and joint

Peter McKellar, Deputy Chairman broker

Tel: +44 (0) 785 0464 301 Giles Rolls / Charles Farquhar

Tel: +44 (0) 20 7260 1000

Panmure Gordon (UK) Limited H/Advisors Maitland

Joint broker Neil Bennett

Atholl Tweedie Rachel Cohen

Tel: +44 (0) 20 7886 2500 Tel: +44 (0) 20 7379 55151

For further details, visit the website, www.assetco.com

Ticker: AIM: ASTO.L

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQNKPBKOBKDANK

(END) Dow Jones Newswires

March 06, 2023 02:00 ET (07:00 GMT)

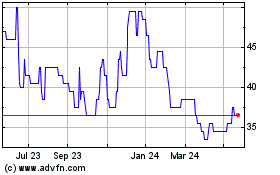

Assetco (AQSE:ASTO.GB)

Historical Stock Chart

From Dec 2024 to Jan 2025

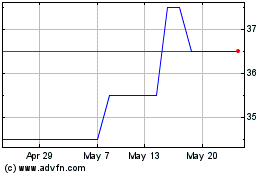

Assetco (AQSE:ASTO.GB)

Historical Stock Chart

From Jan 2024 to Jan 2025