TIDMBOD

RNS Number : 4483I

Botswana Diamonds PLC

14 December 2020

14(th) December 2020

Botswana Diamonds PLC

("Botswana Diamonds" or the "Company")

Annual Results for the Year Ended 30 June 2020

Botswana Diamonds plc (AIM: BOD) today announces its audited

annual results for the year ended 30 June 2020.

Chairman's Statement

Botswana Diamonds is a diamond development company focused on

Southern Africa. To find diamonds you must go to the few areas in

the world where they can be found. You must temper your choices

with the political risk in countries where the diamonds may be,

meaning rule of law and title, and with the logistical /

environmental risks of some locations i.e. they are too remote, too

challenged by climate and / or too costly to operate

profitably.

Sub Saharan Africa has, we believe, a good mix of the above

factors. Botswana, our primary focus is, without doubt, the best

diamond address. Very prospective for diamonds, with low political

risk, somewhat offset by the challenges of operating in the

Kalahari Desert, which covers 93% of the country. Our second base

of operations is South Africa. This choice is not obvious to

everyone. For long the world's leading diamond producer, South

Africa has fallen from a world ranked diamond producer as mines

have run out and political risk has risen. Exploration has fallen

yet, it remains a highly prospective area for diamonds and we

believe that the fiscal regime and local ownership provisions have

added some certainty to the business environment, so we began work

there two years ago.

Our final area of interest is Zimbabwe, a country ravaged by

political and economic uncertainty, which we believe is now

emerging as a location where overseas companies can invest.

Zimbabwe has some interesting diamond geology and has seen little

exploration in recent decades.

Lockdowns have made recent times very difficult for explorers.

Botswana and South Africa banned international travel so only some

local field work was possible. Closed borders made journeys to site

impossible for directors, consultants and international technical

experts. The drastic fall in world economic activity had a spill

over effect on diamond sales and prices. Demand effectively stalled

with many auctions abandoned, while prices, where deals were done

were down by as much as 40 per cent. Few diamond mines are

profitable in that type of business environment. Thankfully, there

are signs of a substantial recovery in both demand and prices.

Botswana

Despite the challenges we believe that we have made significant

progress during the period under review in Botswana, South Africa

and in Zimbabwe.

In Botswana we made what could be a transformative acquisition

of Sekaka Diamonds. Sekaka not only has one of the largest diamond

databases but also holds title to a significant diamond discovery,

KX36 and two surrounding licences.

KX36 is a 3.5 hectare high grade kimberlite pipe in the Kalahari

about 260km northwest of Gaborone, the capital of Botswana. It has

an indicated diamond resource of 17.9 million tonnes at 35 carats

per hundred tonnes (cpht) and a further 6.7 million inferred at 36

cpht. Original values were $65 per carat. We believe and, recent

work done by us reinforces that belief, that diamond breakages

during exploration produced a lower size frequency with consequent

lower diamond values per carat.

It is very rare to find a standalone kimberlite pipe. We, and

others, believe that additional pipes lie hidden in the ground

surrounding KX36. Discovering these will be our primary focus.

There is a fully functioning sampling plant on site which we have

acquired. There are significant challenges where KX36 is located.

Infrastructural costs are very high particularly for power, fuel

and logistics. Alternatives are being examined.

While our focus will be on KX36, do not forget the database

which contains extensive, geophysical, geochemical and drilling

data with many potential targets already identified and can save

participants in the Botswana diamond sector years of preliminary

work.

The Maibwe saga has also made progress. Significant kimberlite

discoveries were made on a 4 licence block in the Kalahari. One of

the kimberlites contained large quantities of microdiamonds. The

operator of the Maibwe joint venture is BCL, a large copper company

which went into liquidation in 2016 leaving all activities at

Maibwe in limbo. There are recent signs that the liquidation may be

coming to a close. Some talks between the Maibwe parties have taken

place.

Further analyses of our Sunland block of twelve licences, also

in the Kalahari, defined a list of priority targets which need to

be drilled.

South Africa

Our flagship project is Thorny River / Marsfontein. There is a

long history of diamond mining of dykes in this area. Dykes can be

very narrow but can be of high grade. Ideally, you map the dykes

which tend to be in echelon or swarms looking for "blows". A blow

is where a dyke swells out to enable quarry type mining. The

Marsfontein "blow" was a 0.4 hectare blow of very high grade where

the capital investment was recovered in just four days. The blow

was mined out in fifteen months.

We have mapped and drilled the Thorny River dykes over a length

of 7km. We have tested a number of anomalies but until the most

recent drilling campaign, had failed to find "blows".

Recent drilling has discovered a 0.4 hectare blow, the so called

River Anomaly. We do not yet know the diamond grade but the average

on this dyke is 55cpht. We have sufficient data to construct 3D

models of the blow. Core drilling will take place in early

2021.

Advanced geophysical techniques have identified other potential

blows on the dykes and these will be drilled in 2021.

Bulk samples of 58 tons of fresh kimberlite were taken from

Marsfontein and a further 62 tons from a residual stockpile. The

kimberlite has a grade of 50 cpht and the stockpile 16 cpht.

The company has an interest in Mooikloof, a 25 hectare pipe and

at Palmietgat, a cluster of six kimberlite pipes.

Zimbabwe

We have long had a connection to Zimbabwe. It is prospective for

diamonds, the Marange field was prolific, but recent years have

been very difficult politically and economically. Diamond

exploration has all but ceased. There have been recent signs of a

limited revival. We would like to be part of the revival.

To that end we have an agreement with Vast Resources to assist

them in relation to a possible licence in the Marange area. We have

a 5% carried interest up to a certain expenditure.

We are also looking at a project in an area known to contain

kimberlite pipes. It is early stage. The current law demands 51%

local ownership. We have no issues with a joint venture as long as

there is sufficient financial incentive for Botswana Diamonds.

Future

The future looks good. The demand for diamonds is recovering. We

are exploring in prospective areas for gem quality diamonds. We

have made progress in Botswana. The acquisition of a known diamond

reserve, KX36 opens doors. The discovery of a "blow" on Thorny

River was positive. We will now look at the commerciality.

John Teeling

Chairman

11(th) December 2020

Annual Report and Notice of Annual General Meeting

The Company's Annual Report and Accounts for the year ended 30

June 2020 (the "Annual Report") will be mailed only to those

shareholders who have elected to receive it on or around 18(th)

December 2020. Otherwise, shareholders will be notified that the

Annual Report and Accounts will be available on the website at

www.botswanadiamonds.co.uk . Copies of The Annual Report will also

be available for collection from the company's registered office at

Suite 1, 3(rd) Floor, 11-12 St. James's Square, London, SW1Y

4LB

The Annual General Meeting ("AGM") is due to be held on Thursday

28(th) January 2021 at The Granite Exchange, 5-6 Kildare Street,

Newry, Northern Ireland, BT34 1DQ at 11.00am. A Notice of the AGM

will be included in the Annual Report.

We are closely monitoring the Coronavirus (COVID-19) situation.

The Board takes its responsibility to safeguard the health of its

shareholders, stakeholders and employees very seriously and so

certain measures will be put in place for the AGM in response to

the COVID-19 pandemic. Details of these measures will be provided

in a letter that will be attached to the Notice of AGM.

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ("MAR"). The person

who arranged for the release of this announcement on behalf of the

Company was John Teeling, Director.

Enquiries:

Botswana Diamonds PLC

John Teeling, Chairman +353 1 833 2833

James Campbell, Managing Director +27 83 457 3724

Jim Finn, Director +353 1 833 2833

Beaumont Cornish - Nominated Adviser

Michael Cornish

Roland Cornish +44 (0) 020 7628 3396

Beaumont Cornish Limited - Broker

Roland Cornish

Felicity Geidt +44 (0) 207 628 3396

First Equity Limited - Joint Broker

Jason Robertson +44 (0) 207 374 2212

Blytheweigh - PR +44 (0) 207 138 3206

Megan Ray +44 (0) 207 138 3553

Rachael Brooks +44 (0) 207 138 3206

Said Izagaren +44 (0) 207 138 3206

Naomi Holmes +44 (0) 207 138 3206

Teneo

Luke Hogg +353 (0) 1 661 4055

Alan Tyrrell +353 (0) 1 661 4055

Ross Murphy +353 (0) 1 661 4055

www.botswanadiamonds.co.uk

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME FOR THE YEARED 30

JUNE 2020

2020 2019

GBP GBP

Administrative expenses (356,831) (336,965)

Impairment of exploration and evaluation assets (34,394) (435,139)

OPERATING LOSS (391,225) (772,104)

LOSS FOR THE YEAR BEFORE TAXATION (391,225) (772,104)

Income tax expense - -

LOSS AFTER TAXATION (391,225) (772,104)

Items that may be reclassified subsequently to profit or loss

Exchange difference on translation of foreign operations (103,715) (132,947)

TOTAL COMPREHENSIVE INCOME FOR THE YEAR (494,940) (905,051)

Loss per share - basic (0.06p) (0.14p)

Loss per share - diluted (0.06p) (0.14p)

CONSOLIDATED BALANCE SHEET AS AT 30 JUNE 2020

30/06/2020 30/06/2019

GBP GBP

ASSETS:

NON CURRENT ASSETS

Intangible assets 8,086,573 8,035,152

8,086,573 8,035,152

CURRENT ASSETS

Other receivables 25,387 40,229

Cash and cash equivalents 17,994 13,812

43,381 54,041

TOTAL ASSETS 8,129,954 8,089,193

LIABILITIES:

CURRENT LIABILITIES

Trade and other payables (432,488) (397,787)

TOTAL LIABILITIES (432,488) (397,787)

NET ASSETS 7,697,466 7,691,406

EQUITY

Called-up share capital - deferred shares 1,796,157 1,796,157

Called-up share capital - ordinary shares 1,678,055 1,441,388

Share premium 10,564,712 10,300,379

Share based payment reserves 111,189 111,189

Retained deficit (5,232,698) (4,841,473)

Translation reserve (236,662) (132,947)

Other reserve (983,287) (983,287)

TOTAL EQUITY 7,697,466 7,691,406

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY FOR THE YEARED 30

JUNE 2020

Share

Called-up Based

Share Share Payment Retained Translation Other

Capital Premium Reserve Deficit Reserve Reserves Total

GBP GBP GBP GBP GBP GBP GBP

At 30 June 2018 3,069,363 10,098,561 104,238 (4,069,369) - (983,287) 8,219,506

Share based payment - 6,951 - - - 6,951

Issue of shares 168,182 201,818 - - - - 370,000

Loss for the year and total comprehensive

income - (772,104) (132,947) - (905,051)

At 30 June 2019 3,237,545 10,300,379 111,189 (4,841,473) (132,947) (983,287) 7,691,406

Issue of shares 236,667 281,333 - - - - 518,000

Share issue expenses (17,000) - - - (17,000)

Loss for the year and total comprehensive

income - (391,225) (103,715) - (494,940)

At 30 June 2020 3,474,212 10,564,712 111,189 (5,232,698) (236,662) (983,287) 7,697,466

Share Premium

The share premium reserve comprises of a premium arising on the

issue of shares. Share issue expenses are deducted against the

share premium reserve when incurred.

Share Based Payment Reserve

The share based payment reserve arises on the grant of share

options under the share option plan.

Retained Deficit

Retained deficit comprises of losses incurred in the current and

prior years.

Translation Reserve

The translation reserve arises from the translation of foreign

operations.

Other Reserves

During 2010 the Company acquired certain assets and liabilities

from African Diamonds plc, a Company under common control. The

assets and liabilities acquired were recognised at their book value

and no goodwill was recognised on acquisition. The difference

between the book value of the assets acquired and the purchase

consideration was recognised directly in reserves.

CONSOLIDATED CASH FLOW STATEMENT FOR THE YEARED 30 JUNE 2020

30/06/2020 30/06/2019

GBP GBP

CASH FLOW FROM OPERATING ACTIVITIES

Loss for the year (391,225) (772,104)

Foreign exchange gains 4,796 1,248

Impairment of exploration and evaluation assets 34,394 435,139

(352,035) (335,717)

MOVEMENTS IN WORKING CAPITAL

Increase in trade and other payables 19,701 82,689

Decrease/(increase) in other receivables 14,842 (15,343)

NET CASH FROM OPERATING ACTIVITIES (317,492) (268,371)

CASH FLOW FROM INVESTING ACTIVITIES

Additions to exploration and evaluation assets (174,530) (347,211)

NET CASH USED IN INVESTING ACTIVITIES (174,530) (347,211)

CASH FLOW FROM FINANCING ACTIVITIES

Proceeds from share issue 518,000 370,000

Share issue costs (17,000) -

NET CASH GENERATED FROM FINANCING ACTIVITIES 501,000 370,000

NET INCREASE / (DECREASE) IN CASH AND CASH EQUIVALENTS 8,978 (245,582)

Cash and cash equivalents at beginning of the financial year 13,812 260,642

Effect of foreign exchange rate changes (4,796) (1,248)

Cash and cash equivalents at end of the financial YEAR 17,994 13,812

1. ACCOUNTING POLICIES

The accounting policies and methods of computation followed in

these financial statements are consistent with those published in

the Group's Annual Report for the year ended 30 June 2019.

The financial statements have been prepared in accordance with

International Financial Reporting Standards (IFRSs). The financial

statements have also been prepared in accordance with International

Financial Reporting Standards (IFRSs) issued by the International

Accounting Standards Board (IASB) and International Financial

Reporting Interpretations Committee (IFRIC) as adopted by the

European Union.

The financial information set out below does not constitute the

Group's financial statements for the year ended 30 June 2020 or 30

June 2019, but is derived from those accounts. The financial

statements for the year ended 30 June 2019 have been delivered to

the Registrar of Companies and those for the year ended 30 June

2020 will be delivered to the Registrar of Companies shortly

The auditors have reported on the 2020 statements; their report

was unqualified with an emphasis of matter in respect of

considering the adequacy of the disclosures made in the financial

statements concerning the valuation of intangible assets, and did

not contain a statement under section 498(2) or 498(3) of the

Companies Act 2006.

2. GOING CONCERN

The Group incurred a loss for the year, after exchange

differences on retranslation of foreign operations, of GBP494,940

(2019: loss of GBP905,051) at the balance sheet date. The Group had

net current liabilities of GBP389,107 (2019:GBP343,746) and the

Company GBP382,560 (2019:GBP340,349) at the balance sheet date.

These conditions represent a material uncertainty that may cast

doubt on the Group's ability to continue as a going concern.

The directors have prepared cashflow projections and forecasts

for a period of not less than 12 months from the date of this

report which indicate that the group will require additional

finance to fund working capital requirements and develop existing

projects. The cashflow projections include any anticipated impacts

of the Covid-19 pandemic on the Group. As the Group is not revenue

or cash generating it relies on raising capital from the public

market. On 7 September 2020 the Group raised GBP300,000 by placing

50,000,000 new ordinary shares. Further details are outlined in

Note 9.

As in previous years the Directors have given careful

consideration to the appropriateness of the going concern basis in

the preparation of the financial statements and believe the going

concern basis is appropriate for these financial statements. The

financial statements do not include any adjustments that would

result if the Group was unable to continue as a going concern.

3. LOSS PER SHARE

Basic loss per share is computed by dividing the loss after

taxation for the year available to ordinary shareholders by the

weighted average number of ordinary shares in issue and ranking for

dividend during the year. Diluted earnings per share is computed by

dividing the profit or loss after taxation for the year by the

weighted average number of ordinary shares in issue, adjusted for

the effect of all dilutive potential ordinary shares that were

outstanding during the year.

The following table sets forth the computation for basic and

diluted earnings per share (EPS):

2020 2019

GBP GBP

Numerator

For basic and diluted EPS retained loss (391,225) (772,104)

============ ============

Denominator No. No.

For basic and diluted EPS 642,643,820 537,481,761

============ ============

Basic EPS (0.06p) (0.14p)

Diluted EPS (0.06p) (0.14p)

============ ------------

The following potential ordinary shares are anti-dilutive and

are therefore excluded from the weighted average number of shares

for the purposes of the diluted earnings per share:

No. No.

Share options 11,410,000 11,410,000

=========== ===========

4. INTANGIBLE ASSETS

Exploration and evaluation assets:

2020 2019

GBP GBP

Cost:

At 1 July 9,299,236 9,063,021

Additions 189,530 369,161

Exchange losses (103,715) (132,946)

------------ ------------

At 30 June 9,385,051 9,299,236

============ ============

Impairment:

At 1 July 1,264,084 828,945

Impairment 34,394 435,139

------------ ------------

At 30 June 1,298,478 1,264,084

============ ============

Carrying Value:

At 1 July 8,035,152 8,234,076

============ ============

At 30 June 8,086,573 8,035,152

============ ============

Segmental analysis 2020 2019

GBP GBP

Botswana 7,024,389 7,056,591

South Africa 1,038,411 972,805

Zimbabwe 23,773 5,756

------------ ------------

8,086,573 8,035,152

============ ============

Exploration and evaluation assets relate to expenditure incurred

in exploration for diamonds in Botswana and South Africa. The

directors are aware that by its nature there is an inherent

uncertainty in exploration and evaluation assets and therefore

inherent uncertainty in relation to the carrying value of

capitalized exploration and evaluation assets.

During the current year, some licences held by the Group in its

subsidiary company Sunland Minerals (Pty) Ltd were relinquished.

Therefore, the directors have decided to impair the costs of

exploration on these licences. Accordingly, an impairment of

GBP34,394 (2019: GBP435,139) has been recorded by the Group in the

current year.

On 11 November 2014 the Brightstone block was farmed out to BCL

Investments (Proprietary) Limited, a Botswana Company, who assumed

responsibility for the work programme. Botswana Diamonds will

retain a 15% equity interest in the project.

On 6 February 2017 the Group entered into an Option and Earn-In

Agreement with Vutomi Mining Pty Ltd and Razorbill Properties 12

Pty Ltd (collectively known as 'Vutomi'), a private diamond

exploration and development firm in South Africa. Pursuant to the

terms of the Agreement, Botswana Diamonds earned a 40% equity

interest in the project.

The directors believe that there were no facts or circumstances

indicating that the carrying value of intangible assets may exceed

their recoverable amount and thus no impairment review was deemed

necessary by the directors. The realisation of these intangible

assets is dependent on the successful discovery and development of

economic diamond resources and the ability of the Group to raise

sufficient finance to develop the projects. It is subject to a

number of significant potential risks, as set out below:

The Group's exploration activities are subject to a number of

significant and potential risks including:

- licence obligations;

- exchange rate risks;

- uncertainties over development and operational costs;

- political and legal risks, including arrangements with

governments for licenses, profit sharing and taxation;

- foreign investment risks including increases in taxes,

royalties and renegotiation of contracts;

- title to assets;

- financial risk management ;

- going concern; and

- operational and environmental risks.

Included in additions for the year are GBPNil (2019: GBP6,951)

of share based payments, GBP14,599 (2019: GBP15,754) of wages and

salaries and GBP76,910 (2019: GBP74,620) of directors remuneration

which has been capitalized. This is for time spent directly on the

operations rather than on corporate activities.

5. CALLED-UP SHARE CAPITAL

Deferred Shares- nominal value of 0.75p

Number Share Capital Share Premium

GBP GBP

At 1 July 2018 and 2019 239,487,648 1,796,157 -

At 30 June 2019 and 2020 239,487,648 1,796,157 -

Ordinary Shares - nominal value of 0.25p

Allotted, called-up and fully paid:

Number Share Capital Share Premium

GBP GBP

At 1 July 2018 509,282,508 1,273,206 10,098,561

Issued during the year 67,272,727 168,182 201,818

At 30 June 2019 576,555,235 1,441,388 10,300,379

Issued during the year 94,666,667 236,667 281,333

Share issue expenses - - (17,000)

At 30 June 2020 671,221,902 1,678,055 10,564,712

Movements in share capital

On 28 January 2019, the Company raised GBP370,000 through the

issue of 67,272,727 new ordinary shares of 0.25p each at a price of

0.55p per share to provide additional working capital and fund

development costs. Each placing share has one warrant attached with

the right to subscribe for one new ordinary share at 0.6p per share

for a period of two years from 23 January 2019.

On 18 July 2019, the Company raised GBP250,000 through the issue

of 50,000,000 new ordinary shares of 0.25p each at a price of 0.50p

per share to provide additional working capital and fund

development costs.

On 18 November 2019, a total of 1,000,000 warrants were

exercised at a price of 0.60p per warrant for GBP6,000.

On 28 January 2020, the Company raised GBP250,000 through the

issue of 41,666,667 new ordinary shares of 0.25p each at a price of

0.60p per share to provide additional working capital and fund

development costs. Each placing share has one warrant attached with

the right to subscribe for one new ordinary share at 0.6p per share

for a period of two years from 28 January 2020.

On 12 June 2020, a total of 2,000,000 warrants were exercised at

a price of 0.60p per warrant for GBP12,000.

6. SHARE-BASED PAYMENTS

The Group issues equity-settled share-based payments to certain

directors and individuals who have performed services for the

Group. Equity-settled share-based payments are measured at fair

value at the date of grant.

Fair value is measured by use of a Black-Scholes valuation

model.

The Group plan provides for a grant price equal to the average

quoted market price of the ordinary shares on the date of

grant.

SHARE OPTIONS 2020 2019

Weighted Weighted

average average

30/06/2020 exercise price 30/06/2019 exercise price

Options in pence Options in pence

Outstanding at beginning of year 11,410,000 5.14 11,410,000

5.14

Issued - - - -

Outstanding at end of the year 11,410,000 5.14 11,410,000

5,14

Exercisable at end of the year 11,410,000 5.14 10,410,000

5.14

WARRANTS 2020 2019

Weighted Weighted

average average

30/06/2020 exercise price 30/06/2019 exercise price

Warrants in pence Warrants in pence

Outstanding at beginning of year 67,272,727 0.60 28,298,700

0.85

Issued 41,666,667 0.60 67,272,727 0.60

Exercised (3,000,000) 0.60 - -

Expired - - (28,298,700) 0.85

Outstanding at end of the year 105,939,394 0.60 67,272,727

0.60

Refer to note 5 Called up Share Capital for the details of the

share options and warrants.

7. POST BALANCE SHEET EVENTS

On 20 July 2020, the Company agreed to acquire the KX36 Diamond

discovery in Botswana, along with two adjacent Prospecting Licences

and a diamond processing plant. These interests are part of a

package held by Sekaka Diamonds. Botswana Diamonds plc acquired

100% of the shares of Sekaka. The vendor was Petra Diamonds. The

consideration comprised a cash payment of US$300,000 and a 5%

royalty on future revenues. The cash consideration is payable on a

deferred basis with US$150,000 payable on 27 November 2021 and the

balance on or before 27 November 2022. The acquisition was

completed on 30 November 2020.

On 7 September 2020, the Company announced that they had raised

GBP300,000 via the placing of 50,000,000 new ordinary shares with

new and existing investors at a price of 0.6p per share. Each share

has one warrant attached with the right to subscribe for one new

ordinary share at 0.6p per new ordinary share for a period of two

years from 7 September 2020.

8. GENERAL INFORMATION

The Annual Report and Accounts will be mailed on the 18(th)

December 2020 only to those shareholders who have elected to

receive it. Otherwise, shareholders will be notified that the

Annual Report and Accounts will be available on the website at

www.botswanadiamonds.co.uk . Copies of The Annual Report will also

be available for collection from the company's registered office at

Suite 1, 3(rd) Floor, 11-12 St. James's Square, London, SW1Y

4LB

9. ANNUAL GENERAL MEETING

The Annual General Meeting is due to be held on Thursday 28(th)

January 2021 at The Granite Exchange, 5-6 Kildare Street, Newry,

Northern Ireland, BT34 1DQ at 11.00am. A Notice of the Annual

General Meeting is included in the Company's Annual Report.

ENDS

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR FLFSRFTLLLII

(END) Dow Jones Newswires

December 14, 2020 02:00 ET (07:00 GMT)

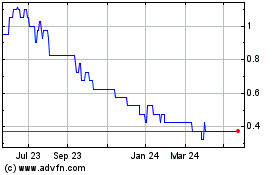

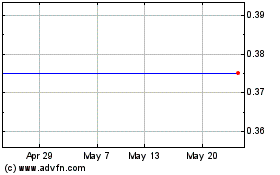

Botswana Diamond (AQSE:BOD.GB)

Historical Stock Chart

From Jun 2024 to Jul 2024

Botswana Diamond (AQSE:BOD.GB)

Historical Stock Chart

From Jul 2023 to Jul 2024