ChallengerX Plc Final Results for the Period Ended 30 June 2022

December 23 2022 - 7:00AM

UK Regulatory

TIDMCXS

23 December 2022

ChallengerX plc

("ChallengerX", "CX" or the "Company")

Final Results for the Period Ended 30 June 2022

ChallengerX (AQUIS: CXS), the trading company with principal activity of

employing both traditional and non-traditional marketing strategies to rapidly

"professionalise" amateur and semi-professional sports clubs around the world

announces its Audited Annual Report and financial statements for the year ended

30 June 2022 (the "Annual Report").

An extract of the Company's audited report and accounts can be found below. A

full copy of the Annual Report, which should be read in full, will shortly be

available from the Company's website https://challengerx.io/investors/ and

will be sent to all shareholders.

In accordance with Rule 4.3 of the AQSE Growth Market Access Rulebook, the

Company will announce management statements within one month of the quarter end

for each quarter until an audit report is published without modification.

Accordingly, the Company will release the following quarterly reports:

· A report for the two quarters ended 30 September 2022 and 30 December

2022 by 31 January 2022

· A report for the quarter ending 31 March 2022 by 30 April 2023

· A report for the quarter ending 30 June 2023 by 31 July 2023

This announcement contains inside information for the purposes of the UK Market

Abuse Regulation and the Directors of the Company are responsible for the

release of this announcement.

For further information, please contact:

Enquiries:

ChallengerX plc

Olivia Edwards, CEO Olivia@challengerx.io

John May, Chairman john@challengerx.io

Nicholas Lyth, CFO

First Sentinel Corporate Finance +44 203 989 2222

AQSE Corporate Adviser Brian Stockbridge

/ Jenny Liu

Statement of Comprehensive Income For the period ended 30 June 2022

2022

£'000

Administrative expenses (279)

Impairment of investment in subsidiary (839)

Impairment of loan (118)

Operating loss (1,236)

Loss before tax (1,236)

Taxation -

Loss for the financial year (1,236)

Total comprehensive loss (1,236)

(Loss) per share (pence) from continuing operations (0.047)

attributable to

owners of the Company - Basic & Diluted

Statement of Financial Position As at 30 June 2022

2022

£'000

Current assets

Trade and other receivables 7

Cash and cash equivalents 385

Total current assets 392

Total assets 392

Current liabilities

Trade and other payables 110

Total current liabilities 110

Net assets 282

Capital and reserves

Share capital 288

Share premium 1,230

Retained earnings (1,236)

Total equity 282

The financial statements were approved by the Board of Directors on 21 December

2022 and signed on its behalf by:

Nicholas Lyth CFO

Statement of Changes in Equity

For the period ended 30 June 2022

Share Share Retained

capital premium earnings Total

£'000 £'000 £'000 £'000

Loss for the year - - (1,236) (1,236)

Total Comprehensive - - (1,236) (1,236)

Income

Issue of shares 288 1,230 - 1,518

Total Transactions with 288 1,230 - 1,518

Owners

As at 30 June 2022 288 1,230 (1,236) 282

Statement of Cash Flows

For the period ended 30 June 2022

2022

£'000

Cash from operating activities

Loss before tax (1,236)

Adjustments for:

(Increase) in trade and other receivables (7)

Increase in trade and other payables 110

Net cash used in operating activities (1,133)

Cash flows from financing activities

Proceeds from issue of shares (net of issue costs) 1,518

Net cash from financing activities 1,518

Net cash flow for the year 385

Cash and cash equivalents at beginning of period -

Cash and cash equivalents at end of period 385

Net change in cash and cash equivalents 1,463

Cash and cash equivalents comprise:

Cash at bank and in hand 385

385

Notes to the financial statements

1. General information

ChallengerX plc is a public limited company limited by shares and was

incorporated in England on 1 October 2019 with company number 13440398. Its

registered office is 16 Great Queen Street, London, WC2B 5DG.

The Company's shares are traded on the Aquis Stock Exchange Growth Market under

symbol CXS and ISIN number

GB00BMD0WG01.

The Company was first incorporated on 7 June 2021 and so the period ended 30

June 2022 represents an approx. 13-month period.

The information above has been extracted from the final report and accounts for

the period ended 30 June 2022. Accordingly, references to notes and page

numbers will related to the final report and accounts which should be read in

full.

2. Basis of Preparation

The financial statements of Greencare Capital plc have been prepared in

compliance with United Kingdom Accounting Standards, including Financial

Reporting Standard 102, "The Financial Reporting Standard applicable in the

United Kingdom and the Republic of Ireland" ("FRS 102") and the Companies Act

2006.

These financial statements are prepared on a going concern basis, under the

historical cost convention, as modified by the recognition of listed

investments at fair value.

The financial statements are presented in Pounds Sterling, which is the

Company's presentation and functional

currency.

The preparation of the financial statements requires the use of certain

critical accounting estimates. It also requires management to exercise its

judgment in the process of applying the Company's accounting policies. The

areas involving a higher degree of judgment and complexity, or areas where

assumptions and estimates are significant to the financial statements are

disclosed in Note 3 to the financial statements.

The financial statements have been prepared on the historical cost basis and

are presented in £'000 unless

otherwise stated.

3. Going Concern

As at 30 June 2022, the Company had cash of £0.385 million. As a newly

established trading business, the Company has limited operating cash flow and

is dependent on the performance of its trading and its cash balances for its

working capital requirements. Annualised normal running costs of the Company

are circa £0.225m. As at the date of this report, the Company had approximately

£0.115 million of cash at bank.

The Directors continue to seek recovery of the sequestered funds held by the

Administrator of it's subsidiary, SportsX, which are believed to be £0.6m

approx .

For this reason, it continues to adopt the going concern basis in preparing the

financial statements.

4. Earnings per share

2022

£'000

Earnings

Loss for the period (1,236)

Number of shares

Weighted average number of shares for the purposes of basic

and diluted earnings per share 264,235,601

Earnings per share (pence) (0.047)

5. Dividends

The Directors do not recommend payment of a dividend for the period ended 30

June 2022.

6. Annual General Meeting (AGM)

The Company's AGM is being held at 10.30am on Friday 30 December at 50 Jermyn

Street, London, SW1Y 6LX.

END

(END) Dow Jones Newswires

December 23, 2022 08:00 ET (13:00 GMT)

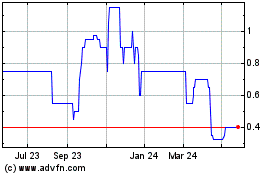

ChallengerX (AQSE:CXS)

Historical Stock Chart

From Nov 2024 to Dec 2024

ChallengerX (AQSE:CXS)

Historical Stock Chart

From Dec 2023 to Dec 2024