TIDMDUKE

RNS Number : 1645I

Duke Royalty Limited

01 December 2022

1 December 2022

Duke Royalty Limited

("Duke Royalty", "Duke" or the "Company")

Interim Results for the six months ended 30 September 2022

Duke Royalty Limited (AIM: DUKE), a provider of alternative

capital solutions to a diversified range of profitable and

long-established businesses in Europe and abroad, is pleased to

announce its interim results for the six-months ended 30 September

2022 ("Interim 2023").

Financial Highlights

-- Total cash revenue* of GBP10.4 million, up 34% from the prior

period (Interim 2022: GBP7.8 million)

-- Recurring cash revenue**, also GBP10.4 million, increased 67%

(Interim 2022: GBP6.3 million)

-- Free cash flow of GBP6.6 million, up 44% (Interim 2022: GBP4.6 million)

-- Net profit generated of GBP10.3 million, a 66% increase (Interim 2022: GBP6.2 million)

-- Adjusted earnings of 1.58 pence per share, a 14% increase

(Interim 2022: 1.39 pence per share)

-- Cash dividends of 1.40 pence per share paid to shareholders,

a 27% increase (Interim 2022: 1.10 pence per share)

Operational Highlights

-- Raised GBP20 million of new equity capital in May 2022

-- Deployed over GBP6 million of capital into existing Royalty Partners

-- The portfolio as a whole has proven resilient as trading

continues to be in line with expectations during the current

macroeconomic headwinds

-- During this period of inflation, the portfolio has produced

five out of five maximum positive adjustments

-- Post period end, invested GBP5.5 million into new royalty

partner New Path Fire & Security

-- Currently over GBP15 million of available liquidity for future deployments

* Total cash revenue is monthly cash distributions from Duke's

royalty partners plus cash gains received from the sales of equity

assets and buyout premiums

** Recurring cash revenue excludes buyout premium receipts and

cash gains from equity sales (formerly termed 'normalised'

revenue)

Nigel Birrell, Chairman of Duke Royalty, said:

"I am pleased to report that Duke Royalty's results for the

six-month period show a continuation of increasing recurring cash

revenue and higher cash flow per share metrics, which are both core

KPIs for the Company. This strong underlying operating performance

allowed Duke to pay two quarterly dividends of 0.70 pence each

during Interim 2023, equating to an annualised dividend of 2.80

pence which represents a material increase from the 2.25 pence per

share of dividends paid out in FY22. These are pleasing results

given the challenging economic and political backdrop globally and

the portfolio debt coverage ratio remains comfortable. With this in

mind, I would like to thank the Duke team for their ongoing efforts

in creating a diversified portfolio of royalty investments that

have proven resilient during the current macroeconomic

headwinds.

"Looking ahead, Duke is well-positioned for growth with

additional liquidity ready for deployment. While we have taken a

cautious approach to additional deployments in Interim 2023, we

feel the current macroeconomic environment will translate to

increased demand for our royalty finance solution from profitable,

long-standing businesses as we compare favourably to other short

term capital solutions. We look forward to expanding our portfolio

over the months ahead as we execute on an exciting pipeline of new

opportunities which will drive further growth in our business."

Investor Webinars

Investor Meet Company

Neil Johnson, CEO, and Hugo Evans, Finance Director, will

deliver a live presentation relating to the Interim Results via the

Investor Meet Company platform on Thursday 8 December 2022 at 4pm

GMT.

The online presentation is open to all existing and potential

shareholders.

Investors can sign up to Investor Meet Company for free and add

to meet Duke Royalty via:

https://www.investormeetcompany.com/duke-royalty-limited/register-investor

Mello Monday

The Company will be presenting at MelloMonday on Monday 12

December 2022, taking place from 5pm to 9.30pm. Both Neil Johnson

and Hugo Evans will be presenting and taking questions from

participants.

If you would like to attend, you can register here for the

event.

For further information, please visit www.dukeroyalty.com or

contact:

Neil Johnson / Charlie

Cannon Brookes / Hugo

Duke Royalty Limited Evans +44 (0) 1481 730 613

Cenkos Securities

plc Stephen Keys / Callum

(Nominated Adviser Davidson / Julian Morse

and Joint Broker) / Michael Johnson +44 (0) 207 397 8900

Canaccord Genuity

(Joint Broker) Adam James / Harry Rees +44 (0) 207 523 8000

SEC Newgate (Financial Elisabeth Cowell / + +44 (0) 20 3757 6880

Communications) Axaule Shukanayeva dukeroyalty@secnewgate.co.uk

CHAIRMAN'S REPORT

Dear Shareholder,

I am pleased to report that Duke Royalty's results for Interim

2023 show a continuation of increasing recurring cash revenue and

higher cash flow per share metrics, which are both core KPIs for

the Company. These are pleasing results given the challenging

economic and political backdrop globally. With this in mind, I

would like to thank the Duke team for their ongoing efforts in

creating a diversified portfolio of royalty investments that have

proven resilient during the current macroeconomic headwinds.

I note that there has only been a short period since the Company

released its full year results for the 12 months ended 31 March

2022 ("FY 2022"). However, in this short period we have witnessed

two different UK Prime Ministers, an escalation in the

Russia/Ukraine conflict, significantly higher interest rates and

more mainstream commentary about the possible onset of a global

recession. Against this undeniably bearish market backdrop, Duke

has continued to selectively deploy its capital and will continue

to be opportunistic at a time when other lenders are pulling back

from the market, thereby providing an opportunity for Duke to

expand and increase its market share.

Duke's simple investment philosophy of providing long dated,

senior secured royalty investments to established and profitable

SME owner-operated business will see it through these challenging

times, and I am pleased to report a strong set of financial results

for Interim 2023 alongside an optimistic outlook for the rest of

the financial year.

Operational Review

In May 2022, Duke announced a GBP20 million equity placing from

both institutional and retail investors. Net proceeds from this

fundraising were used to repay the existing debt and provide

additional liquidity headroom, allowing the Company both to invest

further capital into its existing Royalty Partners as well into new

opportunities. In that regard, Duke invested GBP6.6m into Intec and

Tristone during Interim 2023, both of which are undertaking buy and

build strategies in their respective sectors of I.T. managed

services and specialist residential and domiciliary care. However,

given the volatile macroeconomic back drop, the general feeling in

the period was one of caution whilst positioning the Company to

take advantage of an ever-expanding deal pipeline and market

opportunity.

Based on our current deal pipeline, we expect to deliver an

acceleration in deployments over the next six months, and I am

pleased to note that Duke had GBP21m of liquidity available for

deployment into this pipeline of new deal opportunities at 30

September 2022. In that regard, post period end the Company

announced a GBP5.5 million new deployment into New Path Fire &

Security, a specialist Fire and Security business, that is

undertaking a buy and build strategy in the highly fragmented Fire

and Security sector. I look forward to announcing further follow-on

investments into New Path Fire in due course as they execute on

their business plan.

In terms of the existing portfolio, a further five positive

adjustment resets have been recorded in the first six months of the

financial year, driven by the current high levels of inflation

which have increased the average yield on the Duke portfolio to

record levels. These positive resets, when taken alongside a period

of high deployment in FY 2022, has allowed Duke to continue to

announce record consecutive quarters of recurring cash revenue

during Interim 2023, a trend we again expect to continue in the

coming quarters. Clearly the current falling levels of

discretionary consumer spending remain a key area of focus for the

Company but in general, Duke's stated focus on investing in B2B

businesses has meant that this has had less of a direct impact. To

date, the Company's portfolio as a whole continues to trade

robustly. In that regard, it is pleasing to note that the portfolio

debt service coverage ratio remains at a level above 2x, thereby

providing a good degree of insulation during these volatile times.

As previously discussed in prior Chairman's Statements, as Duke

deploys more capital the ongoing advantages of operational leverage

will increasingly benefit shareholders and this is a trend that I

look forward to reporting on in future periods.

Financial Review

The financial results for Interim 2023 reflect the resilience of

Duke's business model and its ability to withstand stresses in the

global financial system. I am delighted to report that the

Company's cash revenue, being cash distributions from Royalty

Partners and cash gains from the sale of equity investments, grew

to GBP10.4 million during the Period under review, a 34% increase

over the GBP7.8 million generated in Interim 2022. However, it

should be noted that Interim 2022 benefited from the BHP buyout,

which delivered over GBP1.5 million of premiums and realised equity

gains. On a like-for-like basis, Interim 2023 produced GBP10.4

million of recurring cash revenue against GBP6.2 million in FY

2022, a 67% increase.

Free cash flow, which represents the Company's ability to pay

out quarterly cash dividends to its shareholders and is defined as

net operating cash inflow plus cash gains from the sale of equity

investments less its interest on debt financing, grew by 27% to

GBP6.6 million. This equates to 1.71 pence per share, up from

GBP4.6 million and 1.36 pence per share in Interim 2022.

Total income, which includes non-cash fair value movements on

the Company's investment portfolio, grew to GBP15.8 million, a 62%

increase over Interim 2022. This generated total earnings after tax

of GBP10.3 million and earnings per share of 2.65 pence against

GBP6.2 million in Interim 2022 and earnings per share of 1.84

pence. Adjusted earnings, which strips out the fair value movements

and represents a truer reflection of Duke's operating performance,

rose to GBP6.2 million from GBP4.7 million, a 32% increase.

Dividend

This strong underlying operating performance allowed Duke to pay

two quarterly dividends of 0.70 pence each during Interim 2023,

equating to an annualised dividend of 2.80 pence which represents a

material increase from the 2.25 pence per share of dividends paid

out in FY22. It is pleasing to note that at the current 2.80 pence

annualised rate, the dividend is well covered by free cash flow,

and it is the intention of Duke to increase its dividend at a

measured pace over time while at the same time reducing the

Company's payout ratio, thereby allowing more cash to be reinvested

into new deal opportunities.

Outlook

Duke is well-positioned for growth having created a large and

diversified portfolio of royalty investments, an exciting pipeline

of new opportunities and a strong liquidity position ready for

deployment. Additionally, the current macroeconomic climate means

that demand for our solution from profitable, long-standing

businesses, is as high as ever.

As always, I am appreciative of the ongoing support of our

shareholders and am pleased to report the Chairman's Statement for

Interim 2023. Our existing partners have traded resiliently during

the period and the Group's business model is well insulated to

withstand the current economic headwinds and to grow its market

share.

I look forward to reporting on the Group's ongoing progress and

development in future periods.

Nigel Birrell

Chairman

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

Period Year to Period

to to

30-Sep-22 31-Mar-22 30-Sep-21

(unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

Cash flows from operating activities

Receipts from royalty investments 10,234 14,701 6,419

Receipts of interest from loan

investments 173 580 450

Other operating income 30 543 266

Operating expenses paid (1,061) (2,487) (946)

Payments for royalty participation

fees (57) (115) (57)

Tax paid (813) (2,055) (1,569)

------------- ----------- -------------

Net cash inflow from operating

activities 8,506 11,167 4,563

Cash flows from investing activities

Royalty investments advanced (6,550) (74,586) (23,209)

Royalty investments received - 2,938 2,938

Loan investments advanced (700) (3,192) -

Loan investments received - 3,949 3,370

Equity investments advanced - (530) (530)

Receipts from equity instruments - 300 652

Realised gain from sale of equity 2,583 -

investments -

Receipt of deferred consideration - 7,679 -

Investment costs paid (173) (972) (496)

Net cash outflow from investing

activities (7,423) (61,831) (17,275)

Cash flows from financing activities

Proceeds from share issue 20,000 35,000 35,000

Share issue costs (1,115) (1,936) (1,936)

Dividends paid (5,282) (7,270) (3,270)

Proceeds from loans 5,050 38,200 -

Loan repaid (18,500) (7,500) (7,500)

Interest paid (1,872) (1,649) (612)

Other finance costs paid (30) (181) -

Net cash (outflow) / inflow financing

activities (1,749) 54,664 21,682

Net change in cash and cash equivalents (666) 4,000 8,970

------------- ----------- -------------

Cash and cash equivalents at

beginning of period/year 5,707 1,766 1,766

Effect of foreign exchange on

cash 31 (59) 9

Cash and cash equivalents at

the end of period/year 5,072 5,707 10,745

============= =========== =============

CONDENSED CONSOLIDATED STATEMENT OF INCOME

Period Year to Period

to to

30-Sep-22 31-Mar-22 30-Sep-21

Note (unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

Income

Royalty investment net income 6 15,079 18,037 7,584

Loan investment net income 7 173 533 410

Equity investment net income 8 485 9,678 1,497

Other operating income 30 543 266

Total income 15,767 28,791 9,757

Investment Costs

Transaction costs (28) (631) (525)

Due diligence costs (455) (1,113) 11

Total Investment Costs (483) (1,744) (514)

Operating Costs

Administration and personnel (1,811) (2,060) (1,191)

Legal and professional (232) (405) (183)

Other operating expenses (100) (151) (65)

Expected credit losses - (72) -

Share-based payments (458) (930) (472)

------------- ----------- -------------

Total operating costs (2,601) (3,618) (1,911)

Operating profit 12,683 23,429 7,332

------------- ----------- -------------

Net foreign currency gains 177 (60) 108

Finance costs 3 (1,951) (1,996) (693)

Profit for the period before

tax 10,909 21,373 6,747

------------- ----------- -------------

Taxation expense 4 (614) (982) (540)

Total comprehensive income

for the period 10,295 20,391 6,207

============= =========== =============

Basic earnings per share (pence) 5 2.65 5.95 1.84

============= =========== =============

Diluted earnings per share

(pence) 5 2.65 5.95 1.84

============= =========== =============

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

Note 30-Sep-22 31-Mar-22 30-Sep-21

(unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

Non-current assets

Goodwill 13 203 203 203

Royalty finance investments 6 149,853 139,648 93,232

Loan investments 7 3,872 3,172 1,000

Equity investments 8 11,305 10,820 4,810

Trade and other receivables 10 - 2,141 2,236

Deferred tax asset 18 155 156 157

------------- ----------- -------------

165,388 156,140 101,638

Current assets

Royalty finance investments 6 22,091 20,831 13,607

Loan investments 7 1,000 1,000 580

Equity investments 8 - - 60

Trade and other receivables 10 2,294 53 7,780

Cash and cash equivalents 5,072 5,707 10,745

Current tax asset 111 - -

------------- ----------- -------------

30,568 27,591 32,772

Total Assets 195,956 183,731 134,410

------------- ----------- -------------

Current liabilities

Royalty debt liabilities 9 165 160 144

Trade and other payables 11 1,423 423 868

Borrowings 12 337 362 172

Current tax liability - 87 132

1,925 1,032 1,316

Non-current liabilities

Royalty debt liabilities 9 960 951 932

Trade and other payables 11 1,331 1,067 204

Borrowings 12 34,363 47,740 9,659

36,654 49,758 10,795

Net Assets 157,377 132,941 122,299

============= =========== =============

Equity

Shares issued 14 172,939 153,974 153,974

Share based payment reserve 15 2,936 2,478 2,020

Warrant reserve 15 265 265 265

Retained losses 16 (18,763) (23,776) (33,960)

Total Equity 157,377 132,941 122,299

============= =========== =============

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Share-based

Shares payment Warrant Retained Total

Note issued reserve reserve losses equity

GBP000 GBP000 GBP000 GBP000 GBP000

At 1 April 2021 120,870 1,548 265 (36,897) 85,786

---------- ------------- --------- ---------- ----------

Total comprehensive income for

the period - - - 6,207 6,207

Transactions with owners

Shares issued for cash 35,000 - - - 35,000

Share issuance costs (1,936) - - - (1,936)

Share based payments 40 472 - - 512

Dividends - - - (3,270) (3,270)

---------- ------------- --------- ---------- ----------

Total transactions with owners 33,104 472 - (3,270) 30,306

At 30 September 2022 153,974 2,020 265 (33,960) 122,299

---------- ------------- --------- ---------- ----------

Total comprehensive income for

the period - - - 14,184 14,184

Transactions with owners

Share based payments - 458 - - 458

Dividends - - - (4,000) (4,000)

---------- ------------- --------- ---------- ----------

Total transactions with owners - 458 - (4,000) (3,542)

At 31 March 2022 153,974 2,478 265 (23,776) 132,941

---------- ------------- --------- ---------- ----------

Share-based

Shares payment Warrant Retained Total

Note issued reserve reserve losses equity

GBP000 GBP000 GBP000 GBP000 GBP000

At 1 April 2022 153,974 2,478 265 (23,776) 132,941

---------- ------------- --------- ---------- ---------

Total comprehensive income for

the period - - - 10,295 10,295

Transactions with owners

Shares issued for cash 20,000 - - - 20,000

Share issuance costs (1,115) - - - (1,115)

Share based payments 80 458 - - 538

Dividends - - - (5,282) (5,282)

---------- ------------- --------- ---------- ---------

Total transactions with owners 18,965 458 - (5,282) 14,141

At 30 September 2022 172,939 2,936 265 (18,763) 157,377

========== ============= ========= ========== =========

NOTES TO THE FINANCIAL STATEMENTS

1. General Information

Duke Royalty Limited ("Duke Royalty" or the "Company") is a

company limited by shares, incorporated in Guernsey under the

Companies (Guernsey) Law, 2008. Its shares are traded on the AIM

market of the London Stock Exchange.

Throughout the period, the "Group" comprised Duke Royalty

Limited and its wholly owned subsidiaries; Duke Royalty UK Limited,

Capital Step Holdings Limited, Capital Step Investments Limited,

Capital Step Funding Limited, Capital Step Funding 2 Limited and

Duke Royalty Employee Benefit Trust.

The Group's investing policy is to invest in a diversified

portfolio of royalty finance and related opportunities.

2. Significant accounting policies

2.1 Basis of preparation

The interim Condensed Consolidated Financial Statements of the

Group have been prepared in accordance with UK adopted

international accounting standards, and applicable Guernsey law,

and reflect the following policies, which have been adopted and

applied consistently.

On 31 December 2020, IFRS as adopted by the European Union at

that date was brought into the UK law and became UK-adopted

international accounting standards, with future changes being

subject to endorsement by the UK Endorsement Board. The group

transitioned to UK-adopted international accounting standards in

its consolidated financial statements on 1 April 2021. There was no

impact or changes in accounting from the transition.

The accounting policies adopted in the preparation of the

interim Condensed Consolidated Financial Statements are consistent

with those followed in the preparation of the Consolidated

Financial Statements of the Group for the year ended 31 March

2022.

The Financial Statements have been prepared on a historical cost

basis, except for the following:

-- Royalty investments - measured at fair value through profit or loss

-- Equity investments - measured at fair value through profit or loss

-- Royalty participation liabilities - measured at fair value through profit or loss

The Directors consider that the Group has adequate financial

resources to enable it to continue operations for a period of no

less than 12 months from the date of approval of the financial

statements. Accordingly, the Directors believe that it is

appropriate to continue to adopt the going concern basis in

preparing the financial statements.

2.2 New and amended standards adopted by the Group

There were no new standards adopted by the Group during the

reporting period.

2.3 New standards and interpretations not yet adopted

At the date of authorisation of these interim Condensed

Consolidated Financial Statements, certain standards and

interpretations were in issue but not yet effective and have not

been applied in these interim Condensed Consolidated Financial

Statements. The Directors do not expect that the adoption of these

standards and interpretations will have a material impact on the

interim Condensed Consolidated Financial Statements of the Group in

future periods.

2.4 Going concern

In assessing the going concern basis of accounting the Directors

have had regard to the guidance issued by the Financial Reporting

Council. After making enquiries and bearing in mind the nature of

the Company's business and assets, the Directors consider that the

Company has adequate resources to continue in operational existence

for the foreseeable future.

The cash flow needs of the Group have been assessed taking

account the need for further funding for any of the existing

royalty partners and the ongoing working capital needs of the

business against the current cash and liquidity of the Group.

Furthermore, there is adequate headroom in terms of the uncalled

loan facility in place should it be required.

3. Finance Costs

Period Year to Period

to to

30-Sep-22 31-Mar-22 30-Sep-21

(unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

Interest payable on borrowings 1,750 1,499 409

Non-utilisation fees 112 350 213

Deferred finance costs released

to P&L 89 147 71

1,951 1,996 693

============= =========== =============

4. Income tax

The Company has been granted exemption from Guernsey taxation.

The Company's subsidiary in the UK is subject to taxation in

accordance with relevant tax legislation.

Period Year to Period

to to

30-Sep-22 31-Mar-22 30-Sep-21

(unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

Current tax

Income tax expense 613 980 539

Deferred tax

Decrease in deferred tax assets 1 3 2

Decrease in deferred tax liabilities - (1) (1)

1 2 1

Income tax expense 614 982 540

============= =========== =============

Factors affecting income tax expense for the period

Period Year to Period

to to

30-Sep-22 31-Mar-22 30-Sep-21

(unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

Profit on ordinary activities

before tax 10,910 21,373 6,747

Tax using the Groups effective

tax rate of 5.63% (2022: 4.60%,

period to 30 September 2022:

8.00%) 614 982 540

Income tax expense 614 982 540

============= =========== =============

5. Earnings per share

Period Year to Period

to to

30-Sep-22 31-Mar-22 30-Sep-21

(unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

Total comprehensive income

(GBP000) 10,295 20,391 6,207

Weighted average number of

Ordinary Shares in issue, excluding

treasury shares (000s) 388,412 342,822 337,310

Basic earnings per share (pence) 2.65 5.95 1.84

============= =========== =============

Period Year to Period

to to

30-Sep-22 31-Mar-22 30-Sep-21

(unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

Total comprehensive income

(GBP000) 10,295 20,391 6,207

Weighted average number of

Ordinary Shares, diluted for

warrants in issue (000s) 388,412 342,822 337,310

Diluted earnings per share

(pence) 2.65 5.95 1.84

============= =========== =============

Basic earnings per share is calculated by dividing total

comprehensive income for the period by the weighted average number

of shares in issue throughout the period, excluding treasury shares

(see Note 14). Diluted earnings per share represents the basic

earnings per share adjusted for the effect of dilutive potential

shares issuable on exercise of share options under the Company's

share-based payment schemes, weighted for the relevant period.

All share options, warrants and Long-Term Incentive Plan awards

in issue are not dilutive at the year-end as the exercise prices

were above the average share price for the period. However, these

could become dilutive in future periods.

Adjusted earnings per share

Adjusted earnings represent the Group's underlying performance

from core activities. Adjusted earnings is the total comprehensive

income adjusted for unrealised and non-core fair value movements,

non-cash items and transaction-related costs, including due

diligence fees, together with the tax effects thereon. Given the

sensitivity of the inputs used to determine the fair value of its

investments, the Group believes that adjusted earnings is a better

reflection of its ongoing financial performance.

Valuation and other non-cash movements such as those outlined

are not considered by management in assessing the level of profit

and cash generation of the Group. Additionally, IFRS 9 requires

transaction-related costs to be expensed immediately whilst the

income benefit is over the life of the asset. As such, an adjusted

earnings measure is used which reflects the underlying contribution

from the Group's core activities during the year.

Period Year to Period

to to

30-Sep-22 31-Mar-22 30-Sep-21

(unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

Total comprehensive income

for the period 10,295 20,391 6,207

Unrealised fair value movements (5,330) (10,431) (2,663)

Expected credit losses - 72 -

Share-based payments 458 930 472

Investment costs 483 1,746 525

Tax effect of the adjustments

above at Group effective rate 247 350 134

-------------

Adjusted earnings 6,153 13,058 4,675

============= =========== =============

Period Year to Period

to to

30-Sep-22 31-Mar-22 30-Sep-21

(unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

Adjusted earnings for the year

(GBP000) 6,153 13,058 4,675

Weighted average number of

Ordinary Shares in issue, excluding

treasury shares (000s) 388,412 342,822 337,310

Adjusted earnings per share

(pence) 1.58 3.81 1.39

============= =========== =============

Period Year to Period

to to

30-Sep-22 31-Mar-22 30-Sep-21

(unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

Diluted adjusted earnings for

the year (GBP000) 6,153 13,058 4,675

Diluted weighted average number

of Ordinary Shares in issue,

excluding treasury shares (000s) 388,412 342,822 337,310

Diluted adjusted earnings per

share (pence) 1.58 3.81 1.39

============= =========== =============

6. Royalty investments

Royalty investments are financial assets held at FVTPL that

relate to the provision of royalty capital to a diversified

portfolio of companies.

30-Sep-22 31-Mar-22 30-Sep-21

(unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

Brought forward 160,479 85,301 85,301

Additions 6,550 74,586 23,209

Refinanced assets - (2,939) (2,938)

Gain on financial assets at

FVTPL 4,915 3,531 1,267

-------------

171,944 160,479 106,839

============= =========== =============

Royalty finance investments are comprised of:

30-Sep-22 31-Mar-22 30-Sep-21

(unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

Non-Current 149,853 139,648 93,232

Current 22,091 20,831 13,607

171,944 160,479 106,839

============= =========== =============

Royalty investment net income on the face of the consolidated

statement of comprehensive income comprises:

Period Year to Period

to to

30-Sep-22 31-Mar-22 30-Sep-21

(unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

Royalty interest 10,234 13,987 5,705

Royalty premiums - 714 714

Gain on royalty assets at FVTPL 4,916 3,531 1,267

Loss on royalty liabilities

at FVTPL (71) (195) (102)

15,079 18,037 7,584

============= =========== =============

All financial assets held at FVTPL are mandatorily measured as

such.

The Group's royalty investment assets comprise royalty financing

agreements with 13 (30 September 2021: 11, 31 March 2022: 13)

investees. Under the terms of these agreements the Group advances

funds in exchange for annualised royalty distributions. The

distributions are adjusted based on the change in the investees'

revenues, subject to a floor and a cap. The financing is secured by

way of fixed and floating charges over certain of the investees'

assets. The investees are provided with buyback options,

exercisable at certain stages of the agreements.

7. Loan investments

Loan investments are financial assets held at amortised cost

which the exception of the GBP2.2 million loan issued at 0%

interest. The impact of discounting is immaterial to the financial

statements. The below table shows both the loans at amortised cost

and fair value.

30-Sep-22 31-Mar-22 30-Sep-21

(unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

Brought forward 4,172 4,950 4,950

Additions 700 3,192 -

Buybacks - (3,950) (3,370)

Expected credit losses - (20)

4,872 4,172 1,580

============= =========== =============

The Group's loan investments comprise secured loans advanced to

two entities (30 September 2021: two, 31 March 2022: two) in

connection with the Group's royalty investments.

The loans comprise fixed rate loans of GBP4,872,000 (30

September 2021: GBP1,580,000, March 2022: GBP4,172,000) which bear

interest at rates of between 0% and 15%.

The loans mature as follows:

30-Sep-22 31-Mar-22 30-Sep-21

(unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

In less than one year 1,000 1,000 580

In one to two years - - -

In two to five years 3,872 3,172 1,000

4,872 4,172 1,580

============= =========== =============

Loan investment net income on the face of the consolidated

statement of comprehensive income comprises:

Period Year to Period

to to

30-Sep-22 31-Mar-22 30-Sep-21

(unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

Loan interest 173 533 410

============= =========== =============

ECL Analysis

The measurement of ECLs is primarily based on the product of the

instrument's probability of default ("PD"), loss given default

("LGD"), and exposure at default ("EAD"). The Group analyses a

range of factors to determine the credit risk of each investment.

These include, but are not limited to:

-- liquidity and cash flows of the underlying businesses

-- security strength

-- covenant cover

-- balance sheet strength

If there is a material change in these factors, the weighting of

either the PD, LGD or EAD increases, thereby increasing the ECL

impairment.

The disclosure below presents the gross and net carrying value

of the Group' loan investments by stage:

Gross Net

carrying Allowance Carrying

amount for ECLs amount

As at 30 September 2022 GBP000 GBP000 GBP000

Stage 1 4,872 - 4,872

Stage 2 - - -

Stage 3 - - -

4,872 - 4,872

=========== =========== ===========

Net

Gross carrying Allowance Carrying

amount for ECLs amount

As at 31 March 2022 GBP000 GBP000 GBP000

Stage 1 4,192 (20) 4,172

Stage 2 - - -

Stage 3 - - -

4,192 (20) 4,172

================ =========== ===========

Net

Gross carrying Allowance Carrying

amount for ECLs amount

As at 30 September 2022 GBP000 GBP000 GBP000

Stage 1 1,580 - 1,580

Stage 2 - - -

Stage 3 - - -

1,580 - 1,580

================ =========== ===========

Under the ECL model introduced by IFRS 9, impairment provisions

are driven by changes in credit risk of instruments, with a

provision for lifetime expected credit losses recognised where the

risk of default of an instrument has increased significantly since

initial recognition.

The credit risk profile of the investments has not increased

materially and they remain Stage 1 assets. No ECLs have been

charged in the period on these assets as they are not deemed

material.

The following table analyses Group's provision for ECL's by

stage for the period ended 30 September 2022:

Stage Stage Stage Total

1 2 3

GBP000 GBP000 GBP000 GBP000

At 1 April 2021 and 30 - - - -

September 2021

Expected credit losses

on loan investments in

year 20 - - 20

Expected credit losses

on other receivables

in year 52 - - 52

Carrying value at 31

March 2022 and 30 September

2022 72 - - 72

======== ======== ======== ========

8. Equity investments

Equity investments are financial assets held at FVTPL.

30-Sep-22 31-Mar-22 30-Sep-21

(unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

Brought forward 10,820 3,495 3,495

Additions - 530 530

Disposals - (2,883) (652)

Gain / (loss) on equity assets

held at FVTPL 485 9,678 1,497

11,305 10,820 4,870

============= =========== =============

The Group's equity investments comprise unlisted shares and

warrants in 10 of its royalty investment companies (30 September

2021: eight, 31 March 2022: nine).

The Group also still holds two (30 September 2021: two, 31 March

2022: two) unlisted investments in mining entities from its

previous investment objectives. The Board does not consider there

to be any future cash flows from the remaining investments and they

are fully written down to nil value.

Equity investment net income on the face of the consolidated

statement of comprehensive income comprises:

Period Year to Period

to to

30-Sep-22 31-Mar-22 30-Sep-21

(unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

Gain / (loss) on equity investments

at FVTPL 485 7,095 1,497

Realised gain on sale of equity - 2,583 -

investments

485 9,678 1,497

============= =========== =============

9. Royalty debt liabilities

Royalty debt liabilities are financial liabilities held at

FVTPL.

30-Sep-22 31-Mar-22 30-Sep-21

(unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

Brought forward 1,111 1,031 1,031

Payments made (57) (115) (57)

Loss on financial assets held

at FVTPL 71 195 102

-------------

1,125 1,111 1,076

============= =========== =============

Royalty debt liabilities are comprised of:

30-Sep-22 31-Mar-22 30-Sep-21

(unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

Current 165 160 144

Non-current 960 951 932

1,125 1,111 1,076

============= =========== =============

10. Trade and other receivables

30-Sep-22 31-Mar-22 30-Sep-21

(unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

Current

Prepayments and accrued income 8 53 43

Other receivables 2,286 - 7,737

------------- ----------- -------------

2,294 53 7,780

Non-current

Other receivables - 2,141 2,236

2,294 2,194 10,016

============= =========== =============

The other receivable balance consists of funds due on the sale

of Duke Royalty Switzerland Gmbh, incorporated to hold the

riverboat assets. On 31 March 2021, Duke sold its Swiss subsidiary

to Starling Fleet AG for EUR11,600,000. The deal was structured so

that EUR5,000,000 was payable on or before 30 September 2021,

EUR4,000,000 was due on or before 30 September 2022, with the

remaining EUR2,600,000 due on or before 30 June 2023. The second

instalment of EUR4,000,000 was repaid early in March 2022. The last

instalment is classified as current.

Using the same methodology as laid out in note 7 for the loan

investments, the deferred consideration has been subject to ECL

impairment. The financial strength of the counterparty has been

reviewed in conjunction with current and future outlook for river

cruising, while also taking into account the charges that the Group

owns over the riverboats. An ECL impairment of GBP52,000 was

recognised against this asset in the year to 31 March 20022 (refer

to Note 10 for classification). No further impairment was

recognised in the period to 30 September 2022.

11. Trade and other payables

30-Sep-22 31-Mar-22 30-Sep-21

(unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

Current

Trade payables 8 11 10

Transaction costs 279 233 125

Accruals and deferred income 1,136 179 733

1,423 423 868

------------- ----------- -------------

Non-current

Transaction costs 1,331 1,067 204

2,754 1,490 1,072

------------- ----------- -------------

12. Borrowings

30-Sep-22 31-Mar-22 30-Sep-21

(unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

Secured loan

Current - accrued interest 337 362 172

Non-current 34,363 47,740 9,659

34,700 48,102 9,831

============= =========== =============

The secured loan facility has an interest rate of 7.25% over

one-month UK LIBOR per annum. In January 2022, the facility term

was extended and the facility size increased from GBP35,000,000 to

GBP55,000,000. Of this, GBP35,000,000 comprised a revolving

facility and GBP20,000,000 a term facility. The principal amount is

repayable on 18 January 2027. Furthermore, the interest rate was

amended to 7.25% over SONIA. The loan is secured by means of a

fixed and floating charge over the assets of the Group.

The Group has adopted Interest Rate Benchmark Reform - IBOR

'phase 2' (Amendments to IFRS 9, IAS 39, IFRS 7, IFRS 4 and 16).

Applying the practical expedient introduced by the amendments, when

the benchmarks affecting the Group's loans are replaced, the

adjustments to the contractual cash flows will be reflected as an

adjustment to the effective interest rate. Therefore, the

replacement of the loans' benchmark interest rate will not result

in an immediate gain or loss recorded in profit or loss, which may

have been required if the practical expedient was not available or

adopted.

As at 30 September 2022, GBP20,250,000 was undrawn on the

facility (30 September 2021: GBP25,000,000, 31 March 2022:

GBP6,800,000).

At 30 September 2022, GBP387,000 (30 September 2021: GBP355,000,

31 March 2022: GBP460,000) of unamortised fees remained

outstanding.

The table below set out an analysis of net debt and the

movements in net debt for the period ended 30 September 2022, the

prior period and the year ended 31 March 2022.

Interest

Payable Borrowings

GBP000 GBP000

At 1 April 2022 362 47,740

Cash movements

Loan advanced - 5,050

Loan repaid - (18,500)

Deferred finance costs paid - -

Interest paid (1,872) -

Other finance costs paid (30)

Non-cash movements

Deferred finance costs released to P&L - 73

Interest charged 1,862 -

Other finance costs charged 15 -

As at 30 September 2022 337 34,363

========== ============

Interest

Payable Borrowings

GBP000 GBP000

At 1 April 2021 161 17,103

Cash movements

Loan repaid - (7,500)

Interest paid (611) -

Non-cash movements

Deferred finance costs released to P&L - 56

Interest charged 622 -

As at 30 September 2021 172 9,659

========== ============

Cash movements

Loan advanced - 38,200

Deferred finance costs paid - (181)

Interest paid (1,038) -

Non-cash movements

Deferred finance costs released to P&L - 62

Interest charged 1,228 -

As at 31 March 2022 362 47,740

========== ============

13. Goodwill

30-Sep-22 31-Mar-22 30-Sep-21

(unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

Goodwill arising on business

combination 203 203 203

============= =========== =============

14. Share capital

External Treasury Total

Shares Shares shares

No. No. No. GBP000

Allotted, called up

and fully paid

At 31 March 2021 247,052 10,855 257,907 120,870

---------- ---------- --------- ---------

Shares issued for cash

during the period 100,000 - 100,000 35,000

Share issuance costs - - - (1,936)

Shares issued to directors

and key advisers as remuneration 105 - 105 40

At 30 September 2021 347,157 10,855 358,012 153,974

---------- ---------- --------- ---------

Shares issued to Employee

Benefit Trust during

the period - 792 792 -

PSA shares vested during

the year 1,457 (1,457) - -

At 31 March 2022 348,614 10,190 358,804 153,974

---------- ---------- --------- ---------

Shares issued for cash

during the period 57,143 - 57,143 20,000

Share issuance costs - - - (1,115)

Shares issued to directors

and key advisers as remuneration 205 - 205 80

---------- ---------- --------- ---------

At 31 September 2021 405,962 10,190 416,152 172,939

========== ========== ========= =========

There is a single class of shares. There are no restrictions on

the distribution of dividends and the repayment of capital with

respect to externally held shares. The shares held by the Duke

Royalty Employee Benefit Trust are treated as treasury shares. The

rights to dividends and voting rights have been waived in respect

of these shares.

15. Equity-settled share-based payments

Warrant reserve

There were no movements in the warrant reserve during the

period:

Warrants

No. (000) GBP000

At 1 April 2021, 30 September 2021,

31 March 2022, and 30 September 2022 4,375 265

=========== ========

At 30 September 2022, 4,375,000 (30 September 2021: 4,375,000,

31 March 20212 4,375,000) warrants were outstanding and exercisable

at a weighted average exercise price of 46 pence (30 September

2021: 46 pence, 31 March 2022: 46 pence). The weighted average

remaining contractual life of the warrants outstanding was 0.50

years (30 September 2021: 1.50 years, 31 March 2022: 1.00

years).

Share-based payment reserve

The following table shows the movements in the share-based

payment reserve during the period:

Share options LTIP Total

GBP000 GBP000 GBP000

At 1 April 2021 and 30 September

2021 136 1,412 1,548

LTIP awards - 472 472

--------------- -------- --------

At 30 September 2021 136 1,884 2,020

LTIP awards - 458 458

--------------- -------- --------

At 31 March 2022 136 2,342 2,478

LTIP awards - 458 458

--------------- -------- --------

At 30 September 2022 136 2,800 2,936

=============== ======== ========

Share option scheme

No share options were granted during the period to 30 September

2022.

At 30 September 2022, 200,000 options (30 September 2021:

960,000, 31 March 2022: 200,000) were outstanding and exercisable

at a weighted average exercise price of 50 pence (30 September

2021: 31 March 2022: 50 pence). The weighted average remaining

contractual life of the options outstanding at the period end was

1.00 years (30 September 2021: 2.00 years, 31 March 2022: 1.50

years).

Long Term Incentive Plan

No performance share awards (PSAs) were granted during the

period to 30 September 2022.

At 30 September 2022, 12,298,000 (30 September 2021: 11,855,000,

31 March 2022: 12,298,000) PSAs were outstanding. The weighted

average remaining vesting period of these awards outstanding was

1.00 year (30 September 2021: 1.44 years, 31 March 2022: 1.50

years).

16. Distributable reserves

Under Guernsey law, the Company can pay dividends provided it

satisfies the solvency test prescribed by the Companies (Guernsey)

Law, 2008. The solvency test considers whether the Company is able

to pay its debts when they fall due, and whether the value of the

Company's assets is greater than its liabilities. The Company

satisfied the solvency test in respect of the dividends declared in

the period.

17. Dividends

The following interim dividends have been recorded in the period

to 30 September 2022, 31 March 2022 and 30 September 2021:

Dividend Dividends

per

share payable

Record date Payment date pence/share GBP000

26 March 2021 12 April 2021 0.55 1,359

25 June 2021 12 July 2021 0.55 1,909

Dividends paid for the period ended 30 September

2021 3,268

===========

Dividend Dividends

per

share payable

Record date Payment date pence/share GBP000

24 September 2021 12 October 2021 0.55 1,909

24 December 2021 12 January 2022 0.60 2,093

Dividends paid for the period ended 31 March

2022 4,702

===========

25 March 2022 12 April 2022 0.70 2,440

1 July 2022 12 July 2022 0.70 2,842

Dividends paid for the period ended 30 September

2022 5,282

===========

On 30 September 2022 the Company approved a further quarterly

cash dividend of 0.70 pence per share, totalling GBP2,8420,000,

which was paid on 12 October 2021.

18. Deferred tax

Total

GBP000s

1 April 2021 158

Credited / (charged) to profit & loss (1)

---------

At 30 September 2021 157

Credited / (charged) to profit & loss (1)

---------

At 31 March 2022 156

Charged to profit & loss (1)

At 30 September 2022 155

=========

The deferred tax asset arises due to a temporary timing

differences on the treatment of transaction costs in the UK

subsidiary. This deferred tax asset is expected to reverse over a

30 year period. The utilisation of this asset is dependent on

sufficient future taxable profits being generated by the UK

subsidiary.

19. Related parties

Directors' fees

The following fees were payable to the Directors during the

period:

Period Year to Period

to to

30-Sep-22 31-Mar-22 30-Sep-21

(unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

Short term remuneration 734 730 463

Share-based payments 211 485 273

945 1,215 736

============= =========== =============

Other related party transactions

The following amounts were paid to related parties during the

period in respect of support services fees:

Period Year to Period

to to

30-Sep-22 31-Mar-22 30-Sep-21

(unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

Abingdon Capital Corporation 205 363 175

Arlington Group Asset Management

Limited 43 85 43

248 448 218

============= =========== =============

Support Service Agreements with Abingdon Capital Corporation

("Abingdon"), a company of which Neil Johnson is a Director, and

Arlington Group Asset Management Limited ("Arlington"), a company

of which Charles Cannon Brookes is a Director, were signed on 16

June 2015. The services to be provided by both Abingdon and

Arlington include global deal origination, vertical partner

relationships, office rental and assisting the Board with the

selection, execution and monitoring of royalty partners and royalty

performance. Abingdon fees also includes fees relating to

remuneration of staff residing in North America.

Dividends

The following dividends were paid to related parties:

Period Year to Period

to to

30-Sep-22 31-Mar-22 30-Sep-21

(unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

Directors (1) 186 262 124

Other related parties 27 37 17

213 299 141

============= =========== =============

(1) Includes dividends paid to Abinvest Corporation, a wholly

owned subsidiary of Abingdon Capital Corporation, and to Arlington

Group Asset Management

20. Fair value measurements

Fair value hierarchy

IFRS 13 requires disclosure of fair value measurements by level

of the following fair value hierarchy:

Level 1 : Inputs are quoted prices (unadjusted) in active

markets for identical assets and liabilities that the entity can

readily observe.

Level 2: Inputs are inputs other than quoted prices included

within Level 1 that are observable for the asset, either directly

or indirectly.

Level 3: Inputs that are not based on observable market date

(unobservable inputs).

The Group has classified its financial instruments into the

three levels prescribed as follows:

30-Sep-22 31-Mar-22 30-Sep-21

(unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

Financial assets

Financial assets at FVTPL

- Royalty finance investments 171,944 160,479 106,839

- Equity investments 11,305 10,820 4,870

183,249 171,299 111,709

============= =========== =============

Financial liabilities

Financial liabilities at FVTPL

- Royalty debt liabilities 1,125 1,111 1,076

============= =========== =============

The following table presents the changes in level 3 items for

the periods ended 30 September 2022, 31 March 2022 and 30 September

2021:

Financial Financial

Assets Liabilities Total

GBP000 GBP000 GBP000

At 31 March 2020 88,796 (1,031) 87,765

Additions 23,739 - 23,739

Repayments (3,590) - (3,590)

Royalty income received 5,705 - 5,705

RP liability paid - 57 57

Net change in FV (2,941) (102) (3,043)

----------- ------------- ----------

At 30 September 2021 111,709 (1,076) 110,633

Additions 51,377 - 51,377

Repayments (2,232) - (2,232)

Royalty income received (10,453) - (10,453)

RP liability paid - 58 58

Net change in FV 21,000 (93) 20,907

----------- ------------- ----------

At 31 March 2022 171,299 (1,111) 170,188

Additions 6,550 - 6,550

Repayments - - -

Royalty income received (15,079) - (15,079)

RP liability paid - 57 57

Net change in FV 20,479 (71) 20,408

At 30 September 2022 183,249 (1,125) 182,124

=========== ============= ==========

Valuation techniques used to determine fair values

The fair value of the Group's financial instruments is

determined using discounted cash flow analysis and all the

resulting fair value estimates are included in level 3.

Valuation processes

The main level 3 inputs used by the Group are derived and

evaluated as follows:

Annual adjustment factors for royalty investments and royalty

participation liabilities

These factors are estimated based upon the underlying past and

projected performance of the royalty investee companies together

with general market conditions.

Discount rates for financial assets and liabilities

These are initially estimated based upon the projected internal

rate of return of the royalty investment and subsequently adjusted

to reflect changes in credit risk determined by the Group's

Investment Committee.

Changes in level 3 fair values are analysed at the end of each

reporting period and reasons for the fair value movements are

documented.

Valuation inputs and relationships to fair value

The following summary outlines the quantitative information

about the significant unobservable inputs used in level 3 fair

value measurements:

Royalty investments

The unobservable inputs are the annual adjustment factor and the

discount rate. The range of annual adjustment factors used is -6.0%

to 6.0% and the range of risk-adjusted discount rates is 14.7% to

17.4%.

Equity investments

Sensitivity analysis has not been performed on the Group's

equity investments on the basis that they are not material to the

Condensed Consolidated Financial Statements

Royalty participation instruments

The unobservable inputs are the annual adjustment factor and the

discount rate. The range of annual adjustment factors used is -6.0%

to 6.0% and the range of risk-adjusted discount rates is 16.3% to

17.4%.

21. Events after the financial reporting date

Dividends

On 12 October 2022, the Company paid a quarterly dividend of

0.70 pence per share.

On 26 November, Duke announced a GBP5.5 million investment into

New Path Fire & Security.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BMBPTMTBJBJT

(END) Dow Jones Newswires

December 01, 2022 02:00 ET (07:00 GMT)

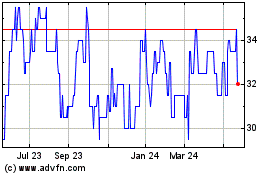

Duke Capital (AQSE:DUKE.GB)

Historical Stock Chart

From Dec 2024 to Jan 2025

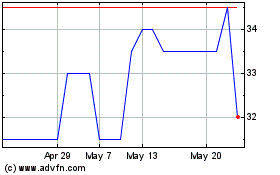

Duke Capital (AQSE:DUKE.GB)

Historical Stock Chart

From Jan 2024 to Jan 2025