TIDMINC

RNS Number : 5249X

Incanthera PLC

21 December 2023

21 December 2023

Incanthera plc

("Incanthera" the "Company")

Half-yearly results for the six months ended 30 September

2023

Incanthera plc (AQSE:INC), the company specially focussed on

innovative technologies in dermatology and oncology presents its

interim results for the six months ended 30 September 2023.

The period under review has seen the Company's activity

concentrate on moving its first commercial deal to completion.

Following the period end, Incanthera is pleased to have

announced, on 18 December 2023, a commercial skincare deal for

Incanthera's dermatological technologies with Marionnaud, part of

the world's largest health, beauty and lifestyle brand retailer

A.S. Watson Group ("AS Watson").

The post-balance sheet event of the commercial skincare deal is

expected to transform Incanthera into a company with significant

revenues and profits, generating free cash flow from roll out in Q2

2024.

In conjunction with announcement of the commercial deal, the

Company also announced an institutional led Subscription and

Conversion for GBP1 million with investment coming from new and

existing institutional investors which was oversubscribed and

undertaken at a premium to the mid-market price.

The fundraise also provides the Company with sufficient working

capital to fund the manufacturing of the initial launch orders.

Once trading in its products starts, the Company intends to issue

regular trading updates regarding revenue generation and the

financial position of the company as the roll out of the commercial

deal takes effect in 2024.

Therefore these half- yearly results presented are not expected

to be indicative of the company's financial performance for the

financial year starting in April 2024.

This announcement contains inside information for the purposes

of the UK Market Abuse Regulation.

The Directors of Incanthera accept responsibility for this

announcement.

For further information, please contact:

Incanthera plc

www.incanthera.com

Tim McCarthy, Chairman

tim.mccarthy@incanthera.com +44 (0) 7831 675747

Simon Ward, Chief Executive Officer

simon.ward@incanthera.com +44 (0) 7747 625506

Suzanne Brocks, Head of Communications

suzanne.brocks@incanthera.com +44 (0) 7776 234600

Aquis Exchange Corporate Adviser:

Cairn Financial Advisers LLP

Jo Turner / Liam Murray +44 (0) 20 7213 0880

Broker:

Stanford Capital Partners Ltd

Patrick Claridge / Bob Pountney +44 (0) 20 3650 3650/51

Notes to Editors

Incanthera is a specialist company focused on transformative

treatment technologies in oncology and dermatology. It seeks to

identify and develop innovative solutions to current clinical,

commercially relevant unmet needs, utilising new technology from

leading academic institutions and industry, combined with

Incanthera's unique targeting delivery platform.

The Company's current focus is a range of dermatological

applications utilising its unique formulation and delivery

technologies to meet currently unmet needs in the skincare

market.

The Company has developed sophisticated formulation and

targeting technology platforms to address previously unavailable

options across dermatology and oncology. These deliver treatments

specifically to a disease site, reducing side effects whilst

enabling higher doses to reach a target and therefore increase

efficacy.

The Company originated from the Institute of Cancer Therapeutics

("ICT") at the University of Bradford and has acquired and

developed a portfolio of specific targeting therapeutics through

both a Pipeline Agreement with the ICT and via other corporate

acquisitions and partnerships. Incanthera's strategy is to develop

each candidate in the portfolio from initial acquisition or

discovery to securing its future through commercially valuable

partnerships at the earliest opportunity in its development

pathway.

Incanthera's Board and management possess a broad range of

commercial, scientific, and public company experience. In addition,

Incanthera benefits from a diverse, experienced team of advisers

who cover the necessary range of specialities required for all

aspects of the Company's business and has several beneficial

collaborative relationships with both clinicians and clinical

centres.

For more information on the Company please visit:

www.incanthera.com

@incantheraplc

Incanthera plc

HALF-YEARLY RESULTS FOR THE SIX MONTHSED 30 SEPTEMBER 2023

Consolidated Statement of Comprehensive Income

for the six months ended 30 September 2023 - unaudited

Six months Six months Year ended

ended ended 31 March

30 September 30 September 2023

2023 2022

GBP'000 GBP'000 GBP'000

Notes Unaudited Unaudited Audited

--------------------------------------- ------ -------------- -------------- -----------

Operating expenses (587) (486) (811)

Share-based compensation 4 (28) (25) (149)

Total operating expenses (615) (511) (960)

Operating loss (pre-exceptional

items) (615) (511) (960)

Loss on ordinary activities before

taxation (615) (511) (960)

Exceptional costs

Cost of issue of shares to service

providers - - (78)

Impairment of Intellectual Property - - (409)

Operating loss (post exceptional

items) (615) (511) (1,447)

Loss before taxation (615) (511) (1,447)

Taxation - - 75

--------------------------------------- ------ -------------- -------------- -----------

Loss and total comprehensive expense

attributable to equity holders for

the period (615) (511) (1,372)

--------------------------------------- ------ -------------- -------------- -----------

Loss per share attributable to equity

holders of the parent (pence) 3

--------------------------------------- ------ -------------- -------------- -----------

Basic loss per share (pence) (0.80) (0.69) (1.82)

Diluted loss per share (pence) (0.80) (0.69) (1.82)

Loss per share before exceptional

costs (pence) (0.80) (0.69) (1.18)

--------------------------------------- ------ -------------- -------------- -----------

Consolidated Statement of Financial Position

as at 30 September 2023 - unaudited

As at As at As at 31

30 September 30 September March

2023 2022 2023

GBP'000 GBP'000 GBP'000

Notes Unaudited Unaudited Audited

------------------------------- ------ -------------- -------------- ---------

ASSETS

Non-current assets

Property, plant and equipment 1 1 1

Intangible assets 58 409 58

-------------------------------- ------ -------------- -------------- ---------

Total non-current assets 59 410 59

Current assets

Trade and other receivables 33 115 62

Current tax receivable 73 77 73

Cash and cash equivalents (4) 28 3

-------------------------------- ------ -------------- -------------- ---------

Total current assets 102 220 138

Total assets 161 630 197

-------------------------------- ------ -------------- -------------- ---------

LIABILITIES AND EQUITY

Current liabilities

Trade and other payables 633 202 280

Total current liabilities 633 202 280

Non-current liabilities

Convertible loan 195 - 131

-------------------------------- ------ -------------- -------------- ---------

Total liabilities 828 202 411

Equity

Ordinary shares 5 1,556 1,528 1,528

Share premium 5,239 5,057 5,169

Reorganisation reserve 2,715 2,715 2,715

Warrant reserve 1,129 1,088 1,129

Other reserves 55 - 19

Share based compensation 287 210 259

Retained deficit (11,648) (10,170) (11,033)

-------------------------------- ------ -------------- -------------- ---------

Total equity attributable

to equity holders of the

parent (667) 428 (214)

Total liabilities and equity 161 630 197

-------------------------------- ------ -------------- -------------- ---------

Consolidated Statement of Changes in Equity

for the six months ended 30 September 2023 - unaudited

Share Share Merger Warrant Other Share based Accumulated

capital premium reserve reserve reserves compensation losses Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------- --------- --------- --------- --------- ---------- -------------- ------------ --------

Balance at

1 April 2023 1,528 5,169 2,715 1,129 19 259 (11,033) (214)

Total comprehensive

expense for

the period - - - - - - (615) (615)

Transactions

with owners

Equity investment 28 70 - - - - - 98

Equity component

on convertible

loan notes - - - - 36 - - 36

Share-based

compensation

- share options - - - - - 28 - 28

Total transactions

with owners 28 70 - - 36 28 - 162

--------------------- --------- --------- --------- --------- ---------- -------------- ------------ --------

Balance at

30 September

2023 1,556 5,239 2,715 1,129 55 287 (11,648) (667)

--------------------- --------- --------- --------- --------- ---------- -------------- ------------ --------

Share Share Merger Warrant Other Share based Accumulated

capital premium reserve reserve reserves compensation losses Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------- --------- --------- --------- --------- ---------- -------------- ------------ --------

Balance at

1 April 2022 1,482 5,055 2,715 1,054 - 185 (9,659) 832

Total comprehensive

expense for

the period - - - - - - (511) (511)

Transactions

with owners

Share-based

compensation

- creditor

non-cash settlement 46 36 - - - - - 82

Share-based

compensation

- warrants - (34) - 34 - - - -

Share-based

compensation

- share options - - - - 25 - 25

Total transactions

with owners 46 2 - 34 - 25 - 25

---------------------- --------- --------- --------- --------- ---------- -------------- ------------ --------

Balance at

30 September

2022 1,528 5,057 2,715 1,088 - 210 (10,170) 428

---------------------- --------- --------- --------- --------- ---------- -------------- ------------ --------

Share Share Merger Warrant Other Share based Accumulated

capital premium reserve reserve reserves compensation losses Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000s GBP'000 GBP'000 GBP'000

---------------------- --------- --------- --------- --------- ---------- -------------- ------------ --------

Balance at

1 April 2022 1,482 5,055 2,715 1,054 - 185 (9,659) 832

Total comprehensive

expense for

the period - - - - - - (1,372) (1,372)

Transactions

with owners

Equity component

on convertible

loan notes - - - - 19 - - 19

Share issue

- advisor agreements 46 114 - - - - - 160

Share-based

compensation

- share options - - - 75 - 74 - 149

Total transactions

with owners 46 114 - 75 19 74 - 328

---------------------- --------- --------- --------- --------- ---------- -------------- ------------ --------

Balance at

31 March 2023 1,528 5,169 2,715 1,129 19 259 (11,033) (214)

---------------------- --------- --------- --------- --------- ---------- -------------- ------------ --------

The registered number of Incanthera plc is 11026926.

Consolidated Statement of Cash Flows

for the six months ended 30 September 2023 - unaudited

Six months Six months Year ended

ended ended 31 March

30 September 30 September 2023

2023 2022

GBP'000 GBP'000 GBP'000

Unaudited Unaudited Audited

----------------------------------------- -------------- -------------- -----------

Cash flows from operating activities

Loss before taxation for the period (615) (511) (1,447)

Depreciation and amortisation - 130 71

Impairment - - 409

Share-based compensation 28 25 149

------------------------------------------ -------------- -------------- -----------

(587) (356) (818)

Changes in working capital

Decrease in trade and other receivables 29 3 56

Increase in trade and other payables 453 6 234

Creditor non-cash settlement - 82 -

Cash used in operations 482 91 290

Taxation received - (2) 75

------------------------------------------ -------------- -------------- -----------

Net cash used in operating activities (105) (267) (453)

------------------------------------------ -------------- -------------- -----------

Cash flows from financing activities

Proceeds from issue of shares 98 - 160

Net cash generated from financing

activities 98 - 160

Movements in cash and cash equivalents

in the period (7) (267) (292)

------------------------------------------ -------------- -------------- -----------

Cash and cash equivalents at start

of period 3 295 295

------------------------------------------ -------------- -------------- -----------

Cash and cash equivalents at end

of period (4) 28 3

------------------------------------------ -------------- -------------- -----------

1. GENERAL INFORMATION

Incanthera plc ('the Company') is a public limited company

incorporated in England and Wales and was admitted to trading on

the AQSE Growth Market (formerly NEX Exchange), under the symbol

INC on 28 February 2020.

The address of its registered office is 76 King Street,

Manchester, England, M2 4NH and the registered company number is

11026926. The principal activity of the Company is clinical stage

drug development.

2. BASIS OF PREPARATION AND SIGNIFICANT ACCOUNTING POLICIES

Basis of preparation

The consolidated financial statements have been prepared in

accordance with International Financial Reporting Standards

('IFRS') as adopted by the United Kingdom, IFRIC interpretations

and the Companies Act 2006 applicable to companies operating under

IFRS.

The consolidated financial statements have been prepared under

the historical cost convention modified by the revaluation of

certain financial instruments.

The consolidated financial statements are presented in Sterling

(GBP) and rounded to the nearest GBP000. This is the predominant

functional currency of the Group and is the currency of the primary

economic environment in which it operates.

The consolidated financial statements have not been reviewed by

the Groups auditors.

Significant management judgement in applying accounting policies

and estimation uncertainty

When preparing the condensed consolidated half-yearly financial

information, the Directors make a number of judgements, estimates

and assumptions about the recognition and measurement of assets,

liabilities, income and expenses.

The following are significant management judgements and

estimates in applying the accounting policies of the Group that

have the most significant effect on the condensed consolidated

half-yearly financial information. Actual results may be

substantially different.

Research and development expenditure

Careful judgement by the Directors is applied when deciding

whether the recognition requirements for development costs have

been met. This is necessary as the economic success of any product

development is uncertain until such time as technical viability has

been proven and commercial supply agreements are likely to be

achieved. Judgements are based on the information available at each

reporting date which includes the progress with testing and

certification and progress on, for example, establishment of

commercial arrangements with third parties. In addition, all

internal activities related to research and development of new

products are continuously monitored by the Directors.

3. LOSS PER SHARE

Basic loss per share is calculated by dividing the loss for the

period attributable to equity holders by the weighted average

number of ordinary shares outstanding during the period.

For diluted loss per share, the loss for the period attributable

to equity holders and the weighted average number of ordinary

shares outstanding during the period is adjusted to assume

conversion of all dilutive potential ordinary shares. As the effect

of the share options would be to reduce the loss per share, the

diluted loss per share is the same as the basic loss per share.

The calculation of the Group's basic and diluted loss per share

is based on the following data:

Six months Six months

ended ended Year ended

30 September 30 September 31 March

2023 2022 2023

GBP'000 GBP'000 GBP'000

Unaudited unaudited Audited

------------------------------------------- --------------- --------------- -----------

Loss for the period attributable

to equity holders for basic loss

and adjusted for the effects of dilution (615) (511) (1,372)

Loss for the period attributable

to equity holders for basic loss

and adjusted for the effects of dilution

(excl. Exceptional Costs) (615) (511) (885)

------------------------------------------- --------------- --------------- -----------

As at As at As at

30 September 30 September 31 March

2023 2022 2023

Number Number Number

Unaudited unaudited Audited

------------------------------------------- --------------- --------------- -----------

Weighted average number of ordinary

shares 77,242,219 74,120,611 75,211,874

Weighted average number of ordinary

shares adjusted for the effects of

dilution 77,242,219 74,120,611 75,211,874

------------------------------------------- --------------- --------------- -----------

Pence Pence Pence

------------------------------------------- --------------- --------------- -----------

Loss per share - basic and diluted (0.80) (0.69) (1.82)

Loss per share - before exceptional

costs (0.80) (0.69) (1.18)

------------------------------------------- --------------- --------------- -----------

4. SHARE-BASED PAYMENTS

As at the end of the current period, the reconciliation of share

option scheme movements is as follows:

As at 30 September

2022

Number WAEP

Pence

------------------------------------ ------------ --------

Outstanding at 1 April 2023 5,975,000 11.78

Granted during the period - -

Exercised during the period - -

Lapsed/cancelled during the period - -

------------------------------------ ------------ --------

Outstanding at 30 September 2023 5,975,000 11.78

------------------------------------ ------------ --------

During the six month period ended 30 September 2023, a

share-based payment charge of GBP27,763 (2022: GBP24,631) was

expensed to the consolidated Statement of Comprehensive Income.

The fair values of the options granted have been calculated

using a Black-Scholes model.

5. ISSUED CAPITAL AND RESERVES

Ordinary shares

Company

Number of Shares Share Capital (GBP'000)

---------------- -----------------------

At 31 March 2023 76,385,028 1,528

---------------- -----------------------

At 30 September 2023 77,824,166 1,556

---------------- -----------------------

Caution regarding forward looking statements

Certain statements in this announcement, are, or may be deemed

to be, forward looking statements. Forward looking statements are

identi ed by their use of terms and phrases such as "believe",

"could", "should" "envisage", "estimate", "intend", "may", "plan",

"potentially", "expect", "will" or the negative of those,

variations or comparable expressions, including references to

assumptions. These forward-looking statements are not based on

historical facts but rather on the Directors' current expectations

and assumptions regarding the Company's future growth, results of

operations, performance, future capital and other expenditures

(including the amount, nature and sources of funding thereof),

competitive advantages, business prospects and opportunities. Such

forward looking statements re ect the Directors' current beliefs

and assumptions and are based on information currently available to

the Directors.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR TMBRTMTBTBRJ

(END) Dow Jones Newswires

December 21, 2023 02:00 ET (07:00 GMT)

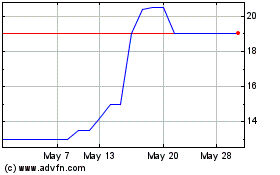

Incanthera (AQSE:INC)

Historical Stock Chart

From Nov 2024 to Dec 2024

Incanthera (AQSE:INC)

Historical Stock Chart

From Dec 2023 to Dec 2024