TIDMIOF

RNS Number : 9327L

Iofina PLC

11 September 2023

D

11 September 2023

Iofina plc

("Iofina", the "Company" or the "Group")

(AIM: IOF)

Interim Results for the six months ended 30 June 2023

Growth year on year in revenue and profit

Iofina plc, specialists in the exploration and production of

iodine and manufacturers of specialty chemical products, is pleased

to announce its unaudited Interim Results for the six months ended

30 June 2023 (the "Period").

Revenue and profitability

H1 2023 H1 2022

$m $m % change

-------- -------- ---------

Adjusted EBITDA(1) 5.9 3.7 60%

-------- -------- ---------

Revenue 24.3 19.2 27%

-------- -------- ---------

Cost of Sales 16.0 13.5 19%

-------- -------- ---------

Gross profit 8.3 5.7 46%

-------- -------- ---------

Operating profit 4.9 2.8 77%

-------- -------- ---------

Profit Before Tax 4.7 2.6 80%

-------- -------- ---------

(1) see Note 9 for definition

Net cash/debt

-- Net cash was $0.2m (H1 2022: net debt $2.8m), excluding lease

liabilities and after capex of $3.7m, mainly on IO#9 (capex H1 2022

$0.7m)

-- Cash up 33% to $6.3m (H2 2022: $4.7m)

-- Well-placed to finance our ongoing operational investment

program through a strong cash position and availability of bank

finance, including $4.0m of currently undrawn loans.

Iodine production and sales

-- Produced 242 metric tonnes ("MT") of crystalline iodine

during H1, in line with 235-250MT range

-- With the addition of IO#9 output, H2'23 production is on track to meet the 325-350MT target

-- Crystalline iodine sales up 122% to 169MT reflecting a return

to strong demand after impact of Covid restocking by customers at

the end of 2021

-- The average prices realised (100% iodine equivalent) for

sales of crystalline iodine increased by 13% from $63.27 for H1

2022 to $71.53 for H1 2023.

Commenting on today's results, Dr. Tom Becker, President and CEO

stated: " The Group delivered its best commercial performance for a

first half period, supported by the ongoing robust iodine prices

and meeting our production targets. In the process we have further

improved our cash position even as we constructed a new iodine

plant, which provides us with additional capability to fund growth

projects.

"The completion of IO#9 in June 2023 is set to deliver a jump in

iodine production during the second half and we are on track to

meet our H2 target range of 325-350MT.

"We continue to successfully advance our growth plans and expect

to finalise an agreement for IO#10 soon. Additionally, the planning

process of IO#11 is already underway and we look forward to

updating the market in due course on this project, along with all

business updates throughout the rest of 2023."

This announcement contains inside information for the purposes

of article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of domestic law by virtue of the European Union

(Withdrawal) Act 2018.

Enquiries:

Dr. Tom Becker

CEO & President

Iofina plc

Tel: +44 (0)20 3006 3135

Nomad & Broker:

Henry Fitzgerald-O'Connor/Harry Rees

Canaccord Genuity Limited

Tel: +44 (0)20 7523 8000

Media Contact:

Charles Goodwin/Shivantha Thambirajah/Jazmine Clemens

Yellow Jersey PR Limited

Tel: +44 (0)7747 788 221/+44 (0)7983 521 488

INTERIM RESULT

Business Overview

Iofina plc ("Iofina" the "Company" or the "Group") is the

holding company of a group of companies (the "Group") in the

specialty chemical industry with unique, proven technologies and

competencies for producing iodine and halogen-based chemical

derivatives. The Group's business model involves producing a key

raw material, iodine, at a low cost and in the most environmentally

friendly way possible, providing the Company's customers vertical

integration into high-quality iodine and other halogen based

chemical products.

The Company is committed to producing its products with minimal

environmental impact. The Group's iodine is produced from brine

water waste streams co-produced with oil & gas production in

the United States. By utilizing a produced waste stream to isolate

iodine, Iofina is extracting a valuable resource from a stream that

would otherwise provide no use or value. Also, by isolating iodine

from these streams, Iofina avoids the additional drilling and

mining environmental impacts of many other iodine producers.

Iofina operates two active business units in the United States.

Iofina Chemical ("IC") develops and produces halogen-based

specialty chemicals and sells these products, along with the

Group's crystalline iodine, globally in a variety of applications.

Iofina Resources ("IR") currently operates six IOsorb(R) iodine

production plants with the sixth plant starting in June 2023 and is

planning for additional plant expansions. IR continues to explore

for new iodine sources and further develop its proprietary models

relating to iodine and other mineral sources in North America.

Expertise in core halogen technologies, the vertical integration of

iodine into specialty products, the diversity of iodine production

plants and specialty halogen-based products, and operating our

businesses within the pillars of responsible ESG practices are key

business tenets for Iofina. The Directors are focused on the

continued prudent growth of the Group, and the development and

implementation of business strategies for the ongoing improvement

of Iofina.

Financial Review

Trading results

Turnover Crystalline H1 2023 Crystalline H1 2022

Iodine Sales Iodine Sales

85% 85%

MT $m MT $m

Crystalline

iodine 169 10.3 76 4.1

Derivatives 105 7.5 117 8.5

Prilled iodine 2.0 0.9

------------ -------- ------------ --------

Total iodine

sales 274 19.8 193 13.5

------------ ------------

Non-iodine 4.5 5.7

-------- --------

Total sales $24.3 $19.2

-------- --------

Sales

Total sales increased by 27% from $19.2m to $24.3m, with total

iodine sales up by 47% from $13.5m to $19.8m, while non-iodine

sales decreased by 21% from $5.7m to $4.5m. Volumes of crystalline

iodine sales were up significantly by 122% from 76MT to 169MT,

reflecting a return to strong demand after a subdued H1 2022

following pandemic-driven restocking by customers at the end of

2021. The average prices realised (100% iodine equivalent) for

crystalline iodine rose by 13% from $63.27 for H1 2022 to $71.53

for H1 2023. The 21% fall-off in non-iodine sales reflected higher

inventories held by a key customer at the beginning of 2023.

Production

Production from the Company's five existing Oklahoma plants was

slightly up at 242MT for H1 2023 compared to 234MT for H1 2022. The

new sixth plant IO#9 has contributed to production since July.

Average production costs per kilogram included in trading costs of

sales were 15% higher than for H1 2022, a major factor being

substantial inflationary increases in the prices of chemicals used

for processing.

Gross profit

Gross margin percentages were mainly consistent by product

grouping year on year, with iodine price increases offset by

inflationary increases in costs of production. The 42% increase in

the total volume of crystalline iodine sold, from 193MT to 274MT,

was the main driver in the 46% increase in gross profit from $5.7m

to $8.3m.

Administrative expenses

Administrative expenses (excluding depreciation and

amortisation) increased by 20% year on year from $2.0m to $2.4m,

due to inflation effects and a greater level of activity.

Taxation

The deferred tax expense of $1.1m (approximately 25% of profit

before tax - H1 2022: $0.7m) is the continuing amortisation of the

asset set up in 2021 to recognise the value of US Federal tax

losses accumulated over previous years. The Company does not expect

any US Federal tax to be payable in respect of 2023, but the losses

will likely be used up in the early part of 2024 and tax will be

payable in full thereafter.

Capital expenditure

Capex for H1 2023 totalled $3.7m compared to $0.7m for H1 2022.

Analysing the capex for H1 2023, $3.2m was related to the

construction of the new IO#9 plant, and after including H2 2022

capex brought the total cost of the plant to $5.2m. This is

significantly more than the original budget of $4.0m, and reflects

a number of factors, including additional requirements of the new

oil and gas partner, higher costs than expected to incorporate

material from IO#5 plant and implementation of the specific

configuration, and additional inflation between the time of quote

and ordering.

Cash flow and financing

Adjusted EBITDA was 60% higher at $5.9m (H1 2022: $3.7m). After

additional net working capital requirements of $1m, capex of $3.7m

(mainly re IO#9 as above), and loan repayments and interest of

$0.9m, net H1 2023 cash flow was $0.4m positive. At 30 June 2023

cash was $6.3m, and cash net of the $6.1m outstanding on the bank

term loan was $0.2m, which compares to net debt of $2.8m at 30 June

2022. The debt to EBITDA ratio was 0.44 compared to 1.05 for H1

2022. The Company's bank debt facilities are set out in Note 5, and

include $4.0m undrawn loans for capital projects.

Iofina Chemical

Iofina Chemical ("IC") is the specialty chemical subsidiary of

the Group and has been in business for 40 years producing a diverse

array of high-quality halogen-based chemicals for various growing

industries including pharma, biocides, human and animal health, and

many others. IC is a globally recognised leader in halogen

chemicals. The Group continues to invest in IC to increase its

development capabilities to supply customers with existing and new

products. In addition to the halogen-based chemicals produced

on-site at IC's facility in Covington, Kentucky, IC is the Group's

main sales and commercial arm, selling iodine directly to the

market and processing all external sales for the Group. While the

iodine production component of the business is generally well known

to investors, the Directors believe the importance of Iofina

Chemical, its diversity of products including non-iodine offerings,

and the value-add for iodine derivative products is not as well

recognised as a significant contributor to the Group.

IC achieved record first half sales, which were boosted by

robust iodine prices. Examples of product offerings that realised

increased sales in the Period versus H1'22 included methyl iodide,

chloramine-T, and the Group's produced crystalline iodine. Methyl

iodide is used in acetic acid manufacturing, synthesis of

pharmaceuticals, and other specialty applications. Chloramine-T is

a broad-based biocide used as a disinfectant and sanitizer and is

also effective for odour-control. The Group's produced crystalline

iodide is sold to numerous iodine derivative manufacturers around

the world.

In the Period, IC invested in its facilities and is now

utilising a Hastelloy reactor for a non-iodine product and has

installed a larger capacity chiller to support multiple iodine

derivative manufacturing processes. IC will continue to invest in

its manufacturing facilities to improve current processes and

develop new halogen-based commercial processes. R&D efforts in

our newly remodelled laboratory included new product development,

research on iodide recycling opportunities, and improvements to our

IPBC manufacturing process and formulations. Post period, IC has

hired an experienced sales and marketing manager to support the

growth and development of IC.

The diversity of IC's halogenated products (iodo-, chloro-,

fluoro-) is key to both the growth and the stability of the

organization. Additionally, the vertical integration of iodine into

iodine derivatives provides, the Group and its customers with

stability of supply for the iodine-based compounds produced.

Iofina Resources

Iofina Resources ("IR") identifies, develops, builds, owns, and

operates iodine extraction plants, based on Iofina's WET(R)

IOsorb(R) technology. Iodide is isolated from a brine waste stream

produced from existing oil and gas operations. Without Iofina, this

resource would not be realised. The isolation of iodine from this

waste stream adds value to Iofina, its shareholders, and our oil

and gas partners and minimises environmental impact.

During the Period, IR produced 242MT of crystalline iodine from

its five plants in operation in Oklahoma. This was a 7.5MT increase

when compared to the same period in 2022. The significant news item

from the Company in H1 2023 was the start-up of IR's new iodine

plant, IO#9, in June 2023. The completion of IO#9 was a substantial

achievement for the Company which is now operating six iodine

production facilities in Oklahoma. This new plant, with a new oil

& gas partner, begins a new growth phase for Iofina in a new

core area in Oklahoma. Whilst the plant did not contribute to the

production total in the Period, it continues to ramp up its

production and is expected to be in full production in early Q4

2023. The ramp-up of IO#9 has proven to be more difficult than

anticipated as we work with our new partner and their

water-gathering system to optimise iodine production. With the new

production of IO#9 adding to the other five iodine plants, the

Company expects to produce between 325-350MT of crystalline iodine

in H2 2023. Currently, all six iodine plants operate in Western

Oklahoma.

IR is committed to growing its iodine production and expects to

double its iodine production from 2021 levels in the next 2-4

years. IR's management is confident that negotiations for our next

IOsorb(R) plant, IO#10 are close to conclusion, and once complete

will progress the Company's strategic growth plan of additional

iodine production in our new core area. Iofina is committed to

continuing investments in business development for future plants,

and has recently added another geologist to the team and plans to

continue to invest in additional personnel to support current

operations and fast-track business development. Negotiations and

exploration efforts for plants IO#11 and beyond are

progressing.

Iodine Market Outlook

Iodine is utilized in various applications, the largest of which

is injectable iodinated contrast agents used in medical procedures

to enhance the visibility of numerous medical diagnostic

procedures. The iodine demand for contrast agents continues to grow

especially in countries that are advancing their healthcare systems

and it is anticipated that this particular end market will be the

core driver of iodine demand for the foreseeable future. Iodine is

also used in many other applications including LCD screens,

pharmaceutical synthesis, biocides, and many others.

Iodine spot prices have remained high when compared to

historical iodine prices. Iodine pricing increased from c.$50/kg at

the beginning of 2022 to c.$70/kg by mid-2022. Spot prices have

fluctuated near $70/kg over the course of the last 12 months and

spot prices are currently between the upper sixties to low

seventies per kilogram.

Future iodine prices are difficult to predict. Demand for iodine

and its products remains strong. Barring any major changes in the

iodine market or a significant global economic downturn, we expect

prices to remain at or near current levels for the remainder of

2023 and into H1 of 2024. SQM has indicated that they expect to add

800MT of production in 2023. With no other noteworthy iodine

production expected in the near term, it is unlikely that this

additional volume will affect prices significantly.

Operations Outlook

The Group continues to execute its growth plans and is committed

to the ongoing improvement of all aspects of our operations. We

have invested in safety initiatives and management systems and the

Group has had no lost-time incidents in over two years. IC is now

both a Chemstewards(R) certified facility and an ISO 9001:2015

certified facility. We are currently implementing a new groupwide

EHS software system.

Business Outlook

The financial position of the Group has never been better. H1'23

revenues and adjusted EBITDA were 27% and 60% higher than H1'22

levels respectively. Additionally, the Group recently announced in

July it had improved the terms of its loan facilities. The first

phase of our multi-year growth plan is being executed with the

completion of IO#9 and we are confident that an IO#10 agreement

will be completed soon signalling Iofina's commitment to this

growth strategy to increase iodine production is steadfast. These

additional plants will significantly increase our crystalline

iodine production in the coming years. Looking slightly ahead, the

expectations are that external costs will continue to rise,

especially chemical raw material costs, and Iofina continues to

work with our suppliers and investigate measures to control costs

throughout the organisation.

Exploration and negotiations for future plants beyond IO#10 are

progressing. IC is exploring the production of new compounds to use

more iodine by producing more value-added iodine derivatives.

Iodine market prices are expected to continue at or near current

levels in the near term. Our prime focus is the organic growth of

our business, and we will continue to re-invest in growth projects

within our core businesses whilst prudently exploring additional

external business opportunities. The Directors are pleased with the

continual improvement of the Group as the Directors looks forward

to the implementation of additional organic growth within the

organisation.

IOFINA PLC

CONSOLIDATED STATEMENT OF COMPREHENSIVE

INCOME

FOR THE SIX MONTH PERIODED 30

JUNE 2023

Unaudited Audited

Six months ended Year ended

30 June 30 June 31 December

2023 2022 2022

Note $'000 $'000 $'000

Continuing operations

Revenue 24,300 19,178 42,198

Cost of sales (16,036) (13,519) (26,369)

----------------

Gross profit 8,264 5,659 15,829

Administrative expenses (2,399) (1,997) (4,361)

Depreciation and amortisation (986) (904) (1,824)

Operating profit 4,879 2,758 9,644

Other income:

Release of plant acquisition

accrual - - 450

----------------

Profit before finance expense 4,879 2,758 10,094

Finance income 44 1 13

Interest payable (166) (159) (326)

Interest swap derivative

liability (73) - 249

Profit before taxation 4,684 2,600 10,030

Taxation - current tax (19) - (31)

Taxation - deferred tax 8 (1,103) (675) (2,134)

----------------

Profit for the period attributable

to owners of the parent $3,562 $1,925 $7,865

----------------- ---------- ----------------

Earnings per share:

* Basic 4 $0.019 $0.010 $0.041

* Diluted 4 $0.018 $0.010 $0.040

----------------- ---------- ----------------

30 June 30 June 31 December

2023 2022 2022

Adjusted EBITDA: 9 $'000 $,000 $'000

Profit before finance expense 4,879 2,758 10,094

Depreciation and amortisation 986 904 1,824

-------- -------- ------------

EBITDA 5,865 3,662 11,918

Other income - - (450)

-------- -------- ------------

Adjusted EBITDA $5,865 $3,662 $11,468

------------------------------- -------- -------- ------------

IOFINA PLC

CONSOLIDATED BALANCE SHEET

30 JUNE 2023

Unaudited Unaudited Audited

30 June 30 June 31 December

2023 2022 2022

Note $'000 $'000 $'000

Intangible assets 193 373 283

Goodwill 3,087 3,087 3,087

Property, plant & equipment 23,326 18,975 20,557

Deferred tax 829 3,391 1,932

Term loan - interest swap

asset 176 - 249

Total non-current assets 27,611 25,826 26,108

---------- ---------- ------------

Inventories 11,580 8,399 10,184

Trade and other receivables 11,633 6,901 10,487

Cash and cash equivalents 6,316 4,737 5,927

------------

Total current assets 29,529 20,037 26,598

---------- ---------- ------------

Total assets $57,140 $45,863 $52,706

---------- ---------- ------------

Trade and other payables 9,094 5,952 7,538

Term loan - due within one

year 5 1,429 1,429 1,429

Lease liabilities 106 98 101

Total current liabilities 10,629 7,479 9,068

---------- ---------- ------------

Term loan - due after one

year 5 4,642 6,071 5,357

Lease liabilities 246 366 309

Total non-current liabilities 4,888 6,437 5,666

---------- ---------- ------------

Total liabilities $15,517 $13,916 $14,734

---------- ---------- ------------

Issued share capital 6 3,107 3,107 3,107

Share premium 60,687 60,687 60,687

Share-based payment reserve 2,240 2,067 2,153

Retained losses (18,467) (27,970) (22,031)

Foreign currency reserve (5,944) (5,944) (5,944)

------------

Total equity $41,623 $31,947 $37,972

---------- ---------- ------------

Total equity and liabilities $57,140 $45,863 $52,706

---------- ---------- ------------

CONSOLIDATED STATEMENT OF CHANGES IN SHAREHOLDERS'

EQUITY

Share Share Share-based Retained Foreign Total

capital Premium payment losses currency equity

reserve reserve

$'000 $'000 $'000 $'000 $'000 $'000

Balance at 31

December 2021 (Audited) $3,107 $60,687 $2,007 $(29,896) $(5,944) $29,961

Share-based expense - - 146 - - 146

Total transactions

with owners - - 146 - - 146

Profit for the

year attributable

to owners of the

parent - - - 7,865 - 7,865

-------- -------- ------------ ---------- --------- --------

Total comprehensive

income attributable

to owners of the

parent - - - 7,865 - 7,865

-------- -------- ------------ ---------- --------- --------

Balance at 31

December 2022 (Audited) $3,107 $60,687 $2,153 $(22,031) $(5,944) $37,972

Share-based expense - - 87 - - 87

-------- -------- ------------ ---------- --------- --------

Total transactions

with owners - - 87 - - 87

Profit for the

period attributable

to owners of the

parent - - - 3,562 - 3,562

---------- --------- --------

Total comprehensive

income attributable

to owners of the

parent - - - 3,562 - 3,562

-------- -------- ------------

Balance at 30

June 2023 (Unaudited) $3,107 $60,687 $2,240 $(18,467) $(5,944) $41,623

IOFINA PLC

CONSOLIDATED CASH FLOW STATEMENT

FOR THE SIX MONTH PERIODED

30 JUNE 2023

Unaudited Audited

Six months ended Year ended

30 June 30 June 31 December

2023 2022 2022

$'000 $'000 $'000

Cash flows from operating activities

Adjusted EBITDA 5,865 3,662 11,468

Share options expense 87 60 146

Release of plant acquisition

accrual - - 450

5,952 3,722 12,064

Changes in working capital

Trade receivables (increase) (1,444) (977) (4,329)

Inventories (increase) (1,396) (2,103) (3,888)

Trade and other payables increase 1,856 388 1,737

--------- -------- ------------

Net cash inflow from operating

activities 4,968 1,029 5,584

--------- -------- ------------

Cash flows from investing activities

Interest received 44 1 13

Acquisition of property, plant

& equipment (3,665) (675) (3,087)

Net cash outflow from investing

activities (3,621) (674) (3,074)

--------- -------- ------------

Cash flows from financing activities

Term loan repayments (714) (714) (1,429)

Interest paid (161) (154) (311)

Lease payments (65) (12) (74)

Net cash outflow from financing

activities (940) (880) (1,814)

--------- -------- ------------

Tax paid/accrued (19) - (31)

Net increase/(decrease) in cash 388 (525) 665

Cash and equivalents at beginning

of period 5,927 5,262 5,262

Cash and equivalents at end

of period 6,315 4,737 $5,927

--------- -------- ------------

1. Nature of operations and general information

Iofina plc is the holding company of a group of companies (the

"Group") involved primarily in the exploration and production of

iodine and the manufacturing of halogen-based specialty chemical

derivatives. Iofina's principal business strategy is to identify,

develop, build, own and operate iodine extraction plants, with a

current focus in North America, based on Iofina's WET(R) IOsorb(R)

technology. Iofina has current production operations in the United

States, specifically in Kentucky and Oklahoma. The Group has

complete vertical integration, from the production of iodine from

produced brine waters to the manufacture of the chemical

end-products derived from iodine and sold to global customers.

The address of Iofina plc's registered office is 48 Chancery

Lane, London WC2A 1JF.

Iofina plc's shares are listed on the London Stock Exchange's

AIM market.

Iofina's consolidated financial statements are presented in US

Dollars, which is the functional currency of the operating

subsidiaries.

The figures for the six months ended 30 June 2023 and 30 June

2022 are unaudited and do not constitute full statutory accounts.

The comparative figures for the year ended 31 December 2022 are

extracts from the 2022 audited accounts (which are available on the

Company's website and have been delivered to the Registrar of

Companies) and do not constitute full statutory accounts. The

independent auditor's report on the 2022 accounts was unqualified

and did not contain statements under sections 498(2) or (3)

(accounting records or returns inadequate, accounts not agreeing

with records and returns or failure to obtain necessary information

and explanations) of the Companies Act 2006.

2. Accounting policies

The basis of preparation and accounting policies set out in the

Annual Report and Accounts for the year ended 31 December 2022 have

been applied in the preparation of these condensed consolidated

interim financial statements. These interim financial statements

have been prepared in accordance with the recognition and

measurement principles of the International Financial Reporting

Standards (UK adopted IFRS) that are expected to be applicable to

the consolidated financial statements for the year ending 31

December 2023 and on the basis of the accounting policies expected

to be used in those financial statements.

3. Segment reporting

(a) Business segments

The Group's operations comprise the exploration and production

of iodine with complete vertical integration into its specialty

chemical halogen derivatives business and are therefore considered

to fall within one business segment.

3. Segment reporting (continued)

Unaudited Audited

Six months ended 30 June 31 December

2023 2022 2022

Assets $'000 $'000 $'000

Halogen Derivatives

and iodine 57,140 45,863 52,706

Total $57,140 $45,863 $52,706

------------- ------------ ------------

Liabilities

Halogen Derivatives

and iodine $15,518 $13,916 $14,734

Total $15,518 $13,916 $14,734

------------- ------------ ------------

(b) Geographical segments

The Group reports by geographical segment. All the Group's

activities during the period were related to exploration for, and

development of, iodine in certain areas of the USA and the

manufacturing of specialty chemicals in the USA with support

provided by the UK office. In presenting information on the basis

of geographical segments, segment assets and the cost of acquiring

them are based on the geographical location of the assets.

Unaudited Audited

Six months ended 30 June 31 December

2023 2022 2022

Total assets $'000 $'000 $'000

UK 281 179 96

USA 56,859 45,684 52,610

------------- ------------ ------------

Total $57,140 $45,863 $52,706

------------- ------------ ------------

Total liabilities

UK 145 116 153

USA 15,372 13,800 14,581

------------- ------------ ------------

Total $15,517 $13,916 $14,734

------------- ------------ ------------

Capital expenditures

UK - - -

USA 3,665 675 3,087

------------- ------------ ------------

Total $3,665 $675 $3,087

4. Earnings per share

The calculation of earnings per ordinary share is based on

profits of $3,562,521 (H1 2022: $1,925,372) and the weighted

average number of ordinary shares outstanding of 191,858,408 (H1

2022: 191,858,408). After including the weighted average effect of

share options of 5,393,650 (H1 2022: 3,966,173) the diluted

weighted average number of ordinary shares outstanding was

197,252,058 (H1 2022: 195,824,581).

5. Bank loan facilities

Term loan

$'000

At 31 December 2021 $8,214

Term loan instalment repayments (1,429)

At 31 December 2022 $6,785

Term loan instalment repayments (714)

----------

At 30 June 2023 $6,071

----------

Due within one year 1,429

Due after one year 4,642

----------

$6,071

----------

Bank facilities are with First Financial Bank of Ohio, are fully

secured by fixed and floating charges, and the principal terms

are:

Term loan

a) The term loan balance of $6.8m (2021 $8.2m) relates to a

$10.0m loan drawn down in September 2020 and repayable in full by

equal monthly instalments over the seven years to 30 September

2027. The interest rate on $7 million of the loan has been fixed to

maturity by a swap contract at 3.99%, and the interest rate on the

balance is variable monthly at 2.50% above the one month Secured

Overnight Financing Rate ("SOFR"), subject to a minimum SOFR rate

of 1.00%. Repayment of all or part of the loan may be made at any

time without penalty.

Revolving loan facility

b) The revolving loan facility is for $6.0m over the period to

16 September 2025, and may be drawn and repaid in variable amounts

at the Group's discretion. Amounts that may be drawn are subject to

a borrowing base of sufficient eligible discounted monthly values

of receivables and inventory, and compliance on a quarterly basis

with trailing 12 months financial covenant ratios of 1) a maximum

multiple of 2.5 total debt to EBITDA, and 2) a minimum multiple of

1.2 EBITDA net of capital expenditure to the total of principal and

interest payments on the total debt. The interest rate is variable

monthly at 2.11% above SOFR, subject to a minimum SOFR rate of

1.00%. Iofina is currently not drawing on this line of credit.

Project loan facilities

c) There is a $4 million term loan with a drawdown period

through to July 1, 2024 to be used for IO#10 plant expenditures and

other Capex projects as appropriate. A seven-year term begins from

July 1, 2024 with interest payable during the drawdown period. The

interest rate is 2.11% plus SOFR (1 month Secured Overnight

Financing Rate) subject to a minimum of 1%. No drawings have as yet

been made on this loan.

6. Share capital

Unaudited Unaudited Audited

30 June 30 June 31 December

2023 2022 2022

Authorised:

Ordinary shares of

GBP0.01 each

-number of

shares 1,000,000,000 1,000,000,000 1,000,000,000

-nominal value GBP10,000,000 GBP10,000,000 GBP10,000,000

Allotted, called up and

fully paid:

Ordinary shares of

GBP0.01 each

-number of shares 191,858,408 191,858,408 191,858,408

-nominal value GBP1,918,584 GBP1,918,584 GBP1,918,584

7. Share based payments

On 27 April 2023 options over 1,196,700 ordinary shares of the

Company, representing 0.62% of the Company's issued share capital

at that date, were granted to directors and key management

personnel. The options are exercisable at the closing share price

on 27 April 2023 of 31.75p per share, with 50% vesting after one

year on 27 April 2024 and 50% vesting after two years on 27 April

2025. The options expire ten years from the date of grant. The

above options were valued using the Black Scholes model and the

exercise price of 31.75p, an expected term of 5.75 years,

historical volatility of 69.07% and a risk-free rate of 3.59%. The

resulting valuation of $300,355 is being amortised over the vesting

periods, and $39,409 has been charged as an expense in respect of

the period from 27 April 2023 to 30 June 2023. No options lapsed or

were forfeited or exercised during the six months to 30 June 2023.

There were 6,197,100 total options outstanding at 30 June 2023,

representing 3.23% of shares in issue.

8. Taxation - deferred tax

The deferred tax charge of $1,103k (H1 2022 $675k) relates to

amortisation of the $4.07m deferred tax asset set up in the balance

sheet at 31 December 2021 to recognise $19.4 million of accumulated

US Federal tax losses expected to be available for offset against

future profits.

9. Adjusted EBITDA

Management uses certain non-IFRS performance measures to assess

performance of the Group, and considers them to provide useful

supplementary information to the IFRS results. EBITDA is profit

before finance expense adjusted to exclude depreciation and

amortisation, and Adjusted EBITDA additionally excludes exceptional

items of non-recurring income and expense. Management considers

that this latter measure provides a fair representation of the

period's operating results excluding non-cash items. A

reconciliation to Profit before finance expense is set out below

the Consolidated Statement of Comprehensive Income.

10. Cautionary Statement

This report contains certain forward-looking statements with

respect to the financial condition, results of operations and

businesses of Iofina plc. These statements are made by the

directors in good faith based on the information available to them

up to the time of their approval of this report. However, such

statements should be treated with caution as they involve risk and

uncertainty because they relate to events and depend upon

circumstances that will occur in the future. There are a number of

factors that could cause actual results or developments to differ

materially from those expressed or implied by these forward-looking

statements. Nothing in this announcement should be construed as a

profit forecast.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR XBLFFXKLZBBF

(END) Dow Jones Newswires

September 11, 2023 02:00 ET (06:00 GMT)

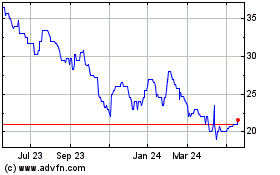

Iofina (AQSE:IOF.GB)

Historical Stock Chart

From Jan 2025 to Feb 2025

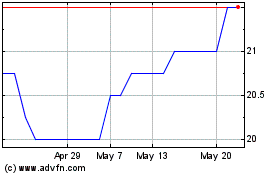

Iofina (AQSE:IOF.GB)

Historical Stock Chart

From Feb 2024 to Feb 2025