TIDMIQO

18 October 2023

Inteliqo Limited

("Inteliqo", the "Company")

Interim Results

Inteliqo (AQSE: IQO), a start-up technology company that provides sales,

marketing and distribution services to technology product owners under long-term

distribution agreements, is pleased to announce its unaudited interim results

for the 6-month period ended 30 September 2023. A full copy of the Interim

Report will be obtainable from the Company's website at https://inteliqo.com/ .

This announcement contains information which, prior to its disclosure,

constituted inside information as stipulated under Regulation 11 of the Market

Abuse (Amendment)(EU Exit) Regulations 2019/310 (as amended).

This announcement may contain "forward-looking" statements and information

relating to the Company. These statements are based on the belief of Company

management, as well as assumptions made by and information currently available

to Company management. The Company does not undertake to update forward-looking

statements or forward-looking information, except as required by law.

The directors of Inteliqo Limited accept responsibility for this announcement.

For more information, please contact:

Inteliqo Limited j.hill@inteliqo.com

Joseph Hill

First Sentinel Corporate Finance Limited +44 20 3855 5551

Brian Stockbridge

Inteliqo Limited: Chairman's Report for the period ended 30 September 2023

Introduction

I am pleased to present the Chairman's statement, highlighting the progress and

achievements of Inteliqo Limited (the "Company") and its subsidiary (together

the "Group") for the 6 months to 30 September 2023. Under the leadership of our

CEO, Joseph Hill, our dedicated team has made significant strides in positioning

the Company for success in the technology market.

Business Overview and Objectives

Inteliqo is a technology company focused on delivering sales, marketing and

distribution services to two prominent technology brands through long-term

agreements with Ipedia and Langaroo.

Ipedia (https://ipedia.co)

The Ipedia iQ product is a smart translation earphone (earbuds) system offering

integrated real-time speech translation in 130 languages, built-in smart assist

(Google and Siri), multiple built-in microphones, and high-definition sound.

The Company's principal activity is to market, sell, and distribute Ipedia

technology products by appointing resellers in defined territories globally. The

Company generates income from the sales of these products; sharing a proportion

of such income with the product owners under the terms of its distribution

agreements.

Last year, Inteliqo appointed an exclusive reseller for the promotion and sale

of Ipedia products in nine territories. The agreements carry an initial five

-year term, and we expect the first orders from these agreements to start during

Q4 of 2023.

The quantum and timing of these orders are not guaranteed.

Langaroo (https://langaroo.co)

Langaroo is a mobile application that enables users to understand, speak,

message, and share information across over 130 languages. It serves as the

ultimate translation buddy, facilitating seamless communication for users in

various scenarios.

Inteliqo secured an exclusive sales and marketing agreement for the Langaroo

App, solidifying our commitment to driving its global adoption. This agreement

enables us to distribute the Langaroo App effectively and leverage its

impressive features across various industries and regions.

The Company generates income from the sales of subscriptions or territory

licence agreements, benefiting from a proportion of revenue as defined in a

revenue share agreement.

Financial Results

The Group's financial results to 30 September 2023 reflect the commencement of

sales leading to a profit of $185k, with basic earnings per share from

continuing activities of $0.002. These figures reflect the early stages of our

operations and we remain focused on executing our strategic initiatives and

achieving sustainable growth.

Outlook and Future Prospects

The Group is now operating profitably, with positive cash flows and this

promising result aligns with our commitment to delivering value to our

shareholders.

Looking ahead, we are optimistic about the Group's prospects. The Langaroo App

is now generating sales from its Beta launch and Full Application is scheduled

for release early in Q1 2024.

Coupled with the recent attainment of Exclusive Reseller Agreements for Ipedia,

we are confident that the Company will operate profitably this year.

Thank you for your continued support and trust in our vision. We are committed

to driving Inteliqo's growth and creating value for all stakeholders.

Joseph Truelove

Chairman of the Board

Inteliqo Limited

17 October 2023

Inteliqo Limited: Statement of comprehensive income and retained earnings for

the period ended 30 September 2023

Period to 30 Period to 30 September 2022

September

2023

USD USD

Revenue 558,029 -

Other income 88 42

Administrative expenses (370,447) (452,216)

Realised foreign currency 223 20,123

gains

Unrealised foreign (2,504) 4,412

currency gains

Operating profit and 185,389 (427,639)

profit before tax

Tax expense - -

Profit for the period from 185,389 (427,639)

continuing operations

Earnings per share

Basic earnings per share 0.002 (0.007)

from continuing operations

Diluted earnings per share 0.002 (0.007)

from continuing operations

Inteliqo Limited: Statement of financial position as at 30 September 2023

Notes 30 September 2023 30 September 2022

USD USD

ASSETS

Non-current assets

Office equipment 2,958 1,259

Current assets

Trade and other receivables 44,928 15,611

Cash and cash equivalents 384,221 475,246

429,149 490,857

Total assets 432,107 492,116

LIABILITIES AND EQUITY

Current liabilities

Trade and other payables 116,908 105,678

Equity

Share capital 6 14,188 14,188

Share premium 799,889 799,889

Retained earnings (498,878) (427,639)

315,199 386,438

Total liabilities and equity 432,107 492,116

The accompanying notes on pages 6 and 7 form an integral part of these interim

condensed consolidated financial statements.

These interim condensed consolidated financial statements were approved and

authorised for issue by the directors on 17 October 2023 and are signed on their

behalf by:

Ray Smart

Finance Director

Inteliqo Limited: Statement of changes in equity for the period ended 30

September 2023

Share Share Retained earnings Total

capital premium

USD USD USD USD

Issue of share capital 13,900 738,621 - 752,521

prior to admission to

Aquis

Issue of share capital on 288 61,268 - 61,556

admission to Aquis

Profit for the period - - (427,639) (427,639)

Balance at 30 September 14,188 799,889 (427,639) 386,438

2022

Balance at 1 April 2023 14,188 799,889 (684,267) 129,810

Profit for the period - - 185,389 185,389

Balance at 30 September 14,188 799,889 (498,878) 386,438

2023

Inteliqo Limited Statement of cash flows for the period ended 30 September 2023

Period to 30 Period to 30 September 2022

September

2023

USD USD

Operating activities

Profit before tax 185,389 (427,639)

Adjustments for non-cash

income and expenses:

Depreciation of office 534 36

equipment

Changes in operating assets

and liabilities:

Trade and other receivables (12,058) (15,611)

Trade and other payables 22,320 105,678

Net cash from operating 196,185 (337,536)

activities

Cash flows from investing

activities

Purchases of equipment (1,126) (1,295)

Cash flows from financing

activities

Proceeds from issue of share - 814,077

capital

Net change in cash and cash 195,059 475,246

equivalents

Cash and cash equivalents at 189,162 -

the beginning of the period

Cash and cash equivalents at 384,221 475,246

the end of the period

Inteliqo Limited accounting policies and explanatory notes to the financial

statements for the period ended 30 September 2023

1. General information

Inteliqo Limited (the "Company") is a company limited by shares under The

Companies (Guernsey) Law 2008 (as amended) and was incorporated in Guernsey on 3

May 2022 and listed on the Access Segment of Aquis Stock Exchange ("AQSE") on

5th August 2022 The address of its registered office and principal place of

business is Dixcart House, Sir William Place, St Peter Port Guernsey, GY1 1GX.

The Group's principal activity is the provision of sales, marketing and

distribution services.

2. Basis of preparation and accounting policies

These unaudited interim condensed consolidated financial statements (the

"Financial Statements") are for the six months ended 30 September 2023 and

comprise the Company and its subsidiary (together the "Group") and have been

prepared on an accruals basis and under the historical cost convention in

accordance with IAS 34 "Interim Financial Reporting" and applicable legal and

regulatory requirements. They are presented in US Dollars, the functional

currency of the Group and they do not include all disclosures that would

otherwise be required in annual financial statements in accordance with IFRS,

and should be read in conjunction with the Company's audited consolidated

financial statements for the period ended 31 March 2023.

The Company has applied the same accounting policies and methods of computation

in these Financial Statements as applied in its first full audited consolidated

financial statements to 31 March 2023 which were prepared in accordance with the

International Financial Reporting Standards ("IFRS"), as issued by the

International Accounting Standards Board ("IASB").

There are no accounting pronouncements which have become effective from 1 April

2023 that have a significant impact on the Financial Statements.

3. Significant management judgement in applying accounting policies and

estimation uncertainty

When preparing the Financial Statements, management undertakes a number of

judgements, estimates and assumptions about recognition and measurement of

assets, liabilities, income and expenses. The actual results may differ from the

judgements, estimates and assumptions made by management, and will seldom equal

the estimated results.

The judgements, estimates and assumptions applied in the Financial Statements,

including the key sources of estimation uncertainty, were the same as those

applied in the Group's last audited annual financial statements for the period

ended 31 March 2023.

4. Earnings per share and dividends

Earnings per share, both the basic and diluted earnings per share, have been

calculated using the profit attributable to shareholders of the Company as the

numerator, ie no adjustments to profit were necessary. The reconciliation of the

weighted average number of shares for the purposes of diluted earnings per share

to the weighted average number of ordinary shares used in the calculation of

basic earnings per share is as follows:

2023 2022

USD USD

Weighted average number of shares 112,500,000 58,991,589

used in basic earnings per share

Weighted average number of shares 117,472,500 61,560.166

used in diluted earnings per share

5. Interests in subsidiaries

On 22 March 2023, the Company acquired the entire share capital of Inteliqo

Marketing Limited which is registered in England and Wales. The acquisition was

made to support the Company's treasury function and the principal activity of

Inteliqo Marketing Limited is to hold bank accounts and collect and pay out the

proceeds of transactions on behalf of the Company and it does not operate in its

own right. As the company does not meet the criteria as set out in IFRS 3 to be

defined as a business the purchase has been recognised in these accounts as an

asset acquisition and the acquisition cost of $1,209 has been allocated to the

assets categories of the subsidiary as at 30 September 2023.

6. Share capital

The share capital of the Company comprises 112,500,000 ordinary shares with par

value GBP0.0001. An additional 15,027,500 ordinary shares with par value

GBP0.0001 are authorised but unissued. The Company has issued warrants over

4,972,500 ordinary shares with par value GBP0.0001.

7. Commitments under operating leases

The Group rents an office under an operating lease on a three month rolling

basis with a one month notice period. The minimum lease commitment at the

period end is GBP1,950.

8. Related party transactions

Key management of the Company are the executive and non-executive directors. Key

management personnel remuneration includes the following expenses:

Period to 30 September 2023 Period to 30 September 2022

USD USD

Short-term 23,945 31,755

employee

benefits

Director fees 16,569 5,245

Salaries 149,935 70,342

including

bonuses

Social 11,056 4,399

security costs

Total 201,505 111,741

remuneration

The Company has paid a deposit to a 3[rd] party for a property rented by the

Company which forms part of the short term employee benefits noted above. At 30

September 2023 the balance of the deposit was £8,850.

HKML Limited, a company owned by a director, Michael Hill, holds 7,312,500

ordinary shares in the Company and holds warrants over a further 1,399,500

ordinary shares. HKML Limited also entered into a revenue share agreement with

the Company on 1 June 2023.

Ray Smart, a director of the Company, holds 135,872 ordinary shares in the

Company.

9. Approval of Interim Report

This Interim Report was approved by the board of directors and authorised for

issue on 17 October 2023.

This information was brought to you by Cision http://news.cision.com

END

(END) Dow Jones Newswires

October 18, 2023 02:00 ET (06:00 GMT)

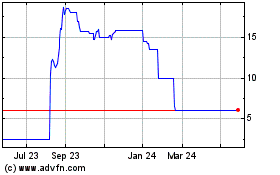

Inteliqo (AQSE:IQO)

Historical Stock Chart

From Jan 2025 to Feb 2025

Inteliqo (AQSE:IQO)

Historical Stock Chart

From Feb 2024 to Feb 2025