TIDMPBX

RNS Number : 8989A

Probiotix Health PLC

28 September 2022

28 September 2022

ProBiotix Health plc

("ProBiotix" or the "Company" or the "Group")

Unaudited Results to 30 June 2022

ProBiotix Health p lc (AQSE: PBX), a life sciences busi ness d

eveloping probiotics to tackle cardiovascular disease and other

lifestyle conditions, a nnounces its unaudited results for the

three month period from 31 March 2022, when the Company listed,

through to 30 June 2022 .

Highlights

-- Successful flotation on the AQSE Growth Market on 31 March

2022, raising GBP2.5m for future development of the Group

-- Significant benefits of public listing in enhanced corporate

profile, improved access to capital and greater ability to recruit,

retain and motivate key staff

-- Industry leader Steen Andersen appointed CEO

-- Confirmed orders to end of August of GBP1.12m, higher than sales for FY 2021 (GBP1.1m)

-- Invoiced sales in three month period to end of June of

GBP306,042 with a gross profit of GBP157, 577

-- Strong balance sheet with net cash balance of GBP2,034,509 as

at 30 June 2022 ( 2021: GBP196,982).

-- New customers gained in China, Israel, Hong Kong and Belgium

-- Third human volunteer study confirms efficacy of LP(LDL) (R)

-- Important entry into dairy market with functional yoghurt

containing LP(LDL) (R), with key health claim "helps to reduce

cholesterol"

-- Expanding CholBiome(R) portfolio with phytosterol-containing

product with US health claims to support expansion into US

market

Stephen O'Hara, acting CEO of ProBiotix, commented: "The

separate public listing of the Company enables us both to raise

awareness of the scale of the opportunity in probiotics and to

accelerate the realisation of our strategic objectives through

improved access to capital and by helping us to attract, retain and

motivate key personnel. The recruitment as CEO of such a leading

industry figure as Steen Andersen would not have been possible had

Probiotix remained part of a larger group.

"Reported first half sales understate the success of the Company

in winning new customers, expanding into new territories and

developing its product portfolio with confirmed orders as of the

end of August 2022 of more than GBP1.12m, already higher than sales

in the full year 2021 (GBP1.1m).

"We will continue to grow the business through a clear strategic

focus on commercialising products across more territories with

larger partners supported by a developing product pipeline - both

by exploring new probiotic strains and by extending the

applications and use of LP(LDL) (R). We will expand our range of

finished products with the addition of a phytosterol product to the

CholBiome(R) portfolio, and continue to develop the substantial

opportunities in dairy with major partners.

"Given the scale of the market opportunity, the proven efficacy

of our existing products, the substantial scope for expansion of

our range and geography, the significant benefits of public listing

and the financial strength of the Company, we look to the future

with confidence and enthusiasm."

This announcement contains information which, prior to its

disclosure, was considered inside information for the purposes of

the UK Market Abuse Regulation and the Directors of the Company are

responsible for the release of this announcement.

For further information, please contact:

ProBiotix Health plc https://probiotixhealth-ir.com/

Stephen O'Hara, Chief Executive Contact via Walbrook

below

Peterhouse Capital Ltd (AQSE Corporate Adviser Tel: 020 7220 0500

and Broker)

Mark Anwyl Tel: 020 7469 0930

Duncan Vasey

Walbrook PR Ltd probiotix@walbrookpr.com

Anna Dunphy Mob: 07876 741 001

Chairman's and Chief Executive's Statement

We are pleased to report the Company's inaugural results as a

separately listed public company, covering the period ended 30 June

2022. For the first three months of this period ProBiotix was a

wholly-owned subsidiary of AIM-listed OptiBiotix Health plc

("OptiBiotix"). On 31 March 2022 ProBiotix floated on the AQSE

Growth Market, raising GBP2.5m through a placing and subscription

of shares to accelerate the future development of the Group.

OptiBiotix shareholders received a dividend of approximately

GBP10.24m in specie through the distribution of ProBiotix shares to

them on the flotation, while OptiBiotix retains a 44% shareholding

in the Company following its flotation.

As the listing took place on 31 March 2022 the accounts show the

results for ProBiotix health from when it became a plc, the three

month period from 31 March 2022 through to 30 June 2022. This makes

year on year comparisons challenging as you are not comparing

similar time periods.

Strategic overview

ProBiotix is a life sciences business d e veloping probiotics to

tackle cardiovascular disease and other lifestyle conditions.

The market opportunity

The global probiotics market is forecast to reach $94.48 billion

by 2027, at a CAGR of 7.9%, dominated by the use of probiotics in

food and beverages, particularly dairy, and using clinically proven

probiotics as a natural replacement for pharmaceutical solutions

(Fortune Business insights, 2022).

The Group's strategy is to develop next-generation microbiome

solutions for a wide range of health conditions and to deliver

commercially successful products supported by a strong scientific

and clinical evidence base. We aim to partner with health and

wellbeing and/or pharmaceutical companies which are active in the

probiotics sector.

Since its creation, ProBiotix has made considerable progress and

has successfully transitioned from a research and development

specialist into a commercial organisation whose products are being

commercialised in over 60 countries.

Recent clinical studies with human volunteers have shown that

ProBiotix's principal product, Lactobacillus plantarum ECGC13110402

( LP(LDL) (R) ) can reduce key cardiovascular risk markers, such as

total cholesterol, LDL (bad) cholesterol, and Apolipo protein B

(biomarker of atheroschlerosis), by up to 34.2 per cent, 28.4 per

cent and 28.6 per cent respectively. Six publications on LP(LDL)

(R)'s mechanisms of action and three peer reviewed publications

have shown L P(LDL) (R) to be safe and well-tolerated, as well as

showcasing statistically significant reductions in multiple

cardiovascular disease risk biomarkers within six weeks.

The fact that 50% of all deaths globally can be related to

cardiovascular disease, and 80% are believed to be preventable

underlines the scale of the opportunity for L P(LDL) (R).

The CholBiome (R) portfolio

ProBiotix commercialises L P(LDL) (R) as an ingredient and in a

unique range of patented and proprietary food supplements

containing L P(LDL) (R) under the CholBiome(R) brand. The

CholBiome(R) portfolio currently comprises four products, which can

either be sold under the CholBiome(R) brand or customers' private

labels:

-- CholBiome (R)

Contains L P(LDL) (R) as the only active ingredient, to focus on

healthy cholesterol maintenance and deliver tangible health

benefits.

-- CholBiome (R)(X3)

A cholesterol-reducing formula that combines three targeted

ingredients into a triple-layer tablet. It consists of L P(LDL) (R)

, Monacolin K from red yeast rice, and Vitamin B3 (niacin) to

deliver a tri-factor approach that utilises synergistic mechanisms

of action to reduce cholesterol and aid overall cardiovascular

health.

-- CholBiome (R)(BP)

A blood pressure reducing formula that combines four

science-backed natural ingredients - L P(LDL) (R), Thiamine

(Vitamin B1), L-arginine and CoEnzyme Q10 - to provide a

multi-targeted mechanism approach for aiding hypertension and

improving cardiovascular health.

-- CholBiome(R)(VH)

A vascular health formula that combines three specialised

ingredients in a triple layer tablet. Consisting of L P(LDL) (R),

Thiamine and Vitamin K2 Vital (from Kappa Bioscience) to provide a

multi-targeted mechanism to work against the build-up of lipid and

calcium deposits in the blood vessels.

This gives us a product portfolio which allows us to create

different formulations to allow us to enter the widest possible

range of international markets. This is important because

regulatory conditions vary widely around the world. For example,

Monacolin K is used extensively across Asia but is prohibited in

food supplements in North America and subject to restrictions on

dosage in Europe. Our CholBiome(R) product range has been developed

to meet existing and anticipated regulatory requirements in all key

potential markets, and we anticipate adding a

phytosterol-containing product, CholBiome(R) CH with health claims

in the second half to support our expansion into the US market.

Benefits of public listing

We believe that the separate listing of the Company will enhance

recognition of the value of the probiotics opportunity by allowing

investors to perceive and evaluate Probiotix as a standalone

business in way that was not previously realised within its former

parent company. The listing also improves our access to funding,

enabling the Company to meet its working capital needs more

effectively than it could either as an unquoted company or as a

division competing for resources within a broader quoted group.

The enhanced status of the Company through the public trading of

its shares offers significant benefits in raising its corporate

profile and improving its ability to recruit and retain key staff.

The ability to attract personnel through the future grant of share

options will be of great value in securing, retaining and

motivating high calibre personnel. In particular, the appointment

of an industry-leading figure as CEO, announced in June, would not

have been possible in the absence of a public listing.

The Company believes that the scale of the opportunities

available to ProBiotix are greater than those previously being

exploited within OptiBiotix, where there was competition for

available resource across many parts of the business. A separate

listing, and the ability to fundraise independently, will enhance

the Company's ability to extend territories, grow

direct-to-consumer product sales, expand into the dairy market, and

further explore the potential of LP(LDL) (R) as a live

biotherapeutic or over-the-counter product with consumer health

pharma companies. These developments have the potential for

substantial future value enhancement.

Future strategy

The Group's strategic aim is to continue extending its product

range into new application areas, such as dairy and functional

foods; into new areas of health, including stress, anxiety, sleep

disorders, and allergies; and into new geographical territories,

principally focusing on the USA and Asia. Our objective is to

secure multiple deals with multiple partners - manufacturers,

formulators and distributors - allowing the Group to control the

complete value chain for the products it develops. Given a high

proportion of current sales are from a few partners we are working

hard to broaden our customer base by building new partnerships with

larger companies, particularly in the USA. This has been supported

by investment is a new business development director, Zac

Sniderman.

We believe that investor and consumer interest in probiotics and

the human microbiome is growing, presenting a significant market

opportunity. The Group intends to capitalise on this opportunity by

continuing to develop products with a strong scientific and

clinical evidence base which demonstrate clear product

differentiation and the potential for high commercial interest.

In this way, we intend to continue to develop the Group's

business in an area of science which we believe has the potential

to revolutionise the future of healthcare.

Commercial and scientific overview

Since the beginning of the current financial year we have

announced:

-- Publication of a third human volunteer study on the medical

efficacy of LP(LDL) (R), demonstrating through a placebo-controlled

trial that LP(LDL) (R) delivered large and statistically

significant reductions in total cholesterol, LDL-C (bad)

cholesterol and Apolipoprotein B (widely accepted as the most

important causal agent of atherosclerotic cardiovascular disease),

with no compliance, tolerance or safety issues. The results of this

and other studies suggest efficacy similar to many statins and

other treatments more typically associated with pharmaceuticals,

suggesting considerable potential in high value pharmaceutical

markets for the use of LP(LDL) (R) in individuals who are unwilling

or unable to tolerate other treatments.

-- Publication of a consumer study undertaken among purchasers

from our own e-commerce website of CholBiome(x3) , our proprietary

food supplement containing LP(LDL) (R) , which confirmed its

effectiveness in reducing cholesterol with no reports of

side-effects or any tolerance issues.

-- Admission of ProBiotix Health to the AQSE Growth Market on 31

March 2022, raising GBP2.5m for the further development of the

Company through a placing and subscription of new shares, while

giving OptiBiotix shareholders a dividend in specie, worth

approximately GBP10.24m, through the distribution of 0.554673 of a

ProBiotix share for every OptiBiotix share held.

-- The appointment of Steen Andersen as Chief Executive Officer

of ProBiotix Health, discussed in more detail below.

-- The launch by our partner Granja Pocha in Uruguay of a new

probiotic functional yoghurt brand, Yo-Life(R), containing

ProBiotix's patented cholesterol reducing Lactobacillus plantarum

strain (LP(LDL) (R)). Yo-Life(R) is a science-backed innovation

brand that has been developed to help reduce cardiovascular disease

risk, one of the leading causes of death in South America, by

lowering harmful cholesterol and blood pressure. Granja Pocha is

one of Uruguay's largest and most respected dairy producers,

specialising in the sale of products such as milk, cheeses and

yogurts under its Colonial brand. The launch followed two and a

half years of development work carried out by Granja Pocha and our

manufacturing partners CSL/Sacco to ensure the addition of LP(LDL)

(R) to yoghurt did not change its taste, texture, or shelf life. T

he launch of Yo-Life(R) represents a significant milestone for the

Company, as it extends the use of LP(LDL) (R) into functional dairy

foods with a health claim ("helps reduce cholesterol") which may be

replicated in other territories and other functional foods on a

global scale. This affords us entry to markets where volumes and

sales are significantly higher than the dietary supplement

industry.

-- Entry into an agreement with the University of Southampton as

part of a PhD studentship with Professor Jon Swann from the

University of Southampton and Professor Kieran Tuohy from the

University of Leeds as well as Fondazione Edmund Mach - Centro

Ricerca e Innovazione ("FEM"), based in Trento, Italy. The project

is designed to examine the role of LP(LDL) (R) a to improve sleep,

stress, and anxiety. Sleep aids and stress management products are

the fastest growing category within healthcare (Goldstein Market

Intelligence, 2020) and this is another step in extending the range

of applications for our scientifically and clinically proven

products into large growing markets where there is an unmet

clinical need. We also continue to explore with a partner the

potential of LP(LDL) (R) as a Live Biotherapeutic Product (LBP)

either alone or together with statins.

During the first half we have also gained a number of new

customers, with notable achievements including the placement of new

orders for LP(LDL) (R) as an ingredient from China and Israel, and

for our finished product Cholbiome(R) from Hong Kong and Belgium.

Our new Belgian partner offers promise as they are already

operating in the online dietary supplement channel in key markets

including the USA, China and Germany, as well as Belgium itself,

and supplying leading retail channels such as Amazon in the USA and

TMall in China.

Results

ProBiotix results for the three month period ended 30 June 2022

are set out below.

As the Company's listing took place on 31 March 2022, the

accounts show the results from 31 March 2022 through to 30 June

2022. Results for the period prior to that are included within the

Optibiotix Health PLC interim accounts.

The comparatives shown in the accounts are the results for

Probiotix Limited for the previous 6 month period.

Since the beginning of the financial year ProBiotix has received

confirmed orders for its products totalling GBP1.12m. These are

invoiced on dispatch so that the accounts only record sales of

products invoiced during the period of GBP306,042 (2021 6 months:

GBP537,262).

Gross profit for the period was GBP157,577 (2021 6 months:

GBP258,855). After total administrative costs of GBP412,499 (2021 6

months: GBP181,477), loss before tax was (GBP73,704)(2021 6 months:

profit GBP46,630).

Within the administrative costs for the period to 30 June 2022

there were one- off recruitment and expenses connected to the

listing process. If these were discounted there would have been a

small profit for these results.

As at 30 June 2022, the Group enjoyed a strong balance sheet

with cash balances totalling GBP2,034,509 (2021: GBP196,982).

Board and management

We were delighted to announce in June 2022 the appointment of

Steen Andersen as Chief Executive Officer ("CEO"), and look forward

to Steen joining the Company after completion of his notice period

with his current employer. This appointment is part of a

long-planned strategy to appoint an experienced industry business

leader to the Company to drive sales and profitability, allowing

the current acting CEO to focus on finding and developing new

technologies that will provide the pipeline of new products and

applications to ensure future growth.

Steen has more than 30 years' experience in building businesses

in the Probiotics industry, having been President of Deerland

Probiotics and Enzymes, President and CEO of Bifodan, President and

CEO of Fluxome, and Vice President of Human Health at Chr. Hansen.

Deerland is a market leading turnkey probiotic solution provider

acquired by ADM in November 2021 to help ADM meet the $775 billion

global demand in health and wellness. Prior to joining Deerland,

Steen was President and CEO of Bifodan, a market leading provider

of ready to market probiotic dietary supplements and over the

counter (OTC) pharma products. Bifodan was acquired by Deerland in

November 2019. Steen was integral in building these businesses,

increasing global reach, revenues, and profitability. Prior to this

he worked as CEO and President at Fluxome, a young biotechnology

company, and Vice President of Chr. Hansen's Health and Nutrition

unit where he built an organisation and position in the market

allowing the company to become a leading provider of probiotic

solutions within the dietary supplement space.

Steen brings experience of selling high value turnkey probiotic

solutions as supplements and OTC solutions in international

markets, building strategy and organisations, a wealth of industry

contacts, and is well respected within the probiotic industry. He

has a strong track record of rapidly growing sales and

profitability and has been involved in a number of acquisitions and

takeovers in support of accelerating business growth. His

experience in the Probiotics industry will help build ProBiotix's

business in its next phase of growth, as it moves from selling

ingredients to delivering high value turnkey solutions.

ProBiotix will also benefit from a number of senior appointments

immediately below the level of the main Board that were made by its

former holding company and continuing major shareholder OptiBiotix

in the early part of the current financial year. These will

contribute to the development of both ProBiotix and OptiBiotix

under a shared service agreement which will allocate their costs

between the companies according to usage.

Paul Cannings joined in January 2022 as Head of Operations &

Quality. His focus is on managing every step of the supply chain

from negotiating and ordering raw ingredients through warehouse and

inventory management to order fulfilment and invoicing. As part of

this process, we are changing our current warehousing supplier to

reduce fulfilment costs and increase our international

coverage.

Zac Sniderman joined in March 2022 as Business Development &

Sales Director for North America, as part of a strategic focus for

2022 to increase the number of large partners in the important US

market. Zac's role is to identify and reach agreement with large US

partners for the commercialisation of ProBiotix and OptiBiotix

products in North America.

Shiraz Butt also joined in March as E-Commerce Director. His

role is to grow the online sales business by selling ProBiotix and

OptiBiotix own label products direct to customers both in the UK

and in Asia. This involves improving the online sales experience,

working with influencers and social media channels to increase

product awareness, and most importantly growing online sales into a

profitable business in its own right. Shiraz comes with a strong

record of online sales growth achieving the all-time highest online

sales consistently for large sports nutrition brands PhD Nutrition,

TheProteinWorks and Iovate. He has grown ecommerce divisions for

brands internationally from launch to GBP10million+ covering D2C

and marketplaces.

These appointments are all part of a strategy to bring in

industry leaders and specialist expertise to support the Group's

growth plans and capitalise on the opportunities created by our

growing pipeline of products. We would expect the value from these

appointments to be realised in the second half of 2022 and

beyond.

Outlook

We aim to continue capitalising on the benefits of our public

listing, expanding our existing product portfolio into new

geographical territories, increasing our direct-to-consumer sales

of finished products, and developing new technologies that offer

enhanced potential for the future. We will continue to work with

AQUIS and explore opportunities on other markets, including AIM, to

increase liquidity in ProBiotix shares.

As noted above, confirmed orders received during the year to end

of August of GBP1.12m exceeded those invoiced and reported in the

full year results for 2021. During H2 we also expect to expand our

CholBiome(R) range by adding a phytosterol-containing product with

US health claims that will support our planned expansion into the

important US market. We would anticipate revenues from this coming

through in 2023.

The pace of our entry into new geographical areas reflects the

fact that ProBiotix is dependent on its partners' thorough and

successful registration in each territory of our LP(LDL) (R)

ingredient or CholBiome(R) finished products as dietary

supplements. That regulatory processes may take as little as one

month in Europe, but as long as 24 months in Asia and South

America.

Some important markets like Brazil have a very long registration

period: a minimum of 18 months for dietary supplements, plus

additional time if the regulatory authority does not find the

documentation satisfactory. We entered an exclusive agreement with

our partner Ayalla in Brazil in September 2020, and they have since

worked with an experienced regulatory consultant who had already

successfully registered other probiotic strains in the Brazilian

market, and who built a registration dossier on LP(LDL) (R). Ayalla

filed this dossier with Anvisa (the Brazilian Health Regulatory

Agency) in August 2021 and the regulatory process is still ongoing.

We anticipate regulatory approval of LP(LDL) (R) in Brazil during

2023.

Similarly, in June 2020, Probiotix entered an agreement with

Actial Pharmaceutica Srl., a leading probiotic company known

worldwide amongst medical doctors and gastroenterologists for its

probiotic brand VSL#3(R). After a positive introduction of

CholBiome(R) to Actial's local distributors in 2021, Actial entered

an agreement for CholBiome(R) and CholBiome(R)(X3) formulations

with a Malaysian distributor in June 2021 and has since then have

been developing a registration dossier for the Malaysian

authorities. Probiotix anticipates regulatory approval and launch

of the CholBiome(R) formulations under the VSL# brand in 2023.

Whilst regulatory approvals are costly and take a long time they

represent significant barrier to entry to many companies reducing

the competitive landscape and creating the potential for long term

recurrent revenues.

In October 2022 we will be presenting at the 6th Microbiome

Movement - Human Nutrition Summit in the USA on our next generation

clinically proven probiotics for cardiovascular health. This will

highlight LP(LDL) (R) clinical studies and help create interest in

the US market. The Company has commissioned a consultant to explore

pharma partnerships in the UK and Europe with the aim of

understanding the potential for LP(LDL) (R) as a live

biotherapeutic in these markets. Our US partner continues to

explore development of a biotherapeutic, despite the difficult

trading environment. The development of a live biotherapeutic is a

high risk, high-cost opportunity, which is not within the

capabilities of ProBiotix but is available for licensing to

suitable partners.

During the second half we will continue to focus on

commercialising products across more territories with larger

partners supported by a developing product pipeline - both by

exploring new probiotic strains and by extending the applications

and use of LP(LDL) (R). This will include expanding our range of

products with the addition of a phytosterol product to the

CholBiome(R) portfolio as part of our focus on growing

opportunities to provide final product solutions to partners,

rather than selling ingredients. Following our successful yoghurt

launch with Granja Pocha in Uruguay, we will also continue to

develop the substantial opportunities with major partners in the

dairy market, which affords us considerably greater potential for

volume sales than the market for dietary supplements.

The scale of the market opportunity in probiotics, the proven

efficacy of our existing products, the substantial scope for

expansion of our range and geography, the significant benefits of

public listing and the financial strength of the Company, all allow

us to look to the future with confidence and enthusiasm.

A Reynolds and S O'Hara

28 September 2022

Consolidated Statement of Comprehensive Income

For the period to 30 June 2022

Period to 6 months to Year to

30 June 30 June 31 December

2022 2021 2021

Unaudited Unaudited Audited

Continuing operations GBP GBP GBP

Revenue 306,042 537,262 1,100,132

Cost of sales (148,465) (278,407) (545,181)

-------------- -------------- --------------

Gross Profit 157,577 258,855 554,951

Share based payments (38,988) - -

Depreciation and amortisation (23,900) (23,225) (120,881)

Other administrative

costs (349,611) (158,252) (328,273)

Administrative expenses (412,499) (181,477) (449,154)

-------------- -------------- --------------

Operating (loss)/profit (254,922) 77,378 105,797

Finance income / (costs) 181,218 (30,748) (62,954)

-------------- -------------- --------------

Profit/(Loss) before

Income tax (73,704) 46,630 42,843

Income tax - (6,316) (6,497)

-------------- -------------- --------------

Profit/(Loss) for the

period (73,704) 40,314 36,346

Other Comprehensive - - -

Income

-------------- -------------- --------------

Total comprehensive

income for the period (73,704) 40,314 36,346

Total comprehensive

income attributable

to the owners of the

group (73,704) 40,314 36,346

(73,704) 40,314 36,346

Earnings/(loss) per

share

Basic & Diluted - pence 4 (0.082)p 40.31p 36.4p

Basic & Diluted before (0.076)p 40.31p 36.4p

Profit on investment

revaluation - pence

Consolidated Statement of Financial Position

As at 30 June 2022

Notes As at As at As at

30 June 30 June 31 December

2022 2021 2021

Unaudited Unaudited Audited

ASSETS GBP GBP GBP

Non-current assets

Intangibles 344,227 370,908 345,990

-------------- -------------- --------------

344,227 370,908 345,990

-------------- -------------- --------------

CURRENT ASSETS

Inventories 5,837 20,415 11,281

Trade and other receivables 508,634 631,853 742,380

Cash and cash equivalents 2,034,509 196,982 146,048

-------------- -------------- --------------

2,548,980 849,250 899,709

-------------- -------------- --------------

TOTAL ASSETS 2,893,207 1,220,158 1,245,699

EQUITY

Shareholders' Equity

Called up share capital 5 60,833 1,000 1,000

Convertible loan note

equity - 122,617 122,617

Group reorganisation reserve 1,000 - -

Share premium 3,129,863 - -

Share based payment reserve 38,988 - -

Retained Earnings (617,465) (539,793) (543,761)

-------------- -------------- --------------

Total Equity 2,613,219 (416,176) (420,144)

-------------- -------------- --------------

LIABILITIES

Current liabilities

Trade and other payables 201,256 506,338 503,460

-------------- -------------- --------------

201,256 506,338 503,460

-------------- -------------- --------------

Non - current liabilities

Deferred tax liability 78,732 78,551 78,732

Convertible loan notes 1,051,445 1,083,651

-------------- -------------- --------------

78,732 1,129,996 1,162,383

-------------- -------------- --------------

TOTAL LIABILITIES 279,988 1,636,334 1,665,843

-------------- -------------- --------------

TOTAL EQUITY AND LIABILITIES 2,893,207 1,220,158 1,245,699

Consolidated Statement of Changes in Equity

For six months to 30 June 2022

Called Convertible Share Group Share-based Retained Total

up loan notes premium Reorganisation Payment Earnings Equity

Share reserve reserve

Capital

GBP GBP GBP GBP GBP GBP GBP

------------ -------------- -------------- -------------- -------------- ------------ --------------

Balance at 31

December 2020 1,000 122,617 - - - (580,107) (456,490)

Profit for the

year - - - - - 36,346 36,346

------------ -------------- -------------- -------------- -------------- ------------ --------------

Balance at 31

December 2021 1,000 122,617 - - - (543,761) (420,144)

Group

reorganisation (1,000) (122,617) - 1,000 - - (122,617)

Loss for the

period - - - - - (73,704) (73,704)

Share based

payments - - - - 38,988 - 38,988

Share Issues 60,833 3,464,217 - - - 3,525,050

Share issue

costs - (334,354) - - - (334,354)

------------ -------------- -------------- -------------- -------------- ------------ --------------

Balance at 30

June 2022 60,833 - 3,129,863 1,000 38,988 (617,465) 2,613,219

------------ -------------- -------------- -------------- -------------- ------------ --------------

Consolidated Statement of Cash Flows

For the six months to 30 June 2022

Notes 6 months 6 months Year to

to to 31 December

30 June 30 June 2021

2022 2021 Audited

Unaudited Unaudited

Reconciliation of loss before

income tax to cash outflow from

operations

Operating (loss)/profit (73,704) 46,629 42,843

Decrease/ (Increase) in inventories 5,444 (20,415) (11,281)

(Increase)/decrease in trade

and other

receivables 233,745 (153,269) (263,794)

(Decrease)/increase in trade

and other

payables (302,204) 163,017 160,137

Share Option expense 38,988 -

Finance expenses - 30,748 62,954

Depreciation and amortisation 23,900 23,225 45,396

------------ ------------ ------------

Net cash outflow from operations (73,831) 89,935 36,254

Interest received (181,218)

- -

Tax received - - -

------------ ------------ ------------

Net cash (outflow)/inflow from

operating activities (255,049) 89,935 36,254

Cash flows from investing activities

Purchase of intangible assets (22,137) (31,561) (28,814)

------------ ------------ ------------

Net cash (outflow)/inflow from

investing activities (22,137) (31,561) (28,814)

------------ ------------ ------------

Cash flows from financing activities

Share issues 2,165,647 - -

Disposal of Investments -

------------ ------------ ------------

Net cash inflow from financing 2,165,647 -

activities

------------ ------------ ------------

Increase/(decrease) in cash

and equivalents 1,888,461 58,674 7,440

Cash and cash equivalents at

beginning of year 146,048 138,608 138,608

------------ ------------ ------------

Cash and cash equivalents at

end of year 2,034,509 196,982 146,048

Notes to the results

For the three months to 30 June 2022

1. General Information

Probiotix Health Plc is a com pany incorp orated and d omiciled

in England and Wales. The com pan y 's offices are in Wakefield.

The com pany is listed on the AQUIS market of the Lo nd on Stock

Exchange (ticker: PBX).

The financial information set out in this report does not

constitute statutory accounts as defined in Section 434 of the

Companies Act 2006. The group's statutory financial statements for

the period ended 310 December 2022 will be prepared under

International Financial Reporting Standards ("IFRS").

Copies of the annual statutory accounts and the Half Yearly

report can be found on the Company's website

https://probiotixhealth-ir.com/financials/latest-results

2. Basis of preparation and significant accounting policies

This report has been prepared using the historical cost

convention, on a going concern basis and in accordance with

International Financial Reporting Standards ("IFRS") as adopted by

the European Union.

The preparation of financial statements in conformity with IFRS

requires the use of certain critical accounting estimates. It also

requires management to exercise its judgement in the process of

applying the accounting policies and making any estimates. Changes

in assumptions may have a significant impact on the financial

statements in the period the assumptions changed. Board of

Directors believe that the underlying assumptions are appropriate

and that the financial statements are fairly presented. The Board

of Directors believes, there are no areas involving a higher degree

of judgement or complexity, or areas where assumptions and

estimates are significant to the financial statements, and

therefore, these financial statements have limited disclosures.

3. Segmental Reporting

In the opinion of the directors, the Group has one class of

business, in three geographical areas being that of identifying and

developing microbial strains, compounds and formulations for use in

the nutraceutical industry. The Group sells into three highly

interconnected markets, all costs assets and liabilities are

derived from the UK location.

Following the listing of Company on the AQUIS market only the

turnover from Probiotix Health Limited for the period 31 March 2022

to 30 June 2022 are included the figures below.

Revenue analysed by geographical market

Period ended

30 June

2022

GBP

UK 21,750

US 190,356

International 93,936

------------

306,042

During the reporting period one customer represented GBP190,356

(62.2%) of Group revenues.

4. Earnings per Share

Basic earnings per share is calculated by dividing the earnings

attributable shareholders by the weighted average number of

ordinary shares outstanding during the period.

Reconciliations are set out below:

6 Months 6 Months

to to Year to

30 June 30 June 31 December

2022 2021 2021

Unaudited Unaudited Audited

Basic

Earnings attributable to ordinary

shareholders (73,704) 40,314 36,346

Weighted average number of shares 90,398,559 100,000 100,000

Earnings /(Loss) per-share (0.082)

- pence p 40.31 p 36.34p

Diluted

Earnings attributable to ordinary

shareholders (73,704) 40,314 36,346

Weighted average number of shares 96,898,559 100,000 100,000

Earnings/(Loss) per-share -

pence (0.076)p 40.31p 36.34p

As at 30 June 2022 there were 6,500,000 outstanding share

options.

5. Share Capital

Issued share capital comprises:

Period Period Year

to 30 June to 30 June to 31 December

2022 2021 2021

Unaudited Unaudited Audited

GBP GBP GBP

Ordinary shares of 1p

100,000 - 1,000 1,000

Ordinary shares of 0.05p 60,833 - -

each

121,666,666

-------------- -------------- --------------

60,833 1,000 1,000

6. Post balance sheet events

No post balance sheet events.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NEXFLFLRARIDFIF

(END) Dow Jones Newswires

September 28, 2022 02:02 ET (06:02 GMT)

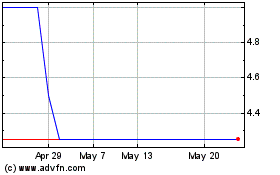

Probiotix Health (AQSE:PBX)

Historical Stock Chart

From Nov 2024 to Dec 2024

Probiotix Health (AQSE:PBX)

Historical Stock Chart

From Dec 2023 to Dec 2024