TIDMPGH

RNS Number : 5608G

Personal Group Holdings PLC

19 July 2023

19 July 2023

Personal Group Holdings plc

("the Company", "Personal Group" or "Group")

Trading Update and Update on CEO transition

Positive first half trading resulting in significant YOY EBITDA

growth alongside continued growth in recurring revenues

The following amendment has been made to the "Trading Update and

Update on CEO transition" announcement on 19 July 2023 at 07:00

under RNS 4368G.

-- In the Highlights section the benefits platform ARR has been

amended from GBP5.3m to GBP5.5m representing an increase of c. 8%

rather than c. 6%.

All other details remain unchanged.

The full amended text is shown below.

Personal Group (AIM: PGH), the workforce benefits and services

provider, is pleased to provide the following update on trading for

the six-month period ending 30 June 2023 (HY23).

Highlights

-- Total revenue for the six months to 30 June 2023 increased

34% to GBP46.4m (HY22: GBP34.7m), driven primarily by voucher

resales through the benefits platform of GBP24.6m (HY22: GBP13.8m),

demonstrating the value placed on it by our clients and their

employees;

-- Adjusted EBITDA increased 75% to GBP2.7m (HY22: GBP1.5m);

-- Strong balance sheet and liquidity with a cash position of

GBP22.6m as at 30 June 2023 (31 Dec 2022: GBP18.7m) and no

debt;

-- The Group continues to benefit from an increasing proportion

of recurring revenues, providing high levels of visibility for the

second half of 2023 and into 2024:

o Insurance Annualised Premium Income ("API") increased by c.6%

to GBP29.6m (31 Dec 2022: GBP28.0m)

o Benefits Platform Annual Recurring Revenue ("ARR") increased

c.8%. to GBP5.5m (31 Dec 2022: GBP5.0m)

o Pay & Reward ARR increased c.4% to GBP0.57m (31 Dec 2022:

GBP0.54m)

Operational Highlights

Growth of the Group's client base continued in the first half,

with 52 new client wins (HY22: 52) and the award of a place on the

Crown Commercial Services framework, alongside high levels of

retention of existing clients. Continued progress against the

Board's key strategic objectives was also made; in particular,

positive momentum across the business' largest division -

Affordable Insurance.

Affordable Insurance

Strong insurance sales in the first half resulted in 34% growth

in new annualised insurance sales to GBP5.8m for the period (2022:

GBP4.3m). This, alongside strong retention levels, which remain

above pre-pandemic averages, helped to drive up the API value to

GBP29.6m (31 Dec 2022: GBP28.0m). As anticipated, claims levels for

the first half remained higher than historic norms on Hospital

Cashplans, as activity continued at an increased rate, in an

attempt to address NHS backlogs.

Benefits Platform

Continued growth was seen in HY23, across both Enterprise

clients, taking Hapi, and Sage Employee Benefits, ending the half

year with ARR of GBP2.2m and GBP3.3m respectively (31 Dec 2022:

GBP2.0m and GBP3.0m).

The contribution from Pay & Reward, comprising Innecto and

Quintige Consulting Group, has remained steady. This division has

shown resilience despite the attention of their normal audience of

HR Directors being diverted to the tactical focus of dealing with

the cost-of-living crisis for their employees and growth in the

pipeline towards the end of the period gives confidence for

improved performance in H2.

Contribution from Other Owned Benefits (Let's Connect) was in

line with management's expectations post cessation of the long-term

scheme with a major client in March 2023, as previously

announced.

Outlook

It is pleasing to achieve this level of financial growth in the

context of the current cost-of-living crisis. The need for

organisations to look after their people has never been more

important and Personal Group's offering remains extremely relevant

in a growing market.

The Group's financial performance in the first half has

reinforced management's belief in a return to a growth trajectory

and provides the Company with a solid foundation from which to grow

further. While continuing to focus on strategic execution in H2,

the Company is well-placed to capitalise on opportunities and is

strengthened by a strong balance sheet, a quality customer base and

leading technology platform. The Group's continued growth of

recurring revenues, and the level of visibility which it provides,

enables the Board to remain confident that trading for the full

financial year remains in line with market expectations.

Update on CEO transition

Further to the Company's announcement on 4 May 2023 with respect

to the Company's CEO succession, the Board is pleased to announce

that, following the expedited completion of the sale of the

underlying businesses of the Woven Group Solutions Limited, Paula

Constant will assume the role of CEO Designate with immediate

effect. Following an orderly transition period, Deborah Frost will

step down from the role of CEO and from the Board with effect from

1 August 2023, and will remain an employee of the Company until 31

December 2023 to support a smooth and effective handover.

Deborah Frost, Chief Executive of Personal Group, commented:

"Personal Group is well positioned to serve and capitalise upon

a growing market for employee engagement. Whilst cognisant that

2023 is set to be another challenging year for the economy, our

product offerings are particularly valuable to customers in times

of economic pressure. This is evident with our high levels of

customer retention and new client wins.

Despite economic headwinds, I am very pleased with the strategic

progress made by the Group, and we are on track to meet market

expectations of growth for the full year. We look to the future

with confidence and excitement for the opportunities that lie

ahead.

While my time at Personal Group is coming to an end, I remain

highly confident in the prospects for the business which is

well-positioned to continue delivering strong financial results and

wish Paula and the whole Personal Group team well for the

future."

-ENDS-

For more information please contact:

Personal Group Holdings Plc

Deborah Frost (CEO) / Sarah Mace Via Alma PR

(CFO)

Cenkos Securities Plc

Camilla Hume / Callum Davidson

(Nomad) +44 (0)20 7397 8900

Jasper Berry (Sales)

Alma PR +44 (0)20 3405 0205

Caroline Forde / Joe Pederzolli personalgroup@almapr.co.uk

/ Kinvara Verdon

Notes to Editors

Personal Group Holdings Plc (AIM: PGH) is a workforce benefits

and services provider. The Group enables employers across the UK to

improve employee engagement and support their people's physical,

mental, social and financial wellbeing. Its vision is to create a

brighter future for the UK workforce.

Personal Group provides health insurance services and a broad

range of employee benefits, engagement, and wellbeing products. Its

offerings can also be delivered through its proprietary app, Hapi,

and the recently developed extension to the platform, Hapiflex.

The Group's growth strategy is centred around widening the

footprint of the business into the SME, talent-led & Public

Sectors, thereby expanding the addressable customer base. In

addition, it aims to grow in its existing industrial heartlands, to

re-invigorate growth in insurance policyholders and to drive the

use of its SaaS offerings.

Group Clients include: Airbus, Barchester Healthcare, British

Transport Police, Merseyrail, Randstad, Royal Mail Group, The Royal

Mint, the Sandwell & Birmingham NHS Trust, Stagecoach Group

plc, and The University of York.

For further information on the Group please see

www.personalgroup.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTUKUSROBUBAAR

(END) Dow Jones Newswires

July 19, 2023 10:40 ET (14:40 GMT)

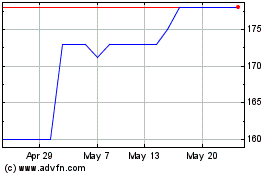

Personal (AQSE:PGH.GB)

Historical Stock Chart

From Dec 2024 to Jan 2025

Personal (AQSE:PGH.GB)

Historical Stock Chart

From Jan 2024 to Jan 2025