TIDMSNOX

RNS Number : 0851W

SulNOx Group PLC

08 December 2023

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF REGULATION 11 OF THE MARKET ABUSE (AMMENT) (EU EXIT) REGULATIONS

2019/310

8 December 2023

SulNOx Group Plc (the "Company" or "SulNOx")

Financial Results for the Six Months to 30 September 2023

(Aquis Stock Exchange: SNOX)

The board of the directors of the Company (the "Board") is

pleased to announce its unaudited half yearly financial results for

the six months to 30 September 2023. A copy of these results has

been published on the Company's website.

Chairman's Statement

It is with great pleasure that I inform you on the Company's

main milestones and interim results for the 6 months to 30

September 2023. As you know, the year so far has been marked with

the Company welcoming a new significant shareholder, and successful

acceleration of product evaluations in the second half of the year,

a positive momentum which has significantly boosted the Company's

revenue prospects in the coming quarters.

For the 6 months to 30 September 2023, SulNOx generated

increased revenue and reduced expenses compared to the same period

in the previous year, resulting in a reduced loss of GBP869,814,

compared to a loss of GBP964,702 in the same period last year.

While sales are still behind our initial projections, we believe

that recent evaluation results and interest, particularly in the

maritime sector, will provide an upward push towards increased

revenue and profitability.

SulNOx's achievements during the period include evaluation data

evidencing material fuel and emissions savings and increased demand

for product from major shipping companies and other large fossil

fuel consumers. An enhanced management team (both technical hires

and industry leaders) will provide the needed resources and

direction to achieve our short and medium-term objectives.

Since the annual general meeting in September, the Company has

been able to secure additional funds in order to continue with our

plans to grow our global salesforce footprint. Recently, we have

added a Technical Director, and two Senior Advisors, to the current

team who will focus their attention on sales, growing and retooling

our distribution network, and supporting operational management and

client value-add.

The current economic uncertainty of geo-political events coupled

with economic forecasts has led the Board to establish new goals of

greater constraint. Within this framework our priorities are to

maintain financial discipline and compliance based upon our

strategic plan moving forward. As such, aside from essential key

hires and engagements, we have decided to maintain a policy of

austerity to ensure that the company is adequately funded until

anticipated significant sales, or additional funding,

materialize.

Since becoming Chairman of the Board just over 3 years ago, I

have defended a management policy based on discipline and

transparency. I am pleased to inform you that this policy is now

bearing fruit and the enhanced team and new advisors are

well-placed to drive the company forward. I remain confident that

the augmented organizational structure, combined with a

strengthened strategic investor base with a global vision, will

provide the ability to adapt to the opportunities from Regulatory

and other changing environments which we face today.

Despite a global backdrop of uncertainties and challenges, with

the augmented team, coupled with the unique abilities of SulNOx to

reduce fossil fuel consumption and emissions, we are ideally placed

to make the very most of a market seeking immediate solutions for

cost and climate issues that lie before us all.

I would like to end this note by expressing my sincerest thanks

to our team, our distribution network and our investors, for your

continued support and contribution to SulNOx, and look forward to

an exciting future to which we will devote all our energies.

Enquiries:

SulNOx Group Plc

Steven Cowin, Chief Financial Officer

steven.cowin@sulnoxgroup.com

AQSE Corporate Adviser :

Allenby Capital Limited

Nick Harriss

020 3328 5656

The directors take responsibility for this announcement.

SulNOx Group Plc

Consolidated Statement of Comprehensive income for the 6

months ended 30 September 2023

Unaudited Audited Unaudited

6 months 6 months

to year ended to

30-Sep-23 31-Mar-23 30-Sep-22

GBP GBP GBP

Revenue 135,727 203,076 74,805

Cost of sales (78,701) (138,090) (64,438)

-------------------------- -------------------------- -------------------------------

Gross profit 57,026 64,986 10,367

Distribution costs - - -

Administrative expenses (926,840) (1,972,502) (975,069)

-------------------------- -------------------------- -------------------------------

Operating loss (869,814) (1,907,516) (964,702)

Interest payable and similar

expenses - - -

Loss before taxation (869,814) (1,907,516) (964,702)

Tax on Loss - 3,903 -

-------------------------- -------------------------- -------------------------------

Loss for the financial

period and

total comprehensive income (869,814) (1,903,613) (964,702)

========================== ========================== ===============================

Earnings per share (pence) (0.83) (1.98) (1.02)

SulNOx Group Plc

Consolidated Statement of Financial Position as at 30

September 2023

Unaudited Audited Unaudited

30-Sep-23 31-Mar-23 30-Sep-22

GBP GBP GBP

Non-current assets

Intangible assets 7,279,545 7,479,545 7,679,545

Property, plant and equipment 13,925 15,914 21,047

7,293,470 7,495,459 7,700,592

-------------------------------- -------------------------------------- ------------------------------------

Current assets

Inventory 128,633 79,072 143,343

Debtors 130,540 47,594 81,632

Cash at bank and in hand 562,257 522,868 311,109

821,430 649,534 536,084

-------------------------------- -------------------------------------- ------------------------------------

Creditors: amounts falling

due within one year (563,589) (360,683) (248,819)

Net current assets 257,841 288,851 287,265

Total assets less current

liabilities 7,551,311 7,784,310 7,987,857

Net assets 7,551,311 7,784,310 7,987,857

================================ ====================================== ====================================

Capital and reserves

Called up share capital 2,176,228 2,018,831 1,882,657

Share premium account 14,391,409 13,911,991 13,322,916

Share based compensation

reserve 588,959 588,959 578,844

Profit and loss account (9,605,285) (8,735,471) (7,796,560)

Shareholders' funds 7,551,311 7,784,310 7,987,857

================================ ====================================== ====================================

SulNOx Group Plc

Consolidated Statement of Changes in Equity for the 6 months

ended 30 September 2023

Share

Called Share Based

Up Share Premium Compensation Retained

Capital Account Reserve Earnings Total

GBP GBP GBP GBP GBP

Balance at 1 April

2022 1,882,657 13,322,916 578,844 (6,831,858) 8,952,559

------------------------ ---------------------------- ------------------------------------ --------------------------- -------------------

Loss of total

comprehensive

income for the

period - - - (964,702) (964,702)

Balance at 30

September

2022 1,882,657 13,322,916 578,844 (7,796,560) 7,987,857

Loss of total

comprehensive

income for the

period - - - (938,911) (938,911)

Issue of share

capital 136,174 589,075 - - 725,249

Movement on reserve - - 10,115 - 10,115

------------------------ ---------------------------- ------------------------------------ --------------------------- -------------------

Balance at 31 March

2023 2,018,831 13,911,991 588,959 (8,735,471) 7,784,310

------------------------ ---------------------------- ------------------------------------ --------------------------- -------------------

Loss of total

comprehensive

income for the

period - - - (869,814) (869,814)

Issue of share

capital 157,397 479,418 - - 636,815

Balance at 30

September

2023 2,176,228 14,391,409 588,959 (9,605,285) 7,551,331

======================== ============================ ==================================== =========================== ===================

SulNOx Group Plc

Consolidated Cash Flows for the 6 months ended 30

September 2023

Unaudited Audited Unaudited

6 months 6 months

to year ended to

30-Sep-23 31-Mar-23 30-Sep-22

GBP GBP GBP

Cash flows from

operating activities

Loss for the year

after tax (869,814) (1,903,613) (964,702)

Adjustments for:

Taxation charge - (3,903) -

Amortisation and

impairment of

intangible assets 200,000 400,243 200,243

Depreciation and

impairment of

property, plant

and equip 1,989 5,956 3,014

Loss on disposal of

fixed assets - 2,192 -

Tax received - 3,903 -

Share based equity

payment - 10,115 -

Movement in working

Capital

(increase)/decrease

in inventories (49,561) 85,395 21,124

(increase)/decrease

in trade

and other

receivables (82,946) (157,435) (3,581)

Increase/(decrease)

in trade

and other payables 202,906 289.377 (10,377)

--------------------------------- -------------------------------------- --------------------------------------

Cash generated from

operations (597,426) (1,267,770) (754,279)

Net cash from

operating

activities (597,426) (1,267,770) (754,279)

================================= ====================================== ======================================

Cash flows from

financing activities

Proceeds from issue

of shares 636,815 725,250 -

Net cash from

financing

activities 636,815 725,250 -

================================= ====================================== ======================================

Net

increase/(decrease)

in cash

and cash

equivalents 39,389 (542,520) (754,279)

Cash and cash

equivalents at

beginning of year 522,868 1,065,388 1,065,388

Cash and cash

equivalents at

end of year 562,257 522,868 311,109

================================= ====================================== ======================================

SulNOx Group Plc

Notes to the Interim Financial Statements

1. General Information

SulNOx Group Plc is a public limited company (the "Company")

incorporated in England & Wales (registration number 08449586).

The Company is domiciled in the United Kingdom and its registered

office is 10 Orange Street, London WC2H 7DQ. The Company's ordinary

shares are traded on the AQSE Growth Market ("AQSE") (formerly

NEX). Copies of the interim report are available from the Company's

website www.sulnoxgroup.com . Further copies of the Interim Report

and Accounts may be obtained from the address above.

The Company's principal activity is the procurement of orders

for customers wishing to use two fuel emulsifier products

previously developed by the group and now owned under licence to

Nouryon BV.

2. Basis of Preparation

The interim financial statements of the Company and its

subsidiaries for the six months ended 30 September 2023, which are

unaudited, have been prepared in accordance with International

Financial Reporting Standards ("IFRS").

The financial information contained in the interim report does

not constitute statutory accounts as defined in Section 435 of the

Companies Act 2006. The financial information for the full

preceding statutory reporting period is based on the statutory

accounts for the year ended 31 March 2023. Those accounts, upon

which the auditors, Jeffreys Henry LLP, issued a report which was

unqualified, have been delivered to the Registrar of Companies.

As permitted, this interim report has been prepared in

accordance with the AQSE Growth Market Rules for Issuers and not in

accordance with IAS 34 "Interim Financial Reporting" therefore it

is not fully compliant with IFRS.

The interim financial statements are presented in sterling.

3. Loss per share

Basic loss per share is 0.83p. The basic loss per ordinary share

is calculated by dividing the loss of GBP869,914 by 104,876,470,

the weighted average number of shares in issue during this

period.

The loss attributable to equity holders (holders of ordinary

shares) of the Company for calculating the fully diluted loss per

share is identical to that used for calculating the loss per share.

The exercise of share options would have the effect of reducing the

loss per share and is therefore anti-dilutive.

SulNOx Group Plc

Notes to the Interim Financial Statements

4. Post-Period Event

On 11 October 2023 the Company announced that Nistadgruppen AS,

an existing substantial shareholder, had subscribe for 3,111,111

new ordinary shares of 2 pence each at a price of 22.5 pence per

share to raise a total of GBP700,000, before expenses.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NEXUBUNRORUURAA

(END) Dow Jones Newswires

December 08, 2023 02:00 ET (07:00 GMT)

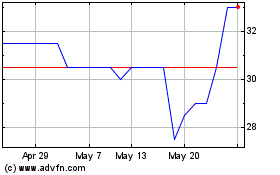

Sulnox (AQSE:SNOX)

Historical Stock Chart

From Apr 2024 to May 2024

Sulnox (AQSE:SNOX)

Historical Stock Chart

From May 2023 to May 2024