TIDMSTB

RNS Number : 2587E

Secure Trust Bank PLC

27 October 2022

PRESS RELEASE

Secure Trust Bank PLC

LEI: 213800CXIBLC2TMIGI76

27 October 2022

For embargoed release at 07.00 am

SECURE TRUST BANK PLC

Q3 2022 Trading Update

Prudent management of lending growth

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) No. 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018.

Secure Trust Bank PLC ("Secure Trust Bank", "STB" or the

"Group"), a leading specialist lender, is pleased to announce its

trading update for the third quarter ended 30 September 2022.

Positive momentum has continued in Q3 with management taking

pre-emptive prudent action to slow lending growth and focus on

operational efficiency. Credit criteria have been proactively

tightened further to reflect macroeconomic uncertainty and

management of the overall risk profile of the lending book. The

Group continues to trade in line with management's

expectations.

Highlights

Q3'22 Q3'21 Change Q2'22 Change

Net Lending - Core* GBP2,813.4m GBP2,315.0m 21.5% GBP2,751.2m 2.3%

------------- ------------- ------- ------------ --------

Deposits GBP2,349.2m GBP1,964.9m 19.6% GBP2,290.9m 2.5%

------------- ------------- ------- ------------ --------

New business lending* GBP502.1m GBP368.4m 36.6% GBP633.9m (20.8)%

------------- ------------- ------- ------------ --------

Net Lending - Core*

The Core net loan book grew by 21.5% compared to Q3 2021 and

2.3% compared to Q2 2022. The Q3 2022 quarter-on-quarter growth was

predominately delivered in Consumer businesses of 6.4%, with

Business Finance reducing by 1.2%. Growth slowed in the quarter

following actions to tighten credit criteria and reduce new

business levels.

Deposits

Customer deposits were 2.5% higher at the end of the quarter

compared to Q2 2022 to support the growth in the loan book. The

Group continues to focus on the management of funding costs in a

steep rising rate environment and preservation of Net Interest

Margin which remained flat in Q3 2022 compared with HY22 at

5.7%.

New Business lending*

Total new business lending grew significantly year-on-year with

market share gains across our Consumer businesses reflecting a

recovery from COVID. As expected, new business lending decreased in

the quarter by 20.8% compared to Q2 2022 reflecting the continued

proactive tightening of credit criteria given the current

macroeconomic environment.

David McCreadie, Chief Executive Officer:

"We have continued to support our customers and business

partners during this period of market uncertainty and are pleased

with our operational performance, progress on our strategic targets

and further improvements in operational efficiency. Against a

backdrop of rising inflation and interest rates we have taken

decisions to slow the growth rate of lending. We will continue to

adopt a flexible approach to loan book growth across our

diversified portfolio and a prudent approach to risk management.

Our track record of navigating economic uncertainties gives us

confidence in managing through this challenging period and being

well positioned to take advantage of growth opportunities when the

economic backdrop improves. Secure Trust Bank remains well

positioned to capitalise on its strong foundations in its Core

specialist lending markets and to deliver its medium-term

targets."

*Following the simplification of our lending activities, 'Core'

excludes the Asset Finance and Consumer Mortgages loan books which

were disposed of in July 2021 and the Debt Managers (Services) loan

portfolio disposed of in May 2022.

Enquiries:

Secure Trust Bank PLC

David McCreadie, Chief Executive Officer

Rachel Lawrence, Chief Financial Officer

Phil Clark, Investor Relations

Tel: 0121 693 9100

Stifel Nicolaus Europe Limited (Joint Broker)

Robin Mann

Stewart Wallace

Tel: 020 7710 7600

Canaccord Genuity Limited (Joint Broker)

Emma Gabriel

Tel: 020 7523 8309

Forward looking statements

This document contains forward looking statements about the

business, strategy and plans of STB and its current objectives,

targets and expectations relating to its future financial condition

and performance. Statements that are not historical facts,

including statements about STB's or management's beliefs and

expectations, are forward looking statements. By their nature,

forward looking statements involve risk and uncertainty because

they relate to events and depend on circumstances that will occur

in the future. STB's actual future results may differ materially

from the results expressed or implied in these forward looking

statements as a result of a variety of factors. These include UK

domestic and global economic and business conditions, risks

concerning borrower credit quality, market related risks including

interest rate risk, inherent risks regarding market conditions and

similar contingencies outside STB's control, the COVID-19 pandemic,

expected credit losses in certain scenarios involving forward

looking data, any adverse experience in inherent operational risks,

any unexpected developments in regulation or regulatory, and other

factors. The forward looking statements contained in this document

are made as of the date of this document, and (except as required

by law or regulation) STB undertakes no obligation to update any of

its forward looking statements.

About the Company:

Secure Trust Bank is an established, well--funded and

capitalised UK retail bank with a 70-year trading track record.

Secure Trust Bank operates principally from its head office in

Solihull, West Midlands, and had 931 employees (full-- time

equivalent) as at 30 June 2022. The Group's diversified lending

portfolio currently focuses on two sectors:

(i) Business Finance through its Real Estate Finance and

Commercial Finance divisions, and

(ii) Consumer Finance through its Vehicle Finance and Retail Finance divisions.

Secure Trust Bank PLC is authorised by the Prudential Regulation

Authority and regulated by the Financial Conduct Authority and the

Prudential Regulation Authority.

Secure Trust Bank PLC, One Arleston Way, Solihull, B90 4LH.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTBKABKBBDBCKB

(END) Dow Jones Newswires

October 27, 2022 02:00 ET (06:00 GMT)

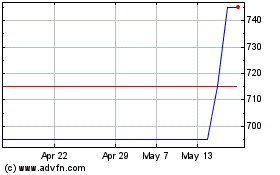

SECURE TRUST BANK (AQSE:STB.GB)

Historical Stock Chart

From Oct 2024 to Nov 2024

SECURE TRUST BANK (AQSE:STB.GB)

Historical Stock Chart

From Nov 2023 to Nov 2024