S & U PLC Trading Update and Notice of Results (4619V)

August 10 2022 - 1:00AM

UK Regulatory

TIDMSUS

RNS Number : 4619V

S & U PLC

10 August 2022

10 August 2022

S&U plc

("S&U" or "the Group")

Trading Update and Notice of Results

S&U plc, the specialist motor and property bridging lender,

today issues its trading update for the period from its AGM

Statement of 26 May 2022 to 31 July 2022. It will announce its

half-year results on 27 September 2022.

Although it is only just over two months since our last trading

update, S&U is pleased to report that both its motor and

property bridging divisions continue to outperform its

expectations, both in transactions growth, and in the quality of

its book and the new business it is writing. Current Group

receivables now stand at approximately GBP370m against GBP340m in

May, and profitability exceeds that of H1 last year. Debt quality

is reflected in strong collection rates and supported by low levels

of default at Advantage, our motor finance business, and at Aspen,

our property bridging lender.

However, these results do not mean that S&U has become

either hubristic or Panglossian. Current political instability and

differing views on fiscal policy, together with persistent UK

economic headwinds do not allow for any complacency. We recognise

that a potentially shrinking economy, higher inflation and interest

rates, historically low levels of consumer confidence and a

possible technical recession in the UK, have all contributed to a

manically depressed view of the future, particularly in the UK

equity markets.

Hence, although growth currently exceeds budget and

expectations, we judge it sensible in light of current uncertainty

about economic prospects, to temper optimism with caution,

particularly in our underwriting policy. Recent adjustments are

designed to continue to ensure that our customers have sufficient

comfort and headroom to withstand any pressure on their household

disposable incomes, which might be felt later in the financial

year. These will help protect our credit quality throughout the

Group, whilst in the case of motor finance, anticipating the new

outcome-based Duty of Care to customers, to be introduced by the

Financial Conduct Authority in one year's time.

Advantage Finance

Advantage Finance, our motor business based in Grimsby,

continues its excellent post-pandemic progress to historic levels

of growth and credit quality. Applications for motor loans remain

robust in a buoyant used car market. This has meant growth in

transactions of nearly a quarter on last year and an increase in

net receivables to approximately GBP280m in July against GBP268m in

May and GBP249m in July 2021. Credit quality remains high, measured

by higher collections against due and by the lower incidence of

voluntary terminations and bad debts. In addition, a revised

scorecard and the introduction of further credit reference

information, as well as strengthened buffers on customer

affordability, are designed to ensure that it remains so.

What is prudent for our customers also applies to our own

excellent, loyal and expert staff. Whilst administrative costs

remain well controlled and within budget, provision is being made

to help those lower paid individuals who may be feeling cost of

living pressures more acutely. This will bolster Advantage's

excellent staff morale and minimise staff turnover.

Aspen

Despite some doomsayers and "cliff-edge" addicts who have

commentated on the UK's residential property market, the real world

has allowed Aspen to continue its growth in serving its niche

developer and investor market. Net receivables in the period have

now reached approximately GBP90m in July against GBP72m in May and

GBP58m in July 2021. Aspen's growing reputation and the

introduction of new products mean that it is attracting more

experienced and expert borrowers, which have seen average gross

loan size increase to around GBP875,000 so far this year, helping

both the receivables and revenue growth.

This trend towards higher quality and more seasoned borrowers

has seen a slight reduction in blended book yield on last year,

although above budget, coupled with excellent repayments and

continued good credit quality.

All this gives a very strong and stable base for further

progress in what is likely to remain, despite increased costs of

borrowing, a strong residential property market.

Treasury

S&U's continued investment in book growth at both Advantage

and Aspen, in addition to the payment of our final dividend has

seen Group net borrowings rise to GBP154m in July against GBP125m

in May and GBP115m in July 2021. Our medium-term facilities are

GBP180m giving us ample headroom for further growth, whilst our low

level of gearing, our strong credit quality and cash generation

will facilitate additional facilities as required.

Commenting on S&U's trading outlook, Anthony Coombs, S&U

chairman, said:

"I am very pleased and encouraged by S&U's trading this

year. However, like many in the financial services sector,

S&U's performance and its prudently planned prospects for the

future, are inadequately reflected in stock market commentary and

valuations dominated by uncertainty and pessimism. That pessimism

is not shared by S&U. We believe that realistic underwriting,

good products, and supportive and sensitive customer relations will

enable us to make further significant and sustainable progress in

the markets which we serve."

Enquiries S&U plc c/o SEC Newgate

Anthony Coombs

Financial Public Relations

Bob Huxford, Molly Gretton SEC Newgate 020 7653 9848

--------------- ----------------

Broker

Andrew Buchanan, Adrian Trimmings,

Sam Milford Peel Hunt LLP 020 7418 8900

--------------- ----------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTEKLFBLVLEBBQ

(END) Dow Jones Newswires

August 10, 2022 02:00 ET (06:00 GMT)

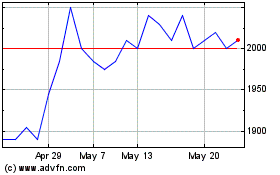

S and U (AQSE:SUS.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

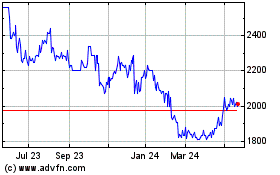

S and U (AQSE:SUS.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024