TIDMTSP

RNS Number : 2873M

TruSpine Technologies PLC

20 September 2021

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS NOT

FOR PUBLICATION, RELEASE OR DISTRIBUTION, DIRECTLY OR INDIRECTLY,

IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES OF AMERICA,

CANADA, AUSTRALIA, NEW ZEALAND, THE REPUBLIC OF SOUTH AFRICA OR

JAPAN OR IN OR INTO ANY OTHER JURISDICTION WHERE TO DO SO WOULD

BREACH ANY APPLICABLE LAW OR REGULATION.

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND DOES NOT

ITSELF CONSTITUTE AN OFFER FOR SALE OR SUBSCRIPTION OF ANY

SECURITIES IN THE COMPANY. THIS ANNOUNCEMENT DOES NOT CONSTITUTE OR

CONTAIN ANY INVITATION, SOLICITATION, RECOMMENDATION, OFFER OR

ADVICE TO ANY PERSON TO SUBSCRIBE FOR, OTHERWISE ACQUIRE OR DISPOSE

OF ANY SECURITIES OF TRUSPINE TECHNOLOGIES PLC IN ANY JURISDICTION

WHERE TO DO SO WOULD BREACH ANY APPLICABLE LAW OR REGULATION.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS DEFINED IN

ARTICLE 7 OF THE MARKET ABUSE REGULATION NO. 596/2014 AS IT FORMS

PART OF THE UK LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT

2018 ("MAR"). UPON THE PUBLICATION OF THIS ANNOUNCEMENT, THIS

INSIDE INFORMATION IS NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN

.

TruSpine Technologies plc

("TruSpine" or the "Company")

Fundraise & Issue of Warrants, FDA update and Appointment of

Broker

TruSpine Technologies plc, (AQSE: TSP) the medical device

company focused on the development of its pioneering "screwless,"

spinal (vertebral) stabilisation systems announces that it has: (1)

conditionally raised GBP650,000 through a Fundraise of 6,500,000

new Ordinary Shares at a price of 10p per share; (2) the

appointment of Oberon Capital; and (3) update on the FDA

submission.

Fundraise & Issue of Warrants

The Fundraise comprises a Placing and a Subscription. 2,300,000

New Ordinary Shares will be issued by way of the Placing raising

gross proceeds of GBP230,000 and 4,200,000 New Ordinary Shares will

be issued through the Subscription raising gross proceeds of

GBP420,000. The Subscription shares and Placing shares will be

issued at a price of 10 p per share.

An additional 125,000 New Ordinary Shares at a price of 10 p per

share will be issued to a third-party involved in the Fundraise in

lieu of services rendered ("Fee Shares").

The Fundraise is conditional, inter alia, on the admission of

the Placing shares, the Subscription shares and the Fee Shares to

trading on AQSE, which is expected to occur on or around 30

September 2021.

Each New Ordinary Share issued pursuant to the Fundraise has one

warrant attached granting the holder the right to subscribe for an

additional one New Ordinary Share at an exercise price of 15 pence

per share for a period of 3 years following Admission.

The net proceeds of the Placing and Subscription will be used to

complete Cervi-LOK(TM) validation & testing, instrumentation,

and product moulds, FDA compliant quality management systems,

product launch marketing and general working capital.

Appointment of Broker

The Company announces that it has appointed Oberon Capital, part

of the Oberon Investments Group plc as sole broker to the Company

with immediate effect.

FDA Update

We continue to work with our key partners as we advance towards

our FDA 510k application, expected to be lodged in Q4 2021.

The following have now been completed since the last update to

market in April 2021:

-- Testing and design freeze of Cervi-LOK(TM) product

-- Testing and design freeze of Cervi-LOK(TM) instrumentation

-- Completion of three Cadaver Studies

-- Appointment of Anthony Swoboda as US Vice President of sales and marketing,

-- Appointment of consultant neurosurgeon Nik Patel as a Non-Executive Director

-- Appointment of William Lavalle, M.D., as the Chairman of our Medical Advisory board

The following are underway or contracted, in preparation for the

FDA 510k application:

-- Implementation of a Quality Management System, with our

regulatory partner, Emergo in conjunction with Greenlight Guru

leaders in document management systems. Manufacture of

Cervi-LOK(TM) moulds - manufacturer Forum Plastics LLC appointed in

August 2021

-- Manufacture of sealed sterile implant and instrumentation

packs - manufacturer Guardian Medical appointed in September 2021.

Independent product testing to be performed in the Lab of Vijay

Goel, Ph.D., at the University of Toledo.

-- Linkotek validation and verification testing

-- Completion of all regulatory filings in collaboration with Emergo

In parallel with the 510K application, TruSpine has commissioned

Emergo, to prepare and file a submission requesting that the FDA

examine the Cervi-LOK(TM) to be designated as a "Breakthrough

Device". This requires a new Q-Sub application which will require

additional time to prepare but will confer significant long-term

benefits on the Cervi-LOK(TM) and its commercialisation. This can

include higher margin returns through preferred insurance coding

and hospital reimbursement.

Total Voting Rights

Following Admission, the Company's issued share capital will

consist of 101,388,967 ordinary shares with voting rights. The new

ordinary shares will rank pari passu with the existing ordinary

shares. No ordinary shares are held in treasury at the date of this

announcement and therefore following the Admission, the total

number of Ordinary Shares in the Company with voting rights will be

101,388,967.

The above total voting rights figure may be used by shareholders

as the denominator for the calculation by which they will determine

if they are required to notify their interest in, or a change to

their interest in the Company.

Ian Roberts, CEO of Truspine commented: "We are pleased to

provide an update on the above matters to our shareholders. The

team are working extremely hard alongside our partners as we

advance the Cervi-LOK(TM) through this critical phase leading up to

lodgement of FDA 510k application. Our decision to pursue FDA

"Breakthrough Device" designation while adding time to the FDA

process, if successful will have significant long-term benefits for

the commercial development of the Cervi-LOK(TM) . We look forward

to moving rapidly to commercialisation phase during 2022."

This announcement contains inside information for the purposes

of the UK Market Abuse Regulation and the Directors of the Company

are responsible for the release of this announcement.

Enquiries:

Truspine Technologies Plc Tel: +44 (0)20 3638 5025

Ian Roberts, CEO

Cairn Financial Advisers LLP (AQSE Corporate Tel: +44 (0)20 7213 0880

Adviser)

Liam Murray / Ludovico Lazzaretti

Oberon Capital Tel: +44 (0)20 3179 5300

Robert Hayward / Mike Seabrook /

Chris Crawford

Walbrook PR (Financial PR Tel: +44 (0) 20 7933 7870 or +44 (0) 7876

& IR) 741 001

Anna Dunphy truspine@walbrookpr.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NEXVBLBLFKLZBBZ

(END) Dow Jones Newswires

September 20, 2021 04:47 ET (08:47 GMT)

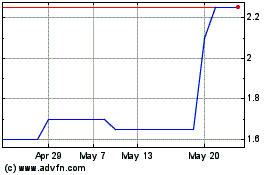

TruSpine Technologies (AQSE:TSP)

Historical Stock Chart

From Dec 2024 to Jan 2025

TruSpine Technologies (AQSE:TSP)

Historical Stock Chart

From Jan 2024 to Jan 2025