TIDMTSP

RNS Number : 4092L

TruSpine Technologies PLC

03 January 2023

3 January 2023

TruSpine Technologies plc

("TruSpine" or the "Company")

Bridge Loan Facility and GBP2.4m Equity Investment Letter of

Intent

TruSpine Technologies Plc, the medical device company focused on

the spinal (vertebral) stabilisation market, announces that it has

entered into a GBP200,000 bridging loan facility ("Bridge Loan")

together with a non-binding letter of intent ("LOI") to provide

GBP2.4m staged equity funding over three tranches ("Investment

Agreement") with a UK investment group (the "Investment

Group").

Terms of the Bridge Loan :

Bridge Loan facility entered with Investment Group

- GBP200,000 to be available immediately

- 8% interest per annum

- Re-payable from proceeds of Tranche 1 of the non-binding LOI

or converted on same terms to equity as Tranche 1 (detailed

below)

Indicative Terms of the Investment Agreement:

Non-binding LOI to provide GBP2.4m equity funding

- Tranche 1 - GBP800k at 4p per new ordinary share drawn on

signing of Investment Agreement ("Tranche 1")

- Tranche 2 - GBP800k at 6p per new ordinary share drawn on

lodgement of FDA 510k application for Cervi-Lok ("Tranche 2")

- Tranche 3 - GBP800k at 10p per new ordinary share on FDA 510k

clearance for Cervi-Lok ("Tranche 3")

Conditions precedent for the equity funding include TruSpine

appointing a non-executive director, proposed by the Investment

Group (the "Nominated Director") and existing non-executive

director, Dr Timothy Evans, moving to an executive director

role.

Investment Agreement and Tranche 1 drawdown expected no later

than 31 January 2023, subject to completion of due diligence and

the appointment of the Nominated Director to the board of

TruSpine.

Due diligence process largely completed having commenced in

early November 2022 in conjunction with the TruSpine executive

team.

Under the Bridge Loan, the Investment Group is providing

GBP200,000 to the Company for general working capital purposes. The

Bridge Loan will be re-paid on the earlier of 30 June 2023 or the

date upon which Tranche 1 is confirmed pursuant to the Investment

Agreement.

The Company will also have the option to convert the Bridge Loan

to new ordinary shares on the same terms as Tranche 1 under the

Investment Agreement which would reduce the equity commitment of

the Investment Group by the Bridge Loan amount.

There is no certainty that the Investment Group will enter into

the Investment Agreement. The Investment Group is still in the

process of completing its due diligence. In the event that the

Investment Group does not complete its investment, the Company will

need to raise further funds in the short term. The Company will

continue to manage its working capital.

Ian Roberts, CEO of TruSpine commented: "The proposed equity

funding will ensure that our ground-breaking first spinal

stabilisation device, the Cervi-Lok, can continue on the 510k

pathway through to FDA clearance and onto commercialisation."

This announcement contains inside information for the purposes

of the UK Market Abuse Regulation, and the Directors of the Company

are responsible for the release of this announcement.

Enquiries:

TruSpine Technologies Plc Tel: +44 (0)20 3638 5025

Ian Roberts, CEO

Cairn Financial Advisers LLP (AQSE Corporate Adviser) Tel: +44 (0)20 7213 0880

Liam Murray / Ludovico Lazzaretti

Oberon Capital (Joint Broker) Tel: +44 (0)20 3179 5300

Mike Seabrook / Chris Crawford

Peterhouse Capital Limited (Joint Broker & Financial Adviser)

Tel: +44 (0)20 7469 0930

Lucy Williams / Duncan Vasey

Walbrook PR (Financial PR & IR) Tel: +44 (0) 20 7933 7870 or +44 (0) 7876 741 001

Anna Dunphy truspine@walbrookpr.com

Caution regarding forward looking statements

Certain statements in this announcement, are, or may be deemed

to be, forward looking statements. Forward looking statements are

identi ed by their use of terms and phrases such as "believe",

"could", "should" "envisage", "estimate", "intend", "may", "plan",

"potentially", "expect", "will" or the negative of those,

variations or comparable expressions, including references to

assumptions. These forward-looking statements are not based on

historical facts but rather on the Directors' current expectations

and assumptions regarding the Company's future growth, results of

operations, performance, future capital and other expenditures

(including the amount, nature and sources of funding thereof),

competitive advantages, business prospects and opportunities. The

stated parameters of the planned agreement between the Company and

Spartan Medical, Inc. do not necessarily represent a final,

legally-binding contract. Such forward looking statements re ect

the Directors' current beliefs and assumptions and are based on

information currently available to the Directors.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NEXUPUUAGUPWPPP

(END) Dow Jones Newswires

January 03, 2023 02:00 ET (07:00 GMT)

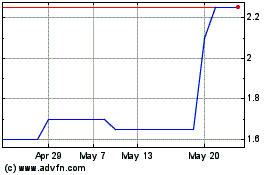

TruSpine Technologies (AQSE:TSP)

Historical Stock Chart

From Dec 2024 to Jan 2025

TruSpine Technologies (AQSE:TSP)

Historical Stock Chart

From Jan 2024 to Jan 2025