MARKET COMMENT: S&P/ASX 200 Down 0.3% Before US Employment Data

April 04 2013 - 7:36PM

Dow Jones News

0005 GMT [Dow Jones] Australia's S&P/ASX 200 falls 0.3% to

4899.6 after hitting a fresh 2-month low of 4893.8 in mixed trading

before Friday's U.S. jobs data. Materials and industrials stocks

have recovered at the expense of defensive and high-yield sectors

including health care, utilities, consumer staples, telcos and

banks. BHP (BHP.AU), Rio Tinto (RIO.AU), Newcrest (NCM.AU) and

Fortescue (FMG.AU) rise 0.4%-1.7%, while CSL (CSL.AU), CBA

(CBA.AU), APA Group (APA.AU), Woolworths (WOW.AU), Telstra (TLS.AU)

and CBA (CBA.AU) fall 0.9%-1.5%. Traders are watching the Nikkei

after the BOJ's stronger-than-expected quantitative easing plans,

which potentially improve the outlook for commodity prices and

global economic growth. "It looks like there's been some portfolio

selling weighing on the market this week," says Macquarie Private

Wealth investment adviser John Milroy; "miners are having a fair

day here after being friendless recently." Still, traders aren't

convinced the resources sell-off is finished, despite obvious signs

of capitulation selling in mid-cap resources Thursday.

(david.rogers1@wsj.com)

Contact us in Singapore. 65 64154 140; MarketTalk@dowjones.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

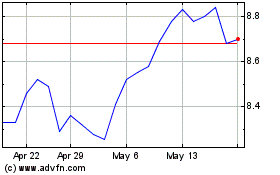

APA (ASX:APA)

Historical Stock Chart

From Dec 2024 to Jan 2025

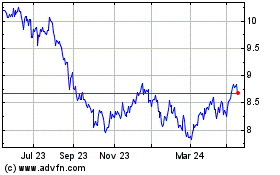

APA (ASX:APA)

Historical Stock Chart

From Jan 2024 to Jan 2025

Real-Time news about APA Group (Australian Stock Exchange): 0 recent articles

More APA Group News Articles