Appen Shares Drop After Citi Downgrades Stock on Guidance Risk

June 05 2022 - 11:00PM

Dow Jones News

By Stuart Condie

SYDNEY--Appen Ltd.'s shares slumped close to a five-year low

after Citi analysts downgraded the stock on risk that the data

annotation company could miss its annual earnings guidance.

The Citi analysts cut their recommendation to neutral from buy,

following the Australian company's weaker-than-expected start to

2022, which leaves it needing a strong second half.

"Appen management noted that... the weakness was primarily due

to one customer, which we see as likely being Facebook based on our

website visit analysis," the analysts said in a note.

Appen's shares are down 4.2% at A$6.13 after earlier hitting

A$6.09. The stock, which was worth as much as A$43.50 in August

2020, touched an intraday low of A$6.08 in February, which was its

lowest since November 2017.

Citi's team also said in a note that Canadian tech company Telus

International (Cda) Inc.'s takeover bid for Appen last month showed

that demand for human-labeled artificial-intelligence training data

still exists.

Telus later withdrew its A$9.50-a-share bid, which valued

Appen's equity at 1.17 billion Australian dollars (US$843.2

million), after the takeover proposal was made public.

Citi's analysts slash their target price for the stock by 28% to

A$6.60, but added that Appen remains attractive given its market

position.

Write to Stuart Condie at stuart.condie@wsj.com

(END) Dow Jones Newswires

June 05, 2022 23:45 ET (03:45 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

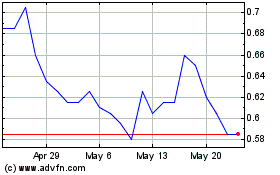

Appen (ASX:APX)

Historical Stock Chart

From Feb 2025 to Mar 2025

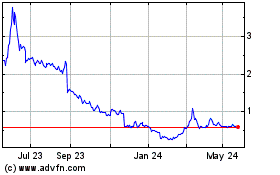

Appen (ASX:APX)

Historical Stock Chart

From Mar 2024 to Mar 2025

Real-Time news about Appen Limited (Australian Stock Exchange): 0 recent articles

More Appen Limited News Articles