BHP Fiscal Year Profit Jumps on Petroleum Sale, Strong Commodity Prices

August 15 2022 - 6:25PM

Dow Jones News

By Rhiannon Hoyle

BHP Group Ltd. said its annual profit nearly tripled as it

benefited from the sale of its petroleum business and strong

commodity prices, but it signaled an uncertain outlook as rising

interest rates take their toll on developed economies.

BHP, the world's biggest miner by market value, on Tuesday

reported a net profit of $30.90 billion for its fiscal year through

June, up from a profit of $11.30 billion in the same period a year

earlier.

BHP declared a dividend of $1.75 a share. Its total payout for

the fiscal year, of $3.25 per share, was up 8% on the year

prior.

The miner recorded an exceptional gain of $7.1 billion following

the merger of its petroleum business with Woodside Energy Group

Ltd. It also sold some coal operations.

Underlying profit--a closely watched measure that strips out

some one-time items--was up by 39% to $23.82 billion, BHP said.

That beat market consensus of $20.89 billion, compiled by Vuma from

17 analyst forecasts.

Chief Executive Mike Henry said policies introduced by China to

support its economy are likely to shore up commodity demand in

coming months. However, developed economies are facing a slowdown

as central banks raise interest rates to tame inflation, tight

labor markets persist, and geopolitical uncertainty continues to

weigh.

"The direct and indirect impacts of Europe's energy crisis are a

particular point of concern," Mr. Henry said.

Weaker output of most of its commodities was eclipsed by the

impact of strong raw material prices.

The miner was paid more than three times as much for the

metallurgical coal it mines than it was in the year-earlier period,

as global production struggled to keep up with demand. BHP runs the

world's biggest export operation for metallurgical coal, used in

steelmaking, in joint venture with Japan's Mitsubishi Corp.

Prices for its thermal coal also surged, nearly quadrupling

year-on-year. While the price that BHP received for iron ore fell

by 13%, it was paid 9% more for its copper and 43% more for its

nickel.

Write to Rhiannon Hoyle at rhiannon.hoyle@wsj.com

(END) Dow Jones Newswires

August 15, 2022 19:10 ET (23:10 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

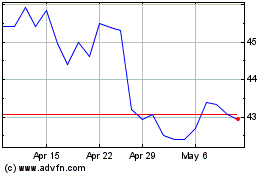

BHP (ASX:BHP)

Historical Stock Chart

From Oct 2024 to Nov 2024

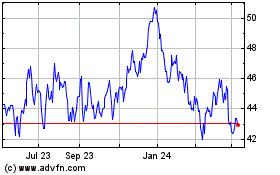

BHP (ASX:BHP)

Historical Stock Chart

From Nov 2023 to Nov 2024