Australia's Whitehaven to Buy Two BHP, Mitsubishi Coal Mines -- 2nd Update

October 17 2023 - 11:24PM

Dow Jones News

By Rhiannon Hoyle

Mining giant BHP Group and Japan's Mitsubishi have agreed to

sell two jointly owned steelmaking coal mines in Australia to

Whitehaven Coal for up to $4.1 billion in cash.

The world's biggest miner by market value said earlier this year

the joint venture was seeking a buyer for its Blackwater and Daunia

mines in the Bowen Basin of Australia's coal-rich Queensland state.

The BHP Mitsubishi Alliance, Australia's largest producer and

exporter of metallurgical coal, is narrowing its focus on

high-quality coal it expects steel mills will increasingly buy to

help curb their carbon emissions.

The deal announced Wednesday includes $2.1 billion cash on

completion plus another $1.1 billion over the following three

years. There's also the potential for up to $900 million in

price-linked payments over three years if coal sales are above

agreed price thresholds.

Whitehaven will take on all current and future environmental

liabilities and rehabilitation obligations when the sale is

completed, BHP said.

The Blackwater and Daunia mines produce millions of metric tons

each year of mostly metallurgical coal for steel that is shipped

mainly to buyers across Asia. The Blackwater mine, opened in 1967,

is one of the longest coal mines in the Southern Hemisphere.

The mines produce lower-quality coal than some of the joint

venture's other operations and BHP previously said those two mines

would struggle to compete for future investment. "What we are doing

here is further concentrating our portfolio on the best-of-the-best

assets," BHP Chief Executive Mike Henry said in February.

Whitehaven said the deal will be transformational for the

Sydney-based coal company, helping to increase exposure to

steelmaking coal versus coal used to generate electricity. It said

it is considering the sale of a minority interest to global steel

producers that would help pay for the deal.

"Daunia and Blackwater produce much-needed metallurgical coal

that is in high demand across Asia," said Whitehaven Chief

Executive Paul Flynn.

BHP last year sold its controlling interest in two other mines

to Stanmore Resources in a roughly $1.35 billion deal. It also sold

a minority interest in a Colombian mine to Swiss commodities giant

Glencore.

BHP sought to sell its last thermal-coal mine, the Mt. Arthur

coal operation in Australia, but failed to secure a buyer. Last

year, BHP said it would instead keep mining the pit for several

years before closing it and beginning rehabilitation work.

The world's top miner has been pivoting toward commodities it

expects to enjoy higher demand amid a global energy transition,

especially industrial metals copper and nickel, and fertilizer

ingredient potash.

BHP bought Australian copper miner OZ Minerals in May in what

was its biggest acquisition in more than a decade. Before that, it

struck a deal with Australia's Woodside Energy to offload its

global petroleum business.

Still, coal remains an important money-spinner for the mining

giant. BHP's coal interests contributed 18% of the group's

underlying Ebitda in the year through June, with a margin of

46%.

BHP says it believes high-quality metallurgical coal will be

needed to fuel blast furnaces in the steel industry for decades to

come, underpinned by growth in steelmaking in countries such as

India, which--unlike China--relies on imports of steelmaking

coal.

"In line with our long-term strategy, we will continue to

develop our high-quality metallurgical coal assets in Queensland,

which are sought after by global steelmakers and needed to support

the energy transition," BHP said in a statement on Wednesday.

BHP said profits from the sale will go toward reducing net debt.

The deal is expected to be completed in the quarter ended June 30,

2024, it said.

Earlier Wednesday, BHP reported a 16% fall in first-quarter

metallurgical coal output compared with the same period a year

earlier. It said that was in part due to planned plant

maintenance.

The miner also reported lower iron-ore production but higher

copper output, and said it is on track to meet fiscal-year

production and cost estimates set for all its operations.

Write to Rhiannon Hoyle at rhiannon.hoyle@wsj.com

(END) Dow Jones Newswires

October 18, 2023 00:09 ET (04:09 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

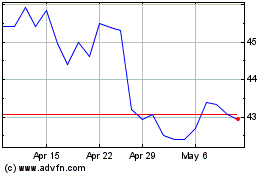

BHP (ASX:BHP)

Historical Stock Chart

From Feb 2025 to Mar 2025

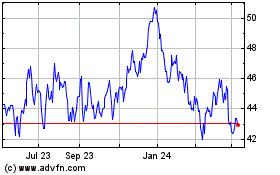

BHP (ASX:BHP)

Historical Stock Chart

From Mar 2024 to Mar 2025