Investcorp AI Acquisition Corp. (“IAAC”) (Nasdaq: IVCA)1

is pleased to announce that it has agreed to terms with Bigtincan

Holdings Limited (“Bigtincan”) (ASX:BTH) under which, if

implemented, IAAC would combine with Bigtincan’s business and list

on the Nasdaq through a newly formed Cayman Islands exempted

company called “Bigtincan Limited” (the

“Transaction”).

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241021452831/en/

Transaction Highlights

- Implied pre-money equity valuation of Bigtincan of US$275m2 on

a fully diluted basis being A$0.483 per share based on the

assumptions described in the footnote below

- Investcorp Cayman Holdings Limited (“Investcorp”), an

affiliate of the sponsor of IAAC, has committed to invest US$12.5m

(~A$18.7m4) into Bigtincan Limited by way of subscription for

ordinary shares as part of the Transaction

- In addition, Bigtincan Limited will seek to raise up to

US$25.0m (~A$37.3m5) from institutional investors in a PIPE6

transaction and up to US$25m of debt finance to support the

Transaction

- Pursuant to the Transaction, a partial cash election

alternative is intended to be made available to Bigtincan

shareholders, under which Bigtincan shareholders may elect to

receive cash consideration for their shares of US$0.16145

(~A$0.2417) per Bigtincan share, subject to availability of funds

and a scale back mechanism8

- Bigtincan shareholders will own approximately 75%9 of Bigtincan

Limited immediately following implementation of the Transaction,

subject to cash elections available to and made by Bigtincan

shareholders, the number of Bigtincan Limited shares sold to PIPE

investors and redemptions made by IAAC shareholders

Harsh Shethia, a 22-year veteran of Investcorp and advisor to

IAAC said: "This transaction offers tremendous value not just for

Bigtincan's shareholders, but also for its customers, employees,

and partners. It’s a chance to showcase Australia’s strength in AI

innovation, especially in sectors like sales enablement, and

position an Australian-born company as a global leader in

enterprise software. We’re excited to help Bigtincan take the next

step in its journey.”

Transaction Overview

Under the Business Combination Agreement (“BCA”), scheme

implementation deed (“SID”) and related Transaction

documents:

- IAAC will merge with and into BTH Merger Sub Limited, a Cayman

Islands exempted company which is a direct, wholly owned subsidiary

of Bigtincan Limited (“Merger Sub”), with Merger Sub

continuing as the surviving company of that merger;

- BTH will be acquired by Bigtincan Limited in a scheme of

arrangement, with all of the shares in BTH being exchanged for

ordinary shares in Bigtincan Limited, or, if a cash election

facility is established and a valid cash election has been made by

the applicable BTH shareholder, a cash payment; and

- Bigtincan Limited shares will be listed on the Nasdaq Stock

Market LLC.

Bigtincan shareholders will receive 1 Bigtincan Limited share

for every 30.97 Bigtincan shares held in the Transaction, with the

result that Bigtincan shareholders will own up to ~75%10 of

Bigtincan ordinary shares immediately following the closing of the

Transaction.

A partial cash election facility may be established, under which

Bigtincan shareholders may elect to receive cash consideration for

their shares of US$0.16145 (~A$0.24111) per Bigtincan share,

subject to availability of funds and a scale back mechanism. If

activated, Bigtincan shareholders on the register as of 12:01am

today will be given preferential access for their first 5,000

shares under the cash election facility (meaning those shareholders

will be entitled to receive the cash scheme consideration on those

shares before any pro-rata scale back is applied).

Investcorp will invest US$12.5m (~A$18.7m12) into Bigtincan

Limited as part of the Transaction, the proceeds of which will be

used to fund the partial cash election facility. If additional

funds can be secured which, together with the foregoing PIPE by

Investcorp, aggregate to at least USD$15m, the partial cash

election facility will be activated.

In addition, Bigtincan Limited will seek to raise up to US$25.0m

(~A$37.3m13) of PIPE from institutional investors and up to US$25m

of debt financing to support the Transaction.

Implementation of the Transaction under the Transaction

Documents is subject to the satisfaction (or, where applicable,

waiver) of various conditions precedent, including:

- Bigtincan shareholders passing an advisory resolution at the

Bigtincan 2024 AGM in support of the Transaction (“AGM

Resolution“);

- Foreign Investment Review Board approval in Australia;

- customary conditions to a scheme of arrangement, including

Bigtincan shareholder approval of the scheme (by 75% of the votes

cast and 50% by number of Bigtincan shareholders present and

voting) and Australian court approval of the scheme;

- an independent expert concluding that the Transaction is in the

best interests of Bigtincan shareholders;

- a registration statement of Bigtincan Limited containing a

proxy statement of IAAC and a prospectus for Bigtincan Limited

shares being declared effective by the SEC for the purposes of

obtaining IAAC shareholder approval and registering the Bigtincan

Limited shares being issued in exchange for Bigtincan shares;

- approval by the IAAC shareholders of the Transaction,

Transaction documents and certain other proposals to be presented

at a meeting of IAAC shareholders;

- listing of Bigtincan Limited shares on Nasdaq; and

- there being no material adverse effect, prescribed occurrence

or breach of representations and warranties in respect of any party

to the transaction documents.

The SID contains reciprocal customary exclusivity provisions

(including ‘no-shop’, ‘no-talk’ and due diligence restrictions, and

a notification obligation). IAAC also has a matching right.

No break fee is payable by Bigtincan to IAAC (and vice versa) if

the AGM Resolution is not passed and the Transaction Documents are

terminated. If the AGM Resolution is passed, then Bigtincan and

IAAC may each be liable to pay a break fee to the other of US$2.75

million in the circumstances outlined in the SID.

Approval of the AGM Resolution does not mean the Transaction

will occur as it will remain subject to other conditions precedent,

including approval by Bigtincan shareholders at a subsequent scheme

meeting.

Unanimous Recommendation of the Directors

The board of directors of IAAC considers entry into the BCA and

the SID to be in the best interests of IAAC’s shareholders and

unanimously recommends that IAAC’s shareholders vote in favor of

the Transaction.

Indicative Timing and Next Steps

IAAC shareholders do not need to take any action at this

stage.

A registration statement on Form F-4 of Bigtincan Limited (the

“Registration Statement”) will be filed with the U.S.

Securities and Exchange Commission (the “SEC”), which will

contain a proxy statement of IAAC to solicit IAAC shareholder

approval at an extraordinary general meeting of IAAC shareholders

and a prospectus of Bigtincan Limited to register the Bigtincan

Limited shares to be issued in connection with the Transaction.

Once the SEC has declared the Registration Statement effective, it

will be promptly mailed to IAAC’s shareholders, along with a proxy

card for each IAAC shareholder entitled to vote at the

extraordinary general meeting.

About IAAC (NASDAQ:IVCA)

Investcorp AI Acquisition Corp. (IAAC) is a blank check company

that was formed for the purpose of effecting a merger,

amalgamation, share exchange, asset acquisition, share purchase,

reorganization or similar business combination with one or more

businesses or entities. IAAC is focusing on AI related investments

to take advantage of the impact of AI in the global economy.

Investcorp Overview

Investcorp is a global investment manager, specializing in

alternative investments across private equity, real assets and

credit. Founded in 1982, Investcorp focuses on generating

attractive returns for clients while creating long-term value in

investee companies and for shareholders as a prudent and

responsible investor. Investcorp has today 14 offices across the

US, Europe, GCC and Asia, including India, China, Japan, and

Singapore. Currently, Investcorp Group has approximately US$53

billion in total AUM, including assets managed by third party

managers, and employs approximately 500 people from 50

nationalities globally across its offices.

Investcorp have provided Bigtincan with a view to its strategic

investment strategy in AI technologies whereby they see the

Bigtincan business becoming an important cornerstone of their

investment portfolio in and around the AI space. Investcorp has

indicated that, if the Transaction is implemented, it intends to

help grow the Bigtincan business in the US and globally, as a

recognized leader in AI powered sales enablement.

Investcorp has sponsored the creation of Investcorp AI

Acquisition Corp. which is focused on identifying globally leading

AI technologies and assets and creating a leading global provider

of AI technologies with Bigtincan as a cornerstone of that

strategy. Investcorp has provided guidance that it intends to

establish an AI Technology Development Centre in Hobart Tasmania

based around existing Bigtincan resources.

Bigtincan Overview

Bigtincan is a leading software development group focused on the

sales enablement and engagement market. The company provides a

comprehensive range of tools for Sales Content Management

(Bigtincan Content Hub), Sales Readiness (Learning Hub) and Sales

Engagement (Engagement Hub). These Hubs and associated technologies

and features are used primarily by larger enterprise organisations

looking to create a better sales experience for their customers in

today’s more digital and remote world.

Bigtincan operates globally with users in over 50 countries and

with a solution localised into more than 40 languages. The business

continues to expand its global footprint while maintaining its

registered head office in Sydney, Australia. The global

go-to-market strategy continues to be led from Boston,

Massachusetts, USA, with sales resources throughout the USA, as

well as customer facing resources in Tokyo, London, Copenhagen, and

throughout the USA as well as in Sydney.

Bigtincan services in excess of 100 Fortune 500 Companies as

clients and has over 2,000 customer deployments globally.

Advisors

Jett Capital Advisors LLC and Henslow Pty Ltd are serving as

financial advisors to Bigtincan. Gilbert + Tobin and A&O

Shearman are serving as legal counsel to Bigtincan. Clayton Utz and

Winston & Strawn LLP are serving as legal counsel to

Investcorp.

The above information is not and is not intended to constitute

financial advice, or an offer or an invitation, solicitation or

recommendation to acquire or sell Bigtincan Holdings Limited

shares, IAAC securities, or other financial products in any

jurisdiction and is not a disclosure document or other offering

document under Australian law, U.S. law, or any other applicable

law. Actual results, performance or achievements of the Bigtincan

Holdings Limited, Bigtincan Limited, or IAAC could be materially

different from those expressed in, or implied by, any

forward-looking statements contained herein. This information is

for information purposes only.

The above information does not constitute (i) a solicitation of

a proxy, consent or authorization with respect to any securities or

in respect of the Transaction described herein or (ii) an offer to

sell, a solicitation of an offer to buy or a recommendation to

purchase, any security of Bigtincan, IAAC, any of their respective

affiliates or any entities formed for the purposes of consummating

the Transaction. Any such offering of securities will only be made

by means of a registration statement (including a proxy

statement/prospectus) filed with the SEC after such registration

statement becomes effective. No offering of securities shall be

made except by means of a prospectus meeting the requirements of

the U.S. Securities Act of 1933 (U.S. Securities Act).

This press release includes certain statements that are not

historical facts but are forward-looking statements for purposes of

the safe harbor provisions under the United States Private

Securities Litigation Reform Act of 1995. Forward-looking

statements are generally accompanied by words such as “believe,”

“may,” “will,” “estimate,” “continue,” “anticipate,” “intend,”

“expect,” “should,” “would,” “plan,” “predict,” “potential,”

“seem,” “seek,” “future,” “outlook,” and similar expressions that

predict or indicate future events or trends that are not statements

of historical matters. These forward-looking statements are based

on various assumptions, whether or not identified in this press

release, and on current expectations of the respective management

of Bigtincan Holdings Limited or IAAC and are not predictions of

actual performance. These forward-looking statements are provided

for illustrative purposes only and are not intended to serve as,

and must not be relied on as, a guarantee, an assurance, a

prediction or a definitive statement of fact or probability. Actual

events and circumstances are difficult or impossible to predict and

will differ from assumptions. Many actual events and circumstances

are beyond the control of Bigtincan Holdings Limited or IAAC.

Potential risks and uncertainties that could cause the actual

results to differ materially from those expressed or implied by

forward-looking statements include, but are not limited to: the

outcome of any legal proceedings that may be instituted in

connection with the Transaction, delays in obtaining or the

inability to obtain necessary regulatory approvals or complete

regulatory reviews required to complete the Transaction, the risk

that the Transaction disrupts current plans and operations, the

inability to recognize the anticipated benefits of the Transaction,

which may be affected by, among other things, competition, the

ability of Bigtincan Limited to grow and manage growth profitably

with customers and suppliers and retain key employees, costs

related to the Transaction, the risk that the Transaction does not

close in the first quarter of 2025 or at all, changes in applicable

laws or regulations, the possibility that Bigtincan or IAAC may be

adversely affected by other economic, business, and/or competitive

factors, economic uncertainty caused by the impacts from the

conflict in Russia and Ukraine and rising levels of inflation and

interest rates, the risk that the approval of Bigtincan

shareholders of the Transaction is not obtained, the risk that the

approval of the shareholders of IAAC for the Transaction is not

obtained, the risk that the PIPE is not completed prior to the

closing of the Transaction or at all, the risk that even if the

PIPE is completed, it will not be sufficient to fund the execution

of Bigtincan’s business plan, the amount of redemption requests

made by IAAC’s shareholders and the amount of funds remaining in

IAAC’s trust account after the satisfaction of such requests,

Bigtincan’s and IAAC’s ability to satisfy the conditions to closing

of the Transaction, the risks discussed in Bigtincan’s public

reports filed with the ASX, and the risks discussed in IAAC’s

public reports filed with the SEC, including its Annual Report on

Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on

Form 8-K, as well as preliminary and definitive proxy

statements/prospectuses that Bigtincan Limited, IAAC and/or

Bigtincan intend to file with the SEC in connection with the

Transaction. If any of these risks materialize or Bigtincan’s or

IAAC’s assumptions prove incorrect, actual results could differ

materially from the results implied by these forward-looking

statements. There may be additional risks that neither Bigtincan or

IAAC presently know or that Bigtincan or IAAC believe are

immaterial, that could also cause actual results to differ from

those contained in the forward-looking statements. In addition,

forward-looking statements reflect Bigtincan’s and IAAC’s

expectations, plans, or forecasts of future events and views as of

the date of this press release. Bigtincan and IAAC anticipate that

subsequent events and developments may cause their assessments to

change. Bigtincan and IAAC specifically disclaim any obligation to

update or revise any forward-looking statements, except as required

by law. These forward-looking statements should not be relied upon

as representing Bigtincan’s or IAAC’s assessments as of any date

subsequent to the date of this press release. Accordingly, undue

reliance should not be placed upon the forward-looking

statements.

None of Bigtincan Holdings Limited, Bigtincan Limited, Merger

Sub, or IAAC warrants or represents that the above information is

free from errors, omissions or misrepresentations or is suitable

for your intended use. The above information has been prepared

without taking account of any person’s investment objectives,

financial situation or particular needs and nothing contained in

the above information constitutes investment, legal, tax or other

advice. The above information may not be suitable for your specific

needs and should not be relied upon by you in substitution of you

obtaining independent advice. Subject to any terms implied by law

and which cannot be excluded, Bigtincan Holdings Limited accepts no

responsibility for any loss, damage, cost or expense (whether

direct or indirect) incurred by you as a result of any error,

omission or misrepresentation in the above information.

In connection with the Transaction, the parties intend to file

with the SEC a registration statement on Form F-4 containing a

preliminary proxy statement of IAAC and a preliminary prospectus of

Bigtincan Limited, and after the registration statement is declared

effective, IAAC will mail a definitive proxy statement/prospectus

and proxy cards relating to the Transaction to its shareholders

entitled to vote at the extraordinary general meeting to be called

by IAAC related to the proposed Transaction. This presentation is

not a substitute for the Form F-4, the proxy statement/prospectus,

or any other document that Bigtincan Holdings Limited, Bigtincan

Limited, or IAAC may file with the SEC or ASX or send to their

respective shareholders in connection with the proposed Transaction

and does not contain all the information that should be considered

concerning the Transaction and is not intended to form the basis of

any investment decision or any other decision in respect of the

Transaction. IAACʼs shareholders and other interested persons are

advised to read, when available, the preliminary proxy

statement/prospectus and the amendments thereto and the definitive

proxy statement/prospectus and other documents filed in connection

with the Transaction, as these materials will contain important

information about Bigtincan, IAAC and the Transaction. When

available, the definitive proxy statement/prospectus and other

relevant materials for the Transaction will be mailed to

shareholders of IAAC as of a record date to be established for

voting on the Transaction. Shareholders will also be able to obtain

copies of the preliminary proxy statement/prospectus, the

definitive proxy statement/prospectus and other documents filed

with the SEC, without charge, once available, at the SECʼs website

at www.sec.gov, on IAAC’s website at www.investcorpspac.com or by

directing a request to: Investcorp AI Acquisition Corporation,

Century Yard, Cricket Square, Elgin Avenue, PO Box 1111, George

Town, Grand Cayman, Cayman Islands KY1-1102 (phone number: +1 (345)

949-5122).

IAAC and its directors and executive officers may be deemed

participants in the solicitation of proxies from its shareholders

with respect to the Transaction. Investors and shareholders may

obtain more detailed information regarding the names, affiliations,

and interests of IAAC’s executive officers and directors by reading

IAAC’s Annual Report on Form 10-K for the fiscal year ended

December 31, 2023 and its subsequent filings under the U.S.

Securities Exchange Act of 1934, as amended, the proxy

statement/prospectus when it becomes available, and other relevant

materials that will be filed with the SEC in connection with the

proposed Transaction when they become available. . Information

concerning the interests of the IAAC’s participations in the

solicitation, which may, in some cases, be different than those of

the IAAC shareholders generally, will be set forth in the proxy

statement/prospectus relating to the proposed Transaction when it

becomes available. Bigtincan and its directors and executive

officers may also be deemed to be participants in the solicitation

of proxies from the shareholders of IAAC in connection with the

Transaction. A list of the names of such directors and executive

officers and information regarding their interests in the

Transaction will be included in the proxy statement for the

Transaction when available.

INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN

APPROVED OR DISAPPROVED BY THE SEC, ANY STATE SECURITIES COMMISSION

OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON

OR ENDORSED THE MERITS OF THE OFFERING OR THE ACCURACY OR ADEQUACY

OF THE INFORMATION CONTAINED HEREIN. ANY REPRESENTATION TO THE

CONTRARY IS A CRIMINAL OFFENSE.

1 A special purpose acquisition company. 2 US$275 million

valuation is based on 851.5 million BTH shares outstanding

(assuming exercise of outstanding in-the-money options and rights),

the exchange ratio of 1 Bigtincan Limited share for every 30.97 BTH

shares under the BCA and the SID, and the US$10 per Bigtincan

Limited share price of Investcorpʼs US$12.5 million investment in

Bigtincan Limited. There can be no assurances that Bigtincan

Limited shares will trade at or above US$10 following completion of

the transaction. 3 Based on US$275 million divided by 851.5 million

BTH shares, converted to AUD at an assumed AUD/USD exchange rate of

AUD1/USD0.67. 4 Assumes an AUD/USD exchange rate of 0.67. 5 Assumes

an AUD/USD exchange rate of 0.67. 6 Private Investment in Public

Equity. 7 Assumes an AUD/USD exchange rate of 0.67. 8 There is no

certainty that this cash election opportunity will be available. 9

This percentage assumes no cash election facility, US$37.5M of PIPE

investment at US$10 per Bigtincan Limited share, that 952,291

Bigtincan Limited shares are issued in exchange for performance

rights, service rights and employee options, and 100% redemptions

of IAAC shares, other than 5,500,000 shares held by the sponsor of

IAAC. 10 This percentage assumes no cash election facility,

US$37.5M of PIPE investment at US$10 per Bigtincan Limited share,

that 952,291 Bigtincan Limited shares are issued in exchange for

performance rights, service rights and employee options, and 100%

redemptions of IAAC shares, other than 5,500,000 shares held by the

Investcorp IAAC sponsor. 11 Assumes an AUD/USD exchange rate of

0.67. 12 Assumes an AUD/USD exchange rate of 0.67. 13 Assumes an

AUD/USD exchange rate of 0.67.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241021452831/en/

North America InvestcorpPR@icrinc.com

International / GCC Firas El Amine +973 175 15404

felamine@investcorp.com

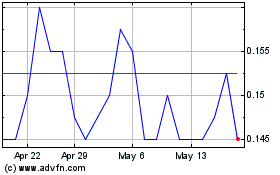

Bigtincan (ASX:BTH)

Historical Stock Chart

From Jan 2025 to Feb 2025

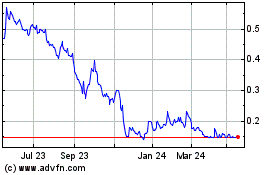

Bigtincan (ASX:BTH)

Historical Stock Chart

From Feb 2024 to Feb 2025