UPDATE: Energy Resources Of Australia Profit Tumbles

December 20 2010 - 10:33PM

Dow Jones News

Energy Resources of Australia Ltd. (ERA.AU) on Tuesday sounded a

reserves downgrade after test drilling at its Ranger mine in the

Northern Territory confirmed recent poor quality ore discoveries.

It also forecast a weak annual profit, capping off a bad year for

the uranium miner.

The Rio Tinto Ltd. (RIO.AU) subsidiary slashed production

guidance several times this year after encountering disappointing

ore grades at Ranger, which aside from being the world's second

biggest uranium mine by production is also running out of ore.

The production downgrades forced ERA to buy uranium oxide from

external providers to meet contracted deliveries. While uranium

prices are at cyclical lows, margins from selling third party ore

aren't high enough to cover the company's costs of production.

On Tuesday it forecast net profit for the year to Dec. 31 of

between A$45 million and A$55 million, down sharply from A$272.6

million in 2009. Slightly lower realized uranium prices and a

strong Australian dollar contributed to the slide.

Chief Executive Rob Atkinson suggested that production in 2011

could increase from this year's low, but said extra analysis is

needed before more solid guidance can be provided.

"I would hope that we'll be able to produce more than what we've

done this year," Atkinson told Dow Jones Newswires.

Persistent low-grade discoveries prompted ERA in October to

launch a drilling program to test the quality and volume of ore for

the remainder of the mine's life.

After drilling 42 holes, it reduced its reserves estimate for

Ranger by about 2,400 metric tons, compared to 108,152 tons of

reserves at the end of 2009.

ERA has guided for annual production of 3,900 tons. Adding this

to the 2,400 ton downgrade would reduce the mine's reserves to

101,852 tons by year end.

Atkinson said that Ranger's current open pit is still due to

close by late 2012 or early 2013, from which point it will sell

stockpiled ore while expansion options are considered.

In the meantime, the test drilling has shown the company the

best places to mine. Atkinson, however, wasn't upbeat about the

overall quality of the remaining ore body.

"I don't think there's terribly much upside on this, but it does

give us certainty for the next couple of years," he said.

ERA is considering an expansion in which it would plunder an

untapped 30,000-40,000 ton resource in the Ranger 3 Deeps mineral

deposit. A decision on whether to proceed with a "decline", or

underground tunnel, to test the resource is expected "in the coming

months", Atkinson said.

Darwin-based ERA is also preparing a draft environmental impact

statement for a proposed heap leach facility, which would use acid

filtration to extract minerals from poor quality ore.

The EIS is on track for release to lawmakers by the end of the

first quarter of 2011, Atkinson said.

At 0400 GMT, ERA shares were down 9% at A$12.00, bringing their

fall for the year to 50%.

-By Ross Kelly, Dow Jones Newswires; 61-2-8272-4692;

Ross.Kelly@dowjones.com

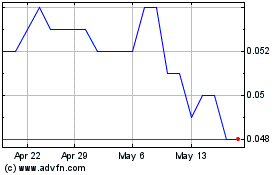

Energy Resources Of Aust... (ASX:ERA)

Historical Stock Chart

From Jan 2025 to Feb 2025

Energy Resources Of Aust... (ASX:ERA)

Historical Stock Chart

From Feb 2024 to Feb 2025