ADM Announces Package of Enhanced Commitments for GrainCorp Acquisition

November 26 2013 - 7:00PM

Business Wire

Pledges additional A$200 million investment in

agricultural infrastructure

Addresses pricing, access, stocks

information

Archer Daniels Midland Company (NYSE: ADM) today announced a

package of additional commitments related to its proposed

acquisition of GrainCorp Limited (ASX: GNC). Key elements of that

package are:

- An additional A$200 million investment

to strengthen Australian agricultural infrastructure, with specific

emphasis on rail enhancement projects;

- Price caps on grain handling charges at

silos and ports;

- Commitment to grain infrastructure

access for growers and third parties;

- Commitment to “open access” regime for

port services;

- A grower and community advisory board

with representation from New South Wales, Victoria and Queensland,

as well as regular public grower consultation; and

- Support for expanded grain stocks

information arrangements.

“Throughout our effort to secure approvals for our proposed

acquisition of GrainCorp, we have worked constructively to create

value for grain growers and the Australian economy as well as

shareholders of GrainCorp and ADM,” said Ian Pinner, president, ADM

Grain. “We have had substantive discussions with growers,

policymakers and other stakeholders, and we’ve been committed to

finding common ground and developing solutions that address issues

and opportunities that have been raised.

“Taking into account the feedback we received, we are committing

to a further package of investments and initiatives to help ensure

that Australian agriculture is able to serve a key role in meeting

growing global demand.

“These commitments are in addition to the existing capital

expenditure and other commitments we have set out in our Bidder’s

Statement, which included a A$50 million enhancement to GrainCorp’s

planned capital expenditure over the next few years. The additional

capital investment that ADM will bring to GrainCorp represents a

100 percent increase in GrainCorp’s original A$250 million capital

expenditure budget prior to ADM’s proposal. Taken together, the

capital investments ADM has committed to support or make for the

GrainCorp business total A$500 million.”

ADM is making commitments in the areas of:

Pricing and cost

- Increases in GrainCorp’s overall grain

handling and storage charges will be capped to inflation for a

period of three years.

- In the case of silo handling charges,

this will be measured by CPI (consumer price index); and

- In the case of port-based handling

charges, this will be measured by AWOTE (average weekly ordinary

time earnings).

Access and competition

- GrainCorp’s port services will be

operated in accordance with the current “open access” regime and

the mandatory industry code of conduct when finished.

- Current access arrangements will be

continued for GrainCorp’s upcountry silos. This means:

- Continuing to provide, to GrainCorp and

third parties, access to GrainCorp’s operational upcountry storage

and transportation services;

- Continuing to make available, to third

party grain marketers, available storage capacity at GrainCorp’s

operational receival sites; and

- Continuing to ensure that prices for

grain for delivery at all GrainCorp receival sites, which are

operational at the relevant time, remain available to growers.

Investment in grain handling and infrastructure

- A$50 million of new investment will be

committed to strategic expenditure in the GrainCorp business in the

next few years. This is over and above the A$250 million program of

investment announced by GrainCorp in November 2012.

- Average annual expenditure on

maintenance and improvement of GrainCorp’s existing portfolio of

assets of between A$40 million and A$60 million.

- An additional A$200 million of capital

expenditure will be exclusively committed to GrainCorp’s Storage

and Logistics business, and its associated infrastructure, over the

next three to five years. The priority of this capital expenditure

will be transformative rail projects that improve supply chain

efficiencies, specifically in areas like:

- Upgrading the silo network to

efficiently handle unit (40 wagon) trains to increase rail capacity

and improve efficiency;

- Work with rail providers to invest in

new generation wagons to increase rail capacity and improve

efficiency (increasing rail wagon payloads from the current net

55-60T per wagon);

- Enhancing silo and grain receival site

efficiencies and handling capability across the network to reduce

turnaround time;

- Working with governments to secure the

future of branch lines by agreeing to co-invest in silo rail

capability on these lines; and

- Constructing new grain handling and

storage locations in areas where investment is needed to improve

the services to growers.

- A proposal to Government on the

establishment of a rail infrastructure fund with the following

features:

- The allocation of seed funding from

ADM’s announced infrastructure investment;

- The provision for matching funding from

the Commonwealth; and

- The ability for other governments,

businesses and individuals to invest in the fund.

Access to stocks information

- GrainCorp will commit to sign up to an

industry-agreed protocol for reporting wheat stocks information

held at an aggregate level of feed or milling grades by port

zone.

- GrainCorp will play an industry

leadership role in encouraging other participants to do

likewise.

Management and engagement

- The headquarters of GrainCorp will

remain in Sydney. Its CEO, who will have oversight of all of

GrainCorp’s operational decisions, will be based in Sydney and will

be supported by GrainCorp’s senior management team.

- A grain marketing team will be

maintained in Australia to maximise the opportunities for

Australian grains and growers, while leveraging the company’s

international marketing network.

- A Grower and Community Advisory Board

will be established, which will include at least four growers (at

least one each from NSW, Victoria and Queensland), at least one

person with a strong connection to regional/rural community

organisations, and senior GrainCorp management.

- A bi-annual consultation forum with

Grower Organisations will also be established, the objective of

which will be to:

- Address the priority issues of concern

to growers in relation to the activities of GrainCorp;

- Discuss any industry-wide policy and

reform proposals which are proposed by government to assist

GrainCorp in formulating a position; and

- Discuss GrainCorp’s community

initiatives and how they can better meet the needs of growers.

“In the competitive global grains market, it makes sense to

operate the most efficient supply chain and maximize utilization of

every location and asset,” Pinner added. “These investments and

commitments—developed following extensive input from Australian

stakeholders—will help ensure the GrainCorp network remains an

attractive option for growers and third-party grain traders, and

also remains a competitive source for global grain buyers.”

The commitments described above would be put into effect upon

the closing of ADM’s proposed acquisition of GrainCorp.

About ADM

For more than a century, the people of Archer Daniels Midland

Company (NYSE: ADM) have transformed crops into products that serve

vital needs. Today, 30,000 ADM employees around the globe convert

oilseeds, corn, wheat and cocoa into products for food, animal

feed, industrial and energy uses. With more than 265 processing

plants, 460 crop procurement facilities, and the world’s premier

crop transportation network, ADM helps connect the harvest to the

home in more than 140 countries. For more information about ADM and

its products, visit www.adm.com.

Archer Daniels Midland CompanyMedia

RelationsJackie Anderson, 217-424-5413media@adm.com

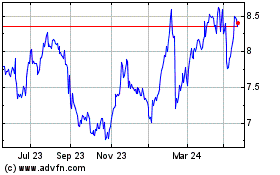

Graincorp (ASX:GNC)

Historical Stock Chart

From Oct 2024 to Nov 2024

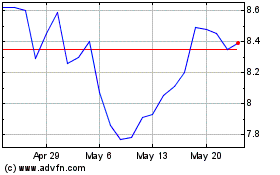

Graincorp (ASX:GNC)

Historical Stock Chart

From Nov 2023 to Nov 2024