UPDATE: Australia's ACCC Maintains Opposition To NAB's Bid For AXA Asia Pacific

September 08 2010 - 11:14PM

Dow Jones News

Australia's competition regulator continued its opposition to

National Australia Bank Ltd.'s (NAB) proposed A$13.3 billion bid

for wealth management company rival AXA Asia Pacific Holdings Ltd.

(AXA.AU) on Thursday, dealing a heavy blow to the bank's plans to

become the country's largest wealth manager.

The latest development in the complex plan by Australia's

fourth-largest bank to split the regional assets of the affiliate

of French insurer AXA SA (AXAHY) also likely stalls AXA's Asian

expansion plans but may open the door for spurned suitor AMP Ltd.

(AMP.AU) to resuscitate its bid, after NAB's efforts to overcome

the regulator's concerns fell short of the mark.

The Australian Competition and Consumer Commission maintained

its April 19 rejection of what would be the biggest deal in

Australia's financial services history, arguing it would crimp

competition in the market for supply of retail investment

platforms--internet portals that link retail investors with the

wide range of investment products that fund management companies

provide.

ACCC Deputy Chairman Peter Kell said in a statement that

undertakings proposed by the bank and AXA APH to onsell the

target's fledgling investment platform North to a smaller local

wealth manager, IOOF Holdings Ltd. (IFL.AU), "do not provide

sufficient certainty that the ACCC's competition concerns will be

addressed".

Because IOOF lacks the infrastructure needed to make North a

competitive force to NAB's Navigator and other market participants'

platforms in its own right, NAB had also promised to provide IOOF

with financial support and technical expertise, and to channel

business its way for three years.

However the ACCC said because NAB and AXA APH have not agreed to

include the distribution network of financial planners or to sell

the financial products that currently support the North platform to

IOOF, there was "considerable uncertainty" that IOOF could become

an effective competitor to the combined NAB-AXA.

"The undertakings as proposed place a heavy reliance upon IOOF

having sufficient distribution capability to provide an effective

competitive constraint upon existing key players in the foreseeable

future," said Kell.

Under NAB's proposal, 55% owner AXA SA would retain the

lucrative Asian assets of AXA APH, while NAB would pay minority

shareholders either A$6.43, or 0.1745 NAB shares and A$1.59 for

each AXA APH share and take ownership of the Australian and New

Zealand businesses. NAB won the necessary support of AXA APH's

independent directors in December, trumping a lower cash and shares

bid from AMP, which would also see the target split along the same

geographic lines.

Shares in AXA APH fell sharply on open, and at 0340 GMT were

down 8.6% or 47 cents at A$4.97, with Goldman Sachs saying NAB is

now likely to throw in the towel on its bid.

"In our view, the most likely option is for NAB to walk away and

pursue an organic acquisition strategy of advisors rather than a

large acquisition," Goldman Sachs analyst Ben Koo said in an early

note to clients.

NAB shares rallied on the outcome, up 3.8% at A$24.87, and while

Koo said it is possible the bank could challenge the decision or

seek to include financial planners in the deal with IOOF, it still

may not change the outcome.

"In the near term, fears of a large capital raising will now

dissipate for NAB however M&A uncertainty will remain an

overhang until NAB clarifies its response to the ACCC decision,"

said Koo.

NAB said earlier it is considering the implications of the

decision and will update the market "as soon as possible".

Unsurprisingly, most of the other major players in the deal also

said they would take some time to consider their position before

commenting on next steps.

A spokesman for AXA SA said the French parent was disappointed

with the ACCC findings but will review the decision more fully

before making further comment, while AXA APH said in a statement

that it "notes" the decision but a spokeswoman wasn't immediately

available for further comment.

For its part, AMP said it welcomed the decision and continues to

see AXA APH as an attractive strategic target but sees no urgency

to make any quick moves. A spokeswoman for AMP said whether the

group will seek fresh talks with AXA SA is "a decision for another

day".

Goldman Sachs analyst Ingrid Groer said AMP "is most likely to

play it tough and try to transfer the pressure onto the AXA APH

board" that rejected its November offer of 0.6896 AMP shares and

A$1.92 cash for each AXA APH share.

Groer said AMP has indicated it won't move to an all-cash offer

nor push its bid, which has already been cleared by the competition

regulator and is currently valued around A$5.37 per AXA APH share,

much higher, so is unlikely to win the support of the target.

"Although, this offer will remain on the table and AXA APH

shareholders may begin to pressure the board if the stock sells off

and the price begins to languish at much lower levels," she said in

a note to clients. AMP shares are down 3 cents at A$5.01.

Meanwhile, AXA SA is likely to be "very frustrated and very keen

to find a way to get its hands on the Asian assets," said Groer,

which could see AXA SA either assist AMP in bumping up its offer or

even engineer a break up itself.

-By Bill Lindsay, Dow Jones Newswires; 61-2-8272-4694;

bill.lindsay@dowjones.com

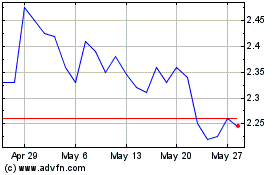

Insignia Financial (ASX:IFL)

Historical Stock Chart

From Jan 2025 to Feb 2025

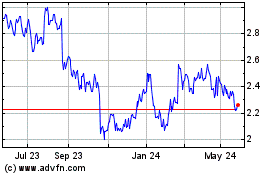

Insignia Financial (ASX:IFL)

Historical Stock Chart

From Feb 2024 to Feb 2025