The Australian government welcomes inward investment from China

and expects it to grow further in coming years but companies need

to approach policy makers before deals are agreed and investments

must maintain a market footing, an official said Thursday.

"If you talk to us early, before deals are signed, sealed and

delivered, we can point out where there may be concerns," Patrick

Colmer, head of Australia's Foreign Investment Review Board, said

in a speech to a China-Australia investment forum in Sydney.

"It is much easier to engage earlier in significant projects,"

he said.

The comments are a firm message for companies to step up their

cooperation with policy makers when considering deals and reminds

China in particular that investments in Australia need to remain

commercially driven.

The investment review board, a unit of Australia's Treasury,

assesses foreign investment proposals but the final decision on

approving such transactions is taken by Treasurer Wayne Swan.

In the past 18 months, the FIRB has reviewed 90 separate Chinese

investment proposals valued at A$34 billion.

One area of concern identified by Colmer is the need to maintain

a market-based system in Australia and he spelled out a preference

for investments that do not involve acquiring an entire company but

didn't rule out approving such takeovers.

"We are keen to see major projects maintain a listing as we

believe listings are important for the development of good sound

businesses," Colmer said.

"Our government has expressed a preference for projects that are

joint projects in various forms. We are much more comfortable when

we see investments that are below 50% for green field and below 15%

for major producers."

However, the government official added that individual

applications will be judged on their own merits.

"We do look at all investment proposals on a case by case basis,

and there are examples where we have accepted quite readily

different arrangements."

The preferred solutions are different forms of cooperation and

partnerships, while at the same time Australia needs to maintain

its position as a reliable supplier of resources to all its

customers, he said.

Among the criteria considered by FIRB in its assessments include

the investor's independence from government, although total

independence is not expected.

"We are looking for evidence it is a true commercially-focused

investment," Colmer said.

"In general, that is our experience with foreign government

investments. We haven't had significant concerns around any of

those."

Colmer was speaking as FIRB continues to mull a string of

investments, the largest of which is Yanzhou Coal Mining Co.'s

A$3.54 billion offer to acquire coal miner Felix Resources Ltd., in

what would be China's largest buyout of an Australian company to

date.

Yanzhou has already had to resubmit its application, although

Felix expects the transaction to be approved in time for a Yanzhou

shareholder vote in mid-October and by Felix shareholders in early

December.

Also being considered is a A$252 million offer by China

Non-Ferrous Metal Mining (Group) Co. to buy a majority stake in

miner Lynas Corp., which has already had to resubmit its investment

application to FIRB three times since the deal was announced on May

1.

Illustrating the Australian government's concerns, earlier

Thursday the Defence Department said it objected to an investment

by Chinese steelmaker, Wugang Australian Resources Pty Ltd., or

Wisco, in Western Plains Resources Ltd. because the company's iron

ore project is in a sensitive military testing zone.

Attracting inward flows is essential for Australia's economic

growth but foreign ownership of the country's assets needs to be

mutually beneficial, Colmer said.

"We are looking for a win-win situation," the FIRB director

said.

Controversy around investments is not unusual, though it is

important to maintain public support. "We are trying to maintain an

orderly flow of investment, while balancing a need to maintain

public support for foreign investment," he said.

Australia has experienced "waves" of investment from various

countries, including the U.K. and U.S. over recent decades, all of

which have generated controversy and which make current concerns

over China investment not unusual, the FIRB director noted.

"Generally it is something that proceeds without any due

concerns," Colmer said.

Using FIRB's own data, it's likely that China was the third

largest investor in Australia in the 2008-2009 fiscal year, after

the U.S. and U.K.

"It's probably going to go higher than that in future years,"

Colmer said.

"We do welcome Chinese investment. The government is keen to see

that continue. The government is also keen to maintain Australia's

national interest."

Also, companies should stop attempting to heavy hand the

government through legal interventions as it's not effective, he

said.

"We are here, we are happy to work with companies, talk with us

early, don't turn it into a legal (battle) and deal with us the way

we like to deal with you, which is in confidence," Colmer said.

Meanwhile, China's Ambassador to Australia said the detention of

Rio Tinto Ltd. employee Stern Hu will not damage relations between

both countries and said it is a one-time, isolated incident.

"It will not affect any relationship between China and

Australia," Ambassador Zhang Junsai told reporters.

-By Enda Curran, Dow Jones Newswires;

61-2-8272-4687; enda.curran@dowjones.com

(David Winning in Sydney and Alex Wilson in Melbourne

contributed to this article)

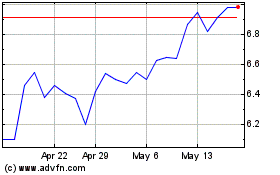

Lynas Rare Earths (ASX:LYC)

Historical Stock Chart

From Oct 2024 to Nov 2024

Lynas Rare Earths (ASX:LYC)

Historical Stock Chart

From Nov 2023 to Nov 2024