NAB Full Year Profit Rises 8.3% -- Update

November 08 2022 - 4:24PM

Dow Jones News

By Alice Uribe

SYDNEY--National Australia Bank Ltd. said rising interest rates

helped its annual profit to increase by 8.3%, with the lender

lifting its final dividend by 16%.

The bank said net profit for the 12 months through September

rose to 6.89 billion Australian dollars (US$4.48 billion). Analysts

had expected a full-year net profit of A$7.16 billion, according to

FactSet's consensus estimate.

"An ongoing focus on strong balance sheet settings has been key

to delivering sustainable growth and keeping the bank safe," Chief

Executive Ross McEwan said. "After 11 years of interest rate

reductions, earnings have also benefited in FY 2022 from the rising

interest rate environment."

Directors of the company raised its final dividend by 16% to

A$0.78 per share, compared with A$0.67 last year.

Cash earnings--a profitability measure tracked closely by

analysts--rose by 8.3% to A$7.10 billion. Stripping out the impact

of the Citi consumer business acquired in June, revenue rose by

7.8%, which the lender said reflected higher volumes and slightly

higher margins excluding its Markets & Treasury unit.

NAB's Corporate and Institutional banking unit was a standout

with annual cash earnings up 35% to A$1.63 billion, while the

Business and Private Banking unit's cash earnings rose 22% to

A$3.01 billion. Still, NAB's Personal Banking unit's cash earnings

fell by 3.6% to A$1.60 billion, which the lender attributed to

margin pressure from home lending.

NAB's full-year net interest margin--the difference between the

interest income generated and the amount of interest paid out to

lenders--fell 6 basis points to 1.65%, but on an adjusted basis it

rose 1 basis point. The lender said this primarily reflected higher

earnings on deposits and capital as a result of the rising interest

rate environment, but said this was mostly offset by mortgage

competition.

"In home lending, process and technology improvements and

further development of our simple and digital home loan platform

are delivering better service outcomes in FY 2022. Unconditional

approval times reduced compared with FY 2021," said NAB.

The lender sees the Australian mortgage market changing in the

future, with credit demand slowing and a push toward refinancing,

which will increase competitive pressure between lenders.

"While there are a number of uncertainties in the outlook, the

most likely scenario has forecast inflation peaking in the December

2022 quarter before easing through 2023," said NAB. "This would see

the cash rate peak at 3.60% in March 2023, but a more inflationary

outcome would likely mean greater monetary policy tightening and a

more pronounced economic correction."

The group's Common Equity Tier 1 capital ratio was 11.51% at the

end of September, compared with 13% the previous year.

Write to Alice Uribe at alice.uribe@wsj.com

(END) Dow Jones Newswires

November 08, 2022 17:09 ET (22:09 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

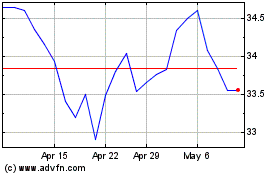

National Australia Bank (ASX:NAB)

Historical Stock Chart

From Dec 2024 to Jan 2025

National Australia Bank (ASX:NAB)

Historical Stock Chart

From Jan 2024 to Jan 2025