Origin Energy Sells Gas Project to LNG Venture for A$231 Million

February 18 2019 - 10:16PM

Dow Jones News

By Robb M. Stewart

MELBOURNE, Australia--Origin Energy Ltd. (ORG.AU) has struck a

231 million Australian dollars (US$165 million) deal to sell a

coal-seam gas development in eastern Australia to its flagship

liquefied natural gas venture.

Origin said Tuesday it has entered an agreement to sell the

Ironbark project in Queensland's Surat Basin to Australia Pacific

LNG, a gas-export business it operates in partnership with

ConocoPhillips (COP) and China Petroleum & Chemical Corp.

(600028.SH).

The energy producer and retailer bought the project in 2009 for

A$655 million, but a year ago warned it would book a A$360 million

impairment for the gas field. Late last year, the company said it

was looking at strategic options for the assets but had agreed to

push ahead with basic engineering design for the first phase of

development.

Based on the sale price, Origin said it expected to book a

further impairment of A$34 million in its first-half financial

statements, though the impact on profit would be offset by a A$68

million benefit to its tax expense.

As operator of Australia Pacific LNG, one of three multi-billion

dollar liquefied natural gas producers sitting side-by-side on

Queensland's coast, Origin will be responsible for developing

Ironbark.

Chief Executive Frank Calabria said the LNG venture would be

able to realize value on the asset by making use of existing nearby

gas and water processing infrastructure to bring the natural gas to

the market.

Ironbark has proven and probable reserves of 129 petajoules, a

measure of volume based on energy content.

The sale remains subject to regulatory approval.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

February 18, 2019 23:01 ET (04:01 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

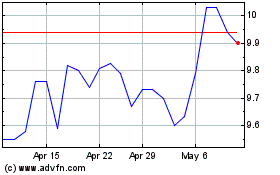

Origin Energy (ASX:ORG)

Historical Stock Chart

From Oct 2024 to Nov 2024

Origin Energy (ASX:ORG)

Historical Stock Chart

From Nov 2023 to Nov 2024

Real-Time news about Origin Energy Limited (Australian Stock Exchange): 0 recent articles

More Origin Ene Fpo News Articles