U. K. 10-Year Gilt Yields Falls Below 1%

June 27 2016 - 6:40AM

Dow Jones News

Investors piling into safe-haven assets pushed the yield on

10-year U.K. government debt below 1% for the first time ever on

Monday.

The 10-year gilt yield fell around 0.17 of a percentage point to

0.94% during European morning trade, according to Tradeweb.

The yield on this debt has now dropped over 0.4 of a percentage

point since Britain voted to leave the European Union on Thursday,

a vote that sparked a rapid rise in the value of ultrasafe

government bonds around the world.

"It is a flight to quality effect," said Olivier De Larouziè re,

head of interest rates at Natixis Asset Management.

Investors are selling equities and riskier corporate bonds and

heading for the safety of sovereign debt, he added.

Investors continued to sell down the British pound and U.K.

stocks, particularly financial shares, Monday after steep falls at

the end of last week. The FTSE 250 was down 3.5% recently, while

the pound fell to its lowest level against the dollar since 1985

during morning trading.

Shares in Barclays PLC and Lloyds Banking Group PLC were down

10% and 8.3% respectively.

Money poured into other haven government debt. The yield on

10-year German debt was around 0.04 percentage point lower at minus

0.1%, while the yield on the 10-year Treasury note fell to 1.47%

from Friday's close of 1.58%.

In the run-up to the referendum, investors had been split on

which direction gilts would trade if Britain voted to leave the

EU.

Some argued international investors would shun all U.K. assets

and sell gilts, while others predicted British government debt

would keep its haven status and rally as funds continued to dial

back risk.

So far, the haven argument has won. Investors looking for a safe

place to park their money have pushed yields lower.

"You are not seeing any indication of a buyer flight pushing up

yields," said Jacob Nell, an economist at Morgan Stanley. "As the

pound weakens, U.K. assets become more attractive."

But uncertainty about what the Bank of England will do with

interest rates is also making investors wary.

The Bank of England will be torn between lowering interest rates

to provide relief to the economy from any adverse consequences of

exiting the EU, and raising them to defend the pound.

Gilts would benefit further from lower interest rates, while

tighter monetary policy would likely hit the market.

Gov. Mark Carney on Friday moved swiftly to reassure markets

that the central bank stood ready to backstop the financial system

should nervousness about the vote spread. He said the BOE has lined

up at least £ 250 billion ($342 billion) of financing for banks

that need it and has arrangements in place with other central banks

that allow it to provide cash in a variety of currencies.

Mr. Carney will detail the BOE's latest thinking on the

stability of the financial system when he presents the central

bank's biannual financial stability report July 5. The interest

rate-setting Monetary Policy Committee's next scheduled

announcement on interest rates is on July 14.

As most British financial markets plummeted, U.K. Treasury Chief

George Osborne moved to reassure households, businesses and

financial markets that the U.K. economy remains resilient.

"I'm going to work very hard to make sure we mitigate the impact

and remind people of the fundamental strengths of the British

economy," he told reporters.

In the run up to last week's vote, Mr. Osborne had repeatedly

warned there will be an "inevitable adjustment" as uncertainty the

U.K.'s future prospects dents spending and investment. That could

weaken growth and hit public finances, Mr. Osborne said.

"As I said before the referendum, this will have an impact on

the economy and the public finances, and there will need to be

action to address that," Mr. Osborne said on Monday.

Jon Sindreu contributed to this article.

Write to Christopher Whittall at christopher.whittall@wsj.com

and Jason Douglas at jason.douglas@wsj.com

(END) Dow Jones Newswires

June 27, 2016 07:25 ET (11:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

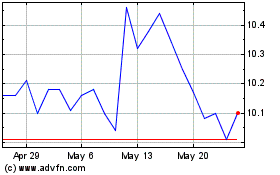

Pacific Current (ASX:PAC)

Historical Stock Chart

From Oct 2024 to Nov 2024

Pacific Current (ASX:PAC)

Historical Stock Chart

From Nov 2023 to Nov 2024