Piedmont Expands Spodumene Resources Through Investments in IronRidge Resources

July 01 2021 - 6:00AM

Business Wire

Supports Piedmont’s Plan to Become America’s

#1 Producer of Lithium Hydroxide

- PLL to acquire 9.47% of IronRidge Resources (“IRR”) and a 50%

interest in IRR’s Ghana-based lithium portfolio

- $15mm equity placement and 50% project interest to be earned

through staged investments over 3-4 years

- Binding supply agreement for 50% of IRR’s planned Ghanaian

spodumene concentrate (“SC6”) production

- The IRR Ghana SC6 supply will support staged growth in

Piedmont’s lithium hydroxide production

- Feasibility Study of Carolina Lithium’s integrated 30,000 t/y

LiOH on track for September 2021

- 30,000 t/y integrated LiOH project in Quebec to be evaluated

jointly with Sayona Mining

- IRR SC6 supply provides optionality for incremental 30,000 t/y

LiOH capacity at a site to be determined

- Hydroxide capacity to be developed in stages to minimize

execution and funding risks

Piedmont Lithium Inc. (Nasdaq: PLL, ASX: PLL) is pleased

to announce that it has entered into definitive agreements (the

“Agreements”) to establish a strategic partnership with IronRidge

Resources (“IRR”) (AIM: IRR) through the purchase of an equity

stake in IRR, staged project investments to earn a 50% interest in

IRR’s Ghana-based lithium portfolio (“IRR Ghana”), and a binding

supply agreement for 50% of IRR Ghana’s planned spodumene

concentrate (“SC6”) production.

IRR Ghana has an impressive portfolio of spodumene prospects,

anchored by the highly promising Ewoyaa Project (the “Ewoyaa

Project”). The Ewoyaa Project has a current Mineral Resource of

14.5Mt @ 1.31% Li2O with vast exploration potential.1 The Ewoyaa

Project has the potential to be a large, low-cost spodumene

concentrate (“SC6”) producer.

In January 2021, IRR published a scoping study for the Ewoyaa

Project forecasting an average of 295,000 t/y of planned SC6

production, a $345 million after-tax net present value and an

after-tax internal rate of return of 125%, for initial capital

investment of $70 million.2 The Ewoyaa Project capitalizes on its

excellent location less than one mile from a major national highway

and only 70 miles to the major port of Takoradi. The site is also

directly adjacent to high voltage power and is expected to have a

low environmental impact due to reliance on solar and hydroelectric

generating capacity to power the facility. Piedmont conducted

extensive due diligence over the past several months, including

through site visits to Ghana, and believes that IRR Ghana has

significant upside potential.

Piedmont will invest approximately $15 million (£10.8mm) to

acquire a 9.47% equity interest in IRR (the “Subscription”) and

will appoint one director to IRR’s Board of Directors. Piedmont

will also have the opportunity to earn a 50% stake in IRR Ghana by

investing (i) $17 million to fund ongoing exploration and a

definitive feasibility study over the next 24 months to earn an

initial 22.5% project interest, and (ii) a further $70 million in

2023-2025 to fund the construction of the Ewoyaa Project to earn an

additional 27.5% project interest, which would bring the total to

50% ownership in IRR Ghana (together, the “Project Investment”).

Piedmont and IRR have also entered into a binding SC6 supply

agreement (the “Supply Agreement”), conditioned on Piedmont

completing its earn-in obligations, pursuant to which IRR will

supply Piedmont 50% of IRR Ghana’s planned SC6 production

(currently estimated to be 147,500 t/y) at market prices on a

life-of-mine basis.

The Subscription is expected to close in August 2021 subject to

satisfaction of conditions precedent with the Project Investment

expected to be staged over a three-to-four-year period leading to

initial production in 2025. . Summary of Transaction Terms are

available on the company website.

Keith D. Phillips, President and Chief Executive Officer,

commented: “We are very pleased to announce a partnership with

IronRidge Resources to jointly develop their outstanding spodumene

project portfolio in Ghana. We consider IRR’s Ewoyaa Project to be

among the world’s most promising spodumene projects. The high-grade

mineral resource is currently modest in scale but offers

substantial exploration potential, and the project is very

well-located, being only 70 miles from a major port. Ewoyaa builds

on Piedmont’s strategic commitment to be a large-scale and low-cost

producer of lithium hydroxide from spodumene concentrate sourced

from diverse sustainable resources in favorable jurisdictions.

“Ghana is one of Africa’s most successful nations, with a strong

mining tradition and an increasingly diverse economic base. In

naming Ghana as the headquarters for its entire African business

earlier this year, Twitter described Ghana as a ‘Champion for

Democracy’. Euler-Hermes regularly rates Ghana among the

lowest-risk jurisdictions in the region, and Transparency

International rates Ghana ahead of other lithium-rich countries

such as Argentina, China, Brazil, Mexico, Bolivia, Mali, and the

DRC in its annual corruption perception rankings.

“2021 has been a transformative year for Piedmont. We have built

the world’s premier lithium development leadership team,

significantly expanded our world-class Carolina Lithium Project,

and become a multi-asset company through strategic investments in

Quebec and in Ghana. We raised sufficient capital in March 2021 to

comfortably fund these strategic initiatives as well as our

definitive feasibility study in North Carolina and should end 2021

with a robust cash balance. We will now evaluate plans to

capitalize on our expanded spodumene resource base to become a

larger producer of the battery-quality lithium hydroxide that

America will require to power the ongoing transition to electric

vehicles. Lithium has been called ‘the irreplaceable element of the

electric era,’ and we will bring large-scale production of lithium

hydroxide to America.”

Click here to view the complete release.

1 Refer to IRR announcement dated January

28, 2020.

2 Refer to IRR announcement dated January

19, 2021.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210701005269/en/

For further information: Keith Phillips President &

CEO T: +1 973 809 0505 E: kphillips@piedmontlithium.com

Brian Risinger VP - Investor Relations and Corporate

Communications T: +1 704 910 9688 E:

brisinger@piedmontlithium.com

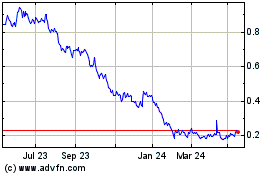

Piedmont Lithium (ASX:PLL)

Historical Stock Chart

From Jan 2025 to Feb 2025

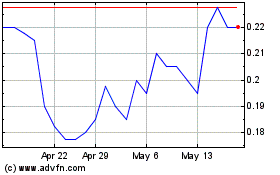

Piedmont Lithium (ASX:PLL)

Historical Stock Chart

From Feb 2024 to Feb 2025