South32 Signals US$109 Million Impairment Charge

July 19 2020 - 6:31PM

Dow Jones News

By David Winning

SYDNEY--South32 Ltd. reported a mixed quarter of production for

commodities that it digs up at operations around the world and

signaled US$109 million in impairment charges tied to a review of

its manganese allow smelters.

South32 said its Cannington silver-lead mine was a standout

performer, exceeding guidance for the year through June by 8%.

Management also reported record production at the Brazil Alumina,

Hillside Aluminium and Australia Manganese ore divisions in fiscal

2020.

However, the latest operational snapshot showed output of energy

coal dropped by 3% in the three months through June, while nickel

production and manganese ore output each fell by 6%.

South32 has responded to the coronavirus pandemic by suspending

its share buyback program with US$121 million remaining and drawing

up plans to cut around US$160 million in spending over 15

months.

The company also mothballed its Metalloys manganese alloy

smelter in South Africa amid concern that it may not be economic

viable in future, while it is reviewing the TEMCO smelter in

Australia. Management said completion of the TEMCO review had been

delayed by the coronavirus pandemic.

South32 said it expected to book pretax impairment charges of

approximately US$109 million in its results for the year through

June. That charge is estimated at US$90 million after tax. The

company said it also expected around US$7 million in pretax

restructuring costs, including redundancies, at Metalloys.

Write to David Winning at david.winning@wsj.com

(END) Dow Jones Newswires

July 19, 2020 19:16 ET (23:16 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

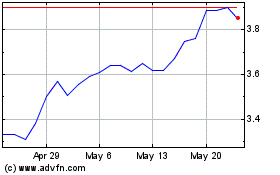

South32 (ASX:S32)

Historical Stock Chart

From Nov 2024 to Dec 2024

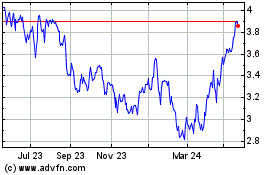

South32 (ASX:S32)

Historical Stock Chart

From Dec 2023 to Dec 2024