Asian Shares Gain, But Australia Bucks Trend -- Update

September 06 2016 - 1:10AM

Dow Jones News

By Ese Erheriene

Asian stock markets were broadly higher Tuesday, buoyed by the

U.S. dollar's strength, though Australian shares extended declines

after the central bank there kept interest rates unchanged.

The Nikkei Stock Average was up 0.3% after closing at its

highest level since May on Monday and building on last week's 3.5%

gain. Singapore's Straits Times Index added 1.1%, while Hong Kong's

Hang Seng Index gained 0.3%.

In Australia, the S&P/ASX 200 was last down 0.4%, following

the Reserve Bank of Australia's decision Tuesday afternoon to keep

rates steady at 1.5%. The RBA signaled that the rates would remain

unchanged for the time being, after the bank eased monetary policy

in May and August.

Australian banking stocks remained mixed following the rate

decision, with National Australia Bank rising 0.4%, Commonwealth

Bank of Australia falling 0.5%, and Westpac Banking Corp. shares

flat.

Meanwhile, the yen was recently down 0.2% against the dollar,

which remained strong after the release of weaker-than-expected

U.S. jobs data on Friday, reducing the likelihood of an imminent

interest-rate increase by the Federal Reserve. A weaker yen helps

boost the competitiveness of Japanese exports.

Japanese banking stocks drove gains on the Nikkei amid

expectations that the Bank of Japan may cut back on longer-term

bond buying at its next meeting, thus boosting bond yields. Mizuho

Financial Group gained 0.8%, Sumitomo Mitsui Financial Group was

trading up 1.4% and Shinsei Bank Ltd was up 1.2%.

"The Japanese banking sector has been doing very well of late,"

said Angus Nicholson, a market analyst at IG. "In the lead-up to

the BOJ meeting on Sept. 21, there's a lot of speculation that the

BOJ is going to do a major recalibration of their [qualitative and

quantitative easing] policy."

Japanese banks have been some of the biggest victims of the

BOJ's monetary easing and negative-rates policy. They claim that

their profits were suffering amid very low yields on all government

bonds.

In the Philippines, the stock market benchmark PSEi was one of

the region's biggest decliners Tuesday, falling 0.6%, after U.S.

President Barack Obama abruptly canceled a first meeting with

Philippine leader Rodrigo Duterte in a rare diplomatic rupture.

Analysts point to concerns that rising tensions between the two

close allies could affect future trade deals.

The meeting was called off following bombastic comments from Mr.

Duterte on Monday demanding that their discussion not touch on his

approach to human rights and referring to the U.S. leader in

Tagalog with an expression widely translated to mean "son of a

bitch."

The decline in Philippine stocks came even as data Tuesday

showed inflation in the country slowing unexpectedly in August,

providing the central bank plenty of scope to keep monetary policy

supportive of stronger economic growth.

Elsewhere in the region, shares in India gained in early trade,

as the market played catch up to news of the weaker U.S. jobs

report after being closed for a holiday Monday. The S&P BSE

Sensex was last up 1%, while the National Stock Exchange's Nifty 50

index rose 0.9%.

Indian auto stocks outperformed after most of them reported

higher sales growth in August. Among them, Tata Motors gained 2.6%,

while Maruti Suzuki added 2.1%.

Looking ahead, investors will be watching for news from the

annual summit of the Association of Southeast Asian Nations, which

kicks off Tuesday in Laos and could move stocks in the region.

More broadly, uncertainty on the U.S. interest rate outlook may

continue ahead of speeches by Federal Reserve officials, including

one by Federal Reserve Bank of San Francisco President John

Williams, later this week.

Kosaku Narioka and Debiprasad Nayak contributed to this

article.

Write to Ese Erheriene at ese.erheriene@wsj.com

(END) Dow Jones Newswires

September 06, 2016 01:55 ET (05:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

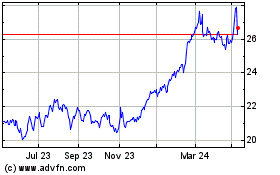

Westpac Banking (ASX:WBC)

Historical Stock Chart

From Nov 2024 to Dec 2024

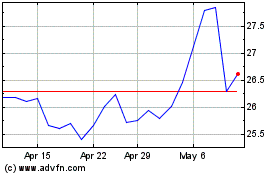

Westpac Banking (ASX:WBC)

Historical Stock Chart

From Dec 2023 to Dec 2024