Westpac to Sell General Insurance Unit to Allianz for A$725 Million

December 01 2020 - 5:51PM

Dow Jones News

By Stuart Condie

SYDNEY--Westpac Banking Corp. has agreed to sell its general

insurance business to Allianz SE for 725 million Australian dollars

(US$534.4 million).

Australia's second-largest bank by market capitalization on

Wednesday said the sale price represents a multiple of 1.3x the

unit's fiscal 2020 gross written premium. The sale will add about

12 basis points to its common equity Tier 1 capital ratio, the

lender said.

Westpac said it will enter into an exclusive 20-year agreement

to distribute Allianz products to bank customers. The transaction

includes contingent payments subject to integration milestones and

business performance over the next five years, as well as ongoing

payments relating to the distribution agreement.

Westpac has distributed Allianz products including auto and

travel insurance since 2015.

"This transaction is another step in simplifying our business,"

Westpac Chief Executive Peter King said.

Westpac earlier this year prepared the business for divestment

by separating it into a new specialist businesses division along

with its superannuation operations and wealth platforms.

Write to Stuart Condie at stuart.condie@wsj.com

(END) Dow Jones Newswires

December 01, 2020 18:36 ET (23:36 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

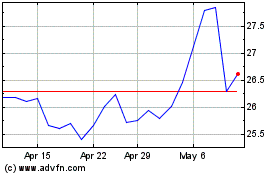

Westpac Banking (ASX:WBC)

Historical Stock Chart

From Jan 2025 to Feb 2025

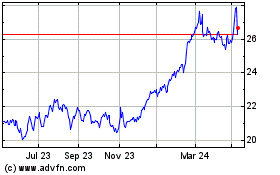

Westpac Banking (ASX:WBC)

Historical Stock Chart

From Feb 2024 to Feb 2025