Rio Tinto Rejects Glencore's $2.5 Billion Offer in Favor of Yancoal

June 20 2017 - 7:36AM

Dow Jones News

By Razak Musah Baba and Scott Patterson

LONDON--Rio Tinto PLC rebuffed a $2.5 billion offer by Glencore

PLC for its Australian coal assets and recommended that

shareholders approve a previous bid by a Chinese company.

Rio Tinto said Tuesday that its board considered a number of

factors related to both proposals, including the size of both bids,

and decided to stick with a $2.45 billion offer that Yancoal

Australia Ltd. made in January, in part because it expects to

complete the deal faster than one with Glencore.

The British-Australian mining giant is trying to shed much of

its coal operations, especially thermal coal, the type burned to

make electricity.

The sale includes Rio's giant coal operation in Australia's

Hunter Valley, Coal & Allied Industries Ltd., which Rio has

been trying to unload for years. Glencore's surprise counteroffer

two weeks ago, set to expire next Monday, briefly threw Rio's plans

into turmoil. Glencore Chief Executive Ivan Glasenberg has long

coveted the Australian coal assets, which sit aside large Glencore

coal operations.

A Glencore spokesman said the company is reviewing the

announcement and "will respond in due course."

Following Glencore's bid, Yancoal revised its offer to make its

$2.45 billion payment upfront, rather than in a series of

installments. The company is a subsidiary of Chinese coal giant,

Yanzhou Coal Mining Co.

"We believe Yancoal's offer to purchase our thermal coal

assets...offers the best value and greater transaction certainty

for shareholders," Rio Tinto Chief Executive Jean-Sebastien Jacques

said.

The bidding contest highlights renewed interest in thermal coal,

which is used to generate electricity. Thermal coal prices plunged

in 2015 followed by a sharp rally last year amid signs of solid

demand in China. Thermal coal prices have softened this year, and

analysts expect demand to remain subdued as countries switch to

cleaner burning fuels.

Glencore, the world's biggest trader of thermal coal, expects

demand for the fossil fuel to remain solid in Southeast Asia, since

thermal coal is one of the cheapest fuels for electricity

generation.

Mr. Jacques said Yancoal's revised offer also is more attractive

because it can meet the timeline set for the transaction and is

more likely to get regulatory approval, including from the Chinese

government. Although the Rio Tinto assets are in Australia, China

is a major coal consuming country and its regulators often insert

themselves into mining deals.

Under U.K. and Australian listing rules, the transaction with

Yancoal requires the approval of Rio Tinto shareholders.

London-listed Rio Tinto PLC has called a general meeting for June

27 to vote on the deal and Rio Tinto Ltd. in Australia for June

29.

The transaction with Yancoal is expected to be completed in the

third quarter of 2017.

Write to Razak Musah Baba at Razak.Baba@wsj.com and Scott

Patterson at scott.patterson@wsj.com

(END) Dow Jones Newswires

June 20, 2017 08:21 ET (12:21 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

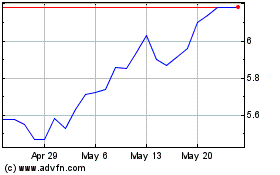

Yancoal Australia (ASX:YAL)

Historical Stock Chart

From Dec 2024 to Jan 2025

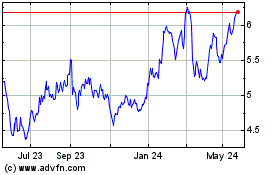

Yancoal Australia (ASX:YAL)

Historical Stock Chart

From Jan 2024 to Jan 2025