Rio Tinto Scales Back Iron Ore Guidance -- Update

July 17 2017 - 8:39PM

Dow Jones News

By Robb M. Stewart

MELBOURNE, Australia--Rio Tinto PLC (RIO) scaled back its export

guidance for iron ore after production in the first half of the

year was disrupted by wet weather and rail maintenance.

The mining company also lowered its annual production target for

steelmaking coking-coal in the wake of Cyclone Debbie, which struck

eastern Australia in March and brought heavy rains and flooding,

but maintained production guidance for its other commodities,

including for copper which was scaled back in April.

Iron-ore shipments from Australia's west coast are now expected

to be about 330 million metric tons in 2017, the bottom of a

previous target of up to 340 million for the year, the London-based

miner said Tuesday.

Shipments had been impacted by an acceleration of a rail

maintenance program following poor weather in the first quarter,

Chief Executive Jean-Sebastien Jacques said.

Across Rio Tinto's operations in the remote Pilbara region,

shipments declined 6% year-over-year to 77.7 million tons in the

three months through June and were down 3% for the first half of

2017. The Anglo-Australian company's share of output from its mines

slipped 2% on a year earlier to 65 million metric tons for the

quarter and was down by a similar level for the half year.

The result from the Pilbara operations was weaker than expected,

although RBC Capital Markets analyst Paul Hissey said he remained

confident the company could achieve its revised export guidance

even with further rail maintenance planned for the remainder of the

year.

Iron ore was the biggest driver of Rio Tinto's earnings last

year, helped by a recovery in the price of the steel-making

ingredient.

The effects of Cyclone Debbie on Australia's eastern Queensland

state continued to restrain hard coking coal production in the

second quarter, with pit access at the Hail Creek operation

restricted by water, Rio Tinto said. Three-month production of hard

coking coal was down 14% on-year to 1.56 million tons and was 17%

lower for the half year. Rio Tinto said it now expected coking coal

output for the year to be between 7.2 million and 7.8 million tons,

against a 7.8 million-8.4 million ton range previously.

Mined copper production rebounded in the second quarter,

although it was still down year-on-year, as the jointly-owned

Escondida mine in Chile recovered from a 43-day strike. Overall

mined copper output was down 6% on the same period last year at

124,700 tons, and down 21% for the first half at 208,900 tons, but

Rio Tinto said it continued to expect its share of production from

operations would be 500,00-550,000 tons for 2017.

Among Rio Tinto's other commodities, aluminum production for the

second quarter was 1% lower on-year at 888,000 tons, but bauxite

output was 7% higher at a record 12.87 million tons, and semi-soft

and thermal coal production was 7% higher at 5.57 million tons.

Late last month, Rio Tinto again backed an offer from Yancoal

Australia Ltd. (YAL.AU) for its Australian coal business, Coal

& Allied Industries Ltd., after the China-backed company raised

its bid to US$2.69 billion to top a rival offer from Glencore PLC

(GLEN.LN). Rio Tinto's shareholders have voted overwhelming to

support Yancoal's bid, and the company said it expects the deal to

complete by the end of September.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

July 17, 2017 21:24 ET (01:24 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

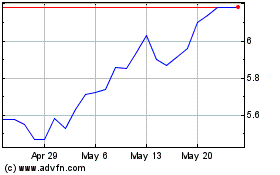

Yancoal Australia (ASX:YAL)

Historical Stock Chart

From Jan 2025 to Feb 2025

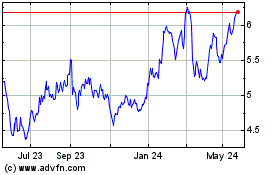

Yancoal Australia (ASX:YAL)

Historical Stock Chart

From Feb 2024 to Feb 2025