Banca IFIS Group: Banca IFIS: 66,2 million Euro in profit, 51,8% in

Cost/Income ratio. Excellent Enterprises segment's gross-impaired

loan ratio: 10,5%

Banca IFIS Group: Banca IFIS: 66,2 million Euro in

profit, 51,8% in Cost/Income ratio. Excellent

Enterprises segment's gross-impaired loan ratio: 10,5%

Highlights– Results of the first half of 20181RECLASSIFIED DATA

2: 1 January – 30 June

- Net banking income: 278,1 million Euro

(+9,8%);

- Net profit from financial activities: 238,1

million Euro (+10,3%);

- Operating costs: 144,2 million Euro

(+20,7%);

- Net profit for the period: 66,2 million Euro

(-36,1%);

- Credit risk cost of the Enterprises segment:

138 bps;

- Enterprises segment’s gross -impaired loan

ratio: 10,5%;

- Total Group employees: 1.577 people (+173

people compared to 2017);

- Common Equity Tier 1 (CET1)

Ratio: 15,13% (15,64% at 31 December 2017) 3;

- Tier1 (T1) Capital Ratio: 15,13% (15,64% at 31

December 2017) 3;

- Total Own Funds Capital Ratio: 20,28% (21,07%

at 31 December 2017) 3.

Highlights– Results of the second quarter of 2018RECLASSIFIED

DATA 4: 1 April – 30 June

- Net banking income: 138,7 million Euro

(-7,3%);

- Net profit from financial activities: 109,7

million Euro (-33,1%);

- Operating costs: 70,8 million Euro

(+10,9%);

- Net profit for the period: 28,4 million Euro

(-60,0%);

Mestre (Venice), 3 August 2018 – The Board of Directors

of Banca IFIS (Fitch BB+, outlook stable) met today under the

chairmanship of Sebastien Egon Fürstenberg and approved the interim

financial report for the first half of 2018.

““In the first six months of the year, we were extremely active

in each segment, evolving our individual businesses, supporting

firms that can now work with more confidence and sustainable

business models”, says Giovanni Bossi, Banca IFIS

CEO. “The Group has developed new alliances to accelerate the

growth of the leasing business, working together with high-standing

partners. Always concerning the leasing segment, innovation led us

to replace our technological platform as well as improve and

streamline all operational processes.

We acquired control of Credifarma—to be consolidated in the

second half of 2018—to strengthen our presence in the pharmacy

lending sector. In the first six months of the year, we announced

the acquisition of the servicer FBS and finalised the acquisition

of 100% of CapitalFin. This allows the Group to enter the

salary-backed loan business, supporting the NPL segment. Finally,

in July we launched a new initiative in the insurance sector. The

economic and other benefits of all these activities will start

materialising in the second half of 2018.

As for NPLs, in July the Group finalised the acquisition of

non-performing loan portfolios with a par value of nearly 600

million Euro. Over the next few months, special emphasis will be

placed on providing new debt restructuring solutions to entities

that currently hold UTPs, so as to identify the best possible

solutions to give new momentum to Italian businesses.

Unfortunately, in the second quarter—concludes Giovanni

Bossi—our performance was affected by a series of particularly

material events that are unlikely to happen again with the same

intensity. I am happy with the results of our ordinary activities

in the first six months of 2018, and we confirm our guidance across

all businesses for the second half of the year”.

The Banca IFIS Group's results5 for the half quarter of the year

can be summarised as follows:

| Net banking income

|

Net banking totalled 278,1

million Euro, +9,8% compared to the first half of 2017 (253,2

million Euro at 30 June 2017). The positive result was largely due

to the outstanding performance of the NPL segment—as well as the

contribution from the Enterprises segment's Trade Receivables and

Leasing areas. The result for the first half of the year was

negatively affected by the lower impact of the reversal of the PPA,

i.e. the breakdown of the difference between the fair value as

measured in the business combination and the carrying amount of the

receivables recognised by the former Interbanca Group over time

(44,1 million Euro at 30 June 2018, compared to 57,8 million Euro

at 30 June 2017, -23,8%) influenced in the recent past by some

early payments. |

|

Net impairment losses |

Net impairment losses amounted

to -40,0 million Euro, compared to 12,1 million Euro in net

reversals in the prior-year period, and essentially referred to

loans to customers of the Enterprises segment. This was

attributable to two factors: the higher provisions set aside (14

million) on an individually significant position in the first six

months of 2018, compared to 26,8 million Euro in reversals in 2017

in the Corporate Banking area. In the first six months of 2018, the

Enterprises segment’s cost of credit calculated under IFRS 9

amounted to 138 bps, compared to 31 bps under IAS 39 at 31 December

2017. In the previous year, the Bank had recognised some reversals

of impairment losses, excluding which the cost of credit quality

would have amounted to 89 bps. |

| Operating

Costs |

Operating costs totalled 144,2

million Euro (119,5 million Euro at 30 June 2017, +20,7%),

resulting in a cost/income ratio of 51,8% (49,0% in the prior-year

period). Personnel expenses rose to 55,5 million Euro (49,5 million

Euro in June 2017, +12,1%), consistently with the addition of new

hires (including those of the new subsidiary Capitalfin); at 30

June 2018 Group employees numbered 1.577 (up 173 people).

Administrative expenses amounted to 95,1 million Euro, up 36,1%

from 69,9 million Euro in the prior-year period. This was the

result of the increase reported by the NPL segment, driven by

rising judicial debt collection costs as well as the adoption of

the new statistical model for estimating the NPL segment's

positions undergoing judicial operations in the NPL area. These

costs totalled 14,8 million (that impact on legal expenses and

registration fees) and had been previously deferred until the issue

of the Garnishment Order. In addition, the period saw an increase

in the expenses associated with consulting services related to the

adoption of new technological systems and the help provided to the

Group's internal employees in the various projects launched during

the first half of the year. |

Pre-tax profit totalled 93,9 million Euro in

the first six months of 2018, compared to 145,9 million Euro in the

prior-year period.

At 30 June 2018, the Group net profit for the

period totalled 66,2 million Euro, down 36,1% from 103,7 million

Euro at 30 June 2017.

As for the contribution of individual

segments6 to the operating and

financial results at 30 June 2018, here below are the

highlights:

- The Enterprises segment's net banking

income, accounting for 59,3% of the total, amounted to 165,1

million Euro, slightly down from the prior-year period

(-3,9%).

Specifically,

Trade Receivables generated 80,3 million Euro in

net banking income (78,8 million Euro in the first half of 2017,

+1,9%); the segment's turnover rose to 6,1 billion Euro (+8,8% from

30 June 2017), while the number of corporate customers rose to over

5.600. Outstanding trade receivables amounted to 3,4 billion Euro,

in line with 31 December 2017. To support the entities that do

business with Italy's Public Administration, the Group continued

developing the TiAnticipo web portal, through which companies can

upload their government-certified invoices and rapidly obtain

financing.

As

for Leasing, the merger of IFIS Leasing into Banca

IFIS was finalised in May, with the adoption of a new technological

platform. The Leasing Area's net banking income totalled 26,2

million Euro, up 7,0% (+1,7 million Euro) compared to 30 June 2017.

The increase was driven by net interest income (+0,8 million Euro)

as well as commission income (+0,9 million Euro), which benefited

from the rise in lending volumes, and the higher number of

customers.

Corporate

Banking's net banking income totalled 52,5 million Euro,

down 7,2 million Euro compared to 30 June 2017. The decline was

largely attributable to the lower positive impact of the breakdown

of the difference between the fair value as measured in the

business combination and the carrying amount of the receivables

recognised by the former subsidiary over time (so-called “reversal

PPA”), down 12,3 million Euro from the prior-year period—which was

to be expected. In the first half of 2017, Corporate Banking

reported 26,8 million Euro in net reversals, largely because of an

individually significant reversal of impairment losses on

receivables.

Loans

to businesses totalled 5.599,7 million Euro at 30 June 2018, +2,5%

compared to the restated data at 1 January 2018.

- The NPL Area7 , dedicated to

acquiring and converting mostly unsecured non-performing loans into

sustainable settlement plans, transferred all its operations to the

subsidiary IFIS NPL S.p.A. effective 1 July 2018. With 119,3

million Euro in net banking 79,0 million Euro in 2017, +51,1%) the

NPL Area was the Group's fastest-growing segment, thanks to the

higher number of court-issued garnishment orders as well as the

strong performance in converting existing portfolios. Cash receipts

rose from approximately 54 million Euro in the first half of 2017

to nearly 81 million Euro in the first six months of 2018. During

the semester, the Group further refined the statistical measurement

models for its assets under management: specifically, it adopted a

new model for estimating the positions undergoing judicial

operations, resulting in an approximately 34,7 million Euro

positive impact through profit or loss.

During

the period, the Bank continued diversifying its funding sources and

making them more flexible. At 30 June 2018, the Group's funding

structure was as follows:

o

59,4% retail;

o

14,0% debt securities;

o

12,8% ABS;

o

8,9% TLTRO;

o 4,9%

other.

As for gross non-performing exposures, following

the introduction of the category of the so-called POCI – “purchased

or originated credit-impaired” financial assets under the new

standard IFRS 9, the new write-off policies adopted by the Group,

and in accordance with the 5th update to Circular 262 of the Bank

of Italy, the presentation of gross non-performing exposures and

the relevant impairment losses has changed significantly starting

from 1 January 2018. As a result, gross non-performing exposures in

the Enterprises segment accounted for 10,5% of total exposures at

30 June 2018, compared to 20,1% at 1 January 2018.

Overall, the gross non-performing loans of the

enterprises segment totalled 615,7 million Euro, with 247,6 million

Euro in impairment losses and a coverage ratio of 40,2% at 30 June

2018.

Below is the breakdown of net non-performing

loans in the Enterprises segment8 (totalling 368,1 billion

Euro):

- net bad loans amounted to 68,0 million Euro,

compared to 62,9 million Euro of the restated data at 1 January

2018 (+8,2%); the net bad-loan ratio was 1,2%, unchanged from the

restated data at 1January 2018. The coverage ratio stood at 70,1%

(71,0% at 1 January 2018);

- net unlikely to pay totalled 143,7 million

Euro, -11,9% from 163,1 million Euro at the data restated at 1

January 2018; the coverage ratio declined to 34,0% from 26,5% at 1

January 2018. The change was mainly attributable to the higher

provisions set aside on an individually significant position;

- Net non-performing past due exposures totalled

156,5 million Euro, compared with 112,0 million Euro at 1 January

2018 (+39,7%). The rise was partly due to the natural increase in

past due exposures to Italy's Public Administration as well as to

new private-sector past due positions, concentrated on individually

significant counterparties. The coverage ratio of net

non-performing past due exposures stood at 8,5% (10,6% at 1 January

2018).

At the end of the period, consolidated

equity totalled 1.373,1 million Euro, compared to 1.368,7

million Euro at 31 December 2017 (+0,3%).

The consolidated Common Equity Tier 1

(CET1), Tier 1 (T1) and Total Own Funds Ratios of the

Banca IFIS Group alone, excluding the effect of the consolidation

of the Parent Company La Scogliera9 at 30 June 2018, amounted

to 15,13% for both the CET1 and T1 ratios, compared to 15,64% at 31

December 2017, while the consolidated Total Own Funds Ratio

amounted to 20,28%, compared to 21,07% at 31 December 2017.

For more details, see the Consolidated Interim

Report at 30 June 2018, available in the “Institutional Investors”

section of the official website www.bancaifis.it

Significant events occurred in the period

The Banca IFIS Group transparently and timely

discloses information to the market, constantly publishing

information on significant events through press releases. Please

visit the “Institutional Investor Relations” and “Media Press”

sections of the institutional website www.bancaifis.it to view all

press releases. Here below is a summary of the most significant

events occurred during the period and before the approval of this

document:

Acquisition of control of Cap.Ital.Fin.

S.p.A.Concerning the binding offer to acquire control of

Cap.Ital.Fin S.p.A. submitted on 24 November 2017, on 2 February

2018 the Bank finalised the acquisition of 100% of Cap.Ital.Fin

S.p.A., a company on the register as per Article 106 of the

Consolidated Law on Banking that operates across Italy and

specialises in salary-backed loans and salary or pension deductions

for retirees as well as private- and public-sector and government

employees.

Preferred unsecured senior bond

placementIn April 2018, Banca IFIS announced and

successfully completed the placement of its first preferred

unsecured senior bond issue. The 300 million Euro bond has a 5-year

maturity and a 2% fixed coupon rate, and the issue price was

99,231%. The bond, reserved for institutional investors except for

those in the United States, was issued under Banca IFIS S.p.A.'s

EMTN Programme and will be listed on the Irish Stock Exchange.

Fitch assigned a “BB+” long-term rating to the bond.

Agreement to acquire FBS

S.p.A.

On 15 May 2018, the Group finalised an agreement

to acquire control over FBS S.p.A., a company operating in the NPL

segment as a servicing specialist (including both master and

special services), manager of secured and unsecured NPL portfolios,

due diligence advisor, and investor authorised to conduct NPL

transactions. The deal was notified to the Bank of Italy and is

expected to close by September 2018 with the Group's acquisition of

90% of FBS for 58,5 million Euro.

Significant subsequent events

Acquisition of control of Credifarma S.p.A.On 2

July 2018, the Group finalised the acquisition of a controlling

interest in Credifarma S.p.A., a company specialising in pharmacy

lending. The deal was finalised through Banca IFIS's acquisition of

the combined 32,5% stake of UniCredit and BNL – BNP Paribas Group

as well as the acquisition of part of Federfarma's current interest

in the company, amounting to 21,5%. Finally, the lender finalised a

capital increase reserved for Banca IFIS to provide Credifarma with

a robust financial position for regulatory purposes as well as to

pursue future growth plans. The deal requires an overall

investment—including the capital increase—of approximately 8,8

million Euro.

Transfer of Banca IFIS's business unit dedicated to

Non-Performing LoansIFIS NPL S.p.A., the joint-stock

company into which Banca IFIS spun off its NPL segment, became

fully operational on 1 July 2018. The transaction, announced in

December 2017, now becomes effective as Banca IFIS's Board of

Directors has approved the transfer of the business unit.IFIS NPL

has obtained the authorisation to extend financing and was entered

into the register of financial intermediaries pursuant to Article

106 of the Italian Consolidated Law on Banking effective 1 July

2018.

Declaration of the Corporate Accounting Reporting Officer

Pursuant to Article 154 bis, Paragraph 2 of the Consolidated Law on

Finance, the Corporate Accounting Reporting Officer, Mariacristina

Taormina, declares that the accounting information contained in

this press release corresponds to the accounting records, books and

entries.

Reclassified financial

statements

Net impairment losses on receivables of the NPL

were reclassified to Interest receivable and similar income to

present more fairly this particular business, for which net

impairment losses represent an integral part of the return on the

investment.

Consolidated Statement of Financial

Position

|

ASSETS (in thousands of Euro) |

AMOUNTS AT |

CHANGE |

|

30.06.2018 |

31.12.2017 |

ABSOLUTE |

% |

|

10. |

Cash and cash equivalents |

47 |

50 |

(3 |

) |

(6,0 |

)% |

|

20. |

Financial assets at fair value through profit or loss |

161.145 |

94.421 |

66.724 |

|

70,7 |

% |

|

|

a) financial assets held for trading |

30.625 |

35.614 |

(4.989 |

) |

(14,0 |

)% |

|

|

c) other financial assets mandatorily measured at fair

value |

130.520 |

58.807 |

71.713 |

|

121,9 |

% |

|

30. |

Financial assets at fair value through other comprehensive

income |

433.827 |

442.576 |

(8.749 |

) |

(2,0 |

)% |

|

40. |

Financial assets measured at amortised cost |

8.278.499 |

8.153.319 |

125.180 |

|

1,5 |

% |

|

|

a) due from banks |

1.568.042 |

1.760.752 |

(192.710 |

) |

(10,9 |

)% |

|

|

b) loans to customers |

6.710.457 |

6.392.567 |

317.890 |

|

5,0 |

% |

|

90. |

Property, plant and equipment |

130.399 |

127.881 |

2.518 |

|

2,0 |

% |

|

100. |

Intangible assets |

24.815 |

24.483 |

332 |

|

1,4 |

% |

|

|

of which: goodwill |

1.504 |

834 |

670 |

|

80,3 |

% |

|

110. |

Tax assets: |

400.773 |

438.623 |

(37.850 |

) |

(8,6 |

)% |

|

|

a) current |

46.433 |

71.309 |

(24.876 |

) |

(34,9 |

)% |

|

|

b) deferred |

354.340 |

367.314 |

(12.974 |

) |

(3,5 |

)% |

|

130. |

Other assets |

303.238 |

272.977 |

30.261 |

|

11,1 |

% |

|

|

Total assets |

9.732.743 |

9.554.330 |

178.413 |

|

1,9 |

% |

|

LIABILITIES AND EQUITY(in thousands of

Euro) |

AMOUNTS AT |

CHANGE |

|

30.06.2018 |

|

31.12.2017 |

|

ABSOLUTE |

% |

|

10. |

Financial liabilities measured at amortised cost. |

7.819.032 |

|

7.725.159 |

|

93.873 |

|

1,2 |

% |

|

|

a) due to banks |

882.324 |

|

791.977 |

|

90.347 |

|

11,4 |

% |

|

|

b) due to customers |

4.840.864 |

|

5.293.188 |

|

(452.324 |

) |

(8,5 |

)% |

|

|

c) debt securities issued |

2.095.844 |

|

1.639.994 |

|

455.850 |

|

27,8 |

% |

|

20. |

Financial liabilities held for trading |

38.627 |

|

38.171 |

|

456 |

|

1,2 |

% |

|

60. |

Tax liabilities: |

50.519 |

|

40.076 |

|

10.443 |

|

26,1 |

% |

|

|

a) current |

8.734 |

|

1.477 |

|

7.257 |

|

491,3 |

% |

|

|

b) deferred |

41.785 |

|

38.599 |

|

3.186 |

|

8,3 |

% |

|

80. |

Other liabilities |

421.087 |

|

352.999 |

|

68.088 |

|

19,3 |

% |

|

90. |

Post-employment benefits |

7.792 |

|

7.550 |

|

242 |

|

3,2 |

% |

|

100. |

Provisions for risks and charges: |

22.603 |

|

21.656 |

|

947 |

|

4,4 |

% |

|

|

a) commitments and guarantees granted |

2.524 |

|

590 |

|

1.934 |

|

327,8 |

% |

|

|

c) other provisions for risks and charges |

20.079 |

|

21.066 |

|

(987 |

) |

(4,7 |

)% |

|

120. |

Valuation reserves |

(14.478 |

) |

(2.710 |

) |

(11.768 |

) |

434,2 |

% |

|

150. |

Reserves |

1.168.592 |

|

1.038.155 |

|

130.437 |

|

12,6 |

% |

|

160. |

Share premiums |

102.052 |

|

101.864 |

|

188 |

|

0,2 |

% |

|

170. |

Share capital |

53.811 |

|

53.811 |

|

- |

|

0,0 |

% |

|

180. |

Treasury shares (-) |

(3.103 |

) |

(3.168 |

) |

65 |

|

(2,1 |

)% |

|

200. |

Profit (loss) for the period (+/-) |

66.209 |

|

180.767 |

|

(114.558 |

) |

(63,4 |

)% |

|

|

Total liabilities and equity |

9.732.743 |

|

9.554.330 |

|

178.413 |

|

1,9 |

% |

Consolidated Income

Statement

|

ITEMS (in thousands of Euro) |

AMOUNTS AT |

CHANGE |

|

30.06.2018 |

|

30.06.2017 |

|

ABSOLUTE |

% |

|

10. |

Interest receivable and similar income |

281.019 |

|

251.042 |

|

29.977 |

|

11,9 |

% |

|

20. |

Interest due and similar expenses |

(51.442 |

) |

(49.495 |

) |

(1.947 |

) |

3,9 |

% |

|

30. |

Net interest income |

229.577 |

|

201.547 |

|

28.030 |

|

13,9 |

% |

|

40. |

Commission income |

46.885 |

|

41.241 |

|

5.644 |

|

13,7 |

% |

|

50. |

Commission expense |

(7.111 |

) |

(6.877 |

) |

(234 |

) |

3,4 |

% |

|

60. |

Net commission income |

39.774 |

|

34.364 |

|

5.410 |

|

15,7 |

% |

|

70. |

Dividends and similar income |

301 |

|

40 |

|

261 |

|

652,5 |

% |

|

80. |

Net profit (loss) from trading |

(352 |

) |

(309 |

) |

(43 |

) |

13,9 |

% |

|

100. |

Gain (loss) on sale or buyback of: |

1.997 |

|

17.577 |

|

(15.580 |

) |

(88,6 |

)% |

|

|

a) financial assets measured at amortised cost |

1.999 |

|

17.625 |

|

(15.626 |

) |

(88,7 |

)% |

|

|

b) financial assets at fair value through other

comprehensive income |

- |

|

(48 |

) |

48 |

|

(100,0 |

)% |

|

|

c) financial liabilities |

(2 |

) |

- |

|

(2 |

) |

- |

|

|

110. |

Net result of other financial assets and liabilities at fair value

through profit or loss |

6.820 |

|

- |

|

6.820 |

|

- |

|

|

|

b) other financial assets mandatorily measured at fair

value |

6.820 |

|

- |

|

6.820 |

|

- |

|

|

120. |

Net banking income |

278.117 |

|

253.219 |

|

24.898 |

|

9,8 |

% |

|

130. |

Net credit risk losses/reversal on: |

(40.036 |

) |

12.109 |

|

(52.145 |

) |

(430,6 |

)% |

|

|

a) financial assets measured at amortised cost |

(39.752 |

) |

12.784 |

|

(52.536 |

) |

(411,0 |

)% |

|

|

b) financial assets at fair value through other

comprehensive income |

(284 |

) |

(675 |

) |

391 |

|

(57,9 |

)% |

|

150. |

Net profit (loss) from financial activities |

238.081 |

|

265.328 |

|

(27.247 |

) |

(10,3 |

)% |

|

190. |

Administrative expenses: |

(150.536 |

) |

(119.336 |

) |

(31.200 |

) |

26,1 |

% |

|

|

a) personnel expenses |

(55.451 |

) |

(49.484 |

) |

(5.967 |

) |

12,1 |

% |

|

|

b) other administrative expenses |

(95.085 |

) |

(69.852 |

) |

(25.233 |

) |

36,1 |

% |

|

200. |

Net allocations to provisions for risks and charges |

948 |

|

1.276 |

|

(328 |

) |

(25,7 |

)% |

|

|

a) commitments and guarantees granted |

1.140 |

|

3.173 |

|

(2.033 |

) |

(64,1 |

)% |

|

|

b) other net provisions |

(192 |

) |

(1.897 |

) |

1.705 |

|

(89,9 |

)% |

|

210. |

Net impairment losses/reversal on property, plant and

equipment |

(2.846 |

) |

(2.048 |

) |

(798 |

) |

39,0 |

% |

|

220. |

Net impairment losses/reversal on intangible assets |

(3.079 |

) |

(3.894 |

) |

815 |

|

(20,9 |

)% |

|

230. |

Other operating income/expenses |

11.337 |

|

4.547 |

|

6.790 |

|

149,3 |

% |

|

240. |

Operating costs |

(144.176 |

) |

(119.455 |

) |

(24.721 |

) |

20,7 |

% |

|

290. |

Pre-tax profit (loss) for the period from continuing

operations |

93.905 |

|

145.873 |

|

(51.968 |

) |

(35,6 |

)% |

|

300. |

Income taxes for the period relating to current operations |

(27.696 |

) |

(42.211 |

) |

14.515 |

|

(34,4 |

)% |

|

330. |

Profit (Loss) for the period |

66.209 |

|

103.662 |

|

(37.453 |

) |

(36,1 |

)% |

|

340. |

Profit (Loss) for the period attributable to non-controlling

interests |

- |

|

5 |

|

(5 |

) |

(100,0 |

)% |

|

350. |

Profit (loss) for the period attributable to the Parent

company |

66.209 |

|

103.657 |

|

(37.448 |

) |

(36,1 |

)% |

Consolidated Income Statement: 2nd Quarter

|

ITEMS (in thousands of Euro) |

AMOUNTS AT |

CHANGE |

|

30.06.2018 |

|

30.06.2017 |

|

ABSOLUTE |

% |

|

10. |

Interest receivable and similar income |

134.008 |

|

135.564 |

|

(1.556 |

) |

(1,1 |

)% |

|

20. |

Interest due and similar expenses |

(23.911 |

) |

(25.004 |

) |

1.093 |

|

(4,4 |

)% |

|

30. |

Net interest income |

110.097 |

|

110.560 |

|

(463 |

) |

(0,4 |

)% |

|

40. |

Commission income |

23.605 |

|

23.457 |

|

148 |

|

0,6 |

% |

|

50. |

Commission expense |

(3.651 |

) |

(3.312 |

) |

(339 |

) |

10,2 |

% |

|

60. |

Net commission income |

19.954 |

|

20.145 |

|

(191 |

) |

(0,9 |

)% |

|

70. |

Dividends and similar income |

301 |

|

40 |

|

261 |

|

652,5 |

% |

|

80. |

Net profit (loss) from trading |

368 |

|

1.306 |

|

(938 |

) |

(71,8 |

)% |

|

100. |

Gain (loss) on sale or buyback of: |

920 |

|

17.625 |

|

(16.705 |

) |

(94,8 |

)% |

|

|

a) financial assets measured at amortised cost |

922 |

|

17.625 |

|

(16.703 |

) |

(94,8 |

)% |

|

|

c) financial liabilities |

(2 |

) |

- |

|

(2 |

) |

- |

|

|

110. |

Net result of other financial assets and liabilities at fair value

through profit or loss |

7.099 |

|

- |

|

7.099 |

|

- |

|

|

|

b) other financial assets mandatorily measured at fair

value |

7.099 |

|

- |

|

7.099 |

|

- |

|

|

120. |

Net banking income |

138.739 |

|

149.676 |

|

(10.937 |

) |

(7,3 |

)% |

|

130. |

Net credit risk losses/reversal on: |

(29.079 |

) |

14.277 |

|

(43.356 |

) |

(303,7 |

)% |

|

|

a) financial assets measured at amortised cost |

(28.876 |

) |

14.937 |

|

(43.813 |

) |

(293,3 |

)% |

|

|

b) financial assets at fair value through other

comprehensive income |

(203 |

) |

(660 |

) |

457 |

|

(69,2 |

)% |

|

150. |

Net profit (loss) from financial activities |

109.660 |

|

163.953 |

|

(54.293 |

) |

(33,1 |

)% |

|

190. |

Administrative expenses: |

(77.084 |

) |

(64.129 |

) |

(12.955 |

) |

20,2 |

% |

|

|

a) personnel expenses |

(28.624 |

) |

(25.411 |

) |

(3.213 |

) |

12,6 |

% |

|

|

b) other administrative expenses |

(48.460 |

) |

(38.718 |

) |

(9.742 |

) |

25,2 |

% |

|

200. |

Net allocations to provisions for risks and charges |

3.754 |

|

2.873 |

|

881 |

|

30,7 |

% |

|

|

a) commitments and guarantees granted |

982 |

|

2.428 |

|

(1.446 |

) |

(59,6 |

)% |

|

|

b) other net provisions |

2.772 |

|

445 |

|

2.327 |

|

522,9 |

% |

|

210. |

Net impairment losses/reversal on property, plant and

equipment |

(1.460 |

) |

(852 |

) |

(608 |

) |

71,4 |

% |

|

220. |

Net impairment losses/reversal on intangible assets |

(1.656 |

) |

(1.631 |

) |

(25 |

) |

1,5 |

% |

|

230. |

Other operating income/expenses |

5.691 |

|

(72 |

) |

5.763 |

|

(8004,2 |

)% |

|

240. |

Operating costs |

(70.755 |

) |

(63.811 |

) |

(6.944 |

) |

10,9 |

% |

|

290. |

Pre-tax profit (loss) for the period from continuing

operations |

38.905 |

|

100.142 |

|

(61.237 |

) |

(61,2 |

)% |

|

300. |

Income taxes for the period relating to current operations |

(10.550 |

) |

(29.168 |

) |

18.618 |

|

(63,8 |

)% |

|

330. |

Profit (Loss) for the period |

28.355 |

|

70.974 |

|

(42.619 |

) |

(60,0 |

)% |

|

340. |

Profit (Loss) for the period attributable to non-controlling

interests |

- |

|

4 |

|

(4 |

) |

(100,0 |

)% |

|

350. |

Profit (loss) for the period attributable to the Parent

company |

28.355 |

|

70.970 |

|

(42.615 |

) |

(60,0 |

)% |

Consolidated Income Statement: Quarterly

|

CONSOLIDATED INCOME STATEMENT: QUARTERLY

EVOLUTION(in thousands of Euro) |

YEAR 2018 |

YEAR 2017 |

|

2nd Q. |

1st Q. |

2nd Q. |

1st Q. |

2nd Q. |

1st Q. |

|

Net interest income |

110.097 |

|

119.480 |

|

121.252 |

|

91.872 |

|

110.560 |

|

90.987 |

|

|

Net commission income |

19.954 |

|

19.820 |

|

21.129 |

|

18.272 |

|

20.145 |

|

14.219 |

|

|

Other components of net banking income |

8.688 |

|

78 |

|

7.639 |

|

11.945 |

|

18.971 |

|

(1.663 |

) |

|

Net banking income |

138.739 |

|

139.378 |

|

150.020 |

|

122.089 |

|

149.676 |

|

103.543 |

|

|

Net credit risk losses/reversals |

(29.079 |

) |

(10.957 |

) |

(37.075 |

) |

(1.140 |

) |

14.277 |

|

(2.168 |

) |

|

Net profit (loss) from financial activities |

109.660 |

|

128.421 |

|

112.945 |

|

120.949 |

|

163.953 |

|

101.375 |

|

|

Personnel expenses |

(28.624 |

) |

(26.827 |

) |

(24.469 |

) |

(24.298 |

) |

(25.411 |

) |

(24.073 |

) |

|

Other administrative expenses |

(48.460 |

) |

(46.625 |

) |

(48.511 |

) |

(34.257 |

) |

(38.718 |

) |

(31.134 |

) |

|

Net allocations to provisions for risks and charges |

3.754 |

|

(2.806 |

) |

1.719 |

|

(2.922 |

) |

2.873 |

|

(1.597 |

) |

|

Net impairment losses/reversals on property, plant and equipment

and intangible assets |

(3.116 |

) |

(2.809 |

) |

(2.688 |

) |

(2.822 |

) |

(2.483 |

) |

(3.459 |

) |

|

Other operating income/expenses |

5.691 |

|

5.646 |

|

4.028 |

|

3.028 |

|

(72 |

) |

4.619 |

|

|

Operating costs |

(70.755 |

) |

(73.421 |

) |

(69.921 |

) |

(61.271 |

) |

(63.811 |

) |

(55.644 |

) |

|

Pre-tax profit from continuing operations |

38.905 |

|

55.000 |

|

43.024 |

|

59.678 |

|

100.142 |

|

45.731 |

|

|

Income taxes for the period relating to continuing operations |

(10.550 |

) |

(17.146 |

) |

(11.387 |

) |

(14.210 |

) |

(29.168 |

) |

(13.043 |

) |

|

Profit for the period |

28.355 |

|

37.854 |

|

31.637 |

|

45.468 |

|

70.974 |

|

32.688 |

|

|

Profit (Loss) for the period attributable to non-controlling

interests |

- |

|

- |

|

(7 |

) |

2 |

|

4 |

|

1 |

|

|

Profit for the period attributable to the Parent

company |

28.355 |

|

37.854 |

|

31.644 |

|

45.466 |

|

70.970 |

|

32.687 |

|

|

EQUITY: BREAKDOWN (in thousands of Euro) |

AMOUNTS AT |

CHANGE |

|

30.06.2018 |

|

31.12.2017 |

|

ABSOLUTE |

% |

|

Share capital |

53.811 |

|

53.811 |

|

- |

|

0,0 |

% |

|

Share premiums |

102.052 |

|

101.864 |

|

188 |

|

0,2 |

% |

|

Valuation reserves: |

(14.478 |

) |

(2.710 |

) |

(14.036 |

) |

517,9 |

% |

|

- Securities |

(7.946 |

) |

2.275 |

|

(12.489 |

) |

(549,0 |

)% |

|

- Post-employment benefits |

75 |

|

20 |

|

55 |

|

275,0 |

% |

|

- exchange differences |

(6.607 |

) |

(5.005 |

) |

(1.602 |

) |

32,0 |

% |

|

Reserves |

1.168.592 |

|

1.038.155 |

|

132.705 |

|

12,8 |

% |

|

Treasury shares |

(3.103 |

) |

(3.168 |

) |

65 |

|

(2,1 |

)% |

|

Profit for the period |

66.209 |

|

180.767 |

|

(114.558 |

) |

(63,4 |

)% |

|

Equity |

1.373.083 |

|

1.368.719 |

|

4.364 |

|

0,3 |

% |

|

OWN FUNDS AND CAPITAL ADEQUACY RATIOS: BANCA IFIS BANKING

GROUP SCOPE (in thousands of Euro) |

AMOUNTS AT |

|

30.06.2018 |

|

31.12.2017 |

|

|

Common equity Tier 1 Capital (CET1) |

1.175.684 |

|

1.152.603 |

|

|

Tier 1 Capital (T1) |

1.175.684 |

|

1.152.603 |

|

|

Total own funds |

1.575.684 |

|

1.552.792 |

|

|

Total RWA |

7.769.825 |

|

7.369.921 |

|

|

Common Equity Tier 1 Ratio |

15,13 |

% |

15,64 |

% |

|

Tier 1 Capital Ratio |

15,13 |

% |

15,64 |

% |

|

Total Own Funds Capital Ratio |

20,28 |

% |

21,07 |

% |

- 20180803_Banca IFIS, utile a 66,2 milioni. Cost income ratio a

51,8%. Rapporto attività deteriorate e impieghi_10,5%_EN

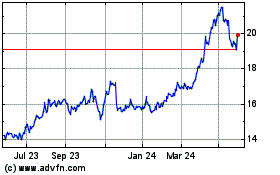

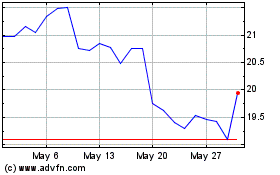

Banca IFIS (BIT:IF)

Historical Stock Chart

From Nov 2024 to Dec 2024

Banca IFIS (BIT:IF)

Historical Stock Chart

From Dec 2023 to Dec 2024