Uniswap 71% Single-Day Rally Raises Eyebrows – Can DeFi Maintain Momentum?

February 24 2024 - 7:00AM

NEWSBTC

The cryptocurrency market witnessed a significant shift in momentum

on February 23rd, as Uniswap native token, UNI, skyrocketed by an

impressive 71%. This surge marks the token’s highest price point

since March 2022, sending shockwaves through the crypto landscape

and reigniting interest in the decentralized finance (DeFi) sector.

Source: Coingecko Related Reading: Siacoin Balloons To 65% in Value

On Network Upgrades – Details Uniswap Proposes Fee-Sharing Feast

For Stakers The primary catalyst behind this astronomical rise

appears to be a pivotal proposal unveiled by the Uniswap

Foundation. This proposition advocates for the implementation of a

novel fee-sharing mechanism, fundamentally altering the token’s

utility and incentivizing long-term participation within the

Uniswap ecosystem. Under the proposed system, UNI holders who stake

their tokens will be rewarded with a portion of the fees generated

by the Uniswap protocol. This not only grants them a direct

financial incentive but also empowers them to choose delegates who

vote on governance proposals, shaping the future direction of

Uniswap. This revolutionary approach resonates with a broader trend

of resurgent interest in DeFi. According to on-chain data provider

Santiment, assets associated with decentralized lending, borrowing,

and cryptocurrency exchange, like $COMP, $SUSHI, and $AAVE, have

all experienced notable value increases, mirroring UNI’s upward

trajectory. Trade Volumes On A Roll Further bolstering this trend,

trading volumes across these protocols have also seen explosive

growth. For instance, the COMP price jumped alongside a staggering

400% increase in trading volume, reaching over $175 million.

Similarly, SushiSwap (SUSHI) witnessed a 27% price surge coupled

with a 153% increase in trading volume. This shift in investor

focus is further underscored by a corresponding decline in the

value of AI-related coins, indicating a potential capital rotation

within the market. UNI currently trading at $12.16 on the daily

chart: TradingView.com Uniswap v4 Upgrade On The Horizon:

Efficiency And Customization Beckon Adding fuel to the fire is the

impending arrival of the highly anticipated Uniswap v4 upgrade,

slated for release in Q3 2024. This transformative update promises

to enhance the protocol’s efficiency and customizability, catering

to the evolving needs of the DeFi space. While the direct impact of

v4 on the current price surge remains debatable, its potential to

revolutionize the Uniswap experience undoubtedly contributes to the

overall bullish sentiment surrounding UNI. Related Reading:

Ethereum Bullish Run: Analyst Eyes $4,500 After ETH Breached $3K

Beyond Uniswap: DeFi Dominance On The Rise? The Uniswap fee-sharing

proposal and upcoming v4 upgrade have not only revitalized the UNI

token but also cast a spotlight on the broader DeFi landscape.

Analysts predict that other DeFi protocols like Blur and Lido

Finance could witness similar surges in the wake of Uniswap’s bold

move. This potential domino effect underscores the growing

importance of DeFi within the cryptocurrency ecosystem, attracting

investors seeking innovative financial solutions beyond traditional

centralized systems. Featured image from Adobe Stock, chart from

TradingView

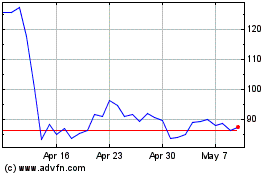

Aave Token (COIN:AAVEUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Aave Token (COIN:AAVEUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024