Ethereum Is Flat, and Whales Selling: More Pain to Follow?

August 22 2024 - 2:00AM

NEWSBTC

Ethereum is struggling for momentum and remains under immense

selling pressure. As of writing, the second most valuable coin is

inside a narrow range, trending within the $2,100 on the lower end

and $2,800 on the upper end. The local resistance level could mark

the start of an impressive leg up, relieving the coin of the

current sell grip from early August. Ethereum Whales Selling

Although supporters are upbeat, expecting the coin to trend higher,

breaking above local liquidation lines in a buy trend continuation

formation, there are concerns. Looking at Ethereum price action,

the coin could post even more losses. Related Reading: XRP Alert:

Raoul Pal Advises Investors To Sell Now – Here’s Why One analyst,

citing on-chain developments, notes that Ethereum whales, or

addresses holding at least 10,000 ETH, have been actively selling

over the past month. Overall, their decision to sell could suggest

that these entities, who are often closely monitored, are not

confident about what lies ahead. Therefore, others could

follow suit by unloading their holdings, leading to a supply glut.

Considering market forces, an uptick in supply could negatively

impact prices, delaying the climb above the immediate roadblocks.

Massive Outflows From Spot ETH ETFs Beyond this, analysts are also

deflated by the current trends of spot Ethereum ETFs. In May,

prices shot higher when the United SEC unexpectedly fast-tracked

the approval of 19b-4 forms for applicants. The approval of the S-1

registration forms was also received positively, lifting prices

above the $3,000 mark. However, days after the product began

trading, there were more outflows, especially from Grayscale’s

ETHE. Concurrently, demand has been lower than expected. Since its

inception, over $247 million worth of ETH has been redeemed from

ETHE. Subsequently, prices have been struggling and moving further

away from March 2024 highs. Related Reading: Bitcoin Sees Surge in

Demand: Are We At The Final Phase of Consolidation? According to

Farside data, all spot Ethereum ETF issuers posted outflows of

around $6.5 million on August 20. This is mostly thanks to the

millions of dollars of redemption through ETHE. This has been a

consistent trend since August 15. It suggests that though the smart

contracts platform offers value, ETH’s immediate to medium-term

outlook is bearish. Accordingly, investors are choosing to move

their capital elsewhere. Feature image from DALLE, chart from

TradingView

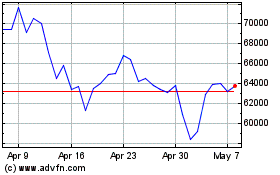

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024