Bitcoin Set To Gain If Trump Wins, JPMorgan Cites ‘Debasement Trade’ As Key Factor

October 31 2024 - 11:00PM

NEWSBTC

According to JPMorgan analysts, a win for the Republican US

presidential candidate Donald Trump could further fuel Bitcoin

(BTC) price momentum. Retail Investors Turn To Bitcoin For

‘Debasement Trade’ In a recent client note, analysts at

JPMorgan suggested that a Trump win might provide ‘additional

upside’ for both BTC and gold, as retail investors increasingly

view Bitcoin as a ‘debasement trade.’ Related Reading: Bitcoin

Makes ATH Against Euro Due To Change In Dollar Strength, Details

Inside In simple terms, a debasement trade is a strategy to protect

purchasing power against the steady erosion of fiat currencies due

to extensive money printing. Notably, the M2 money supply – a

measure of total money in circulation – sharply rose during the

coronavirus pandemic. This surplus in money supply led to

heightened inflation, forcing the U.S. Federal Reserve (Fed) to

raise interest rates to contain it. By purchasing BTC, retail

investors aim to maintain their money’s value, hoping Bitcoin will

act as a hedge against currency depreciation. The JPMorgan note

states: Retail investors appear to be embracing the ‘debasement

trade’ in an even stronger manner by buying bitcoin and gold ETFs.

The retail impulse is also seen in meme and AI tokens the market

cap of which has outperformed. Data from SoSoValue shows that

Bitcoin exchange-traded funds (ETF) have attracted a whopping $1.3

billion in inflows over the past two days alone. As of October 30,

the cumulative net inflow to US-based spot BTC ETFs is $24.18

billion. October’s total ETF inflows alone amount to $4.4 billion,

marking it the third-highest month for BTC ETF inflows since their

launch earlier this year. However, institutional investors appear

to have slowed down on BTC futures activity recently, with analysts

noting that Bitcoin futures have entered overbought territory,

potentially introducing vulnerability for BTC’s near-term outlook.

The client note highlights that credit and prediction markets lean

toward a Trump win, unlike equities, foreign exchange (FX), and

rates markets. The analysts conclude: Overall, to the extent a

Trump win inspires retail investors to not only buy risk assets but

to also further embrace the ‘debasement trade’, there could be

additional upside for bitcoin and gold prices in a Trump win

scenario. Where Is BTC Headed? Analysts Share Their Outlook Bitcoin

is trading within 2% of reaching a new all-time high (ATH), driving

renewed optimism among crypto analysts. Related Reading: Bitcoin

Retail Demand Rises 13% In 1 Month: Time For Q4 2024 Rally? For

instance, crypto analyst Timothy Peterson recently posited that BTC

could surge to as high as $100,000 by February 2025. Meanwhile,

crypto options trading data indicates that traders remain confident

BTC will hit $80,000 by the end of November 2024, regardless of the

election outcome. Veteran trader Peter Brandt, however, has urged

caution, advising BTC bulls that a daily close above $76,000 is

critical for confirming a true breakout. At the time of writing,

BTC is trading at $71,798, down 0.1% in the past 24 hours. Featured

image from Unsplash, Charts from FRED and Tradingview.com

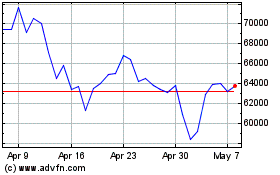

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024