Cosmos (ATOM) Price Displays An Intense Momentum – What’s Driving The Rally?

April 29 2023 - 7:40AM

NEWSBTC

Cosmos (ATOM) demand has risen these past few days, resulting in a

significant performance. According to CoinMarketCap data ATOM price

has fallen to $11.69 after gaining momentum. Related Reading: Terra

Classic (LUNC) Down 4% As Developer Accuses Terraport Of Rugpull

The current market cap of ATOM is $3.3 billion, with a 24-hour

trading volume of $100 million. However, the trading volume is

still down by 31.18%, indicating reduced network activity.

Reason Behind The Surge In Cosmos? Cosmos is a constantly growing

network of interconnected blockchains created with

developer-friendly application components. Inter-Blockchain

Communication (IBC) protocol is the technology that connects these

apps. The SDK platform Cosmos offers allows programmers to produce

top-notch decentralized apps (dApps). Related Reading: Terra

Classic Recent Efforts Could Benefit LUNC’s Growth Potential Other

developers have also constructed applications on top of it, such as

MM Finance and VVS Finance. Cosmo’s (ATOM) recent price surge could

be attributed to its influx of developers topping that of

Ethereum. The other reason for the ATOM price increase might

be the announcement from dYdX that it is building an independent

blockchain on the Cosmos ecosystem instead of Ethereum. Also,

Bitcoin price soared above $29,000, pushing the market cap of all

cryptocurrencies to surpass $1 trillion. Many crypto assets,

including ATOM, recorded price growth due to correlation to

BTC. ATOM Price Action Below is the technical analysis of

ATOM price action on the 4-hour trading timeframe. And also the

possible resistance and support zones. Cosmos has broken through

the short-term resistance level of $11.69 and is currently trading

between $10.571 and $15.484 support and resistance levels. ATOM

must break through the $15.484 primary resistance level to confirm

the bullish momentum. However, the bears are trying hard to break

the $10.571 support level but couldn’t due to the high bullish

momentum. If the bull’s strength is not strong enough to push

ahead, the bears might take over the trend and cause a trend

reversal. What Do The Technical Aspects Suggest? ATOM’s 50-Day

SMA’s change in direction caused the market’s structure to change.

If the bullish momentum doesn’t pick up, the trend may change to a

potential bearish market. The 50-Day SMA established a Death

Cross by crossing below the 200-Day SMA, indicating a potentially

bearish signal and suggesting a selling opportunity. The Relative

Strength Index (RSI) analysis indicator enables traders to

determine the momentum and strength of the price movement of an

asset within a period. At the time of analysis, the RSI of

ATOM/USDT is at 61.74 above the neutral zone. Therefore, this shows

that ADA is neither in the overbought nor oversold

zone. However, the buyers are building momentum to take ADA to

the overbought zone while the seller pushes it down despite weak

momentum. Featured image from Forkast News and Chart: TradingView

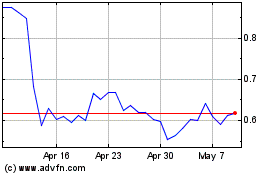

Terra (COIN:LUNAUSD)

Historical Stock Chart

From Feb 2025 to Mar 2025

Terra (COIN:LUNAUSD)

Historical Stock Chart

From Mar 2024 to Mar 2025