Unveiling The Strategic Advantages Of A Bitcoin Reserve For The US Economy

August 15 2024 - 12:00AM

NEWSBTC

As the 2024 presidential election approaches, the idea of the

United States government establishing a strategic Bitcoin reserve

is gaining momentum. This potential policy shift has been

championed by former President Donald Trump and pro-crypto Senator

Cynthia Lummis, who see it as a novel way to help pay down the

country’s $35 trillion national debt. The concept was recently

explored in depth by Bitcoin-focused financial institution River in

a detailed video analysis, arguing that accumulating Bitcoin as a

strategic reserve could provide several key advantages for the US

government. Bitcoin Reserve As Antidote To US Debt Crisis?

Beginning with the example of the United States, the firm points

out the nation’s national debt, emphasizing the critical need for

actions that can fortify the country’s financial standing.

River posits that one method to bolster this position involves

acquiring assets that appreciate in value over time, potentially

enabling the country to offset a substantial portion of its debt in

the future, given that the asset appreciates faster than the rate

at which new currency is printed. Drawing attention to Bitcoin’s

notable yearly average growth rate over the past decade, River

showcases the chart below, which displays BTC’s surge of over 60%,

underscoring its limited supply of 21 million coins, positioning it

as scarcer than traditional stores of value like gold and fiat

currencies. Related Reading: BNB Price Back on Track: Can It Break

$535 to Move Higher? The video also references El Salvador’s

Bitcoin reserve strategy, highlighting the nation’s acquisition of

approximately 5,800 BTC valued at around $340 million, with a

notable profit margin of 38%, equating to approximately $50

million. Comparatively, the United States is one of the

largest Bitcoin holders globally, possessing 213,246 BTC,

predominantly sourced from the Silk Road marketplace confiscation

and funds stolen from the Bitfinex exchange. River advocates

that if the US were to secure 5% of the total BTC supply, it could

substantially alleviate a significant portion of the national debt

burden. Moreover, the firm posits that establishing Strategic

Bitcoin Reserves by more countries could amplify Bitcoin’s value

proposition, potentially catalyzing a domino effect where nations

vie to adopt similar strategies to avoid falling behind in the

evolving financial landscape. The firm concluded by stating that

implementing a Bitcoin Reserve would benefit the nation and its

citizens and contribute to Bitcoin’s mainstream adoption and

usability over time, fostering a more seamless integration into

everyday transactions. Trump And Lummis Push For US BTC Reserve

River’s analysis comes from previous statements by Donald Trump and

Senator Cynthia Lummis last month, highlighting their visions for

using BTC to address the staggering national debt. Trump’s

comments hint at the distribution of cryptocurrency to alleviate

the debt burden. At the same time, Senator Lummis proposes a

strategic plan to acquire one million BTC over five years to carve

out a 5% share of the total Bitcoin supply to reduce the country’s

mounting debt. Related Reading: Maker Sees 7% Upswing As Key

Indicators Signal $2,662 Resistance Test In her address at the

Bitcoin 2024 conference, Lummis emphasized that establishing a

Strategic Bitcoin Reserve could safeguard the dollar’s status as

the global reserve currency and solidify the United States’

leadership in financial innovation, positioning the nation for

continued prosperity in the 21st century. BTC is trading at

$59,000, down 1% over the past 24 hours after failing to

consolidate above the key $60,000 level. Featured image from

DALL-E, chart from TradingView.com

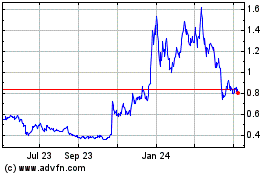

Mina (COIN:MINAUSD)

Historical Stock Chart

From Jul 2024 to Aug 2024

Mina (COIN:MINAUSD)

Historical Stock Chart

From Aug 2023 to Aug 2024