Historic Bitcoin Buy: MicroStrategy Adds 55,500 More BTC To Its Portfolio For $5.4 Billion

November 25 2024 - 10:24AM

NEWSBTC

Business intelligence firm MicroStrategy has significantly

increased its Bitcoin (BTC) purchases this month in response to the

bullish sentiment following President-elect Donald Trump’s victory

on November 5. The company’s recent acquisitions have pushed its

total Bitcoin holdings to approximately $38 billion. Convertible

Notes Fuel Massive Bitcoin Purchase On November 25, co-founder

Michael Saylor announced via social media that MicroStrategy had

acquired 55,500 BTC between November 18 and November 24 for $5.4

billion. This purchase was funded by proceeds from a $3

billion convertible note issuance and sales of common shares, as

detailed in a filing with the US Securities and Exchange Commission

(SEC). Related Reading: XRP Price Builds a Base: Can Bulls Ignite a

New Rally? Since beginning its Bitcoin acquisition strategy in

2020, Saylor has shifted from using corporate cash to a more

complex funding model that involves selling convertible debt and

shares. The latest convertible note was issued at a zero

percent interest rate, reflecting lenders’ confidence that

MicroStrategy’s stock will appreciate beyond the conversion price

in the future. Jeffrey Park, a portfolio manager at Bitwise

Asset Management, noted that Saylor has effectively leveraged

financial arbitrage within the corporate treasury structure,

allowing MicroStrategy to borrow funds at virtually no cost. Saylor

also revealed that MicroStrategy’s treasury operations have yielded

a substantial 59.3% in Bitcoin returns year-to-date, translating to

a net gain of approximately 112,125 BTC for shareholders, or about

341 BTC per day. At a projected price of $100,000 per BTC,

Saylor stated that this could mean an impressive $11.2 billion for

the year, equating to roughly $34.1 million daily. Analyst Warns Of

Risks In Leverage Strategy Since its foray into Bitcoin,

MicroStrategy has acquired a total of 386,700 tokens, with an

average purchase price significantly lower than its current market

value. The latest acquisitions occurred while Bitcoin prices

were nearing all-time highs, with the company purchasing the new

tokens at approximately $97,862 each, slightly above their current

trading price. Related Reading: Solana (SOL) Bulls Stay in Control:

Rally Far From Over? However, this leveraged strategy has raised

concerns among some analysts, particularly after MicroStrategy’s

shares (MSTR) fell by 16% last Thursday. Critics warn that if

Bitcoin’s price declines sharply, the company’s stock could suffer

similarly, recalling the downturn in 2022 when the cryptocurrency

market experienced significant losses. TD Cowen analyst Lance

Vitanza remarked on the risks associated with leverage, stating,

“When you apply leverage to anything, you amplify the returns both

in the up direction and in the down direction.” He emphasized that

MicroStrategy is a pioneer in applying this leverage strategy

specifically to Bitcoin. At the time of writing, the market’s

leading crypto is trading at $95,350, registering a price decrease

of 1.7% in the 24-hour time frame. Featured image from

DALL-E, chart from TradingView.com

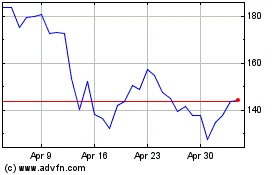

Solana (COIN:SOLUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Solana (COIN:SOLUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024