Solana Outpaces Ethereum In DeFi Activity As Monthly DEX Volume Surpasses $100 Billion

November 25 2024 - 10:00PM

NEWSBTC

Solana (SOL) decentralized finance (DeFi) activity has gained

significant momentum, with its decentralized exchanges (DEX)

surpassing Ethereum (ETH) DEX in monthly trading volume. So far in

November, Solana-based DEXes have recorded over $100 billion in

trading volume, marking a major milestone for the ecosystem. Solana

DeFi Ecosystem Gains Momentum, Outshines Ethereum DeFi Solana, the

fourth-largest cryptocurrency with a reported market cap of $118.34

billion has been on a record-breaking price trajectory. Recently,

the digital asset established a new all-time-high (ATH) of $263

after having hit as low as $8 at the peak of the FTX fiasco.

Related Reading: Solana (SOL) Bulls Stay in Control: Rally Far From

Over? Now, the layer-1 blockchain has achieved another milestone as

Solana-based DEXes surpassed $100 billion for the first time in

monthly trading volume. According to data from DefiLlama, the

30-day cumulative trading volume recorded by Solana DEXes stands at

$116.51 billion. In comparison, Ethereum mainnet-based DEXes saw

$61.61 billion in trading volume during the same period. This means

Solana’s DEX trading volume was more than double that of

Ethereum’s. On a month-over-month (MoM) basis, Solana’s DEX volume

surged over 100% from October, which stood at $52.5 billion.

Meanwhile, the total value locked (TVL) in Solana’s DeFi ecosystem

has increased to $9.30 billion, up from $6.23 billion a month ago.

The unprecedented rise in Solana-based DEX trading volume can be

attributed to several factors. These include the ongoing memecoin

frenzy, the blockchain’s low transaction fees, and an intuitive

user interface. It is worth highlighting that Solana’s TVL has yet

to surpass its ATH TVL of $10.02 billion, which was recorded almost

three years ago in November 2021. In January 2023, the blockchain’s

TVL hit a low of $210 million, dragged down by the wider crypto

bear market exacerbated by the downfall of FTX exchange. At the

time of writing, $3.58 billion of Solana’s TVL is tied to the

liquid staking protocol Jito, while Jupiter DEX holds $2.4 billion.

Another prominent Solana-based DEX, Raydium, accounts for $2.37

billion of TVL. Where Is SOL Headed? Solana’s growing user adoption

has played a crucial role in driving the recovery of its native

token, SOL. On a year-to-date (YTD) basis, SOL has gained over

157%, rising from $101 on January 1 to $263 on November 23. Related

Reading: Solana Records New ATH After 3 Years: Is SOL Ready To Flip

USDT? Despite such extraordinary returns, crypto experts remain

bullish on SOL, expecting further gains for the digital asset.

According to a recent analysis by Titan of Crypto, SOL may hit $400

as it appears to be breaking out from a prolonged cup-and-handle

pattern. Additional bullish factors, such as the declining Bitcoin

(BTC) dominance and the rising likelihood of a Solana

exchange-traded fund (ETF), could further propel SOL to new highs.

SOL trades at $248.31 at press time, up 0.5% in the past 24 hours.

Featured image from Unsplash, charts from DefiLlama.com and

Tradingview.com

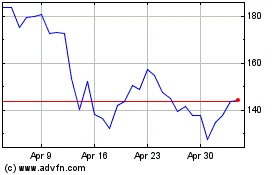

Solana (COIN:SOLUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Solana (COIN:SOLUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024