Will The US Elections Propel Bitcoin Past $74,000? Key Metrics To Track This Week

November 05 2024 - 1:42PM

NEWSBTC

In the wake of the US presidential election, Bitcoin (BTC) is

experiencing the expected volatility that often accompanies major

political events. Tuesday’s trading saw the largest cryptocurrency

fluctuating between $68,000 and $70,000, with the latter level

acting as resistance since Saturday. Market analysis firm Crypto

Birb has released insights into the potential impacts of the

election on Bitcoin’s price trajectory, suggesting that, based on

current indicators, Bitcoin could reach new record highs above

$73,700 in the days following the election. Bitcoin Price

Could Soar To Over $263,000 In a recent social media update, Crypto

Birb highlighted several key figures for traders and investors,

including the upward trends in the 200-week and 50-week simple

moving averages (SMAs), currently at $59,200 and $40,700,

respectively, which point to a bullish long-term outlook for the

Bitcoin price. The firm notes the presence of over $470 billion in

volume from exchange-traded funds (ETFs) investing in BTC, further

contributing to market liquidity, which is critical for Bitcoin’s

price movements to the upside. Related Reading: Dogecoin

Price Rally Gains Momentum, Will DOGE Smash Through $0.18? However,

a market bloat of 51%, measured by the Net Unrealized Profit/Loss

(NUPL), indicates that a significant portion of Bitcoin holders are

in profit, potentially leading to increased selling pressure if

prices rise too quickly. The Market Value to Realized Value

(MVRV-Z Ratio), currently at 1.86, projects a potential price

target of over $263,000, suggesting substantial room for

growth. Notably, Bitcoin’s low correlation of 0.16 with the

S&P 500 indicates that its price movements are largely

independent of traditional equity markets, which could attract

investors seeking diversification. Historical Trends Suggest Strong

November Ahead Despite the bullish long-term outlook, the firm

suggests that traders should be cautious of short-term volatility.

Crypto Birb noted that the market is experiencing a spike in “price

randomness,” common occurrence during election cycles. Key

resistance levels are identified at $70,700 and $72,000, which

could prove critical in determining Bitcoin’s immediate path. The

daily trend shows that $70,000 is a pivotal breakout point, and the

firm suggests that a successful move above this threshold could

trigger further upward momentum to retest all-time high records.

The firm also highlights the current sentiment in the crypto

market, which is currently characterized by a “Fear and Greed”

index reading of 70, indicating a state of greed among

investors. Crypto Birb contends that this sentiment often

leads to heightened buying activity but can also signal a potential

pullback if prices rise too quickly. Additionally, mining costs are

estimated at around $80,700, suggesting miners are operating at a

loss if Bitcoin remains below this threshold. Related

Reading: XRP Price Gears Up: Is a Major Move on the Horizon?

Further strengthening the case for Bitcoin, historical data shows

that November has been a strong month for BTC, with an average gain

of 14.96% over the past nine years. This means that if the

cryptocurrency follows past movements, it could reach $79,000 by

the end of the month. In addition, the fourth quarter of the

past few years has shown an average gain of 50.86%, with the

maximum quarterly gain recorded at 470.44%, suggesting that BTC

could be poised for a significant rally in the coming weeks,

regardless of the US election results between Donald Trump and

Kamala Harris. When writing, the largest cryptocurrency on the

market was trading at $69,830, up 3% in the 24-hour time

frame. Featured image from DALL-E, chart from TradingView.com

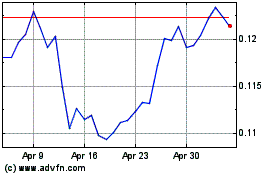

TRON (COIN:TRXUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

TRON (COIN:TRXUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024