Buy Bitcoin If This Happens, Says Arthur Hayes

January 29 2025 - 2:00AM

NEWSBTC

Arthur Hayes, the Chief Investment Officer at Maelstrom and

co-Founder as well as former CEO of BitMEX, has published a new

essay titled “The Ugly,” in which he contends that Bitcoin could be

poised for a profound near-term pullback before ultimately marching

to unprecedented highs. While retaining his characteristic

bluntness, Hayes lays out two scenarios when to buy Bitcoin. Buy

Bitcoin If This Happens Hayes’ essay begins by recounting a sudden

shift in sentiment that caught him off guard. Comparing financial

analysis to backcountry skiing on a dormant volcano, Hayes recalls

how the mere hint of avalanche danger once forced him to stop and

reassess. He expresses a similarly uneasy feeling about current

monetary conditions, an intuition he says he last felt in late

2021, right before the crypto markets collapsed from their record

highs. “Subtle movements between central bank balance sheet levels,

the rate of banking credit expansion, the relationship between the

US 10-yr treasury/stocks/Bitcoin prices, and the insane TRUMP

memecoin price action produced a pit in my stomach,” he writes,

emphasizing that these signals collectively remind him of the

market’s precarious situation prior to the 2022 and 2023 downturns.

He clarifies that he does not believe the broader bull cycle is

finished, but he anticipates that Bitcoin could drop to somewhere

around the $70,000 to $75,000 range before rallying sharply to

reach $250,000 by year’s end. Related Reading: DeepSeek Predicts

Bitcoin Bull Run Peak At $500,000 – Here’s When He describes this

range as plausible given that equity markets and treasury markets

appear, in his words, deeply entangled in a “filthy fiat”

environment still grappling with the vestiges of inflation and

rising interest rates. Hayes points out that Maelstrom, his

investment firm, remains net long while simultaneously raising its

holdings in the USDe stablecoins to buy back Bitcoin if price falls

below $75,000. In his view, scaling back risk in the short term

allows him to preserve capital that can later be deployed when a

genuine market liquidation occurs. He identifies a 30% correction

from current levels as a distinct possibility, while also

acknowledging that the bullish momentum could continue. “if Bitcoin

trades through $110,000 on strong volume with an expanding perp

open interest, then I’ll throw in the towel and buy back risk

higher,” he writes on his second scenario. In attempting to

decipher why a temporary pullback might happen, Hayes asserts that

major central banks—the Federal Reserve in the United States, the

People’s Bank of China, and the Bank of Japan—are either curbing

money creation or, in some cases, outright raising the price of

money by permitting yields to rise. He believes that these shifts

could choke off speculative capital that has elevated both stocks

and cryptocurrencies in recent months. His discussion of the US

focuses on two interlocked perspectives: that ten-year treasury

yields could rise to a zone between 5% and 6%, and that the Federal

Reserve, while hostile to Donald Trump’s administration, will not

hesitate to reinitiate printing if it becomes essential to preserve

American financial stability. Related Reading: Bitcoin Finally

Turns $100K Into Support – Ready To Rally Higher? However, he

believes that at some point, the financial system will need an

intervention—most likely an exemption to the Supplemental Leverage

Ratio (SLR) or a new wave of quantitative easing. He contends that

the reluctance or slowness of the Fed to take these steps increases

the probability of a near-term bond market sell-off, which could

weigh on equities, and by correlation, Bitcoin. His political

analysis homes in on the lingering enmity between Trump and Federal

Reserve Chair Jerome Powell, as well as the Fed’s willingness to

forestall a crisis during the Biden presidency. He cites statements

from former Fed governor William Dudley and references Powell’s

press conference remarks that suggested the Fed might alter its

approach based on Trump’s policies. Hayes describes these tensions

as a backdrop for a scenario in which Trump might allow a

mini-financial crisis to unfold, forcing the Fed’s hand. Under such

stress, the Fed would have little choice but to prevent a broader

meltdown, and monetary expansion could then follow. He suggests

that it would be politically expedient for the Trump administration

to permit yields to surge to crisis levels if it meant that the Fed

would be compelled to pivot into the large-scale money printing

that many in crypto circles expect. China, Hayes remarks, had

seemed poised to join the liquidity party with an explicit

reflation program until a sudden U-turn in January, when the PBOC

halted its bond-buying program and allowed the yuan to stabilize in

a stronger position. He attributes this policy change to internal

political pressures or possibly strategic maneuvering for future

negotiations with Trump. Hayes also acknowledges that some readers

might find the correlation between Bitcoin and traditional risk

assets perplexing, given the long-term argument that Bitcoin is a

unique store of value. Yet he points to charts showing a rising

30-day correlation between Bitcoin and the Nasdaq 100. In the short

term, he says, the leading cryptocurrency remains sensitive to

changes in fiat liquidity, even if the coin ultimately trades on an

uncorrelated basis over extended time horizons. He thus portrays

Bitcoin as a leading indicator: if bond yields spike and equity

markets tumble, Bitcoin could begin its dive before tech stocks

follow. Hayes thinks that once authorities unleash renewed monetary

stimulus to quell volatility, Bitcoin would be the first to bottom

out and rebound. He admits that predicting exact outcomes is

impossible and that any investor must play perceived probabilities

rather than certainties. His decision to hedge is derived from the

concept of expected value. If he believes there is a substantial

chance of a 30% pullback versus a smaller probability that Bitcoin

will continue higher before he decides to buy back in at a 10%

premium, reducing exposure still yields a better risk-reward ratio.

“Trading isn’t about being right or wrong,” he emphasizes, “but

about trading perceived probabilities and maximizing expected

value.” He also underscores that this protective stance allows him

to wait for the kind of dramatic liquidation move in altcoins that

often accompanies a short-term Bitcoin collapse, a scenario he

calls “Armageddon” in the so-called “shitcoin space.” In such

circumstances, he wants ample funds available to pick up

fundamentally sound tokens at severely depressed prices. At press

time, BTC traded at $102,530. Featured image created with DALL.E,

chart from TradingView.com

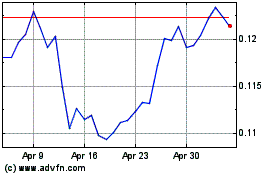

TRON (COIN:TRXUSD)

Historical Stock Chart

From Dec 2024 to Jan 2025

TRON (COIN:TRXUSD)

Historical Stock Chart

From Jan 2024 to Jan 2025