Bitcoin Price Forms Double Bottom After Crash, Is A Bounce To $112,000 ATH Possible?

January 29 2025 - 3:30PM

NEWSBTC

According to a TradingView crypto analyst named ‘TradingShot,’ the

Bitcoin price has formed a Double Bottom pattern and is on track to

reach a new All-Time High (ATH) of $112,000. This potential shift

in trajectory comes after the cryptocurrency experienced a severe

price crash that briefly pushed it below the $100,000 mark.

Bitcoin Price Finds Strong Support At Double Bottom The Bitcoin

price crashed below $100,000 earlier this week as the China-based

Artificial Intelligence (AI) model DeepSeek gained significant

popularity across the US and global investment market, overtaking

OpenAI’s ChatGPT. While this decline came as a shock, triggering a

massive sell-off, Bitcoin managed to recover over 50% of its losses

in a short time. Related Reading: End Of The Road For

Bitcoin? Analyst Reveals When Price Will Crash To $50,000 Following

this severe crash, TradingShot revealed that Bitcoin had rebounded

at a Double support level, using two strong support lines to

prevent further price slips. The analyst shared a detailed price

chart that highlights several Double Bottoms, including one forming

near the 4-hour 200-Moving Average (4H MA200). A Double

Bottom pattern is a chart formation that indicates a potential

trend reversal from a downtrend to an uptrend. It is characterized

by two consecutive lows around the same price level and creates a

W-shaped movement. Looking at the chart, the Bitcoin price is

moving within an Ascending Channel, indicating a general uptrend.

The 4H MA200 on the orange trend line is a strong Double Bottom

support level, which Bitcoin recently tested for the first time in

12 days. TradingShot also mentioned a “Pivot trend line” in

which Bitcoin previously faced resistance, starting from its ATH on

December 17, 2024. This trend line now acts as a support line for

the cryptocurrency, as its price has reversed near it. Notably,

Bitcoin almost touched the bottom of January’s Channel Up,

indicating a potential key support zone. This is similar to a

pattern in December, where the cryptocurrency bounced off the same

support and hit a new ATH. Key Resistance At 4H MA50 —

Breakout Or Rejection? In TradingShot’s chart, the 4H MA50 is

indicated on the blue line, acting as a dynamic resistance level

for the cryptocurrency. Currently, Bitcoin is trading below this

Moving Average, meaning a breakout above this level could trigger

more upside. The analyst predicts that if Bitcoin breaks

above the 4H MA50, it could continue its bullish momentum toward a

higher price level between $110,000 and $112,000. This massive

surge would mark a new ATH for the pioneer cryptocurrency, as the

highest price Bitcoin has ever reached is above $108,000.

Related Reading: Bitcoin Upper Band Moves Above $105,400 – Where

Price Is Headed Next Supporting this bullish scenario, the

TradingView analyst highlights Bitcoin’s Relative Strength Index

(RSI), which shows oversold areas marked in green circles on the

chart. Whenever RSI drops below 30, Bitcoin tends to rebound,

indicating a potential for a strong bounce. Conversely, the

analyst forecasted a bearish scenario for Bitcoin if it faces a

rejection around the 4H MA50. He predicts that Bitcoin could

revisit the Double Bottom at $98,000, a bearish level observed on

both December 23 and January 13. An even deeper correction is

expected for this cryptocurrency if it continues on a downtrend,

with the analyst projecting a crash to $96,000. Featured

image from iStock, chart from Tradingview.com

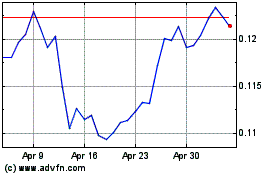

TRON (COIN:TRXUSD)

Historical Stock Chart

From Dec 2024 to Jan 2025

TRON (COIN:TRXUSD)

Historical Stock Chart

From Jan 2024 to Jan 2025