Bitcoin Boom’s Expiry Date? CryptoQuant CEO Reveals Timeline

February 28 2025 - 8:00AM

NEWSBTC

Many people wonder about the length of Bitcoin’s rollercoaster

journey that its price increase has been on. The bull run may

persist until at least April 2025, argues CryptoQuant CEO, Ki Young

Ju. Should this be the case, it could signal the longest ever

Bitcoin bull cycle. Related Reading: Dogecoin Sees 95% Drop In

Network Activity—Trouble Ahead? Variations In Bitcoin’s Growing

Rate Ju created a Bitcoin growth rate difference statistic for May

2024 that formed the foundation for his projection. Monitoring the

long-term market movements of the crypto helps one to ascertain

whether the asset is still in a growth phase or overheated. Right

now, Bitcoin is in what he refers to as a “critical zone,” in which

market signals combine bullish and bearish patterns. Whether

Bitcoin keeps on its ascent or begins to lose vigor will depend

mostly on the next few weeks, or months. #Bitcoin on-chain

indicators are at the bull-bear boundary. I expect this to be the

longest bull run in history, but I could be wrong. We need at least

another month of data to confirm whether we’re entering a bear

market. If demand doesn’t recover, indicators may fully signal a…

https://t.co/QkaZx7wmAt pic.twitter.com/4iHbuitW4o — Ki Young Ju

(@ki_young_ju) February 27, 2025 Market Fluctuations And Past

Corrections Investors are beginning to have jitters about Bitcoin’s

price as it has lost 30% of its value in the last few days. But Ju

is not bothered. According to him, severe pullbacks like these are

not uncommon during a bull cycle phase. Historical records support

his assertion; earlier bull runs show price losses of up to 52%

before recovery. Should history be the barometer, Bitcoin might

still have some surprises in its sleeves and carry out strong

upward moves in the face of a volatile market. The BlackRock

Bitcoin Selloff Movement in Bitcoin price is much influenced by

institutional investors. BlackRock lately sold roughly $70 million

in ether and $440 million in bitcoin. These big sell-offs could

cause temporary devaluations and change investor mood. These events

could change the price direction of Bitcoin in the next months even

if Ju is optimistic. What’s Next For The Alpha Coin? Meanwhile,

Bitcoin is not in good form as we speak: it is languishing in the

$79,900 level, to the delight of those who’ve been waiting to buy

the dip. Bitcoin is trading 7% below its most recent closing. It

peaked at $86,990 then fell to a low of $79,490. The bulls can only

wish it was the other way around. Related Reading: Avalanche (AVAX)

Overextended—Is A Market Shakeup Imminent? Ju’s research shows that

although some investors worry about possible future dips, the bull

run is far from over. Since April 2025 is just a month away,

traders and experts are still captivated by Bitcoin’s long-term

trend and what the coming days will bring on the table. Ju’s

observations offer a data-driven viewpoint even if nobody can

exactly predict the market. Whether Bitcoin follows past patterns

or creates new ground, investors will be closely observing it.

Anything can happen in the crypto space. Featured image from Gemini

Imagen, chart from TradingView

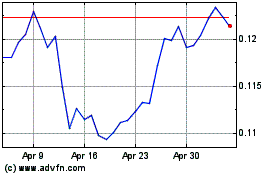

TRON (COIN:TRXUSD)

Historical Stock Chart

From Jan 2025 to Feb 2025

TRON (COIN:TRXUSD)

Historical Stock Chart

From Feb 2024 to Feb 2025