Polkadot (DOT) Nears Critical Zone: A Reversal Could Trigger 180% Surge

March 09 2025 - 8:30AM

NEWSBTC

Polkadot (DOT) prices have declined by 4.38% in the past day as

bearish forces continue to gain stronger market control. According

to data from CoinMarketCap, DOT’s price fall only underlines the

asset’s form in recent days as indicated by the 7.99% loss in the

last week. However, market analyst Ali Martinez postulates that

this downtrend could soon result in something positive. Related

Reading: Polkadot Price Crisis: Further Losses Incoming After DOT

Falls Under $4.8 Polkadot Approaches Key Support — Can DOT Hold And

Rebound To $10.80? Following the intense price volatility that

swept across the crypto market last week, Polkadot slipped below a

key support level at $4.47, signaling an increased bearish

pressure. According to Ali Martinez, the altcoin appears to be

heading to a crucial support zone at $3.80, which could potentially

halt the current decline. Based on the presented analysis, DOT is

undergoing a wide range of consolidation moving in a parallel

channel that stretches as far back as July 2023. Therefore, if the

current downtrend persists, the altcoin will likely retest at $3.80

which represents the lower boundary of this parallel channel.

According to historical patterns, market bulls are expected to step

in at this support zone and ramp up demand to prevent further

decline. Martinez explains that if this projection occurs, Polkadot

could experience a price bounce to around $6.40 i.e. midpoint of

the parallel channel. With strong buying pressure, DOT investors

could expect a price rise to around $10.80 i.e.the upper boundary

of the parallel channel, representing a potential 180% price gain.

On the other hand, if DOT bulls fail to hold the $3.80 support

level, the altcoin could slide to $2.30 with potential price

targets around $1.25-$1.45. Related Reading: Polkadot (DOT) Defies

Market Volatility, Holds Strong Above $4.8 Support Level Polkadot

Market Overview At press time, Polkadot trades at $4.32 following a

daily price decline of over 4% as earlier stated. In tandem, the

asset’s trading volume has reduced by half in the past 24 hours and

is now valued at $145.81 million. A drop in price with falling

trade volume can signal a waning selling pressure presenting the

potential for a price reversal as postulated by Ali Martinez.

Looking at the technical indicators on its daily chart, the

Relative Strength Index (RSI), used to determine overbought or

oversold market conditions, currently stands at 39 but is headed

downward. This reading adds more support for DOT’s predicted

bullish rebound. However, the asset’s price is far below its

100-day Simple Moving Average (SMA) suggesting the projected price

rally may not occur immediately. Meanwhile, with a market cap value

of $6.72 billion, Polkadot continues to rank in the 30 largest

cryptocurrencies in the world. Featured image from Dreamstime,

chart from Tradingview

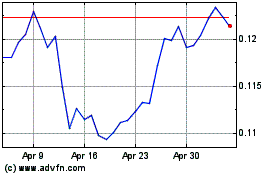

TRON (COIN:TRXUSD)

Historical Stock Chart

From Feb 2025 to Mar 2025

TRON (COIN:TRXUSD)

Historical Stock Chart

From Mar 2024 to Mar 2025