Securitize to bring BUIDL tokenized fund to DeFi with RedStone price feeds

March 12 2025 - 8:00AM

Cointelegraph

Real-world asset (RWA) tokenization company Securitize has

selected RedStone as the primary oracle provider for its tokenized

products, which include BlackRock’s USD Institutional Digital

Liquidity Fund (BUIDL) and the Apollo Diversified Credit Securitize

Fund (ACRED).

According to a March 12 announcement, RedStone will deliver

price feeds for current and future tokenized products offered by

Securitize. As a DeFi-focused oracle provider, RedStone will

purportedly expand the use cases of BUIDL and ACRED into money

market exchanges and collateralized DeFi platforms, Securitize

said.

RedStone provides crosschain data feeds for decentralized

finance protocols on Ethereum, Avalanche and Polygon. According to

DefiLlama data, it has amassed $4.3 billion in total value secured

across all clients.

RedStone’s total value secured as of March 11. Source:

DefiLlama

In July, RedStone raised $15 million in a

Series A funding

round led by Arrington Capital, with additional participation

from Spartan, IOSG Ventures, HTX Ventures and others.

Securitize selected RedStone as its oracle provider because of

its “modular design,” which means it “can scale to thousands of

chains and support new implementations in a matter of days,”

RedStone chief operating officer Marcin Kazmierczak told

Cointelegraph in a written statement.

By using the RedStone oracle price feeds, Securitize’s funds

“can now be utilized across DeFi protocols such as Morpho, Compound

or Spark,” he said.

Related: BlackRock CEO wants SEC to ‘rapidly approve’

tokenization of bonds, stocks: What it means for

crypto

Institutional interest in tokenized assets on the rise

Securitize co-founder and CEO Carlos Domingo told Cointelegraph

that demand for tokenized funds

is growing across a “diverse range of investors and users” spanning

traditional finance and crypto-native firms.

“Institutional investors, private equity firms, and credit

managers are turning to tokenization to enhance efficiency, reduce

operational friction, and improve liquidity for private markets,”

he said.

On the crypto-native side, companies “see tokenized RWAs as a

secure and efficient way to manage treasury reserves while

benefiting from stable yields,” said Domingo.

So far, the tokenization of private credit and US Treasury bonds

have seen the largest uptake, according to industry data. The total

market for onchain RWAs is approaching $18 billion, having grown by

16.8% over the past 30 days, according to RWA.xyz.

At $12.1 billion, private credit accounts for 68% of the

tokenized RWA market. Source: RWA.xyz

Separate data from Security Token Market showed that

more than $50

billion worth of assets were tokenized by the end of 2024, with

the majority coming from real estate.

The tokenization market has attracted

significant players in recent years, with the likes of Ondo

Finance, Tradable and Brickken entering the fray.

Related: Trump-era policies may fuel tokenized real-world

assets surge

...

Continue reading Securitize to bring BUIDL tokenized

fund to DeFi with RedStone price feeds

The post

Securitize to bring BUIDL tokenized fund to DeFi

with RedStone price feeds appeared first on

CoinTelegraph.

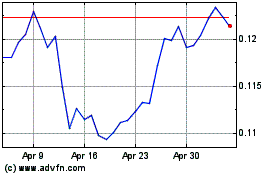

TRON (COIN:TRXUSD)

Historical Stock Chart

From Feb 2025 to Mar 2025

TRON (COIN:TRXUSD)

Historical Stock Chart

From Mar 2024 to Mar 2025