Will Ethereum price bottom at $1.6K?

March 12 2025 - 11:19AM

Cointelegraph

Ethereum’s native token, Ether (ETH), dropped below

$2,000 on March 10, and the altcoin has struggled to regain a

position above the psychological level.

While Bitcoin (BTC) and XRP

(XRP) exhibited

minor recoveries over the past 24 hours, Ether prices failed to

display bullish momentum in the charts.

The altcoin plummeted to a multi-year low of $1,752 on March 11.

However, onchain data and technical analysis indicate that the

price could drop an additional 15% in the coming weeks.

Ethereum dips below realized price after 2 years

The current price deviation below $2,000 carried onchain

implications for the altcoin. According to Glassnode, a data

analytics platform, ETH dropped

below its realized price of $2,054 for the first time since

February 2023.

Ethereum realized price and MVRV. Source: X.com

ETH realized price calculates the average price of each ETH last

moved, representing the average cost basis of the total circulating

supply. The current drop below the realized price indicates

widespread unrealized loss for all ETH holders.

The market value to realized value (MVRV) ratio also dropped to

0.93, indicating a 7% average loss for all ETH holders across the

network. However, it is important to note that the realized price

reflects the weighted average of all historical transactions.

Hence, it encompasses the cost basis of every ETH holder, not a

specific timeframe like 2023 to 2025.

Ethereum’s TVL chart. Source: DefiLlama

Meanwhile, Ethereum’s total value locked (TVL)

dropped to a six-month

low of $45.6 billion on March 12, down 41% from its peak of $77

billion on Dec. 17, 2024.

Additionally, the total fees users paid to use Ethereum fell to

$46.28 million—the lowest level since July 2020—further signaling

weakening network engagement.

Related: Starknet to settle on Bitcoin and Ethereum to

unify the chains

Ether price between $1.6K-$1.9K is “attractive”

In a recent X post, Glassnode explained how Ethereum’s cost-basis distribution

could be useful in identifying potential support levels for ETH.

Based on a weekly outlook, Ether’s recent drop below $1,880 led to

an accumulation of 600,000-700,000 ETH around $1,900. The post

states,

“This suggests $1.9K could establish itself as a

support if $ETH consolidates at current levels. Above spot, $2.2K

(465K $ETH) is the potential next resistance. The supply gap

between $1.9K and $2.2K remains thin, making a short-term move

towards resistance plausible.”

Ethereum weekly analysis by Ninja. Source: X.com

At the same time, anonymous analyst Ninja

believes

that the floor price for Ethereum remains between $1,600 and

$1,900.

The trader added that the above range is an “attractive region

for commercial money” and set a high swing target at $2,500.

Related: Bitcoin whales hint at $80K ‘market rebound’

as Binance inflows cool

This article does not

contain investment advice or recommendations. Every investment and

trading move involves risk, and readers should conduct their own

research when making a decision.

...

Continue reading Will Ethereum price bottom at

$1.6K?

The post

Will Ethereum price bottom at $1.6K? appeared

first on

CoinTelegraph.

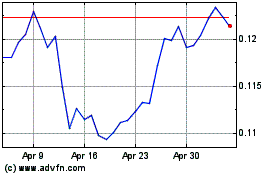

TRON (COIN:TRXUSD)

Historical Stock Chart

From Feb 2025 to Mar 2025

TRON (COIN:TRXUSD)

Historical Stock Chart

From Mar 2024 to Mar 2025